Leveraged Restaking: How and Point Math

The article is from Feb'24 and might have information that is now outdated. In case of any clarifications do reach out to us on TG or Discord.

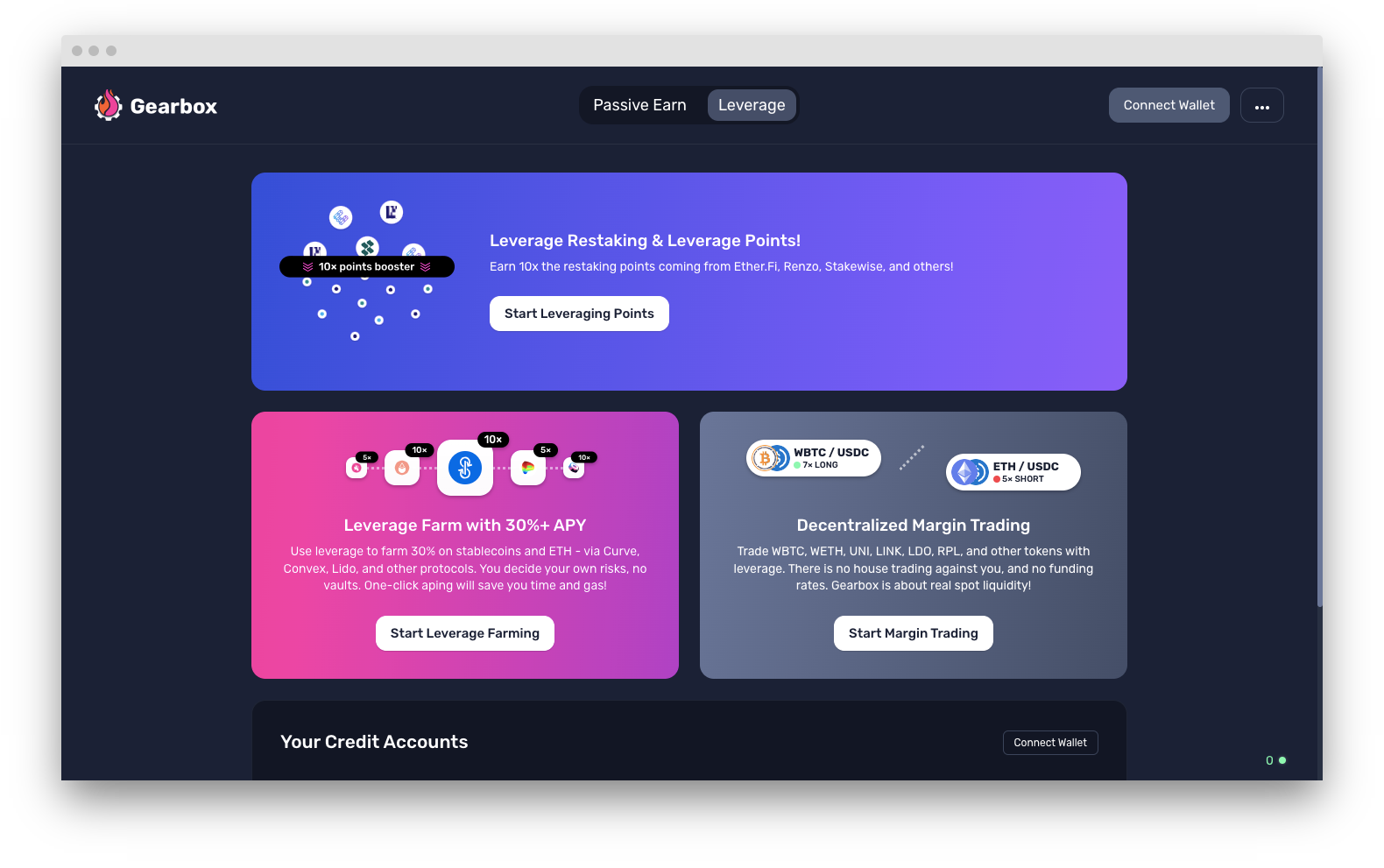

The most efficient LRT strategies to earn EigenLayer and other points are now LIVE, starting with Ether.Fi! We did a piece earlier on the "what" and "why" of restaking which you can read below. This piece, though, focuses on the "how" of leveraged points on Gearbox and gives you a cost per point calculator for any position you intend on taking. So read on!

NOTE: Alongside EL points, you'll also earn 2X EtherFi Points, 2X Renzo Points and 2X Kelp Miles on your position

How does Gearbox make leveraged points happen?

Gearbox creates leverage by letting users borrow real assets up to 10 times the collateral they put up. Since these assets are real in nature, they can be further deployed across DeFi protocols to turn any allowed activity leveraged. For restaking, these borrowed assets can simply be swapped to weETH (Ether.Fi) to get access to Leveraged EIGEN and Ether.Fi points. Later on with other integrations, you can be earning more on top of that!

This is made possible by Gearbox's innovation called Credit Accounts(CAs) which function as leveraged smart contract wallets. The funds you borrow and the collateral you put up is sent to a CA that you open. The CA is programmed to allow usage of these funds only to certain assets, protocols and pools to ensure the borrowed funds aren't at risk. See integrations list (being updated).

In case of losses being incurred, when a user's losses lead to their collateral being exhausted, the position is liquidated and the borrowed funds are auto-returned to the lending pools. This ensures that Gearbox lenders never face bad debt.

This, though, isn't limited to just Restaking

Gearbox is DeFi's Leverage Layer. Think of it as plug and play leverage, whatever protocol Gearbox integrates automatically becomes leveraged. An evolution of onchain credit with composability.

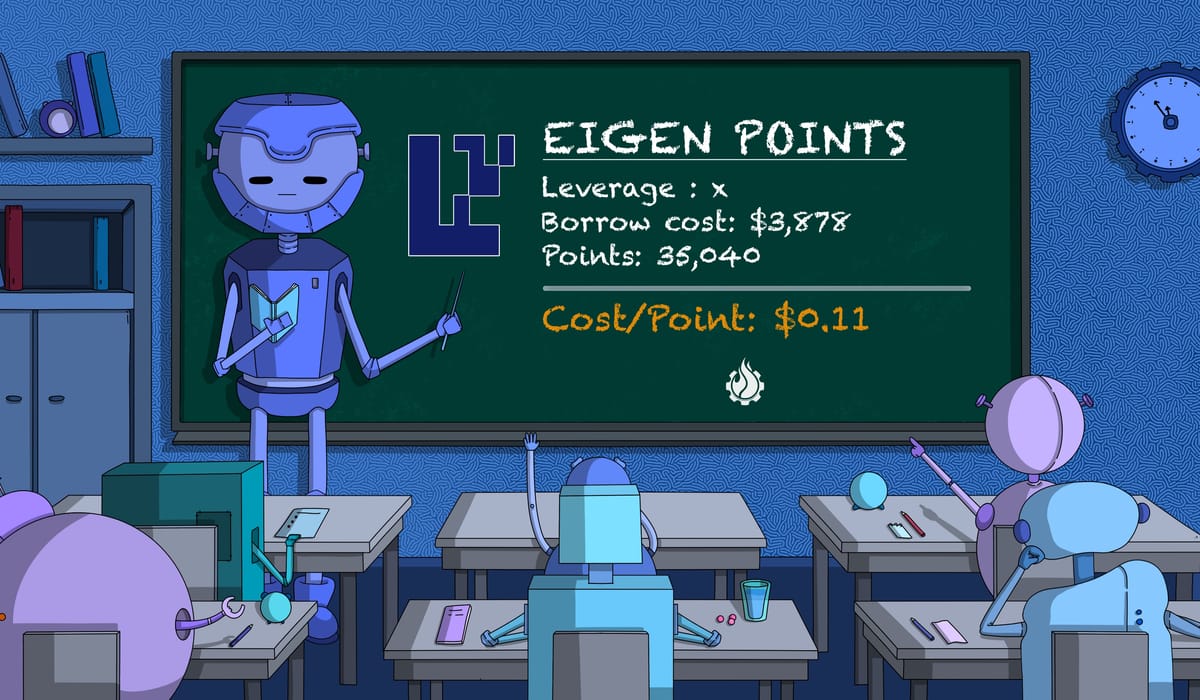

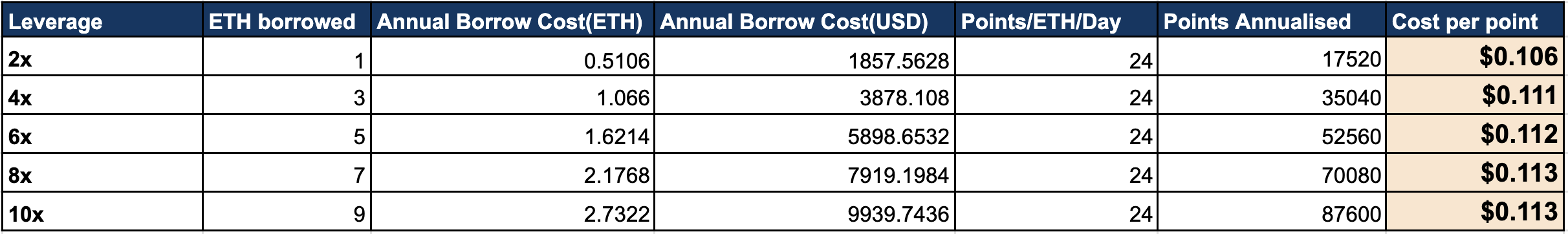

So what do the points cost?

EIGEN points on Gearbox start from as low as 0.106x. This is at a borrow rate of 17%. Any increase in the rate would make points costlier, any decrease would make them cheaper. But with the current 31.28% rates, Gearbox offers the cheapest possible EIGEN points and the best possible Whales arb.

You can know the exact cost of your EIGEN points by inputting your leverage and updating the parameters(borrow rates and ETH price) in the calculator below. If you spot any mistakes, please let us know on Telegram or Discord.

IMPORTANT NOTE: Your position on Gearbox is completely liquid. This means you can enter and exit the farming position anytime you want. So how do you retain your points when exiting your farm? Simply turn your position into a 0 debt position when you close your farm. This way you'll be able to hold the account(smart contract) you had without needing any debt and retain your points.

If you don't want the easy route and want the exact math, read below.

How is this calculation done?

To find the cost of a point, we need two things: 1. Net Borrow Cost incurred 2. Total points earned

The net borrow cost depends on

- The borrow rate on Gearbox for leverage

- The staking APY earned from restaking

Deduct the staking APY from the borrow rate and that's the net rate you pay. Multiply this with your borrowed value and that's your Annual Cost.

To find the points you earn, 1 ETH restaked pays out 1 EIGEN point every hour,. or 8,760 points annually. Multiply 8,760 by your leverage and that's the Eigen Points that your position will earn annually.

Simply divide these points by the costs and you'll have your answer.

NOTE: Both points and borrow costs are time linear. This means that costs remain the same(barring rate fluctuations) and aren't time dependent.

TLDR: This means you have the ability to sell your EIGEN on whales for a 4x from the first hour.

How do I open a position?

To start it all, first go to https://app.gearbox.fi/accounts

then:

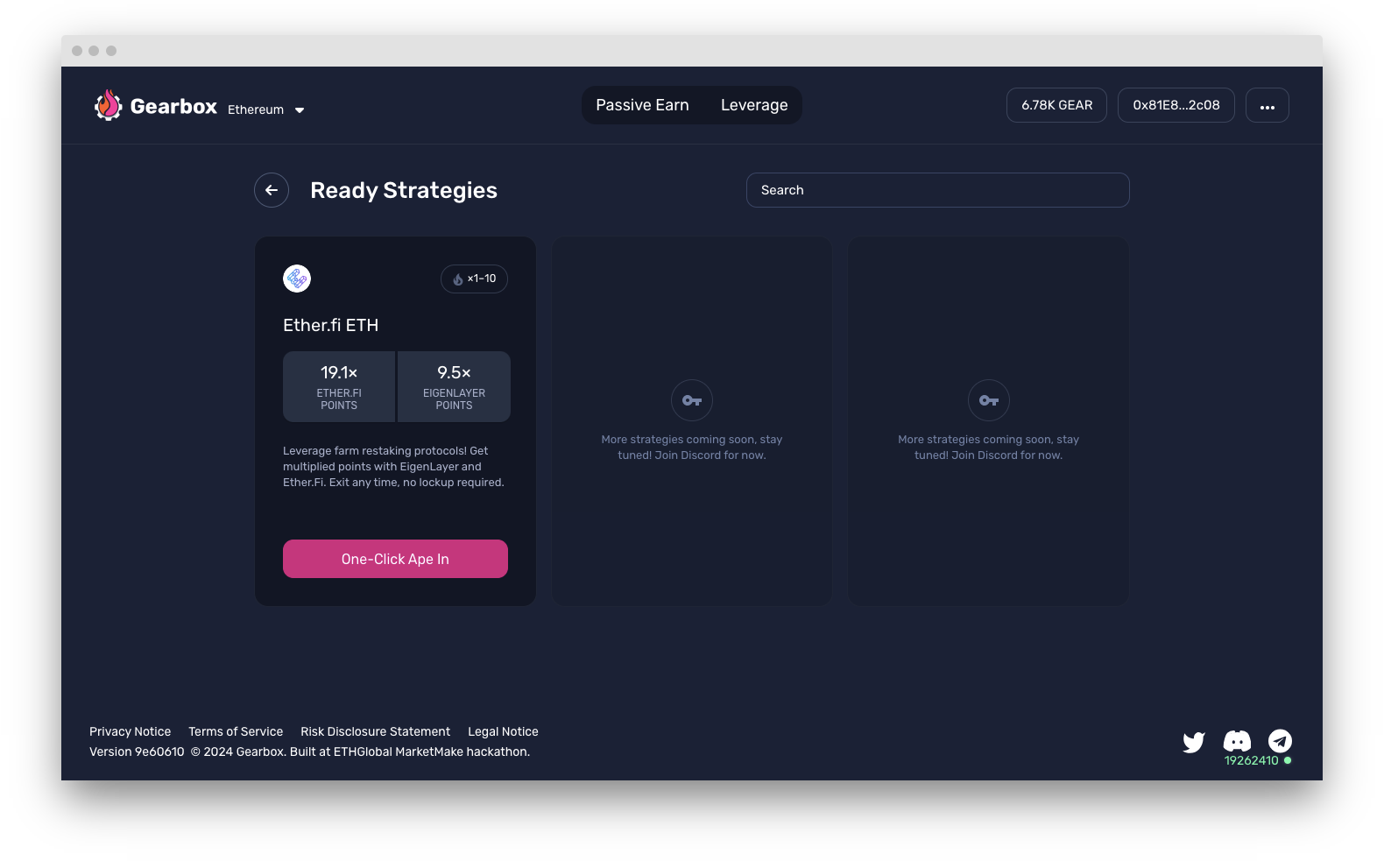

A. Choose the Leveraged Restaking option: Which should bring you to this page. For now it’s Ether.Fi only, later more should be available.

B. Mint a DegenNFT : To ensure safety, only wallets with history that request access are onboarded. If you have asked for access, you should be able to mint an NFT from the pop-up once you go to the Strategies Page. If not, you can request for access here. If you hold an old DegenNFT from V2, you should be able to access it too. A DegenNFT is an SBT that enables a particular user to open a Credit Account.

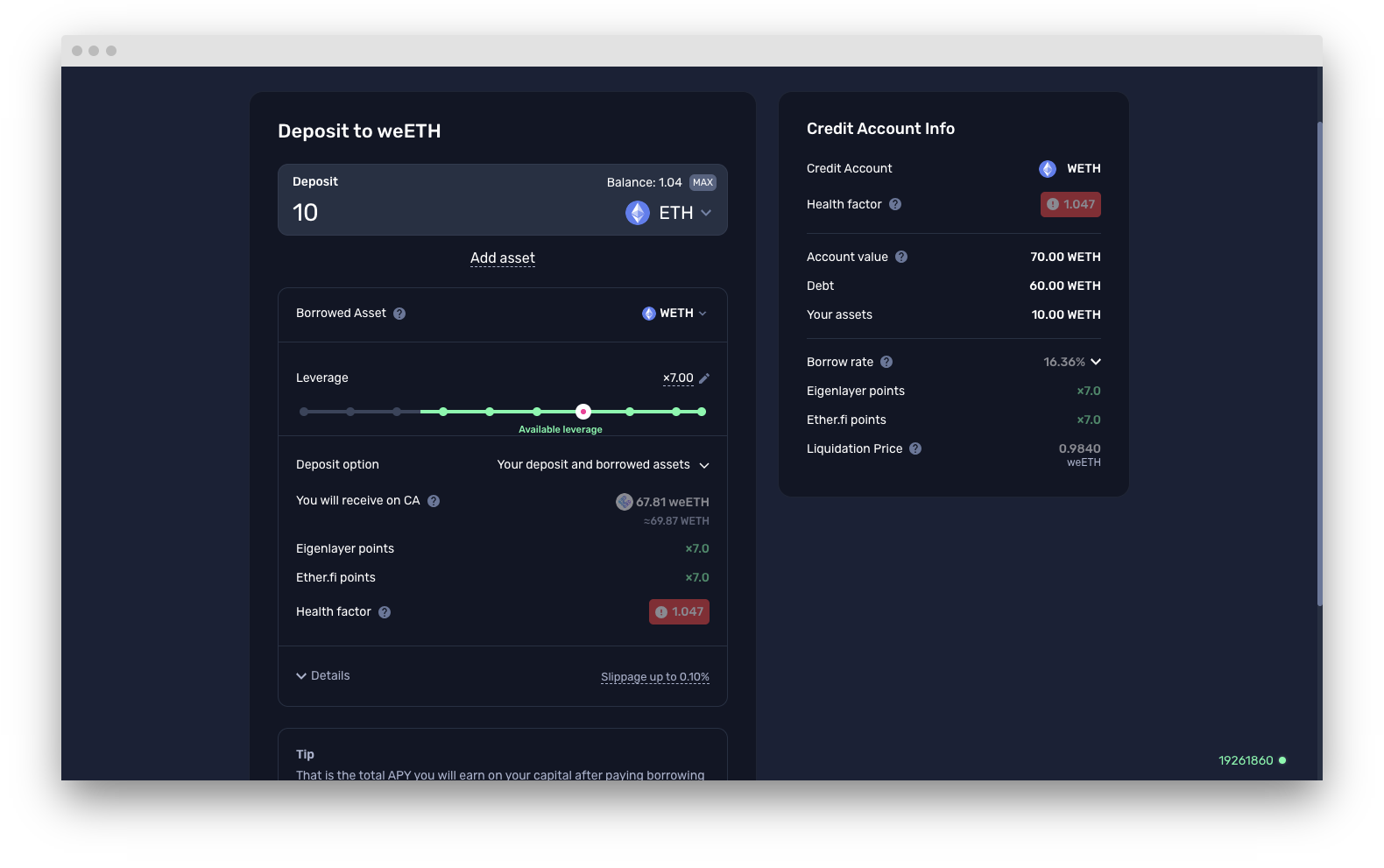

C. Choose Your Leverage: Customise the position as per your risk tolerance. The page also displays the borrow rate, the liquidation price and more to help you take an informed decision. All these details are up to you, you decide all the parameters!

D. Scroll to the bottom of the page and click on "Open position".

And Voila! You are all set. Multicall will now execute all the required transactions in one go with the help of account abstraction.

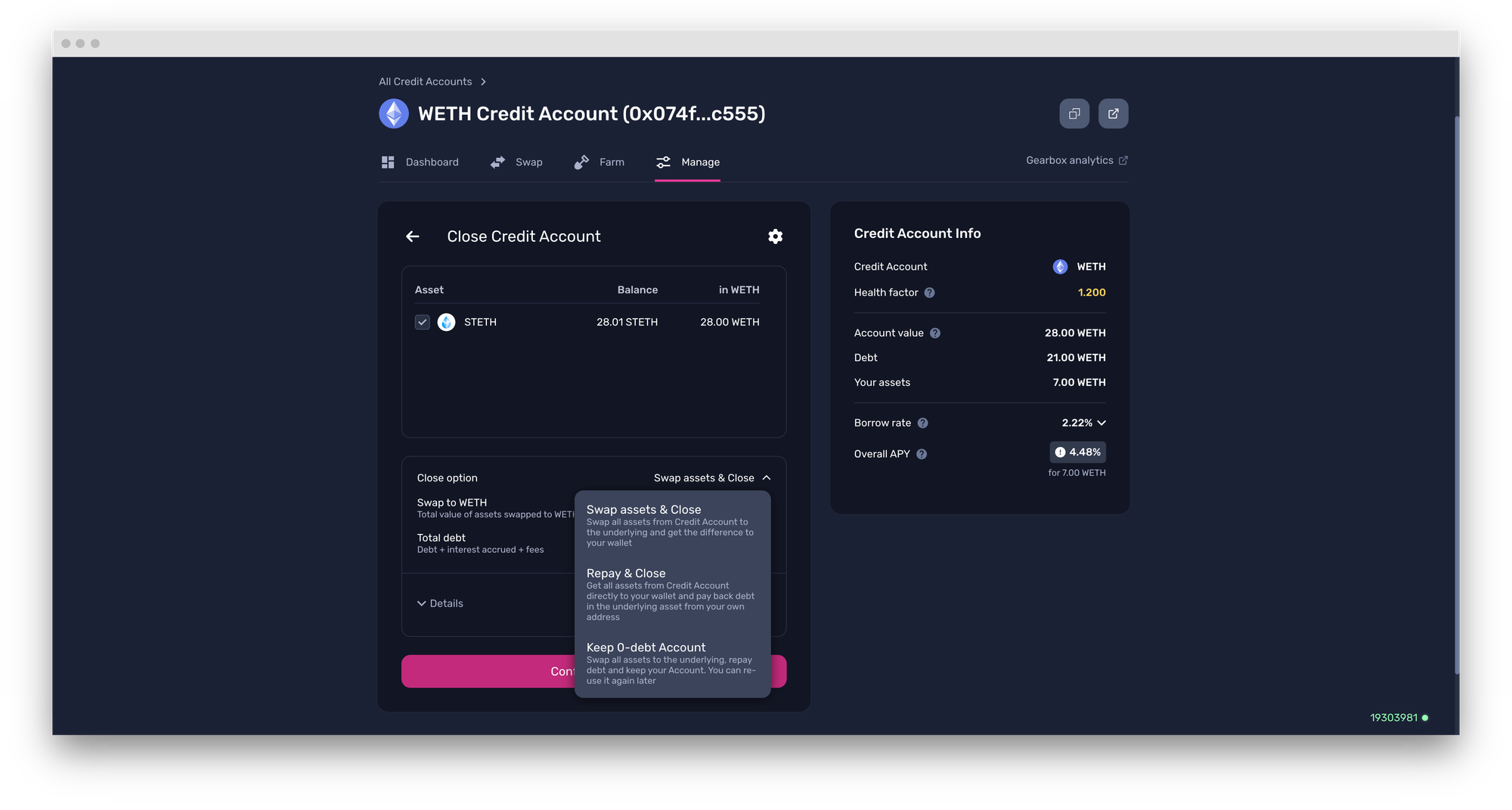

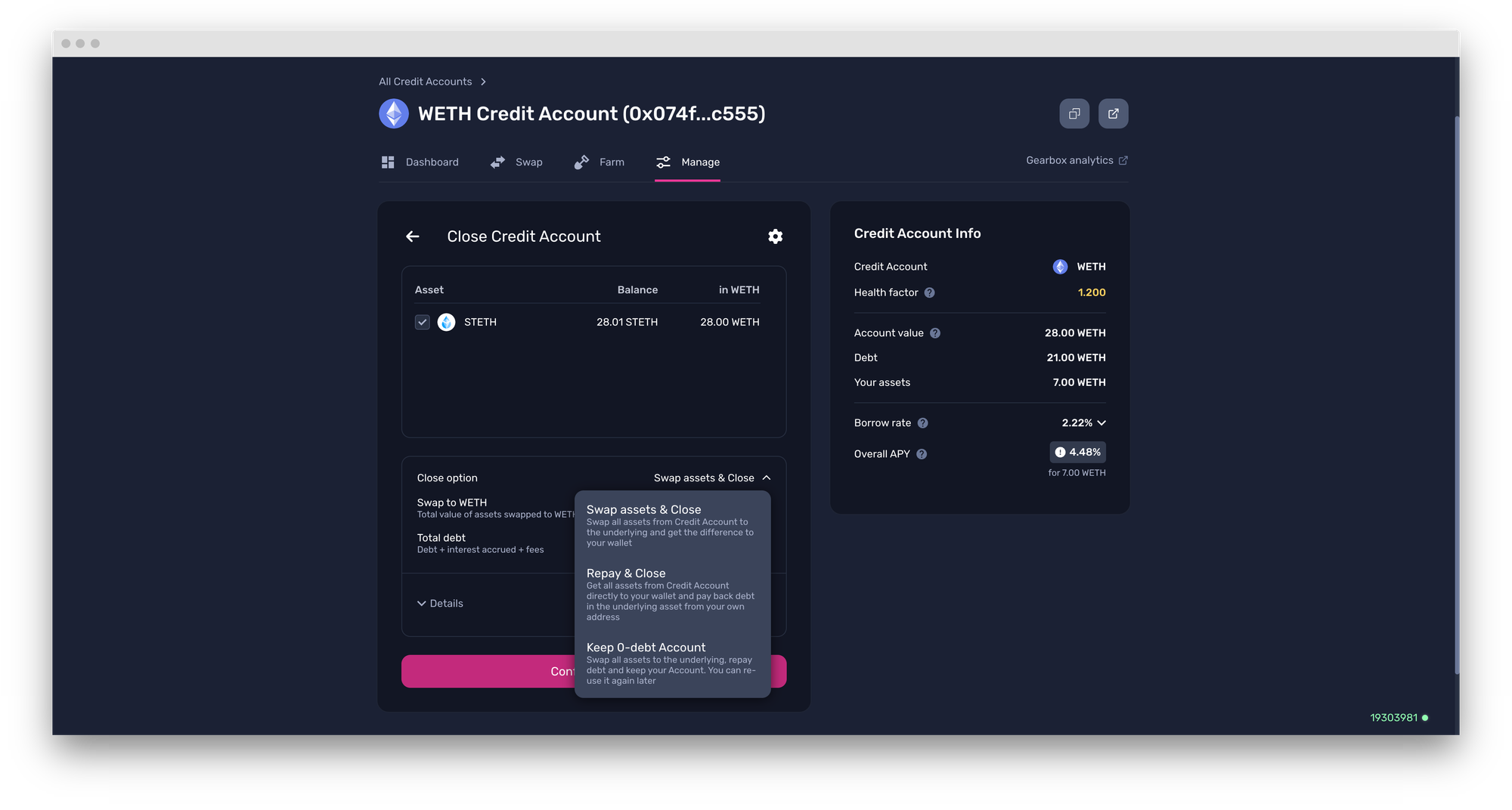

But what if you want to close your position?

You can exit any time!

The beauty of Gearbox leverage restaking & leverage points is that you are able to exit any time. Had fun farming for a week, month, or even 5 hours? You can close your Credit Account and be done with it. Super easy way in with multicall - super easy way out the same path.

But to retain these points make sure you exit with the Keep 0-debt Account option. This enables you to hold onto the CA you farm with and not have to have any debt.

There are just a couple things you should pay attention to:

- These leverage restaking derivatives (weETH, ezETH, etc.) are still fresh. They don’t have hundreds of millions of liquidity, so they can be volatile to an extent. Do make sure you understand your liquidation price, and watch out for that. It is especially important when you compare your entry price vs your exit price. In case you catch a slight depeg when you enter, you will even make MORE ETH if you exit when the peg restores.

- The borrow rates you pay to Gearbox are not exactly static but are not really volatile either. Just keep an eye to understand your cost basis, and don’t leave your leverage positions dormant for months.

And for more details, refer to docs.

What next? You are all set but risk management is still necessary, make sure you take care of the health factor for your position and don’t get liquidated. Our docs will show you how to use functions within a Credit Account manager. Click here to read that or to go deeper into understanding Gearbox Leverage and read the Leverage Bible.

Don't want leverage?

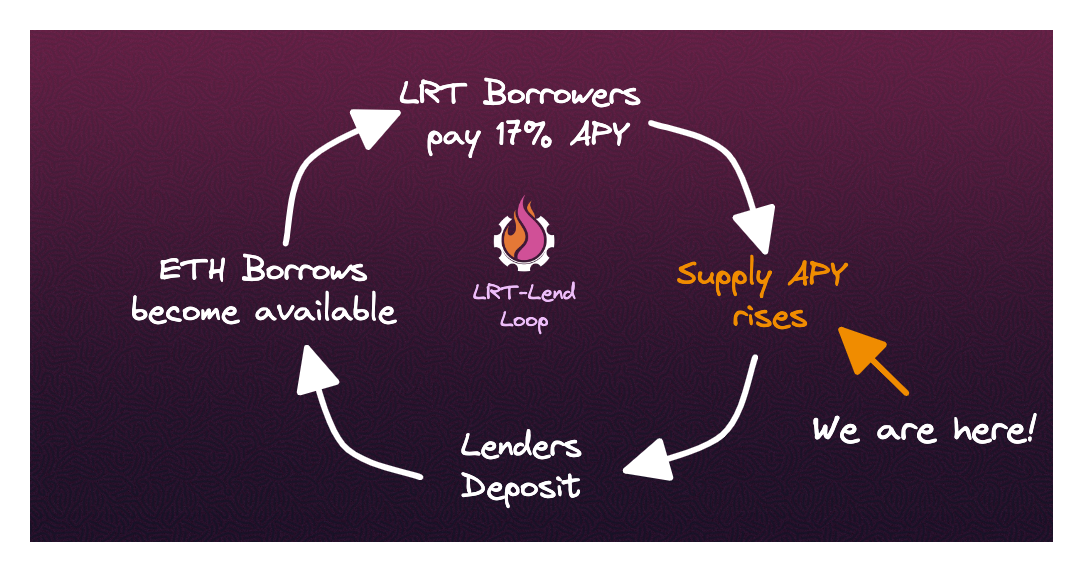

No problem. Gearbox has something for everyone. Leverage Farmers on Gearbox are also a great source of yield for the supply side. With caps on LRT being $100M and borrow rates being 15%+, you can capitalise on this without leverage and still earn double digit yields on your ETH.

Simply passive lend your ETH to the Gearbox lending market and that's it: app.gearbox.fi/pools

There are no lockups, no fee, no leverage or any impermanent loss to the lenders. The market has been live for over 2 years without any security incidences. You can read about how the LRT addition affects these rates in the thread below.

Over the week, we've had 𝟯,𝟬𝟬𝟬+ 𝗘𝗧𝗛 ($9M) deposited to passive lending pool with APYs as high as 15% 💧 And with 4K ETH available to borrow and upcoming LRT borrows paying 16% APY, rates are likely to rise again!

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) February 22, 2024

So what APYs could you earn by lending ETH w/o leverage? 🧵 pic.twitter.com/lC2JFF9HIO

Come join the DAO if you would like to contribute or just vibe — just get involved on Discord or Telegram. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better.

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And, of course, Notion monthly DAO reports: