Expanding Leveraged Restaking

The key goal for Gearbox V3 was to expand. Expand the offerings, expand revenues, expand TVL, expand composable leverage to more chains. Less than 4 months after V3's launch, we are seeing this expansion happen with the TVL now close to $350M and almost all metrics making an all time high.

You can read about more about this below.

Gearbox's TVL has now crossed $300M, an all time high. But this is only one of the 10 key metrics to currently be on ATHs. Let's look at all that is currently on ATH for Gearbox. ⚙️🧰

— Gearbox ⚙️🧰 (@GearboxProtocol) April 8, 2024

Apart from the TVL, the lending supply is on ATH too, rising from $26M to $257M in 60 days. The… pic.twitter.com/Vl1AgbYwuM

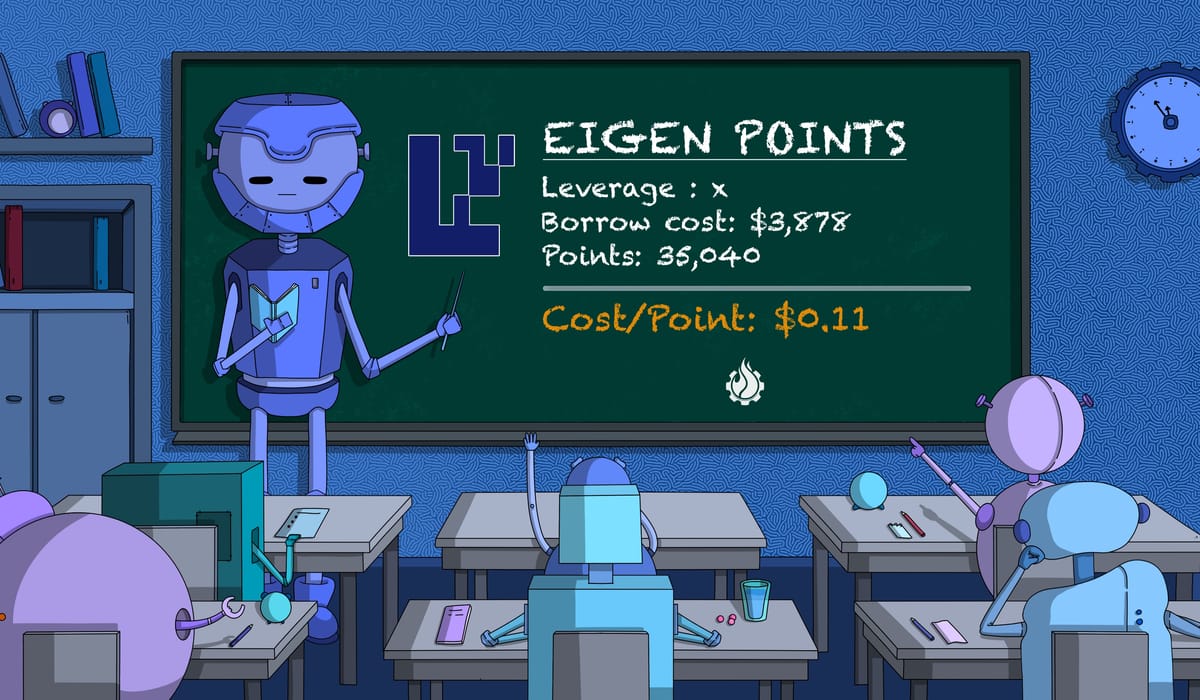

A key of this growth was the introduction of leveraged points farming which began with Leveraged Eigen points farming. Cumulatively, the TVL for point farming strategies is now higher than $265M on Gearbox, divided between Ethena and Eigen Layer LRTs. But a few of these LRTs have been at the max borrow caps. So how does Gearbox expand further again from here? What plans does Gearbox have to add another potential $150M+ of LRT TVL? Read on for a complete LRT farming and upcoming opportunities update.

Eigen Layer and LRTs

Eigen Layer Points have been one of the most talked about introductions over the last few months across DeFi. LRTs have further made restaking significantly easier by bringing liquidity to EL point farming, with more than 42% of ETH restaking happening through LRTs. Gearbox's introduction of leveraged LRTs, and in turn leveraged points, have already seen users earn over 38M Eigen Layer Points worth ~$7.9M. This has further boosted Gearbox's LRT TVL to $160M+ and, at peak, crossing $200M before ETH dumped.

To make it even better, alongside EL points users have been earning specific LRT points as well. With Gearbox listing EtherFi, Kelp and Renzo, users have been able to choose what points they farm. But, Renzo and Kelp strategies have now hit the max borrow limits, limiting further access. How does Gearbox proceed further to expand LRTs and EL point farming?

Existing LRT expansions

The first step for Gearbox is to expand what we already have, starting with..

EtherFi weETH

EtherFi's season 1 of EtherFi loyalty points saw Gearbox users earn over 600M EtherFi points worth over $3.5M(as per whales market floor) in less than a month. This is beyond the 6.5M+ EL points weETH leverage takers earned during season 1 alone.

And in Season 2, weETH currently holds $44M+ or 13.4KETH in TVL. Further, users can earn Season 2 loyalty points with a 2X boost, this was confirmed by the EtherFi team the previous week. With this in consideration, the new max limit cap of EtherFi has now been increased to 30,000ETH. Enabling Gearbox to potentially expand EtherFi's TVL by more than a 2X.

Renzo's ezETH

Renzo became the leading LRT, and has stayed so, within 2 weeks of its introduction on Gearbox. Currently holding over 36K ETH or $118M in TVL through Gearbox.

Part of the reason why ezETH has been able to outperform other LRTs is because of how well they used $GEAR wars to their benefit. By incentivising lenders with ezPoints, renzo was able to get lower rates voted on by $GEAR stakers, this led to borrowers preferring ezETH. You can read all about in the article below.

This lower rate also led the max limits being hit for ezETH. Though, now, they have been revised from 35K ETH to 40K ETH and a new possible max limit of 50K ETH. Enabling Gearbox to potentially add another 15K ETH to our TVL.

Kelp's rsETH

The latest addition to Gearbox's leveraged LRT strategies is Kelp's rsETH. rsETH was added with 3K ETH borrow limit and hit it almost instantly. It currently sits at a $11M+ TVL. Leveraged rsETH farmers receive a 2X boost on Kelp miles as well as upto 9X more EL points on Kelp's RTOB campaign.

But with users demanding for more borrows, the revised ETH borrow limit for Kelp has been moved to 10K ETH while a max limit of 20K ETH is also approved. This enables Gearbox to grow its TVL by potentially another 17K ETH.

Cumulatively, the caps on existing LRT strategies thus go up by 12K ETH. Meanwhile the maximum limits go up by 42K ETH or $131M atm. Enabling Gearbox to significantly grow TVL. But what more?

NOTE: The changes listed above are based on GIP-117. To learn more about how leveraged LRTs actually work, read the article below.

Expanding new LRT strategies

While expanding existing LRTs enables Gearbox users to grow, new LRTs are important to ensure that the users have the freedom to choose and decentralisation for restaking services increases too. Keeping this in mind, a discussion is now live to add 2 new LRT strategies as well.

Puffer Finance

Puffer operates as a decentralized native liquid restaking protocol native to its ecosystem. It currently is the 3rd largest LRT by size with a $1.23B TVL. Prior to its mainnet launch, pufETH serves as a yield-generating token, mirroring the yield of wstETH, while also providing users the opportunity to accumulate both Puffer and EigenLayer points.

The GIP will propose a 10K ETH borrow limit for pufETH.

Swell Network

Swell is the 5th largest LRT with $361M in TVL. With Swell, users are able to earn passive income by staking or restaking ETH to earn both blockchain rewards and restaked AVS rewards, and in return be provided with a yield-bearing liquid token (LST or LRT) to hold or participate in the wider DeFi ecosystem to earn additional yield. The GIP will propose a 10K ETH borrow limit for rswETH.

Cumulatively, these new additions enable a further 20K ETH potential growth. Alongwith our existing strategies, the total max potential limit increases by 62K ETH or $198M for LRTs. Which, if achieved, would more than double Gearbox's LRT TVL.

PSA: You can put in your feedback about the additions to the DAO discussion below!

Expanding passive lending

But for Gearbox's LRTs to grow, growth of the ETH passive side is a pre-requisite. In order to make sure that both the sides can grow together, there are multiple steps that the DAO has taken.

Points for passive lenders

Want to earn LRT points without leverage or even without restaking your ETH? All the while earning 24%+ APYs? Gearbox's passive lending offers lenders exactly that. For every ETH you lend, you earn the base supply APY, the GEAR rewards and 2 different LRT points.

The incentive is a unique proposition made possible by Kelp DAO and Renzo.

Scaleable High Supply APYs

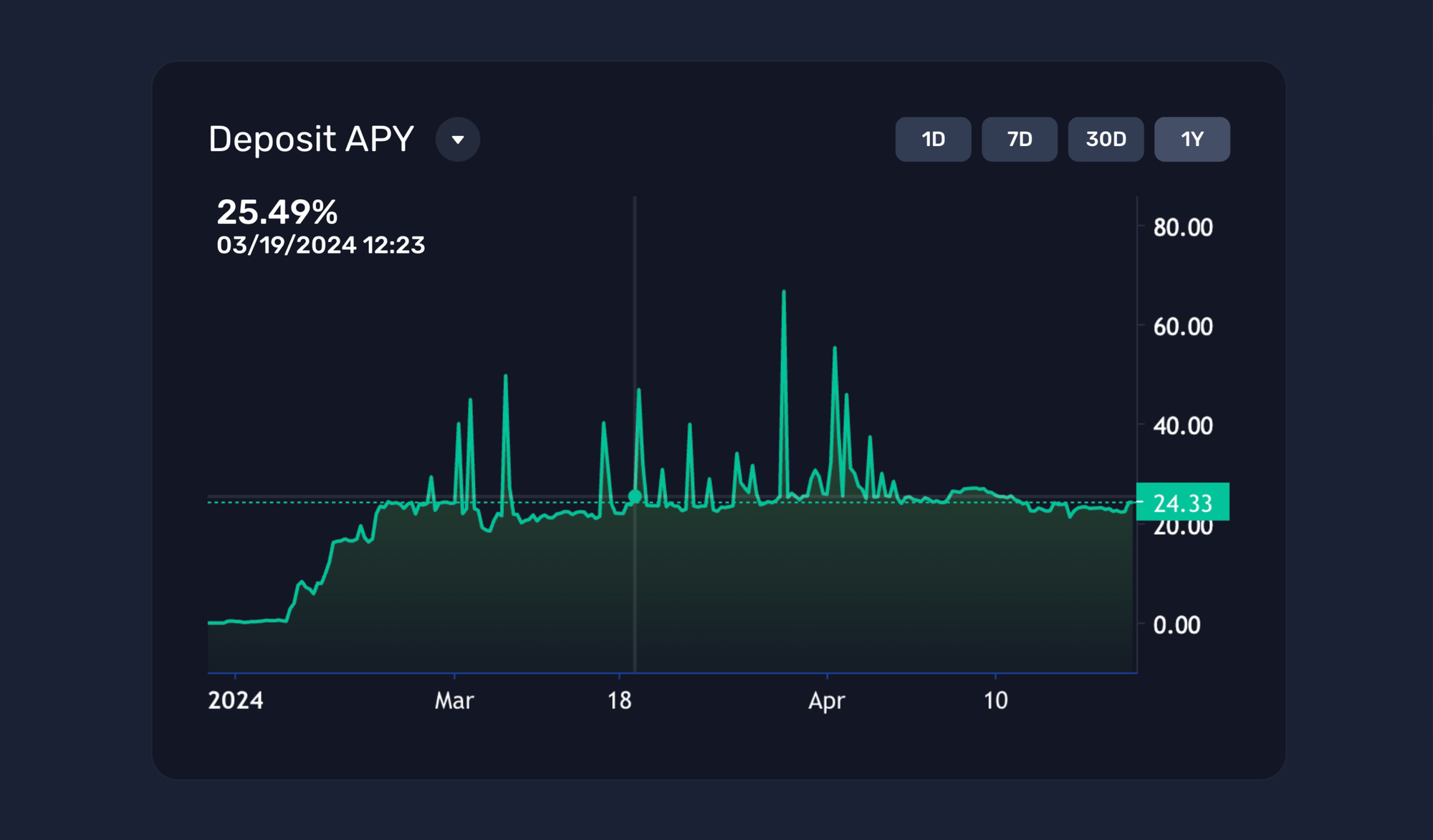

The demand for LRTs mentioned above doesn't attract size, but also lenders that are ready to significant borrow APYs. This creates a lending pool which scales and at the same time doesn't get diluted in terms of APYs. You don't have to trust us, simply look at the data below.

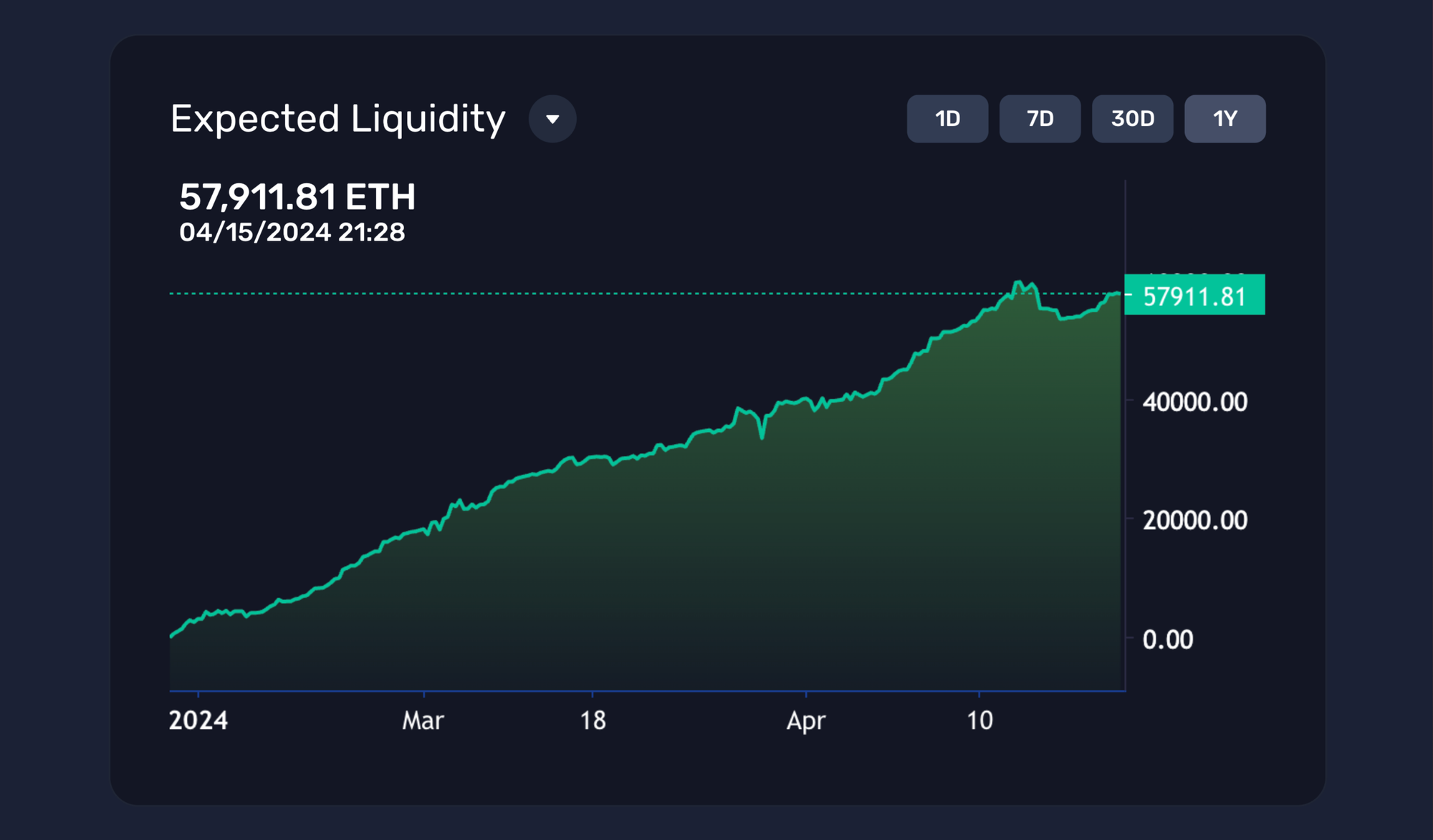

The ETH lending pool TVL on Gearbox has risen from less than 4,000 ETH to 57,911 ETH since LRTs were introduced. Yet, at the same time...

The deposit APYs have increased from 7% to constantly above 20%+ APYs. Displaying how resilient the yield on the lending pools are. Since new borrows happen at rates similar to the existing ones, yield dilution becomes unlikely till caps are hit.

With caps being increased significantly, there's a lot more yield you can earn before you face dilution. Enabling the pool to scale.

Security is our Priority

This will sound overused, this will sound like another thing every protocol has to say which is why we'll urge you to read the thread below to see how Gearbox prioritises providing the safest possible contracts for you to use.

security, security, security

— Gearbox ⚙️🧰 (@GearboxProtocol) March 12, 2024

At Gearbox, our top priority is to provide the safest possible protocol for your capital 🛡️ To make that possible, there are multiple measures we take to fortify security, so you can lend & borrow peacefully.

From monitoring tools to audits to... 👇 pic.twitter.com/jHupyc5NJf

From deploying a Gearbox V2.1 that focused entirely on security to having AI and monitoring tools that ensure that we are always on top of any possible incidents, Gearbox devs are security maxis before DeFi innovators. Which is perhaps why Gearbox lending markets have never faced any security incidence in 2+ years of being deployed.

The recent volatility was another stress test through which the protocol sailed through.

Truly passive lending

Finally, Gearbox's passive lending =! LPing. It is truly passive in nature. You lend without

- Lockups

- Impermanent loss

- Fee

Earn as and when you want to. This is why we are now seeing protocols and projects building on top of Gearbox's lending side. With Drip building onchain launchpools that have now deposited over $10M into Gearbox's passive side.

How can you lend though?- Simple! Just go to the link below.

And that is how Gearbox solves both the demand and supply side scaling for LRTs as Eigen Layer's infinite sum games further help decentralise Ethereum. With AVS' becoming more relevant with EL's mainnet launch, Gearbox's leveraged LRTs become even more important to earn those sweet sweet airdrops.

This article is Duck Certified by DuckDegen. It it reads a little jeety, that's because it's been written by a jeet. Your other options are a Russian degen or devs posting the code itself. Berate us or just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion DAO monthly reports: