Gearbox DAO Update: Sept-Nov'23

As we bid adieu to the year, let us do it with the final transparency update regarding everything that happened and was executed by Gearbox DAO between the months September to November of 2023. Between Curve V2 deployment, V3 Upgrade and the alpha testing launch of Gearbox PURE, this Autumn period has been one of the most crucial ones yet. So strap in as we sum it all up for you in the next 5 minutes.

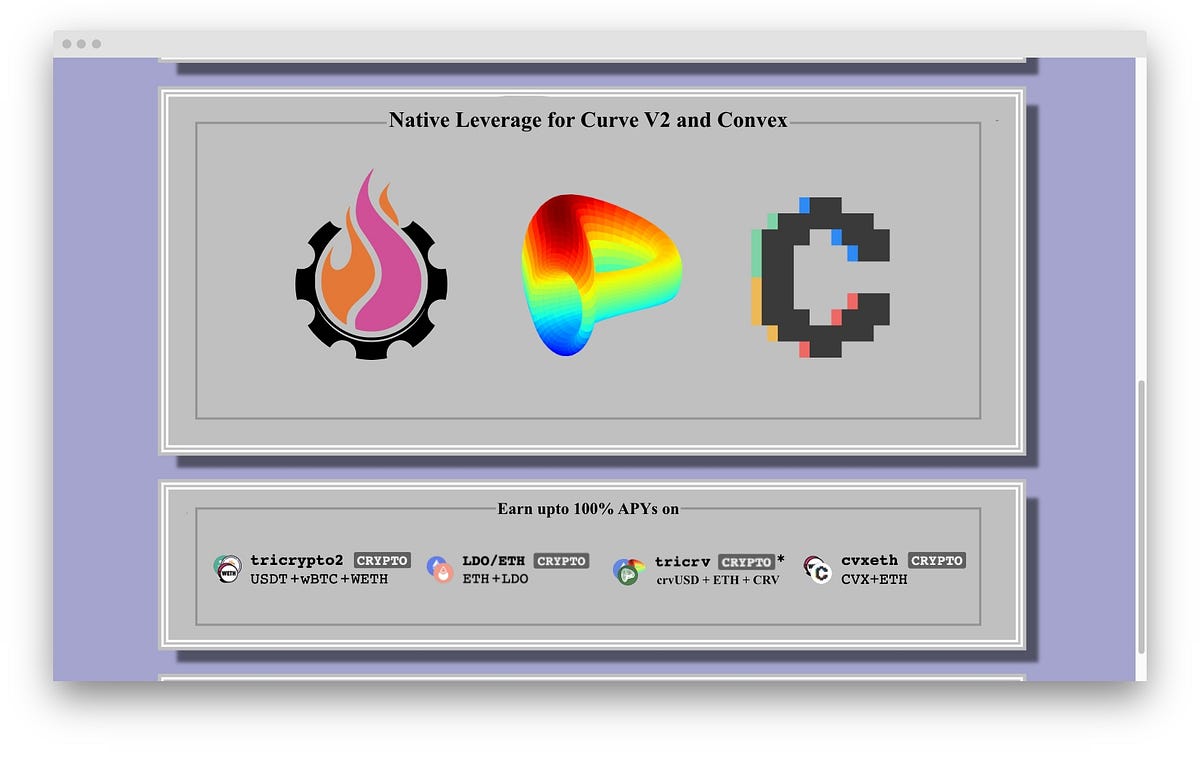

I. Leverage on Curve V2 farms

Curve V2 was Gearbox’s most exciting addition for Q3'23, enabling leveraged LPing to factory pools. Along with providing high double digit APYs, it also served as the test mechanism for Gearbox's upgraded risk framework. The same risk framework is also crucial to ensure safe operations for Gearbox PURE. The below Curve V2 pools and their Convex Counterparts are available to lever up on:

- Tricypto: ETH, WBTC and USDT pool on Curve and Convex

- LDO/ETH pool on Curve and Convex

- CVX/ETH pool on Curve and Convex

- TriCRV: CRV + crvUSD + ETH pool on Curve and Convex

The APYs on the pools constantly remained as high as 50%+ with relatively safe levels of leverage. You can read more details about the additions on the link below.

II. Building the Onchain Credit Layer

There's a lot we have talked about in terms of what Gearbox can do: Leveraged LSDs, Leveraged LPing, Leveraged Stablecoin Farming and with all of that, a simple product can seem complex.

Gearbox is not about just creating purpose specific leverage, Gearbox is about a generalised credit layer. Gearbox effectively is there to give you Credit in the form of leverage so you can borrow 2x, 5x or more of your capital and use it to access leverage on your DeFi activities.

The above article explores the evolution of Credit Onchain and how Gearbox's leverage is a natural progression to enable growth as well as get closer to TradFi like lending capabilities.

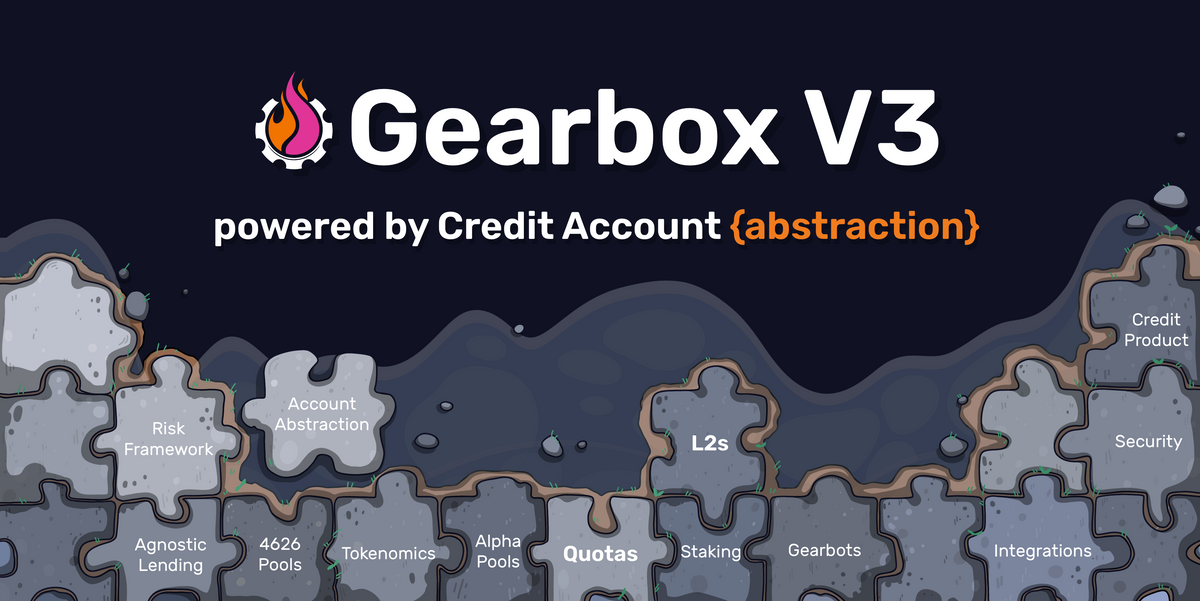

III. The Gearbox V3 details

Our goal for Gearbox has always been clear, to build a credit layer for DeFi, one that enables users to borrow with leverage. With this in mind, every version of Gearbox is a step to achieve that goal. V1 was a proof of concept, V2 was a confirmation of requirement and V3 is all about growth. The goal for V3 is to truly help expand Gearbox.

Since Gearbox's credit relies on the integrations we have, V3 at an architecture level was built to be more

- Modular

- Composable

- Capable of managing risk

By building a protocol capable of all that, Gearbox products gained significant advantages. From L2 deployments to more assets, from customisable lending to new rates mechanism for diverse assets, V3 enables Gearbox products to grow. Read the complete details in the article above.

IV. The Tokenomics Plan

V3 also brought to the world MVT or minimum viable tokenomics which enable GEAR staking and it's utilisation to vote on different assets for dynamic interest rates.

But we already know every development is followed up with the "Wen next?" So saving you GEARHeads some time, we went ahead and creates the blueprint, which are longer term strategies on how MVT could evolve into complete tokenomics.

𝘾𝙤𝙣𝙩𝙧𝙞𝙗𝙪𝙩𝙤𝙧 𝘽𝙡𝙪𝙚𝙥𝙧𝙞𝙣𝙩 #3 💡

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) October 2, 2023

“Bringing value to $GEAR beyond governance.”@Ov3rkoalafied discusses a framework to design GEAR tokenomics with V3's capabilities pic.twitter.com/veAaJ0ZIFi

The tokenomics are being built out with an inherent product related structure. It looks into the dynamics between borrowers-lenders-debt assets and the external utilisation purpose to enable smooth dynamic interest rates. The next step will be to find an area from where GEAR can gain more utility too without hurting any dynamics.

V. Network Effects

V3 worked on making sure that the protocol's code is capable of larger scale. That it can enable growth truly. But what is this growth and why are network effects so important to Gearbox?

In their research on onchain credit, @jump_ cite "Network Effects" as a key growth factor for Gearbox's Credit Accounts and onchain credit.

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) November 2, 2023

But, what are these network effects? And how does Gearbox V3 amplify them? Let's dive into it 🧵

In simple terms, the Network Effects of… pic.twitter.com/sVl1AW05Rq

Jump_ cited network effects to be a key factor for growing Gearbox. In the above longform we highlight exactly these effects are and how the DAO intends to leverage them to grow lending through farming and margin trading.

VI. How V3 evolves Lending

Gearbox V1 and V2 had a one asset-one pool mechanism. All the borrowing for a particular asset happened from 1 pool. But if we increase the number of assets for which funds can be lent, the risk across these assets will vary. Pooling in such a situation generalises the risk to all the lenders in the pool with little customisation.

Freedom of choice is fundamental for an individual to take their own decisions. With V3, Credit Account {abstraction} brings this freedom to how you lend. Choose the risk exposure and how it's governed for your assets.

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) November 7, 2023

Personalised lending with V3: https://t.co/lg8qgEzmFp ⚙️🧰

Gearbox Credit Accounts, though, can determine where the funds are being utilised. Thus, they can categorise how risky the utilisation is. Lenders can thus now choose to personalise lending to their needs. Lenders will soon be able to personalise what they want to lend to, who governs this lending and more with V3. All details in the article.

VII. Introducing Gearbots

Leverage requires timely, swift actions to ensure proper risk management. CEXes deliver this with features like SL, TP, Limit Orders and more that execute your commands when a criteria is met. Having the same capabilities onchain is crucial though.

A significant reason why Gearbox DAO wanted to host a hackathon at @ethglobal was to introduce a key UX addition that the community could further help develop.

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) November 20, 2023

Meet Gearbots 🤖, using intents to improve UX for all Gearbox products, current and upcoming. 🧵 pic.twitter.com/lK4JyaTiv4

Which is why V3 brings you Gearbots. Gearbots are intent agents that effectively enable automation onchain. Users can express their intent by inputting commands to a smart contract. Whenever the criteria to execute that command is reached, gearbots will go ahead and automatically execute that. All of this is done without any private key data being required. Check the thread for complete details.

VIII. The GEAR governance model

With V3 bringing in so many changes, it's imperative the DAO moves forward with the evolving tech too. And with that, an upgraded governance model was put in place as well.

The key goals for this change are to keep governance fast, free and flexible. Go ahead and read the article to learn about the new technical changes and how we accomplish the goals.

IX. Governance Update

Between September and November, Gearbox DAO held a total of 6 votes.

- GIP-73 SC Core Initiative: Focusing on setting up a smart contract initiative

- GIP-74 V3 Audit Budget: Approval to get V3 contracts audited

- GIP-75 Enable TriCRV pools farming: Expanding the Curve V2 pools available for leveraged LPing on Gearbox

- GIP-76 Modify Pool Interest Rate Curve to 2 Points: Making UX better by ensuring the interest rates don’t spike up instantly

- GIP-77 V3 Deployments 1: Deployments necessary to make transition from V2.1 to V3 smooth

- GIP 79 Governance Framework Upgrade: Upgrading the governance as per the details in point 8

All the proposals reached quorum in required time and were acted upon. All the governance votes are available on

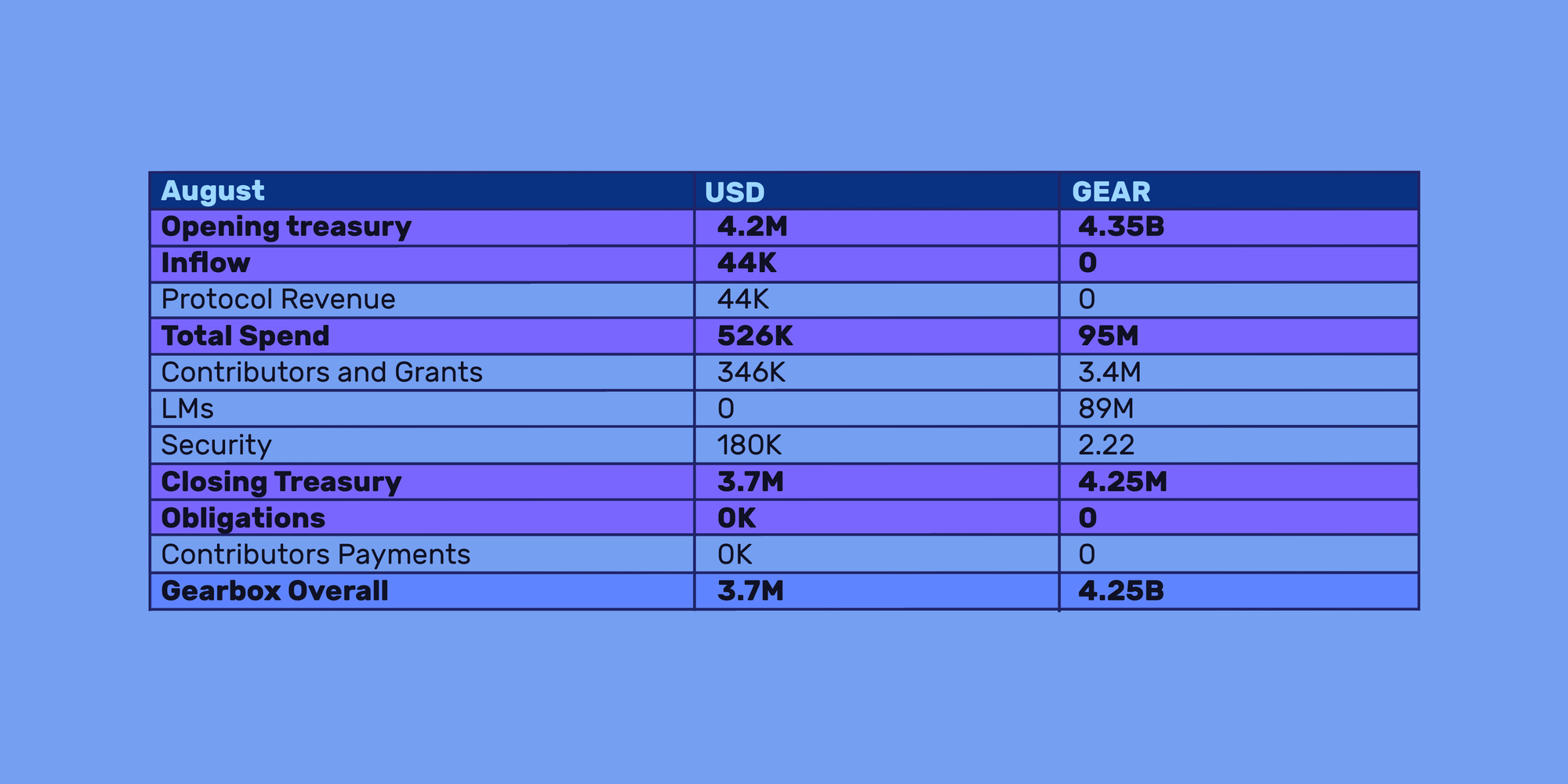

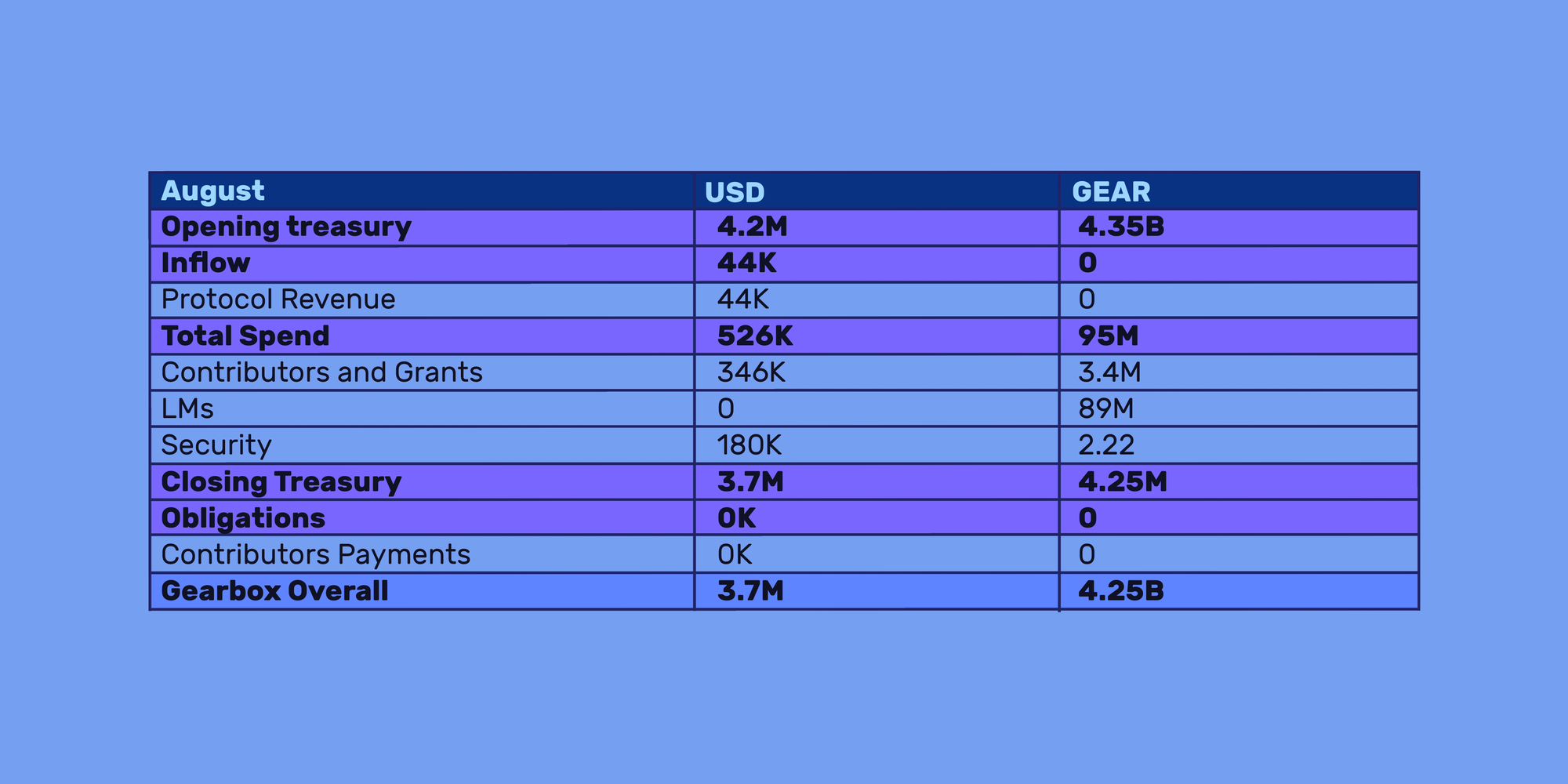

X. Financial Update

As of end of November, the DAO treasury holds $3.7M in stables in its address and an additional 4.25B GEAR Tokens. The realised revenue for the period was $44K while spends were at $526k. Contributor costs were at $283K while $66K were spent on grants further. $180K was spent between Immunefi bounties and Chain Security and ABDK for audits.

For GEAR outflows, 89M were deployed as a part of the LM programs on Gearbox Lending Pools, Curve GEAR/ETH pool and to incentivise voting on the bb-g-USD Balancer pool. 3.4M were spent on pending contributor obligations. A further 2M were spent on Chainsecurity's vesting.

This puts the DAO in a healthy financial place with a runway of about 2 years even after factoring in growth.

Smol Stuff, Big impact

a. Curve TriCRV performance

Live now and generating 75%+ APYs on @CurveFinance and @ConvexFinance is the 𝗧𝗿𝗶𝗖𝗥𝗩 pool.

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) October 13, 2023

LP upto 5x your position here: https://t.co/1nuMZuv4YQ ⚙️🧰 pic.twitter.com/ZLPZcIZQrD

b. V3 and evolution of credit

Our goal is to make 𝐨𝐧𝐜𝐡𝐚𝐢𝐧 𝐜𝐫𝐞𝐝𝐢𝐭 both safe & accessible. See Gearbox as a one-stop place where both end users and protocols can grab more $$ and do with that leverage whatever they desire! Capital efficiency! No credit scores though, only math 🫡 Coming up in V3! https://t.co/I2V1hbs549 pic.twitter.com/Osy4y3CVHH

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) October 28, 2023

c. Movement to two-point IR curves

With demand for leverage increasing, we have often seen borrow rates spike to high double digits. This in turn leads to panic closure of accounts as net APYs turn negative.

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) October 16, 2023

Now, this all changes with GIP-76's two point curve model. Less steep spikes, less panic, better P&Ls 🧵👇 pic.twitter.com/n3MsDmIrmz

d. In-Earn-Out

Figuring out the IL, fee and risks while trying to earn yields on your assets can be tough. But Gearbox makes it easier

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) October 18, 2023

Simply, In-Earn-Out. ⚙️🧰 pic.twitter.com/y4bARiUbMT

e. LLSD highlighted by Defiant

f. V3 continues building on Credit Accounts

DeFi should be about code and math, not convoluted trust systems. Which is why V3 continues building upon Credit Account {abstraction} to deliver credit based leverage.

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) November 9, 2023

And in turn, brings personalisation for users of Gearbox's lending market. YOU choose how you lend.

How? 🧵 pic.twitter.com/MVsVqSNk9O

g. The V3 deployment guide

Not wen… but HOW ⚙️🧰 V3!

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) November 22, 2023

𝑙𝑖𝑛𝑘 𝑤𝑖𝑡ℎ 𝑑𝑒𝑡𝑎𝑖𝑙𝑠 𝑎𝑡 𝑡ℎ𝑒 𝑏𝑜𝑡𝑡𝑜𝑚

Semantics aside (check the quoted tweet for details from the hackathon), we want to say “thank you” to everyone for yet another eventful week! In terms of concrete objectives, a few things were… https://t.co/267dmZp02D pic.twitter.com/57DcCheCwg

i. Gearbox in Istanbul

Good afternoon 🇹🇷 Gearbox is coming to Istanbul for @EFDevconnect & @ETHGlobal. The hackathon theme is Gearbots 🤖

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) November 4, 2023

🧑💻 It should be easy for devs to make DCA, TWAP, copytrading, gasless txs, and other onchain bots... and with up to 10x the capital efficiency thanks to onchain… pic.twitter.com/XqJbQI4DhE

j. Portal Integration

You can now swap your assets directly to Diesel tokens, the tokens you receive after supplying to Gearbox pools. Earning passive yields made easier by @portals_fi ⚙️🧰 https://t.co/M7inkLNan8

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) September 4, 2023

Come join the DAO if you would like to contribute or just vibe — just get involved on Discord or Telegram. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better.

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And, of course, Notion monthly DAO reports: