Gearbox DAO Update: PURE Dec'23

GM, GM to all the believers who now think GM stands for Get Margin. December'23 just like every other December(Gearbox Deployment in '21, 0xCider in '22) was a significant month for the DAO and the protocol with V3 being deployed and PURE being launched.

Want to catch up and learn about it all in 3 minutes? Read on!

We publish these DAO reports monthly, you can sift through our blog to find the monthly updates. Or check the DAO work on our notion. These reports cover key announcements from our twitter, gov forum, votes and other communication channels.

We launched PURE Margin Trading

Leverage trade on top of Uniswap, Curve and DEXes. Leverage trade on top of BILLIONS of dollars worth of liquidity of DEXes. Leverage trade without it being 0-sum. Leverage trade with Gearbox PURE, now LIVE in alpha testing phase!: pure.gearbox.fi

Gearbox PURE was launched with the deployment of Gearbox V3 and the significant protocol advancements it brought. PURE enables users to leverage trade on DEXes, while this sounds straightforward, it completely changes how leverage onchain works.

Since trades are settled on DEXes, it removes the need for the usual perp mechanism that requires LPs or counterparties to take the position against a user. DEXes further enable PURE to use existing DeFi liquidity which has scaled to billions already instead of trying to bootstrap its own. Since this is made possible through spot assets, the borrow fee associated is a fraction of the funding fee on perps. And because spot assets require spot prices, there are no scam wicks either. All of this makes PURE a fairer and more user centric leverage trading platform. Go try it out.

NOTE: You can check out the exact parameters for V3 deployment on GIP-81.

The PURE performance

Since PURE has been live for a month, it makes sense to gauge it on its performance instead.

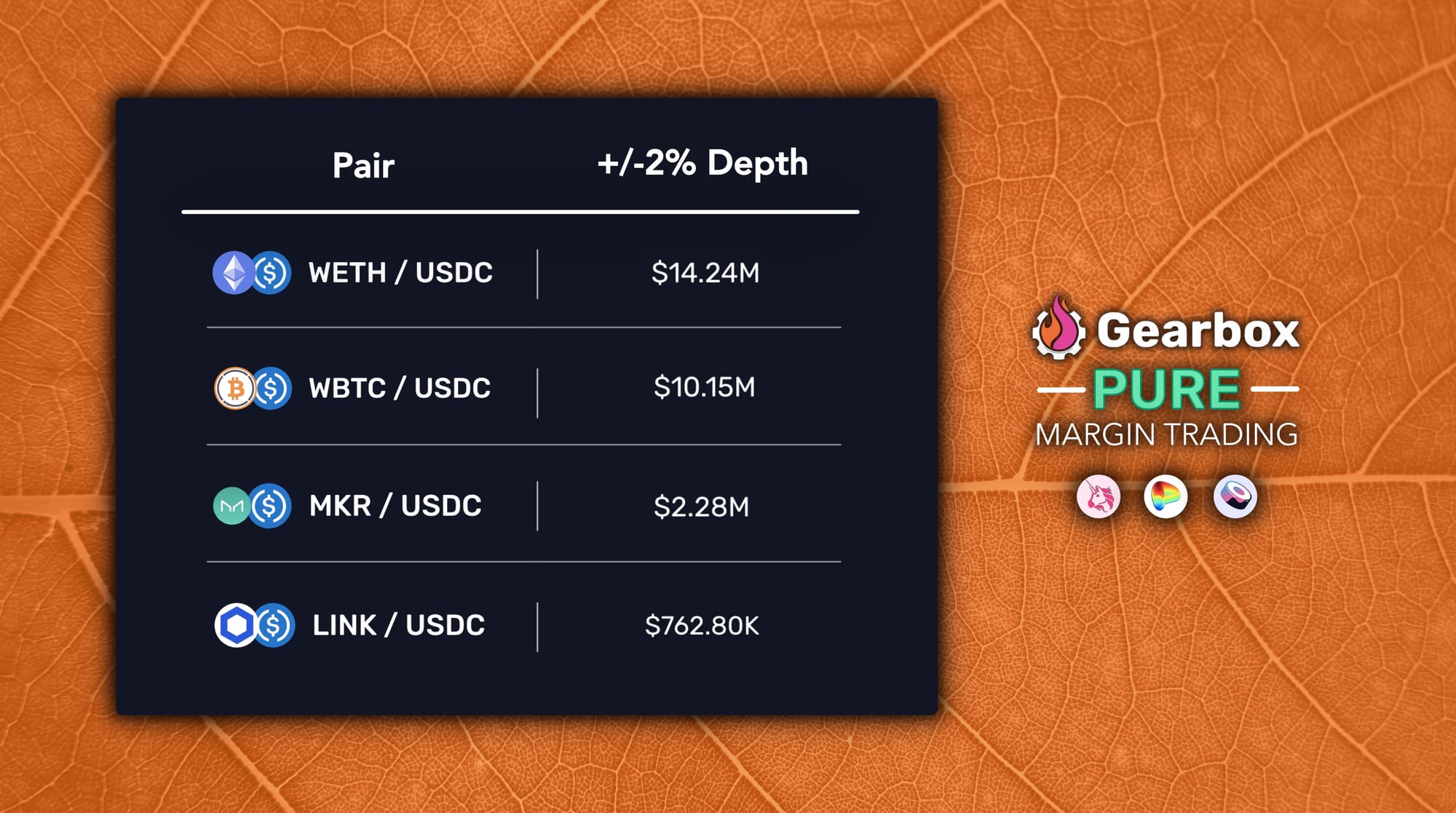

a. Liquidity Depth

How deep is PURE's meaningful(+/-2%) depth? Very, very deep!

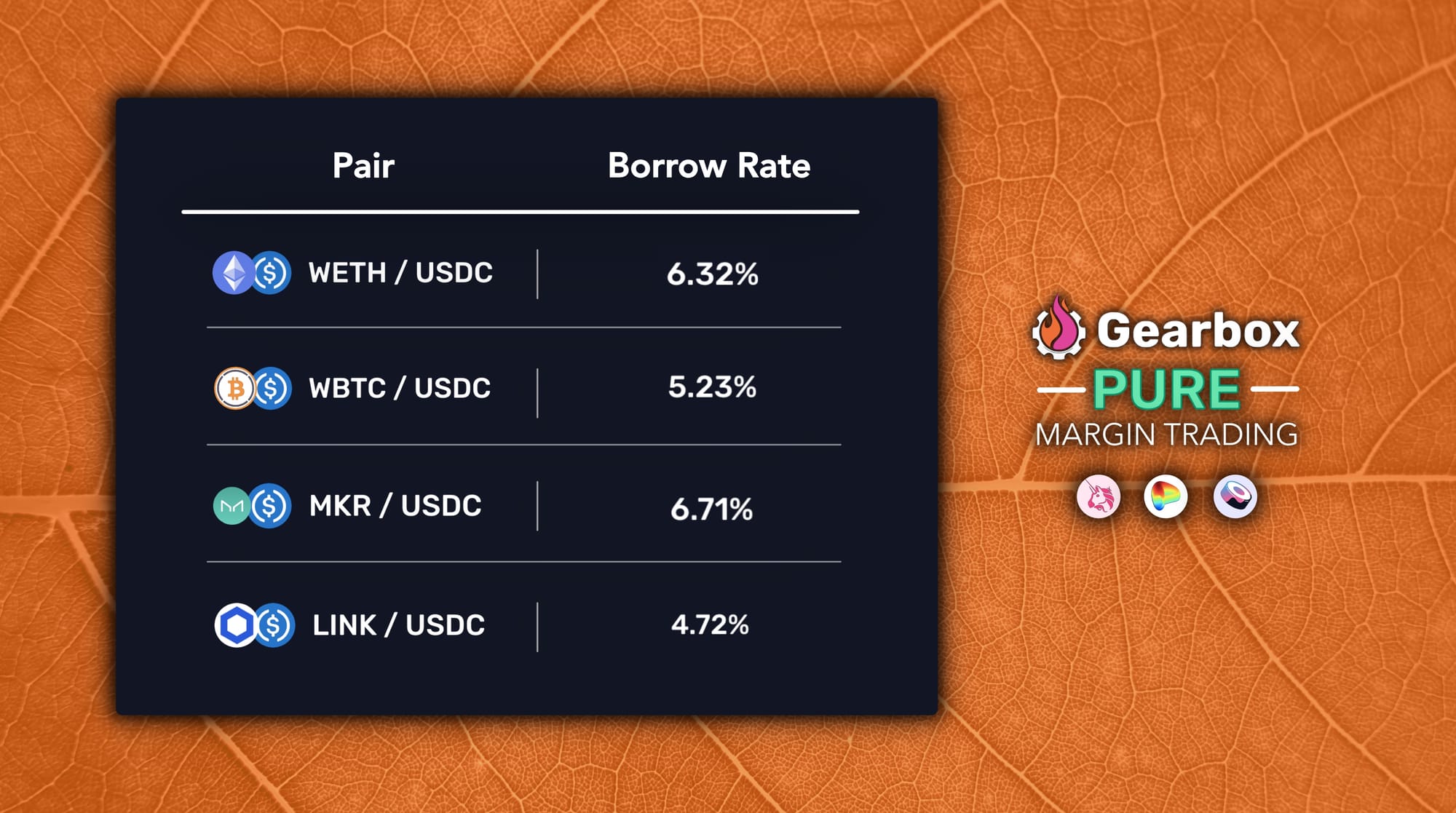

b. Borrow rates

Borrow rates for ETH never crossed 12.1% meanwhile alts and BTC remained <10%

c. User Profits and Lender APYs

The purpose of Gearbox PURE is to break the usual LP vs trader mechanism and create a positive sum trading environment. The 1st month gave us exactly those results.

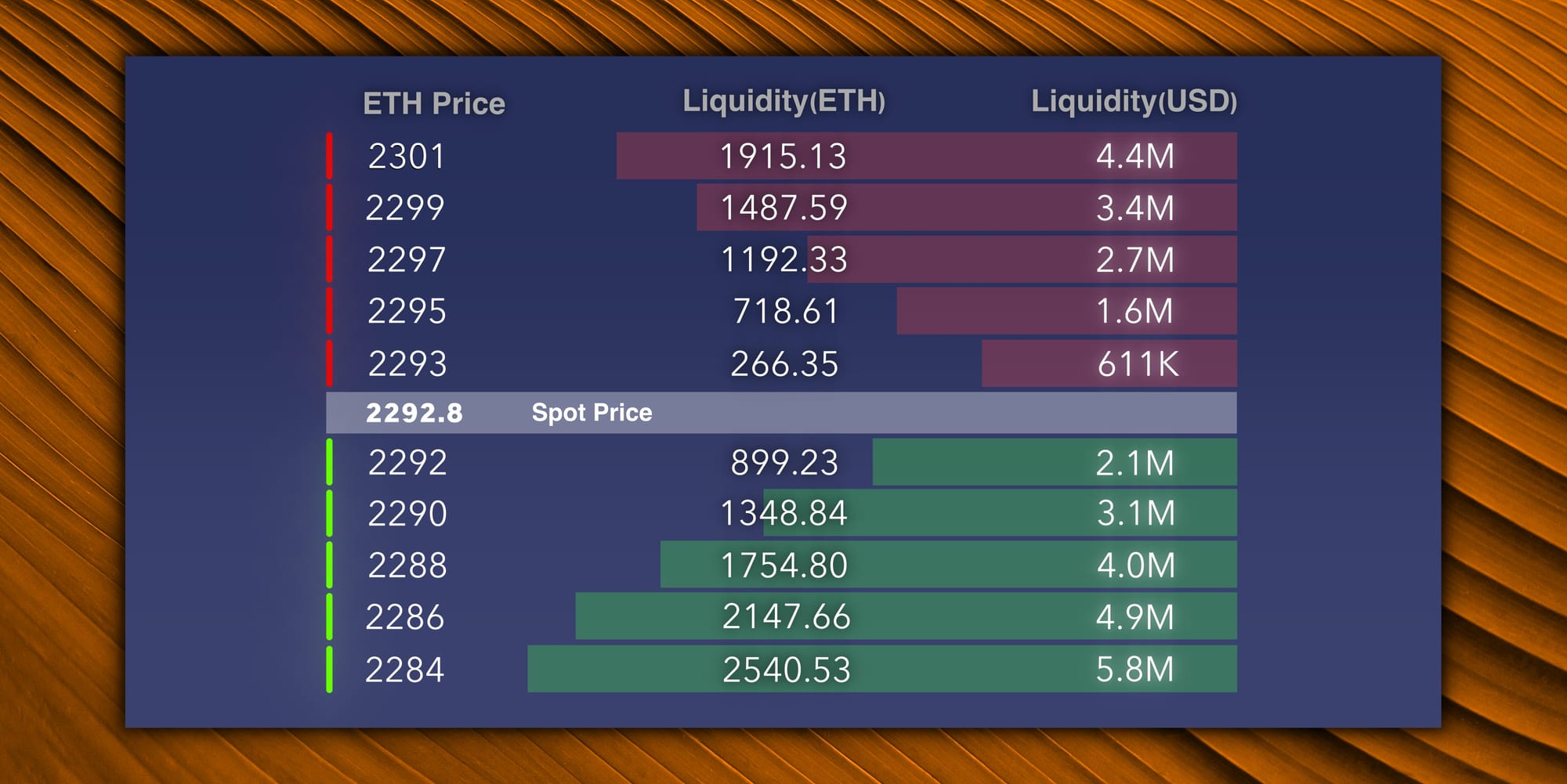

d. Slippage

Slippage can be rough but PURE, using Uniswap and Curve's liquidity, has dealt well. A $1M trade can be settled under 15 BPS on both sides.

e. Open Trade Value

The cumulative open trade value on PURE crossed $5.3M without any incentives to trade. The only incentive being the design of the protocol itself.

Reserve Fund Creation

With GIP-83 passing, Gearbox V3 was deployed with $450K of reserve/insurance fund. These funds come from the revenue generated by V2 and also separate the development funds for the protocol and the revenue it generates.

At the same time, it also offers additional safety to Gearbox users. Though, security is our top most priority with V3 being audited by ABDK and Chainsecurity, this just being an additional measure.

𝐕𝟑 𝐑𝐞𝐬𝐞𝐫𝐯𝐞 𝐅𝐮𝐧𝐝 💰 $𝟒𝟓𝟎,𝟎𝟎𝟎

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) December 20, 2023

get some $GEAR ⚙️ https://t.co/sphd0AU8J3

This might come as a surprise to many, but Gearbox has always had a Reserve Fund. Over the course of V2 being live, the fees accumulated to over $600K in different liquid assets. And with… pic.twitter.com/DsXBK7ljgO

GEAR Emissions Reduced

V2 was launched with a $GEAR LM to bootstrap liquidity for the initial lending pools. This was necessary as the farming APYs weren't high enough to be beyond the required supply APYs.

With V3's new integrations, the APYs are likely to become attractive enough over the next months(and even now). Which is why GIP-82 and GIP-85, have reduced the LM emissions by over 40%.

𝐄𝐦𝐢𝐬𝐬𝐢𝐨𝐧𝐬 𝐫𝐞𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐛𝐲 𝐨𝐯𝐞𝐫 𝟏% 👀

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) December 27, 2023

GIP-85 and GIP-86 are aiming at optimizing V3 parameters and reducing V2 passive lending emissions by over 1%. That means from ~2.6% a year to ~1.6% a year. That is about ~$1,000,000 in GEAR saved per year.

The goal for… pic.twitter.com/jSUuNMv8LM

This effectively reduces the annual GEAR emission by over $1M.

Gauges

PURE and V3 have seen a ton of assets and pools added, all of which have variable risks. Further, within the variable risk profiles, the individual assets have dynamic demands at even a weekly periodic level.

In such a case, how do you actively manage the dynamic rates?

We have talked about how lenders in V3 will be able to earn risk aligned rates. But how will the exact rates be defined? And how does $GEAR matter to the entire mechanism?

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) December 2, 2023

Introducing 𝙂𝙖𝙪𝙜𝙚𝙨 ⚙️🧰 pic.twitter.com/hFWBxliCtT

Meet Gauges. Stake your $GEAR, vote on increasing the rate, your votes decide where in the range the APYs land. Gauges are live now on V3 interface.

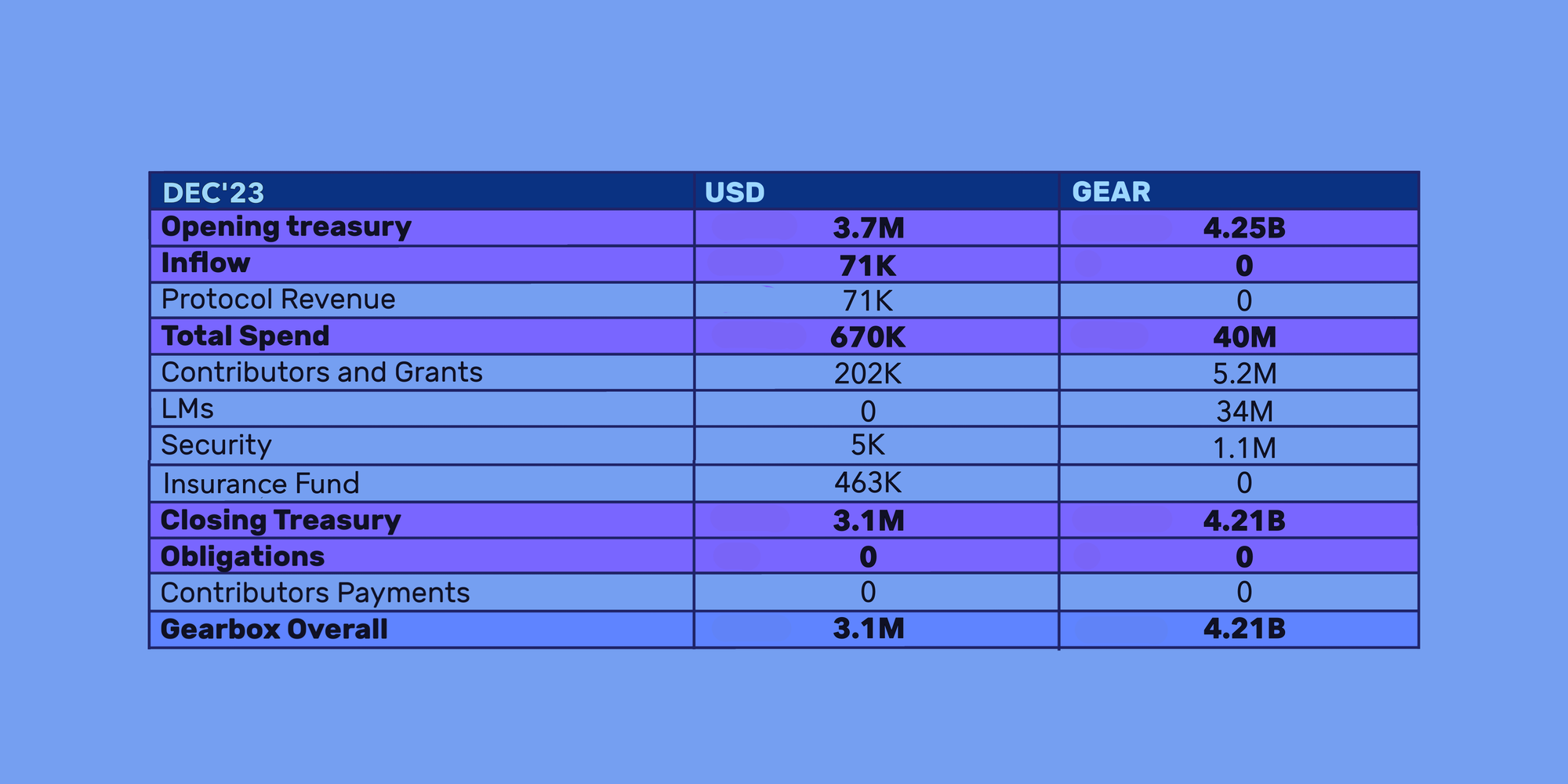

Financial Update

As of end of December, the DAO treasury holds $3.1M in non-GEAR dollar value in its address and an additional 4.21B GEAR Tokens. The realised revenue for the month was $71K while spends were at $670k. Contributor costs were at $79K(With January processed in December as well) while $123K were spent on grants further.

For GEAR outflows, 34M were deployed as a part of the LM programs on Gearbox Lending Pools, Curve GEAR/ETH pool and to incentivise voting on the bb-g-USD Balancer pool. 5.2M were spent on pending contributor obligations. A further 1.11M were spent on Risk DAO's vesting.

This puts the DAO in a healthy financial place with a runway of about 2 years even after factoring in growth.

Small Updates

Hear more about PURE

I can't believe no one is talking about this

— Moose🫎 (@CryptMoose_) December 4, 2023

The global consumer credit market was valued at 7.84 𝗧𝗥𝗜𝗟𝗟𝗜𝗢𝗡 in 2022

What if I told you that a certain protocol is bringing credit to 𝗬𝗢𝗨 onchain?

Find out more in this episode of Moose Meets!

Links down below ⬇️ pic.twitter.com/1WL7uWi8MO

V3 Risk Parameters Validation

B.Protocol’s Risk Level Index in Action -

— B.Protocol (⊟→⊞) (@bprotocoleth) December 5, 2023

We used it to validate community-suggested risk parameters for @GearboxProtocol v3 launch.

Results show that based on the SmartLTV formula, parameters are within DeFi risk level norms, as observed in @compoundfinance v3 markets🧵👇 pic.twitter.com/cebBygT2ot

More assets added

Come join the DAO if you would like to contribute or just vibe — just get involved on Discord or Telegram. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better.

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And, of course, Notion monthly DAO reports: