The State of DeFi Lending and Gearbox DAO Self-Evaluation

Dearest Gentle Reader,

Gearbox Protocol and Gearbox DAO are nearing 3 years of being live. This journey has come with many re-evaluations, security improvements, and product iterations. Understanding the past and the present is vital to make sure one chooses an informed path forward - and that’s the goal for today. To tell you where things have been, where things are, and how we can improve.

PS: this article is written by a non-developer. So if you are a developer and see inconsistencies in the logic, especially dev-related - please come to Discord and shout. Please do!

The Past: V1, V2, and the start of V3

If you are interested in the past evaluations, check out the below pieces in this order:

- How V1 was made and what the product focus was on in 2021 here;

- How V2 was made and what the product focus was on in 2022 here;

- Self-evaluation of the V2 progress in 2023 here;

- How V3 was made and what the product focus was on in 2023 here.

Pushing an abstract yet cool modular architecture comes with challenges: how to concretize and productize it. We went from margin trading to leverage stablecoin farming, to then leverage points farming. All are enabled by the same protocol, all with the same modular leverage (lending) integrations - but the branding, UI, and messaging differ.

The current stage with TVL growth over $125M+ has been incredible, achieving a 3X over the ATH of TVL back from the stablecoin farming uptake in 2022. But how do we sustain this TVL growth? That comes with the understanding of what the competitive scene is, and where the users are.

2. The Present: DeFi these days

2.1. Verticalization and web2zation

The space, be it the underlying block producing vertical or DeFi protocols - is getting verticalized more and more. Things start resembling web2 a little more with every passing day. With the resurgence of the appchain thesis, the vertical might encapsulate all aspects from the bottom to the top. What does it lead to? Things get more mature, safe, boring, and long. Whether it results in slow delivery or longevity of products instead - varies from team to team. But the overall vibe is shifting.

We won’t get into the detailed causes, but it’s evident that as very few new users enter the space - those having the capital and those few users that exist today - have the power.

One of the clearest examples of that is the centralization of fundraises within the core large teams. These days, you either struggle to get $2M in funding or you have an easy journey into a $10M raise. As such, teams grow bigger and the vertical integrations prevail. For example, MakerDAO moving from being a stablecoin issuer to competing for lending (Spark Fi). Or Aave entering the stablecoin business (GHO) as a lending protocol. Or 1inch as a swap aggregator going for the wallet business. The same things happen with Ethereum clients and block building, with Paradigm capturing chunks.

Each one of their launches gets not one, but 5 audits. Bug bounties are at the level of $1M+. All these moves are arguably better for users. It might be annoying for other protocols who get dispersed by the big guys, but as a user, this might feel better. After all, as a $50M liquid fund, do you deposit into a protocol with memes or with solid security practices? Meme-rs can have strong security practices, but branding matters too.

It results in proper “professional messaging”, a bit fewer memes and outright degeneracy in communication, longer-term focus on some integrations, and bigger priorities.

2.2. From over-engineering to users and business

AMMs have long not had any groundbreaking features, because maybe they don’t need to. You can surely say that onchain LPing and trading can drastically change with CLOBs, but that’s a different question. When it comes to AMMs, nobody seems to care for the tiny differences in curves that they bring forward. It’s simply not interesting for anyone to battle over tiny changes.

The same is happening to lending. Surely, there are a ton more things that can be done with pricing collaterals and other efficiencies. The innovation doesn’t need to stop nor does it stop, but there is growing emphasis on “ok, someone needs to use this at some point, right?!” It’s important to note that a technical design and architecture must predict the necessary tooling a potential user segment would require, and to that extent, lending protocols move directionally similar: Gearbox V3, Aave V4, Morpho V2, and others are directionally similar.

To build a dApp which caters to various segments, Gearbox has taken a cohesively modular approach. The approach treats various aspects of the lending stack as individual modules and, yet, at the same enables them to cohesively function in sync. Risk curators can thus individually alter aspects of lending without having to code again, and again.

A modular architecture makes customisation possible and helps cater to more segments.

- Risk Isolation and Segmentation: already possible with Gearbox V3, where every asset and every pool has its own collateral limits, and can even have different LTVs for the same asset within one integration. As much customization as you’d want!

- Pool Isolation and Segmentation: already possible with Gearbox V3, where either “inherited pools” can be made or a fully different instance of Pool<>CreditManager could be set up. Again, as much customization as you’d want!

- Rates Personalization and Segmentation: already possible with Gearbox V3, where gauges help establish rates for every different integration and asset separately.

These are all logical things as we get from “too much infra these days” to “we need users”. Perhaps enough infra was built, and we now need to get down to business? Who knows.

You can read the complete details regarding our Modular Architecture approach in the article attached.

In light of these narrative shifts, below are some things that could be worked upon.

3. The Present: V3 and Self-Evaluation

Gearbox V3 in its current stage can offer margin trading, leverage farming stables and LSTs, and leverage farming points. Anything else is practically possible, but what else is there with large enough demand? This goes back to the previous section 2.2. about over-engineering vs having the necessity to adapt the architecture. What technical capabilities would RWA assets demand beyond whitelisted usage? What about bonds and the demand for those markets in terms of LTV efficiency? Let’s leave these questions of the future for section (4), and for now assess what V3 was able to achieve, and what the DAO was able to do.

From a technical perspective, devs have done an amazing job. They have improved monitoring tools, conducted more audits, improved liquidation logic, improved risk practices, etc. In turn, that allowed them to list collaterals quicker - for example, many of the LRTs and points integrations, including deployments on Abritrum on Optimism.

With that being said, these processes are still not fully flashed out. They could have been faster and more crisp in their execution. Especially when it comes to communication between different initiatives: dev-related and marketing-related. That’s the downside of not having a centralized team: synchronization is harder and is not as obvious. But if you want to grow a DAO beyond just one small cluster of devs, synchronization is needed, and Gearbox preaches it.

3.1 Things Gearbox DAO can be proud of

3.1.1 TVL reaching $400M+ at peak

TVL is a great indicator of adoption, users understanding the value proposition of a product and growth. Thus, reaching a TVL of $400M+ was an important milestone for the DAO. The new ATH marked a 3X increase over the previous TVL ATH from 2022.

Another week, another ATH. Gearbox's TVL has now crossed $400M reaching an ATH of $416M. 🫶

— Gearbox ⚙️🧰 (@GearboxProtocol) April 22, 2024

What next?

We now enter the 2nd phase of Leveraged LRT growth. Max borrow limits increase from 50K ETH to 100K ETH as 2 new LRTs get onboarded over the next week as well. ⚙️🧰 pic.twitter.com/jTgGLT0ulg

3.1.2 V3 enabling the protocol to capture growth

One of our key goals while developing V3 was to make onboarding new assets faster. This was to make sure Gearbox can offer leverage on new opportunities that users requested. And V3 delivered exactly that, onboarding

• Ethena

• Eigenlayer LRTs

• Mellow LRTs

• Lombard (Next Week)

This enabled the protocol to capture significant growth and mindshare.

3.1.3 Growing network effects and adding significantly more users

With the new offerings, Gearbox was also able to add significantly more users, on both the lending and borrowing side.

• The borrowers on Gearbox 30Xed post introduction of new additions. Rising from ~60 in January to 1800 in June. 1900+ Credit Accounts still remain active.

• 4X in lenders. The new opportunities led to an increase in demand which enabled more lenders to supply passively.

The new pools and integrations helped 4X the number of lenders on Gearbox. With new pools capturing over $35M in TVL. pic.twitter.com/TNKquFtdVy

— Gearbox ⚙️🧰 (@GearboxProtocol) June 21, 2024

3.1.4 L2 deployments attracting $30M in TVL

Another key goal for V3 was to take Gearbox to L2s. This summer saw Gearbox deploy to Arbitrum and Optimism, with TVL at peak reaching $30M+.

3.1.5 GEAR token 100% circulating, LM emissions reduced by 66%

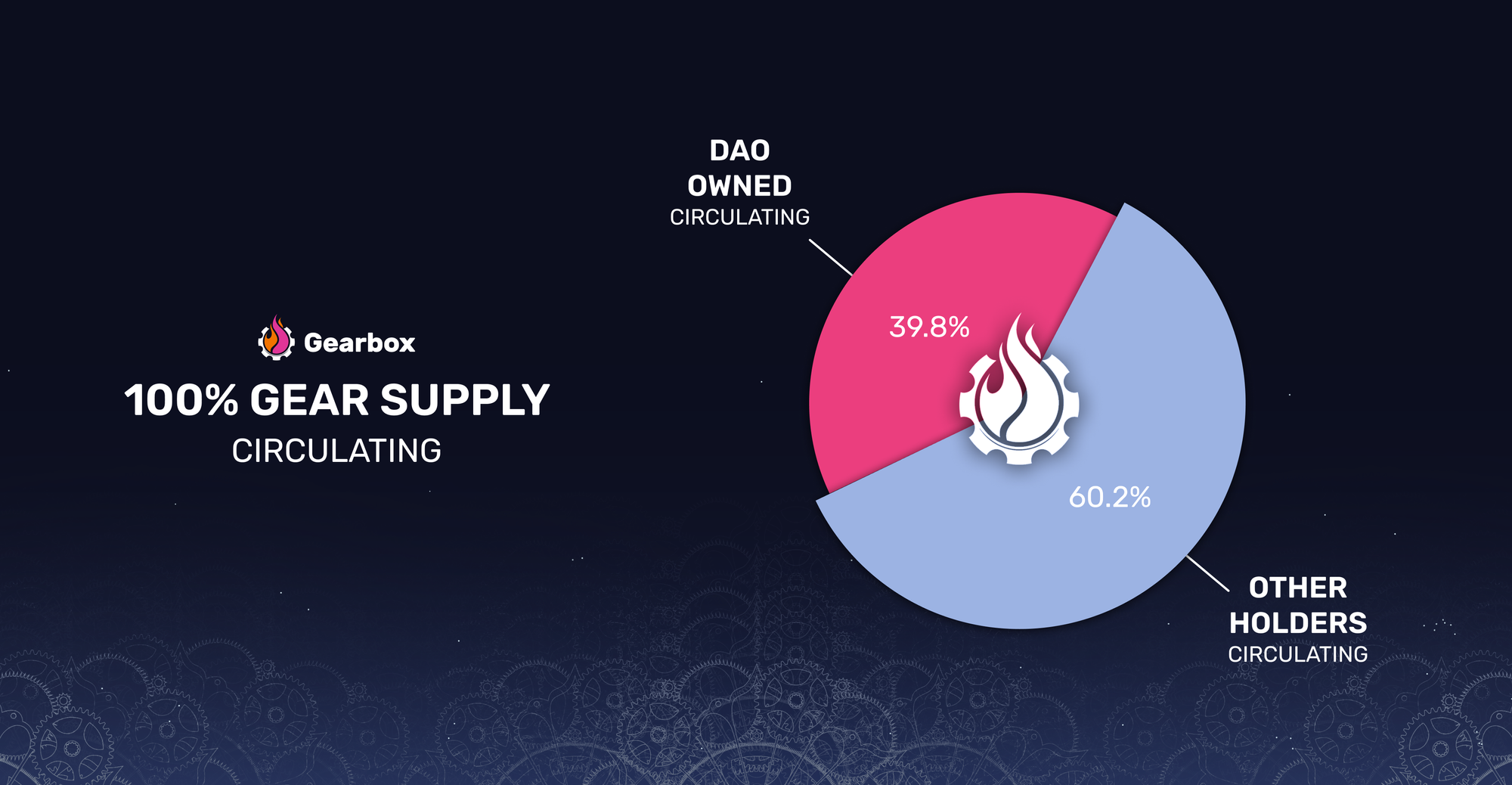

From a token perspective, there is almost 0 free float on $GEAR now. All the vestings and unlocks are now over with 100% of the supply circulating. 39.8% of this circulating supply is owned by the DAO.

To further reduce the emissions, the tokens allocated to passive LM have been reduced by 66%. This reduces the annual emissions by 1.8% of the token supply.

3.1.6 $3M in YTD revenue, sustainable growth

With all the growth, the DAO revenue has also grown ~$3M during the first 8 months of the year. The GEAR incentives used during the same period are worth about $486K. Thus, the incentives used this year have been productive with token spends being at $0.16 for every $1 earned by the DAO.

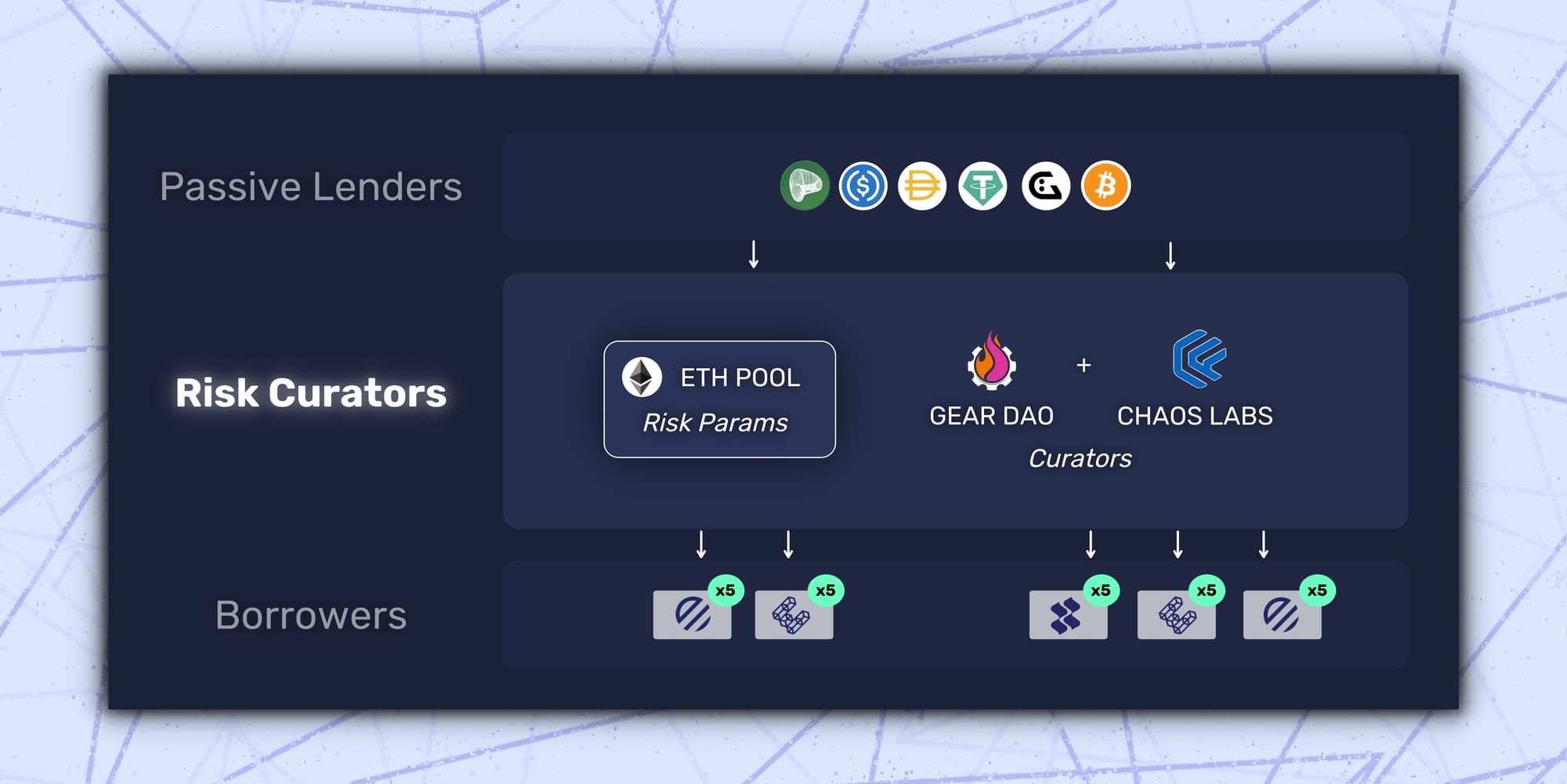

3.1.7 Chaos Labs spearheading risk management

With all the growth and new assets, risk management becomes even more important. To evaluate and mitigate risks, Chaos Labs have been onboarded as Gearbox's Risk Curators. Chaos Labs recommends LTVs, borrow limits and onboarding criteria for various assets after careful risk assessment.

Below is an example of the mathematical and analytical approach of Chaos Labs to onboard LRTs to Gearbox.

3.1.8 Increasing risk and financial transparency with TokenLogic and IntoTheBlock

While risk is managed by Chaos Labs, enabling users to transparently access risk analytics is just as important. A Risk Radar by IntoTheBlock is now live to help users permissionlessly access 18 institutional grade risk metrics. You can access it here.

Apart from IntoTheBlock, TokenLogic will also be creating a financial dashboard for Gearbox to help users evaluate DAO's financial health and operations.

⚙️Hot off the production line: Gearbox Finance Risk Radar is now live

— IntoTheBlock (@intotheblock) August 30, 2024

Track key @GearboxProtocol risk metrics on borrow exposure, leverage ratios, health factors and much more! Stay ahead of the risk curve and learn more - links in tweet below 👇 pic.twitter.com/oEmN9IcPqt

3.1.9 Extra audits with Spearbit, Decurity and Chain Security

At Gearbox, security is our top priority. Gearbox has had 10+ audits since inception. With the new integrations going live, additional audits have been conducted to find and fix any possible sources of risks. You can read more about the audits below.

3.1.10 $8.5B of volume on DEXes through Gearbox

Given the composable nature of the protocol, the increase in activity on Gearbox doesn't just help us grow but also boosts DeFi. Over $8.5 Billion worth of trading volume has now taken place on DEXes like Curve, Uniswap and Balancer through Gearbox's Credit Account. Bringing to life composable growth.

3.2 Things Gearbox DAO could improve on

3.2.1 Fully onchain governance

Being able to vote for concrete pieces of code changes or transactions directly, without having to ask multisigs (guards) to execute offchain proposals. This would increase transparency even more and make everything truly onchain. This is already coming in V3.1.

3.2.2 GEAR Staking Feedback Loop

As GEAR got extra utility with V3 gauges staking, one could argue that there is still a missing piece with what those revenues go to. You can check different ideas in Discord here. This improvement could be coupled to fully standardize the governance processes at the same time.

3.2.3 Gauges Predictability Being Known

Gauges offer an incredible way to make rates for borrowers more predictable. While that’s a fantastic UX for borrowers, it’s not being utilized and communicated as well as it could be.

3.2.4 Reshuffling Governance and Degelators

Yet again tied to the token questions, governance can temporarily be improved by increasing quorum. Quorum has never been a true issue but has always been hard to get, so increasing it feels right (given supply is now 100% circulating) yet it might be impossible to get to. Perhaps a system with delegation needs to be worked on better, in connection with the other ideas above.

3.2.5 Interface Specialization and Polishing

As we have gone to +3 new use cases, trying to find a fit for the modular generalized leverage layer - the interface got overly complex. Switching networks, handling swaps, rates, and a plethora of other variables. As Q3 comes to an end and so do the L2 current grants - it would be wise to reassess the resources spent on maintaining the non-core products.

That would mean reducing some functionalities and improving the most used features.

3.2.6 Branding and Communications Improvement

Fun, quirky, and engaging - are great values to abide by when you try to get off the ground. But once you start talking about $10M amounts - you suddenly start valuing maturity, precision, and security. And as noted above, it’s not that memes can’t carry substance behind the scenes - it’s much easier to not cause doubts in the first place. With that being said, the landing page/communication/images need to be worked on to reflect the growth of priorities of Gearbox.

3.2.7 Visual Messaging Improvements

That’s being done too, can’t wait to show it to you! A new twist and direction ~

4. The Possible Future

The larger long term goal of Gearbox remains the same- To become the omnichain leverage layer of DeFi. To achieve that, though, broader short term and mid term goals is vital. These goals would include:

As always, any of the future details mentioned below are subject to DAO approval. The below points refer to the general plans of the DAO contributors.

Integrating active and in-demand protocols

Integrations are key to make Gearbox's leverage more generalised and to capture wider network effects. Over the shorter term, the goal will to integrate the following protocols

• Pendle: Enable leveraged PTs

• Lombard: The current leader for BTC restaking

• Symbiotic/Mellow: Already integrated with with over 3.5K ETH in TVL. To be expanded to more vaults.

Expanding L2s

Gearbox's deployment on L2s is still in it's nascent stage. Yet, L2s account for ~15% of Gearbox's TVL. Our approach towards expanding on L2s will be to distribute leverage further. This will be done by

• Integrating more L2 native protocols on the L2s we are on

• Deploying on new L2s which are gaining users and TVL

At this stage, Gearbox's tech stack is more or less close to creating a leveraged layer. What we need to accelerate on is the distribution of the tech stack to more assets.

Maturing with our users

A significant, positive pattern we have noticed this year has been Gearbox's adoption by larger, more sophisticated users. These users have often deposited $10M+, which is a serious sum. At the same time, though, Gearbox's communication style has often been "Quirky, Fun". While those tones work well on CT, they can often lead to miscommunications. With Gearbox's users maturing, we'd focus on maturing with our communications too. (Already underway, less degenerate). This would involve:

• A more professional visual identity on socials.

• More informative, clearer communication

• Memes only in chats (Because deep down, we love them just as much.)

Polishing the interface

As mentioned in 3.2.5, an agency is already working on this. A simpler, easier to navigate through UI should be live by end of Q4.

V3.1 and Risk Curator Model

One thing that’s more or less clear is the final stage of risk curator model development. That is to allow anyone to create their little Gearboxes (siloed or not is up to them, it could potentially be abstracted or connected). This franchise-like model of using Gearbox not as a product but as a protocol can allow to scale of cross-chain and cross-primitives!

Details on that you can find in the previous modular piece:

With that, a lot of coordination comes like creating a funnel and onboarding risk curators; as well as discussing a fee model with them and splitting assets among them. All in due time.

When speaking about the future, the sauce might not be in the technical professor fights anymore - but in the distribution strategy of the technology. For example, is Gearbox Protocol ready for RWA assets? Surely, even now or with the risk curator model, an integration can be abstracted to (i) isolate risks of RWA maturities like t-bills (ii) establish separate rates and a utilization curve (iii) require whitelisting for all the sides if the RWA issuer requests it. All that while not fragmenting liquidity unless that’s required by the issuer. Doable!

There is more research ongoing in the realm of turning the modular leverage protocol that Gearbox Protocol is - to a credit layer that’s more omnichain and connected, closer to users than ever before. So if you work in the wallet SDK / account abstraction primitives - please reach out, we’d love to discuss some ideas with you. Just ping us anywhere like on Telegram.

If you vibe with what you’ve read here, then join the DAO! Over the points mania cycle, the treasury got restocked with some youesdicis and ethereums, meaning there are resources to keep pushing forward. Any skills are welcome, but especially if you are devs. See the open positions on the Notion Job Board page.

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion DAO monthly reports: