Building and expanding the Onchain Credit Layer

Credit, by its literal definition, means trust which allows one party to provide money to another. In a “Trustless” financial system, this requirement of trust can seem, and rightly so, counterintuitive.

But, the importance of and demand for credit are factors that can’t be overlooked. Credit, at a rudimentary level, enables people to access money they don’t have. When you couple that with utilisation of borrowed money for investments, credit products can create significantly positive return opportunities. And that’s where we see the demand for credit created. Credit is how the entire world works, and you can’t overlook that.

What factors exactly drive this demand for credit, though? How do you capture it, grow it? How much can you even borrow and with what mechanism while maintaining the best possible standards to keep out bad debt? Many of us would have used some sort of credit products, today let’s go deeper into the growth and evolution of Credit.

PSA: While the goal of the article is to discuss credit and its evolution in this emerging onchain financial ecosystem, it is also closely related to Gearbox’s upcoming V3. V3 through account abstraction will be able to create more credit products to capture different market segments and thus focus on growing credit onchain. More updates on V3 will drop between now and Devconnect Istanbul. Keep an eye out!

The Importance of Credit

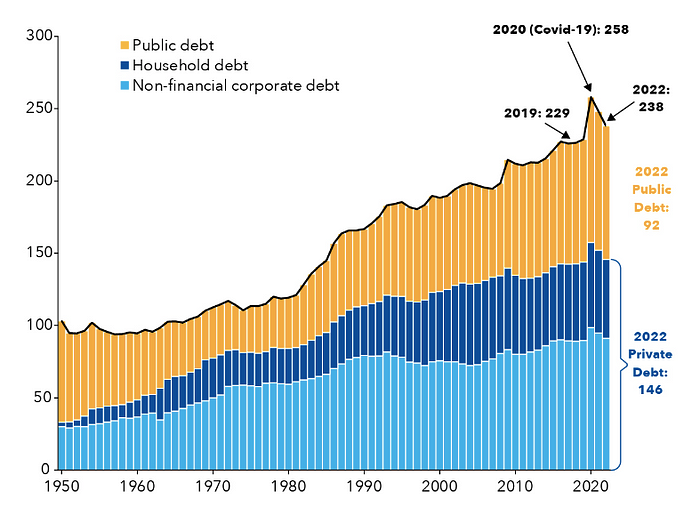

With global debt reaching $238 Trillion and private debt reaching $146 Trillion, the demand for credit and its multi-decade upward momentum see no headwinds. So amidst all the irony of putting trust in a trustlessness realm and the 3ACs we have seen abuse credit offchain, credit still remains a vital tool for creating financial leverage. Financial leverage enables you to turn credit into financial instruments, which have impact across multiple segments. From General Purpose credit that enables borrowers to buy whatever they want, to more specific purpose credit for assets like Real Estate. Credit today is crucial for modern economies to function.

This demand for credit by more active borrower is fulfilled by the need for yields by passive lenders who in a quest to generate returns are ready to lend out their cash. While the need and demand for credit becomes quite clear, credit in traditional finance is plagued by the same issues as most offchain financial instruments. A lack of adherence to terms, selective accessibility, fraud and sub-par ability to reclaim debt. All factors into the increased risk of bad debt.

Bringing credit onchain isn’t thus just a demand based factor to create a comprehensive decentralised financial ecosystem but a crucial one to improve on TradFi standards.

The above graph isn’t to say we are going to achieve $238T lending size in the near future. Though suggests, with DeFi’s credit market being less than $23B, there are likely areas and credit segments that are yet to see growth and should be explored with evolving availability of onchain mechanisms like account abstraction, intents and more. For this, we need to understand how the nature of credit varies…

Understanding Credit

Credit when used diligently for creation of assets or for investments can generate sustainable returns. That is when your return on borrowed capital is higher than the borrowing rate. But when used to sustain a lifestyle or for any non return generating activities, increases risks for the borrower, lender and any other involved stakeholders.

Thus, ability to provide credit critically relies on relating factors:

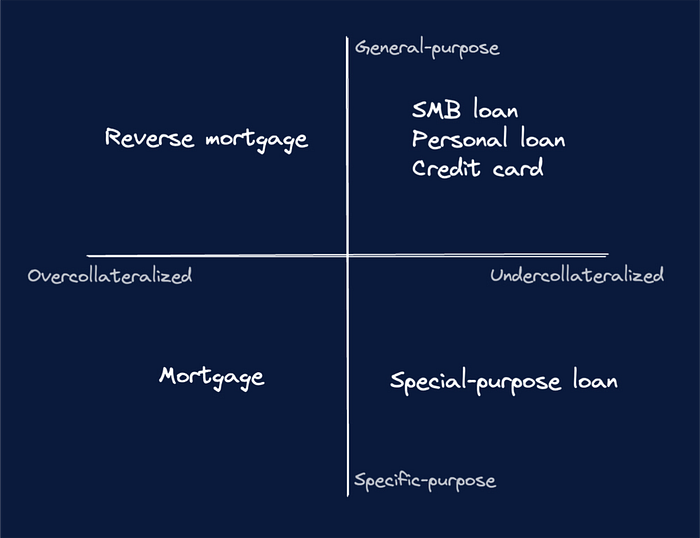

- Collateral: The collateral available to a lender decides how well the assets being lent are secured. For the collateral itself, factors like liquidity of the collateral, volatility and coverage level against the credit are vital factors to understand risk of a credit transaction. In the traditional world, we are now seeing significant increase in undercollateralised and no collateral credit transactions take place. An example of this is 3AC.

- Purpose of credit: The second factor that is crucial in understanding the nature of Credit is the purpose for which the credit is required. The risk varies between how specific to how general the purpose is.

Jump_ crypto in their onchain credit report sum up this nature comprehensively.

So now that we know the nature of credit, why don’t we just create the products onchain?

Factors affecting creation of credit products onchain

The goal isn’t to just go ahead and bring the same products onchain, because that will eventually bring the same problems onchain. DeFi at it’s core is about separation of state and money so no bailouts from Xi or JPow! if you mess up either.

With code being law, any possible source of bad debt should be treated with extreme care and avoided. And so, certain factors that are useful to providing credit traditionally are a deterrent onchain:

- Credit Scores are useless Onchain: Often used as a measure of credit worthiness, credit score alone isn’t capable of building mechanisms that ensure loan repayments. Degenscore perhaps is the closest measure of onchain creditworthiness and the risk on no collateral general purpose loans to beacon holders still might be too high. Credit scores further require wallets to be KYCed in order to avoid obfuscation.

- No claims on non-collateral assets: In case of a default on loan in traditional finance, the lenders often have a legal claim to assets that they can use to avoid bad debt. You can’t base credit transactions on non-approved assets one holds in the wallet.

- Legal measures: With DeFi being truly global, the legal measures and regulatory clarity become more complex to deal with. The trade off between permissionlessness and legal recourse can be made but that again fulfils a segment in DeFi and does not develop a macro generalised protocol.

- Unironically, Transparency: Defi, rightfully, is always held to higher standards than traditional finance. What banks call NPAs or defaults is just bad debt. Any loss due to Duration risk or Credit risk is bad debt. This bad debt eventually eats into customer deposits. Customers though remain calm because there is no transparent way for them to see that the bank doesn’t have reserves and assets at market value higher than the deposits. Kind of like this meme below.

When it comes to onchain though, any bad debt is easily identified due to transparency and called out. Even if it’s 0.1% of the TVL, the standards of risk management are put to question. And that’s absolutely what we should keep striving for, the goal isn’t to be able to cover bad debt onchain but to ensure it never occurs.

With these factors in mind, we have still been able to grow credit onchain to over $23B. How? Let’s dive into it.

How credit has been built on chain

Circling back to the definition of credit(as per Wikipedia. Muggles is a pleb), “trust which allows one party to provide money to another”. The way credit becomes possible onchain is when we replace TRUST with CODE. And at the heart of it, that’s how credit in DeFi has become possible. Through elimination of trust, credit on chain means “code which allows one party to provide money to another”. And this isn’t another quote for CT, but something early credit OGs truly embibed in their protocols:

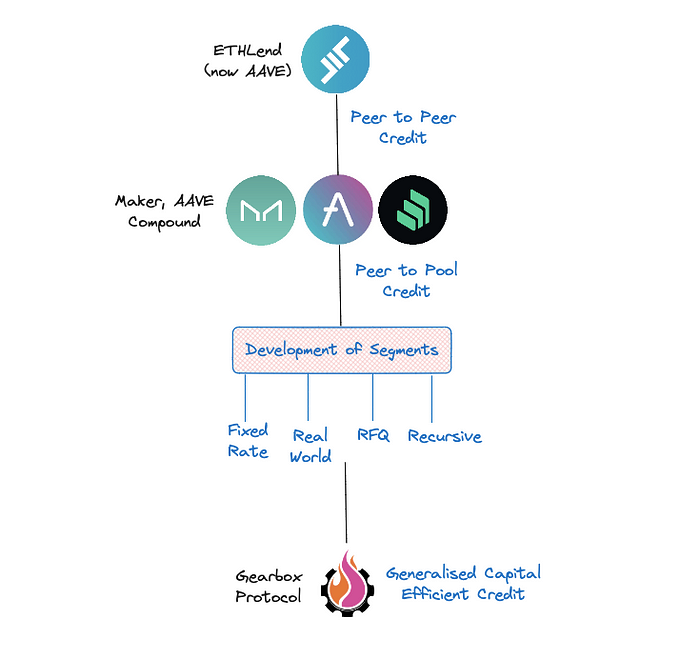

- Peer to Peer Credit: ETHLend started the Peer To Peer lending mechanisms which was the first introduction of yields and credit on chain. This enabled users to directly lend out assets to other users without the requirement of a financial institution in between.

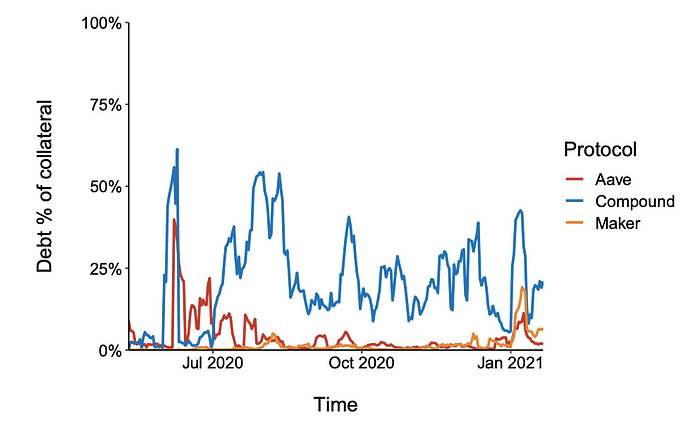

- Peer to Pool Credit: AAVE, Compound and Maker then introduced the Peer to Pool lending. Enabling users to lend to a pool and then borrow from another using their deposits as collateral. The innovation created catapulted DeFi with AAVE reaching $3Bn+ TVL and 1000+ users.

- Rise of Credit Segments: With credit onchain having found it’s way in an over we saw the rise of Credit Segments.

- Real World: Real World Credit focused on using the onchain models to provide credit in the real world. Maple focused on serving Institutional and Individual Accredited Investors while Florence Finance’s focus is on serving SMEs

- Fixed Rate: In a Fixed Rate credit, the interest rate stays the same for the loan’s entire term. Notional, Pendle and Term finance have been building in this segment.

- RFQ: RFQ or Request For Quote based credit again goes back to peer-to-peer mechanism in order to have borrow rates bids filled. Morpho Labs pioneered this by building a peer-to-peer layer over existing lending pools or AAVE and Compound

- Recursive Credit: To increase the capital efficiency, recursive credit focused on borrowing against collateral and then depositing again to borrow more and repeat the cycle. DeFi Saver was an early tool to do this.

So where does the next opportunity for DeFi credit to grow lie?

Evolution of Credit Onchain

DeFi credit in a span of 3 years has become a significantly evolved market. But within all this development lies a significant opportunity. Which becomes clearer with the below chart.

Peer to pool mechanism brought scale and frictionless ability to provide collateralised credit to users. This enabled innovation to foster. Though, since the value you could borrow was lower than the collateral(LTV<1), the efficiency in borrowing was lower. While this seems necessary to ensure bad debt can be avoided, it restricts the growth of financial leverage.

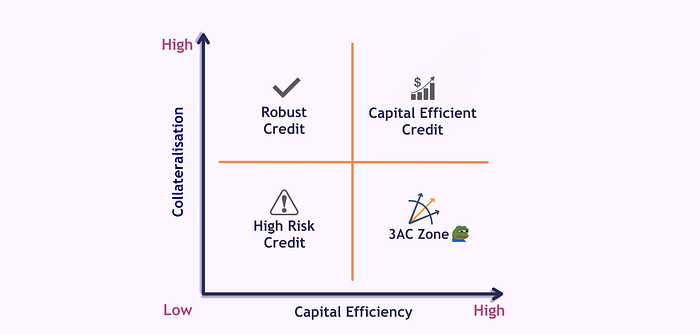

If we were to map the segments and protocols we talked about in terms of how collateralised the debt is to how capital efficient the borrowing is, we’ll find that most lie in the “Robust Credit” Quadrant. All the protocols are healthy but lose out on providing capital efficiency on the borrowable amount. Recursive credit makes way into capital efficiency along with robustness but it’s inefficiency in execution and gas costs makes it harder to use.

This is where we clearly see an untapped whitespace emerge that’ll enable users to go beyond what they currently do with credit. Something that we aim to achieve with the upcoming Gearbox V3. A capital efficient protocol which with a robust collateral profile to avoid bad debt.

So how does this suddenly become possible?

While we have seen segments and credit onchain grow. Parallelly, we have also seen the technical capabilities onchain grow. Today we have mechanisms that we did not a few years back and they are the likely key to create a highly capital efficient generalised credit market. One such mechanism is…

Account Abstraction

Traditionally and with almost all existing credit protocols, users interact using EOAs or externally owned accounts. This limits how they can interact with ethereum or a network as the external accounts are not programable. Account abstraction, though, solves this. It makes an account/wallet a modular part of the network and enables programability. Which means the funds on the wallet can now be governed by code. Which is key to growth of Credit onchain.

Through account abstraction we can create smart contract wallets that are rule bound to

- Hold both user collateral and borrowed funds without all funds being up for withdrawal by the user.

- Interact with only those assets and external protocols that they are allowed to.

- Reclaim borrowed amount in case losses on the account reach the collateral value

These Account Abstraction based contracts solve the capital efficiency issue and effectively create a Credit Layer Onchain. While the universal general purpose nature of the credit will diminish, as network effects and integrations to the said layer grow, the purpose of the credit will become general enough.

As for where could such Credit Abstract Accounts be available… Lets just say SoonTM.

C-R-E-D-I-T

— Gearbox Protocol ⚙️🧰 (@GearboxProtocol) October 24, 2023

Is it about bigbrain capital efficiency or a tool for OnlyUp supercycle moonboys? - That's up to you to decide!

Our job is to make 𝐨𝐧𝐜𝐡𝐚𝐢𝐧 𝐜𝐫𝐞𝐝𝐢𝐭 safe, transparent and user-friendly! Coming up soonTM, Gearbox V3⃣

Powered by Credit Account {abstraction} pic.twitter.com/kUafbEhdum

If you would like to join the DAO — just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- And, of course, the DAO working docs:

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion DAO monthly reports: