Leverage Restaking and… Leveraged Points?!

We know, we know. There's not much that you need to say beyond "Earn 10 times more EIGEN and LRT points" to sell this concept. However, understanding why restaking changes the fabric of society and where the yields come from - will help users learn and make better informed decisions. So here we go!

Before we begin: to leverage LRT farm, you need to request access. Do so by simply pasting your live address (with history) here: https://tally.so/r/3XoVzY

Yields and Delta-Neutral

Yields, yields, yields… (interest rates) Why are people so obsessed with them? Because we are taught that passive income is the way to become financially free. That in itself can be a flawed narrative, but everyone obsesses about passive rates.

Be it, Gearbox is here to serve you all.

Yields come with different flavors. Some yields are generated by the underlying volatile assets (like getting profit sharing earnings of a company whose stock you hold, like XLP ETF). Some are generated in the same asset you hold, be that asset itself volatile or not. That could be Ethereum staking or stablecoin deposit rates: like Powell’s interest rates for your deposit in the bank, remember? Those two are probably some of the most delta-neutral things you can find.

Delta-neutral is the holy grail of rates, because your underlying exposure doesn't change: if you start with ETH, your underlying stays as ETH. Versus something like a 50/50 Uniswap position which is partly a directional trade, potentially. Meaning the volatility risk within the same asset is none or almost none. Like if you held ETH and got more ETH for staking it… woah!

That’s why staking native assets on any chain or protocol is so powerful: if you already love this asset and hold it, why not get more of it?! Disregard the risks for now, for the sake of the story. The risks, in the case of blockchain staking, are usually quite low anyway.

Liquid staking derivatives, having entered the market at the end of 2020, have become the leading segment in DeFi according to TVL. LSDs, in turn, became the basis for widespread penetration into various DeFi instruments, giving birth to a new LSDfi segment. Gearbox did not stand aside here. Gearbox was born to devour “external” yield, so LSD-based strategies have become one of the most popular strategies since the launch of gearbox v2:

“If you don’t know where the yield comes from, you are the yield” - someone wise said.

In DeFi, there are currently a few sources of yields:

- Rewards from trading fees when you LP to Uniswap pools and the likes. Those are generally small because fees paid to LPs are not high, and because the onchain trading activity is still not abundant compared to CEXes. It’s growing, but it’s not there yet.

- Farming rewards in protocols’ tokens like CRV and CVX. That’s basically what caused the DeFi bull run in 2020 with tokens like SNX, CRV, COMP, SUSHI, and UNI (by the way, those are available to margin trade up to 10x on https://pure.gearbox.fi/). Currently those tokens are not at ATH, so the rewards are not huge comparatively speaking.

- TradFi RWA rates are slowly finding their fit in MakerDAO’s PSM (sDAI, available for farming in https://app.gearbox.fi/strategies/list), Ondo, Florence, and other upcoming protocols.

- Vanilla ETH staking on mainnet. PURE, just like our leverage too ;)

And for DeFi's next big thing (or so some say)...

Enter: Restaking

Restaking goes even further: it gives you yields on top of what you already get. So you get ETH for ETH staking, and then on top of that some more. How much more? - Depends on an AVS, on the liquidity of the asset of that AVS, and so on. But it’s a lucrative idea: why not get more yields if you are already a staker of ETH… but how about risks, ser? Many disregard those and just chase the next shiny thing, but it’s an important topic. Anyway, let’s talk about it later.

Restaking has led to the resurgence of DeFi, causing the rates to skyrocket all around! At this point, over 2% of total ETH supply today equal to $6.99B USD is staked with EigenLayer. Wow!

Eigenlayer's restaking narrative has actively entered the industry, becoming the hottest topic in DeFi. Eigenlayer enables shared security models for a broad set of services built on top of Ethereum. These services will offer additional rewards streams to Ethereum stakeholders while exposing them to the additional risk of slashing. These rates will be volatile since they come in AVS’s native token… Accordingly, higher yield attracts capital providers. For Gearbox this is an excellent use case of external yield for Credit Accounts.

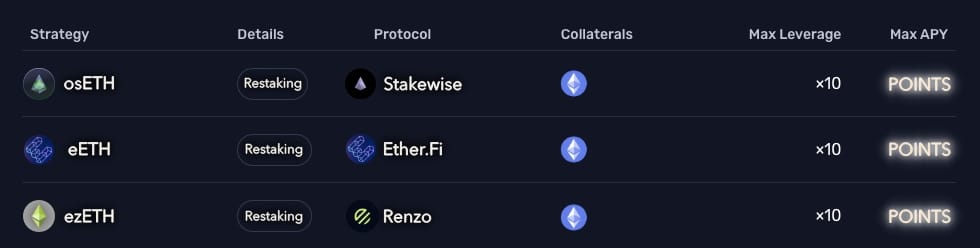

The liquid staking protocols that have caught our attention the most are Stakewise, Ether.Fi and Renzo, having amassed over a BILLION USD worth of ETH through them! If you want to learn more about them:

Before we proceed, let's dive a into AVS and why they could be important...

Applications built on blockchain that run outside of the Ethereum Virtual Machine (EVM) are known as AVSs. These provide a variety of services to the blockchain ecosystem and include layer-2 chains, data availability layers, sequencers, dApps, cross-chain bridges, and virtual machines. Previously, AVSs had to set up their own consensus algorithms making them vulnerable to attacks and exploits because of their isolation.

EigenLayer AVSs can benefit from Ethereum's decentralisation and security features. These services avoid the need to build up separate validation processes by deploying on EigenLayer. You can learn more about AVSs directly from the EigenLayer team in the video below:

Leverage Restaking on Gearbox

Two sides of Gearbox

Generally speaking, the model of leverage restaking with Gearbox is close to dividing opportunities into two tranches - but in a totally liquid manner:

- Passive side acts similar to Senior Tranche: lower inherent risk while still getting passive yield, without any liquidations: https://app.gearbox.fi/pools/

- Credit Account users' side acts similar to a Junior tranche: leveraged users receive greater yield, but at the same time they have risk being liquidated. At the same time, the passive side is protected from small slashes (for example, if LT is 90%, this means that a slash of 4-5% of the stake will not lead to any losses for LP, while a leveraged user can lose up). But the yields here can be as high as +50% even in a delta-neutral position! Let alone combining it with trading, making it 2-3-4-5x…

Another division can be made based on the participant's activity: Credit Account users must actively monitor different AVS providers, weigh the risks and returns between them in order to actively rebalance capital to obtain the best rewards. At the same time, passive LPs simply receive yield as an index from the best AVSes in terms of risk/return. As you can see, Gearbox offers a combination of interesting derivative products on top of re-staking, where everyone can find the right product for themselves.

The above explanation is in line with passive <> active users in general:

Negative APY but Leverage Points

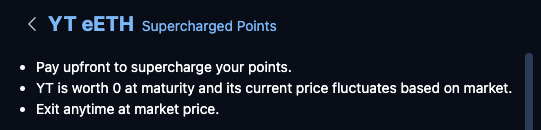

In many of these cases, leverage borrowers are prepared to pay high rates today - to get higher rates “tomorrow”. Quite a gamble, but so is any open market. Just see how leverage works in other markets when it comes to re-staking:

In that sense, a leverage borrower is still technically leverage farming… but negative yields! Wait what?! Yes, the organic rates for staking they get today are quite tiny. What these users want is the distribution of tokens due to the points they earn: EigenLayer, Renzo, EtherFi, and others stacking up on top of each other. That’s where leverage users today see the $$.

And let it be, Gearbox is here to serve you all!

Liquid, Free, YOU are in control!

Gearbox is a superior offering (remember, we are kinda biased here) compared to alternatives, because you can get in and out of a position at any time. If you want to get out, you just sell back your eETH or ezETH back to the pool, that’s it. You don’t pay any huge fees, and the slippage is likely to be minimal unless there were huge (bad) fluctuations with either of the protocols. Meanwhile, wih alternative leverage products for staking you basically lose your ETH and also can't really get out due to the huge fees and slippage you’d incur. This is not a diss, it's just a choice of a user. You can do some here, some there, is fine <3

And of course, all of this is secured by multiple audits, bounties, intelligence tools and devs chained to their screens... We hope to provide the best experience!

Risks coming with restaking

Let’s start from Ethereum itself. There are three reasons slashing can happen for Ethereum validator:

- By proposing and signing two different blocks for the same Slot

- By attesting to a block that ”surrounds” another one (effectively changing history)

- By ”double voting” by attesting to two candidates for the same block

Amount of slashing according to Ethereum anti-correlation penalty rules could vary from 1eth for low-correlation slashing events till 32eth for high-correlation slashing events. Check last slashings on Ethereum staking dashboard provided by Rated. Slashing rules in EigenLayers are specified in a slashing contract by AVS builders. These terms could vary a lot from service to service. Stakers agree to these terms when they opt-in into specific AVS.

How does the user split happen?

Of course, Lenders and Farmers both take on risk over here. Farmers need to pay lenders for the risk they take on the borrowed assets; and lenders want to be paid a rate aligned with the risk. How do you then determine the correct risk adjusted rate?

Meet Gauges

Gauges effectively enable Lenders and Traders to vote on whether the rates should be increased or decreased to end up on a finalised number within a range. For this, they use GEAR and simply vote towards a side.

Assume a seesaw with 2 buckets on either end. As you add GEAR tokens to a bucket, the seesaw moves. Where it stops though decides what rate is applied.

If ninja bucket gets more $GEAR, rates move towards lower end of the range.

If Lender bucket gets more votes, borrow rates increase.

And this is how gauges help the market forces decide what is a fair rate to be paid considering risks. You can read more about gauges here:

Want to leverage EIGEN and LRT points?

Request access on an address with history and $20K in assets by simply pasting your address (no need to connect your address or anything, just the best technology humanity invented: google forms and services alike):

Come join the DAO if you would like to contribute or just vibe — just get involved on Discord or Telegram. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better.

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And, of course, Notion monthly DAO reports: