Gearbox PURE: Margin Trade with DEXes' Deep Liquidity

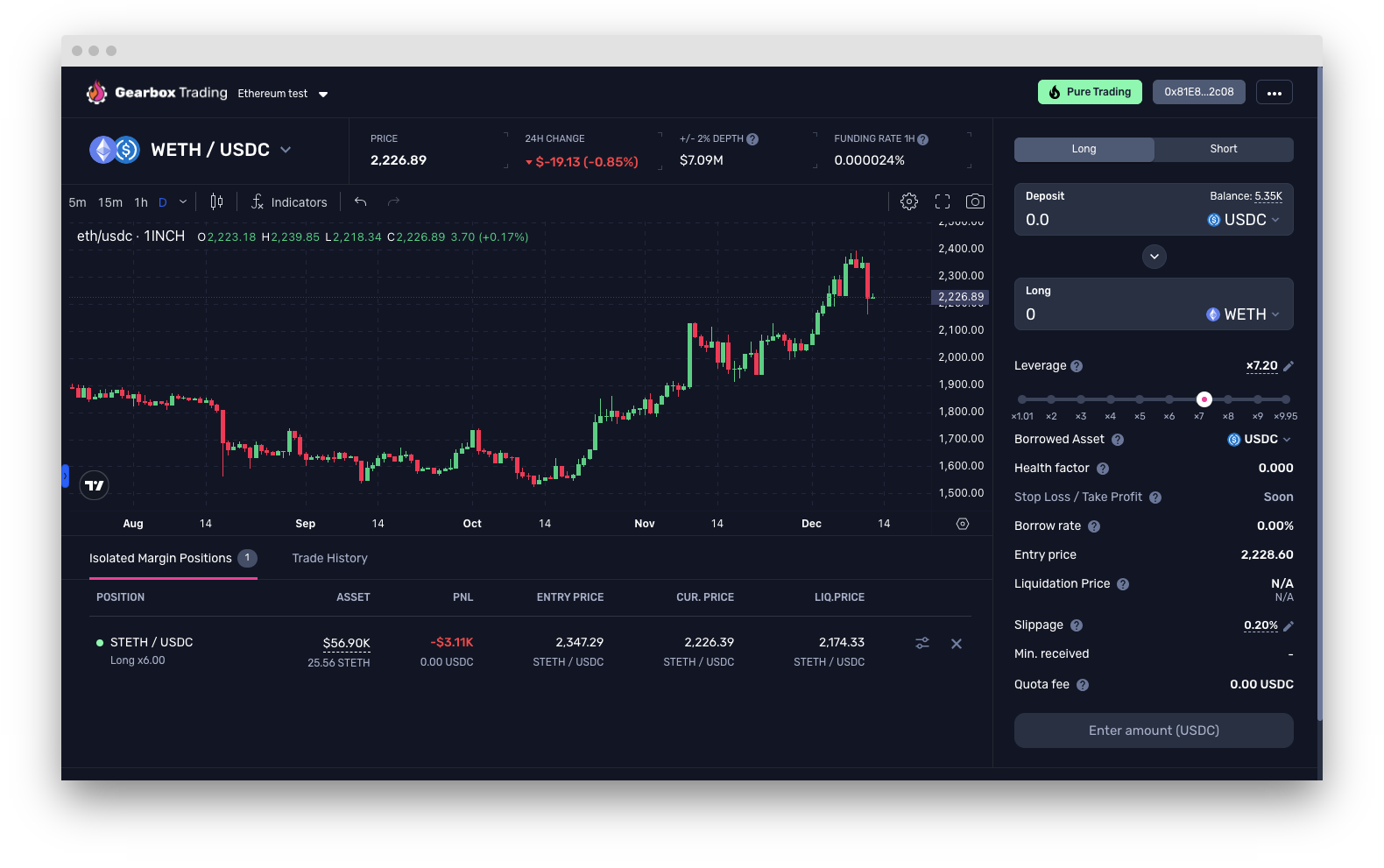

The wait is finally over, meet Gearbox PURE. A Margin Trading based leverage product that enables you to trade natively on Uniswap, Curve and your favourite DEXes. PURE offers the deepest onchain liquidity for leverage without having any LPs or counter-parties trade against you.

PURE at the moment is going live in alpha testing, this phase is key to test out the final bits of the codebase and product before V1 is launched in January. The current version regardless should give users a glimpse of how margin trading on DEXes works. So without ado...

Meet Gearbox PURE

Gearbox PURE utilises real, spot assets to create leverage through Margin Trading. Leverage takers borrow up to 10x(asset dependent) funds against their collateral from Gearbox’s lending pools, which are supplied by the passive lenders. These funds are held in a Credit Accounts which ensures utilisation only on safe, allowed DEXes like Uniswap and Curve. Borrowed funds are returned to the lending pools whenever the position is either closed or liquidated ensuring lenders always stay whole. The app is now live here: https://pure.gearbox.fi/trade.

The purpose to introduce margin trading isn't to build just another leverage trading app. The goal is to provide leverage traders a fairer leverage alternative to trade on, one that isn't 0 sum, one that doesn't need them to lose, one that doesn't create pretend positions but gives users real, PURE assets. Hence, Gearbox PURE🍀.

Since the assets are real and the trades are routed through DEXes, Gearbox PURE solves a few key problems that leverage traders often face:

I. Deepest liquidity to leverage trade onchain

PURE routes your trades through DEXes like Uniswap, Curve etc. Which cumulatively have a TVL($6.6B+) 4x deeper than the liquidity available on all perpetuals combined($1.5B+). In turn, leverage traders on PURE get to settle their trades through the most liquid AMMs. This ensures that the slippage remains in control(Not 0% but low enough to be efficient) and that liquidity is present to actually settle trades.

NOTE: Currently Gearbox PURE uses the DEX option with the maximum liquidity to settle a trade and not the cumulative liquidity available on DEXes. This is an addition that is being worked on and will be made available in subsequent versions.

II. No Counterparties trading against the users

Gearbox uses lenders to create leverage instead of the traditional mechanism of having counterparties or LPs. Lenders are paid a borrow fee by borrowers for the duration of the borrow, post which the assets are returned. This removes the need for LPs to absorb user P&L changes, consequently removing the need for LPs and traders to trade against each other. This makes leverage through margin trading a non 0 sum game and provides a fairer trading environment to users.

III. No Price Wicks:

Since leverage on PURE is built with spot assets, Chainlink oracles are utilised to price the assets. Chainlink oracles aggregate data from multiple CEXes and DEXes to create a spot price that is significantly harder to manipulate than the index price offered through an order book. Leading to significant reduction in chances of a price wick that liquidates users.

NOTE: While Price Wicks are unlikely, oracles too carry deviation and other risks with them.

IV. No funding rates

Leverage users are used to funding rates, which are either paid by the longs to the short or by the short to the longs. Since PURE utilises spot prices, users don't need to pay a funding fee. Users do pay a borrow fee though, which is significantly lower than the funding fee usually. You can check the borrow rate ranges for different assets here.

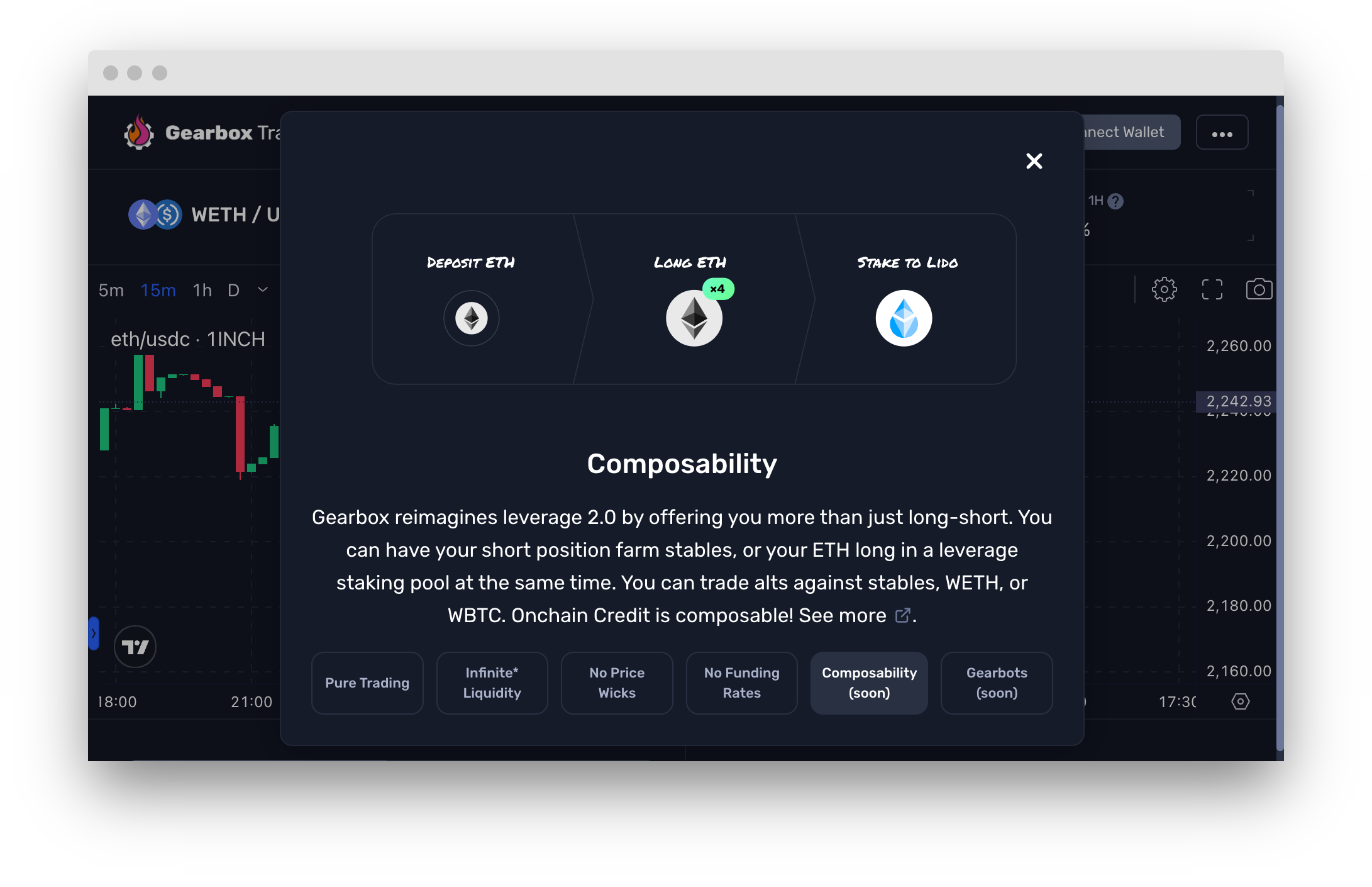

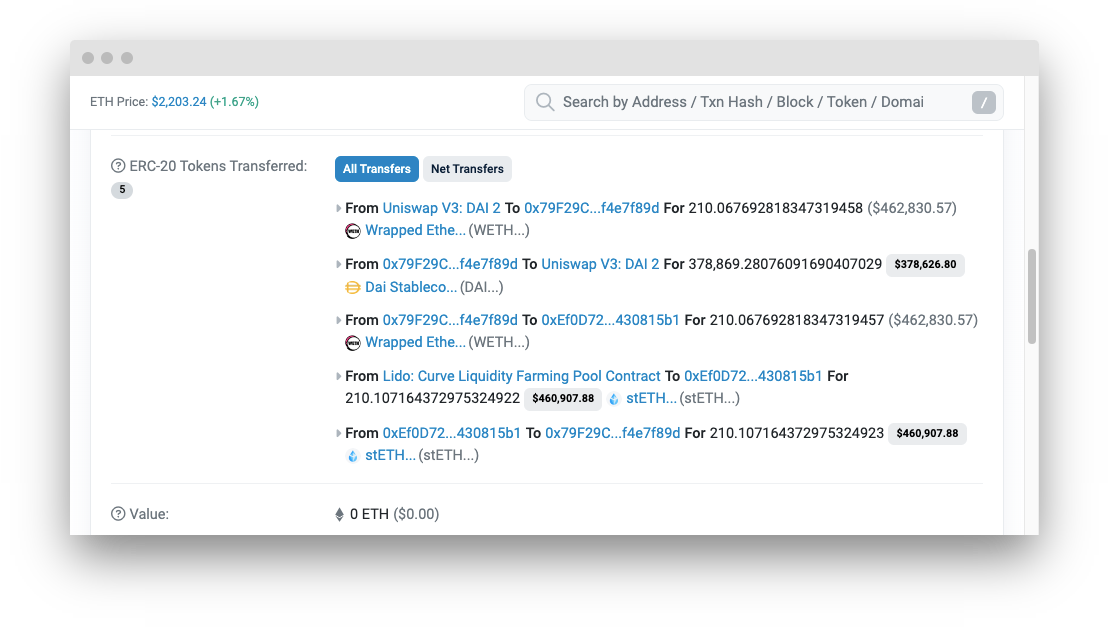

V. Boosted Trades through composability

Since Gearbox uses real, spot assets to create leverage, it becomes possible to go ahead and use this leveraged position for other DeFi activities. This creates the possibilities of Boosted Trades. Considering longing ETH? Long yWETH or stETH instead and earn leveraged yield on your position. This directly reduces the costs you incur to trade.

NOTE: This composability is also why Gearbox doesn't have to be a competitor with the existing perps mechanism. If the DAO were to believe that there's value in adding both the designs, Gearbox can integrate GLP and offer leveraged LPing to GMX too. Collaboration over Competition.

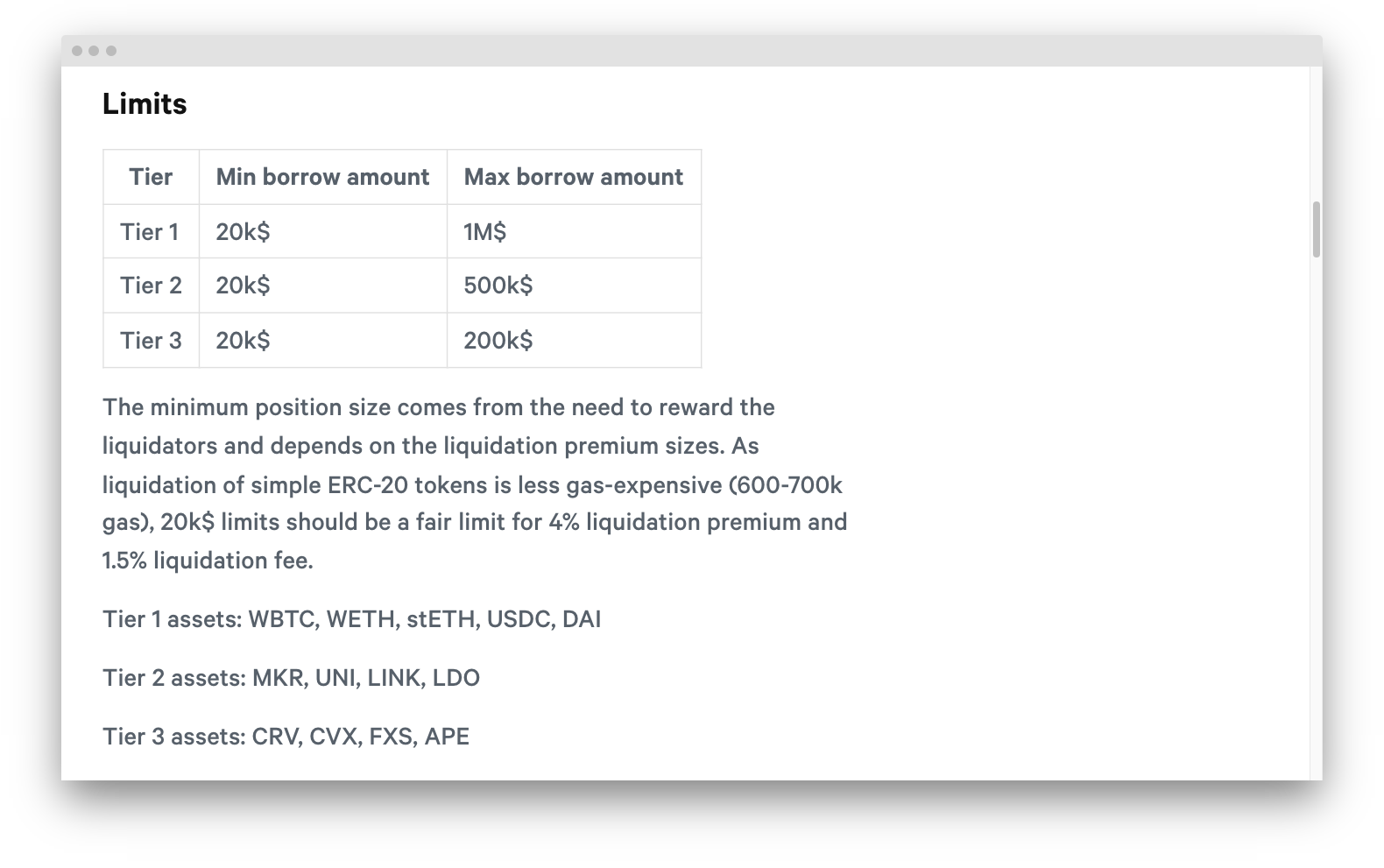

VI. Asset Availability

Gearbox PURE will be going live with 13 different assets and 37 possible pairs. The ability to add an asset for Gearbox depends on its presence on a DEX(ETH network only, for now). If the asset has enough liquidity and a safe enough risk profile, it can theoretically be added. This could potentially enable Gearbox to expand the assets available to trade significantly and even add newer assets. The below assets will be available to users in only isolated margin mode.

While this ensures that margin trading is able to match and perhaps even surpass, on certain parameters, the standards offered by perps. It largely addresses the backend of the trades. For PURE to be easily usable, a seamless UX is key...

To learn more about PURE, read the docs or hop into our discord to ask any questions you have.

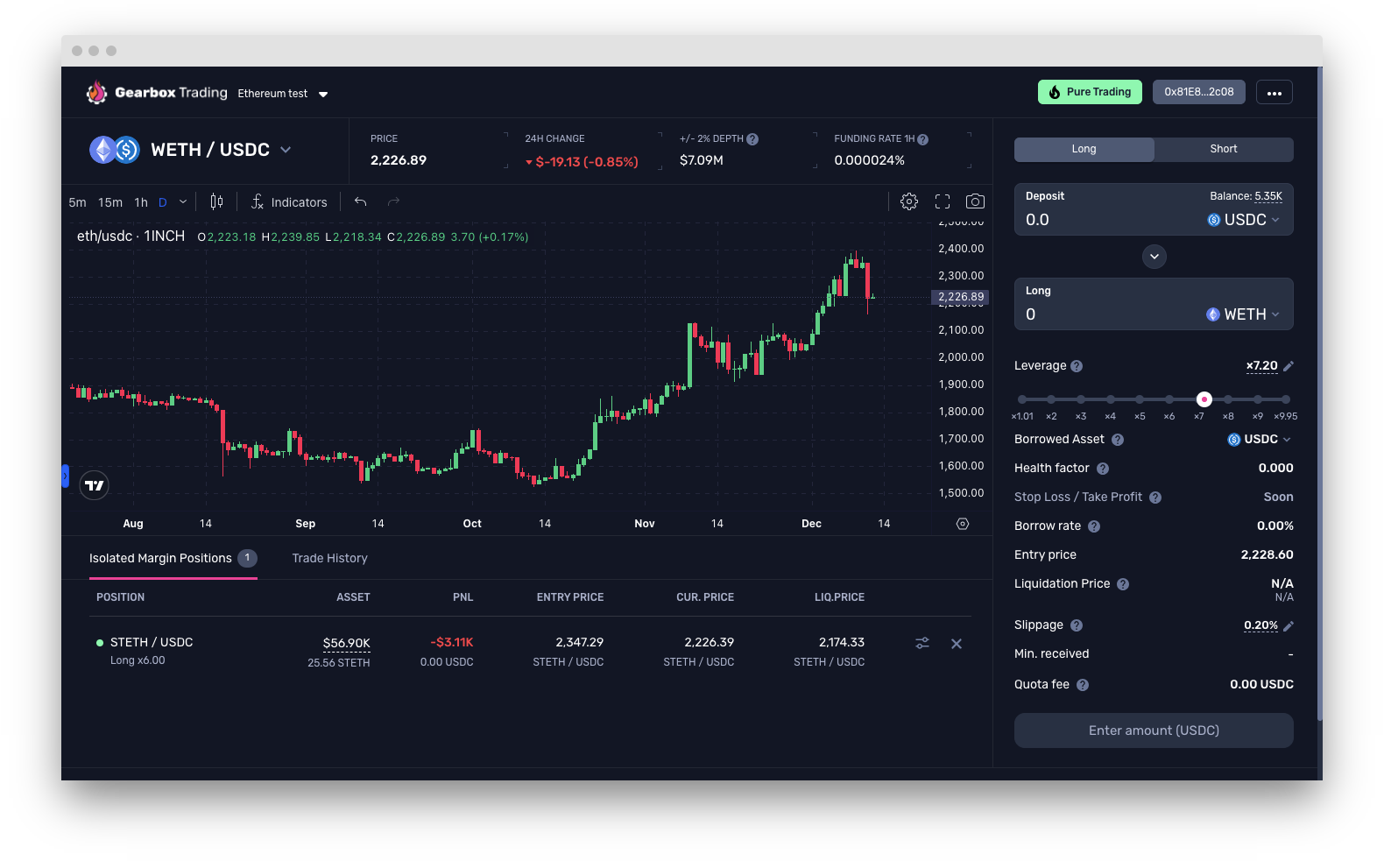

Delivering a smooth user experience

If you have been following Gearbox over the years, you know the devs take providing a smooth UX very seriously. Here's how we intend on delivering a smoother margin trading experience over the coming months.

UI: Familiar, intuitive

CEXes come with their own problems but when it comes to UI, they are the best in class. Gearbox's goal is to match up to those standards, a UI that feels instinctive to use and yet accommodates all the information required to trade is what we aim to provide.

While alpha testing might not be as detailed as CEXes yet, more detailed analytics, charts and visualisations will be added as the usage grows.

Multicall: Executing transactions made easier

Web3's inherent constraints regarding transactions can make user experience frustrating. Since Gearbox routes real assets through DEXes, the number of transactions required to open a position can rise. PURE solves this with multicall, all your transactions get batched into one transaction, enabling execution in one click. Providing seamless user experience, from depositing your collateral to swapping to your preferred asset, all the transactions are executed in one go.

Gearbots: Stop Loss, Limit Orders and More

Leverage trading has higher risks, which requires stricter risk management and timely execution abilities. Features like limit orders, stop loss, DCA enable users to execute their strategy seamlessly without having to constantly be glued to their screens.

Gearbots effectively do the same for Gearbox. Gearbots are intent agents that take in your inputs and execute your risk strategy as and how you want it. Input the price you want to enter a position on and they will execute. Want to spot your losses at a level? Gearbots at your service. Think of them as your Gearbox Concierge that automate your trading experience. You can read the complete details about them here.

NOTE: Gearbots are not available during the alpha testing phase. They though will be available with the launch of V1 in January to make trading smoother.

Fee and Networks

Fee is perhaps the most discussed factor about leverage trading on CT. Fee has effectively 2 components: 1. At a protocol level, 2. At a network level

At a protocol level, there are different types of fees that will be applied to your positions. Those can vary depending on how sophisticated you get with your Credit Account.

- No funding rates: Gearbox is about PURE assets, so there is no long-short ratio to maintain. As such, no funding rates! Only borrow rates. Conceptually, borrow rates are almost always cheaper than funding rates, but in some cases it could be different. It depends. But at least large fluctuations is something extremely unlikely to see with Gearbox.

- Quota rates, quota fees: All lower than the alternatives, at least to the best of our knowledge. The fee structure is specified in the dApps and is being improved, but in case you want to see the details, check the docs.

NOTE: You can read about quotas in detail here.

L2s

And at a Network level, well... Currently Gearbox PURE is only on Ethereum Mainnet, which means gas can be not user friendly. Though, this is all covered. Gearbox V3 has been deployed with capabilities to scale to L2s. This should be the top priority once V1 is live. Perhaps deployment by Q1 end or early Q2?

Maybe the DAO can decide to do a small reward to cover gas fee for alpha testers? Maybe it extends it to initial V1 use too? Maybe We call it STIMMIES? Idk idk, make a proposal sers, it's a DAO.

Live in Alpha Testing

Gearbox PURE is currently live in Alpha testing. This is the final stage of testing before we roll out V1 in January. This means you can possibly encounter:

- Encounter buggy UI

- Face downtime

- Have issues with analytics and charts

The devs tho are trying their best to provide you a seamless experience even in Alpha phase. You should still go ahead and test out the app to check

- The depth of liquidity on PURE

- The UX of a new leverage mechanism

- The benefits and improved risk profile of Margin over Perps

With this said our biggest investment, financially and in terms of time, has been on security. PURE has been audited by ABDK and Chainsecurity between Q2 and Q4'23. Meanwhile, the total number of audits on Gearbox codebase are over 7! (No certik, we promise).

There's additionally a $200K bug bounty up on immunefi and a whole suite of intelligence, risk monitoring/management and security enhancing tools that we have deployed to ensure your safety. You can read the complete details below:

A note on liquidation prices

Since PURE uses real assets, the slippage and liquidity requirement isn’t just limited to your collateral but the whole of your position. This leads to the calculation of liquidation price being slightly different than what you are used to on perps, and hence needs more attention while opening a position. With this being the alpha version, we have been conservative with the LTVs, as the risk framework evolves, the UX on this too should improve. It’s not a protocol “issue”, just precautionary risk management that should improve as we grow. For now, your liquidation point will be visualised on the chart with a line marking it. Trade safe!

Read the Pro-Bible to make understand in depth how to safely margin trade on PURE and Gearbox in general.

Same great leverage trading experience but still different from the rest. Trade fair, trade with the deepest liquidity on Gearbox PURE🍀

Come join the DAO if you would like to contribute or just vibe — just get involved on Discord or Telegram. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better.

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And, of course, Notion monthly DAO reports: