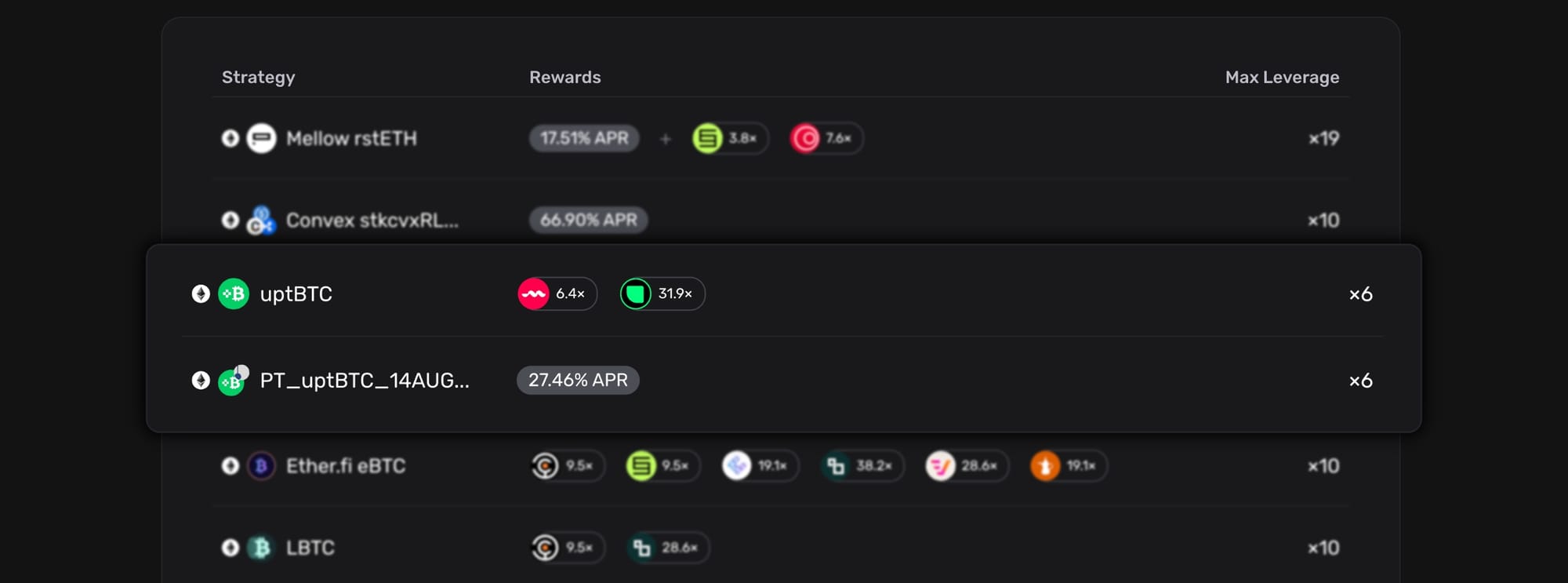

Re7 curated tBTC and uptBTC market: Gearbox Permissionless

Re7 curated BTCfi market is now live! Users can now lend tBTC by Threshold to earn passive yields or borrow tBTC to access up to 6x leverage on uptBTC by Mezo. This marks a pivotal step for bringing Bitcoin-native assets into scalable, composable DeFi lending markets.

This deployment is powered by the Gearbox Protocol’s permissionless codebase, enabling curators to set up lending markets by leveraging Gearbox’s audited and battle-tested protocol. Re7 unlocks capital efficiency, security, and composability, now for Bitcoin DeFi.

In this article, we break down what this means for lenders and borrowers alike: yields, leverage strategies, and how Re7 keeps your assets secure.

Familiar with Gearbox and want to utilise the BTCfi opportunities? Head over to the Gearbox dApp and find your yields!

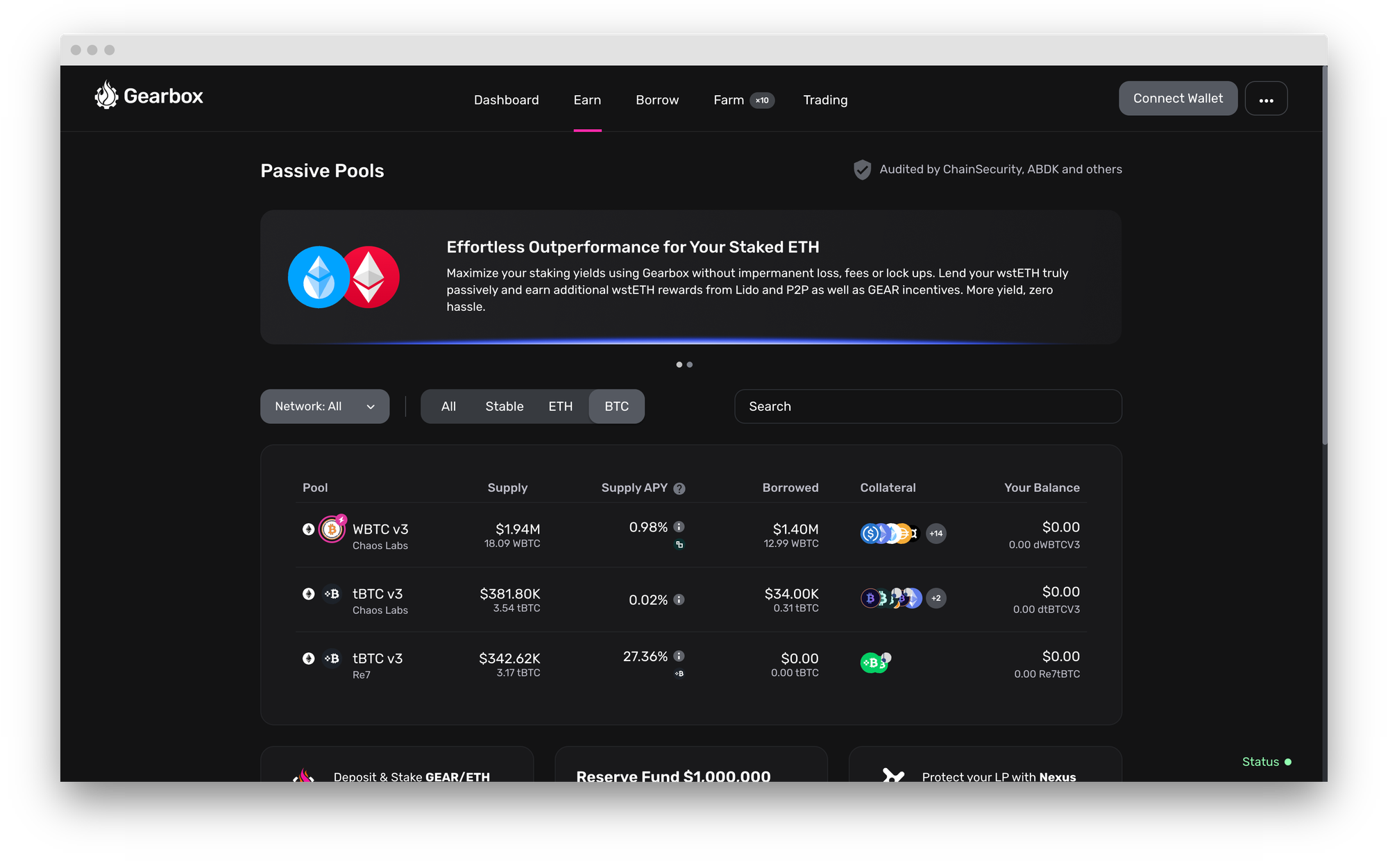

tBTC: Lending Pool and Incentives

tBTC by Threshold is a decentralised representation of Bitcoin on Ethereum, backed 1:1 with real BTC held in wallets secured by a rotating set of independent signers using threshold cryptography. Unlike centralized bridges, tBTC uses an open-source protocol with verifiable on-chain reserves and no intermediaries, making it one of the most trust-minimized and censorship-resistant BTC derivatives available on Ethereum.

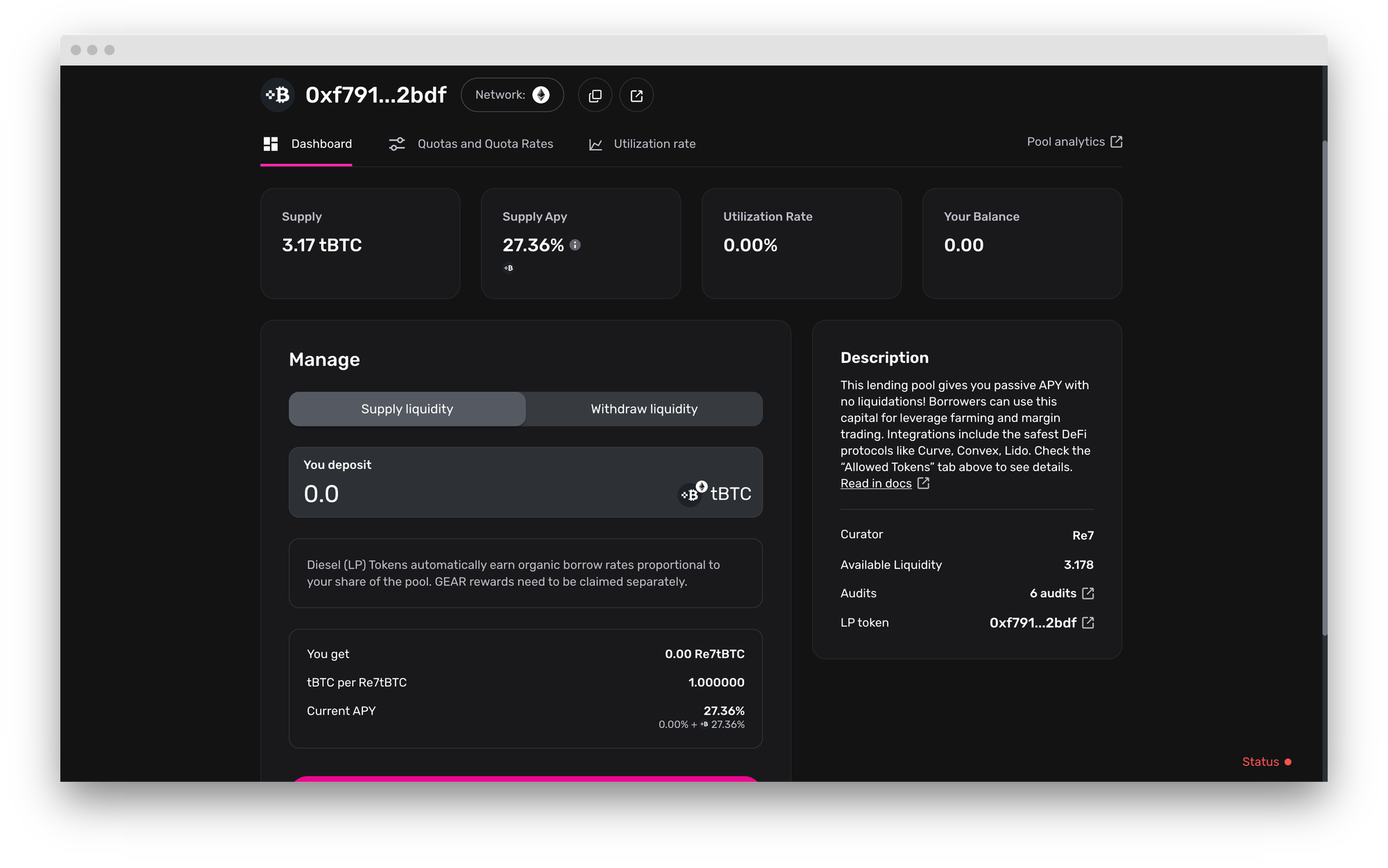

With Re7’s deployment, tBTC unlocks passive yields with an additional $10K in tBTC incentives for its holders. These incentives will be distributed over 2 months to the lenders depositing tBTC in the pool, bringing above-average BTC yields to Gearbox's battle-tested lending pools.

Lending on Gearbox is designed to be incredibly lender friendly. The process of earning passive yields on Gearbox is as simple as: Deposit, Earn and Withdraw. Users choose what asset to deposit and how long they participate in lending. The pools offer yields

• Without lockups: Withdraw whenever

• Without fees: The yield you earn is yours to keep

• Without impermanent loss: Single-sided yields

The passive yields on Gearbox are generated through the interest fee paid by borrowers. Over the years, Lenders on Gearbox have earned over $15M in interest. This deployment unlocks the same opportunity for tBTC lenders.

Go ahead and maximize your passive returns by lending here.

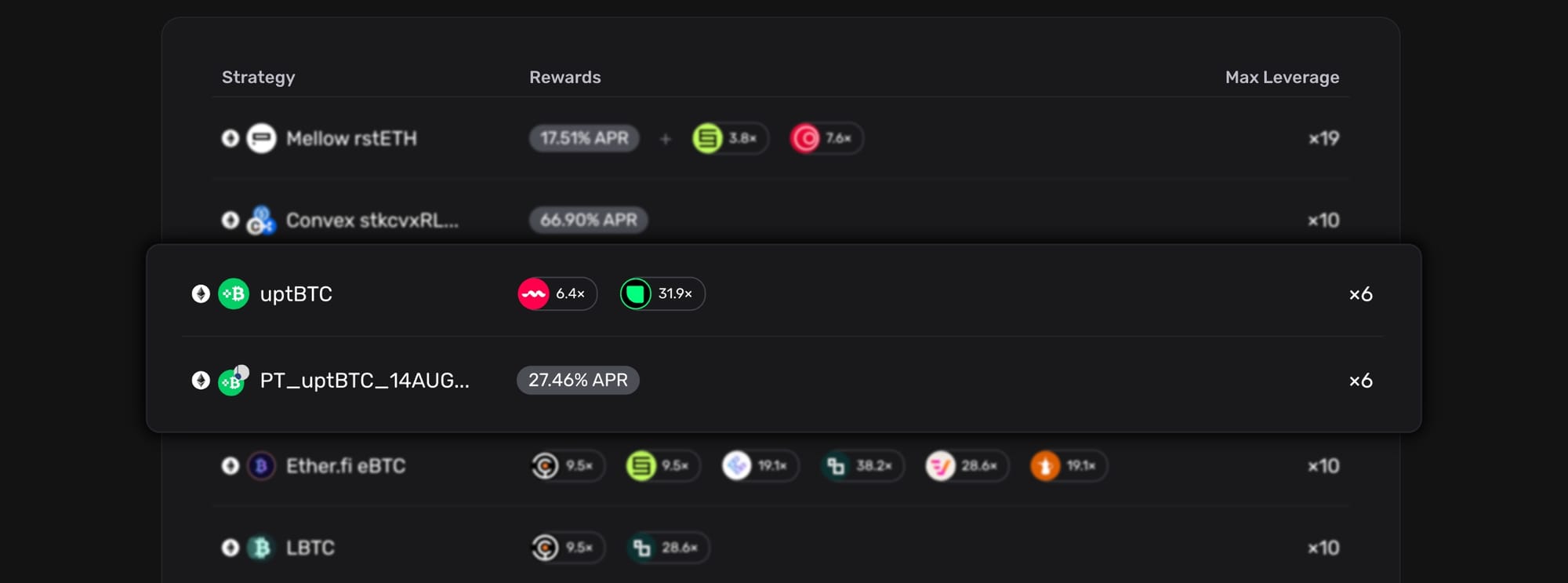

uptBTC: Leverage farming

uptBTC by Mezo represents tokenized Bitcoin from Mezo’s Upshift Pre‑Launch vault. When users deposit BTC (including tBTC, wBTC, or cbBTC), they receive uptBTC, which accrues both base yield and Mezo ecosystem rewards, including early access “MATS” points. tBTC borrowers will be able to access leverage on both

• Spot deposits to the uptBTC pre-launch vault

• uptBTC Pendle PTs for leveraged fixed yields.

Leveraged uptBTC vault deposits

The uptBTC vault offers the best of both worlds, combining APYs and multiple points. This enables users to earn leveraged yields and potential token rewards (subject to the underlying protocol's terms). By accessing leverage on it, users can earn up to

• 15% Target APY

• 30X Upshift points

• 6X Velar Points + 6X Zerolend Points

• 6X Mezo Points

Gearbox also takes multiple measures to make your leverage farming experience peaceful and non-volatile. These include

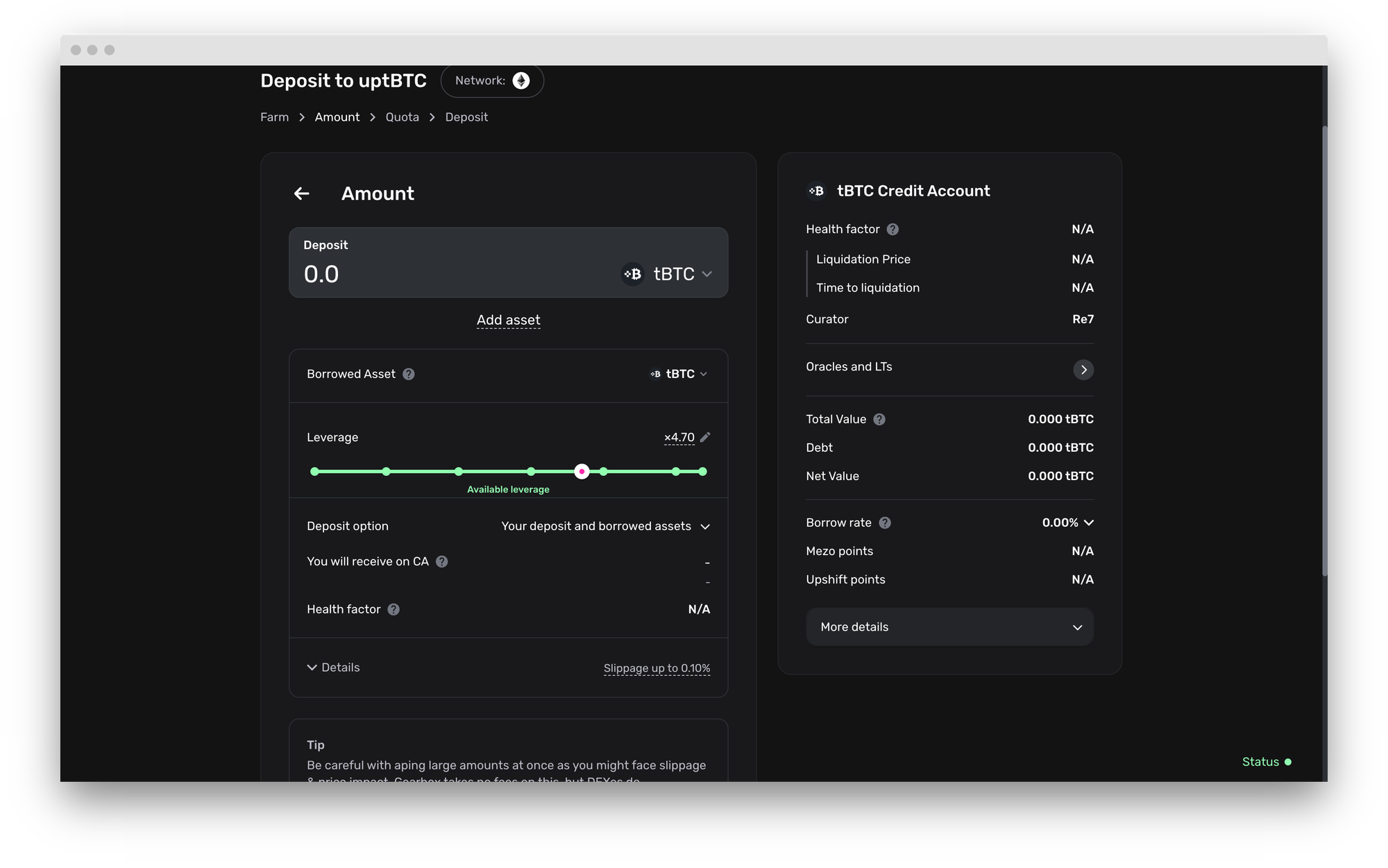

• No DEX price volatility: The fundamental price feed for uptBTC utilises the exchange rate of tBTC deposited into the upshift vault, eliminating DEX price volatility.

• No Slippage on position creation: Gearbox Credit Accounts are able to natively mint the vault token through the Upshift contracts, eliminating slippage while opening a position. Exiting a position can incur slippage, though.

• Correlated Debt: The correlation between the borrowed tBTC and leveraged uptBTC further reduces volatility as BTC's directional risk is avoided.

NOTE: While no slippage deposits are live, withdrawals from the vault will go live over the coming weeks. For now, users can only perform a partial withdrawal (up to max LTV) and redeem manually.

Withdrawing at any point before the pre-deposit period ends results in forfeiture of all Mezo points and partner points.

Leveraged uptBTC Pendle PTs

tBTC borrowers can also access credit on uptBTC's Pendle PT. The PTs enable users to lock in a fixed yield on uptBTC and can be traded using Pendle's DEX. While the yields remain fixed, the borrow rates can vary.

The PTs utilise a TWAP oracle to ensure fairer pricing and just like spot uptBTC, come with correlated debt.

Earn these peaceful yields by heading over to the Farms tab on the dApp.

What is Leverage Farming

Leverage farming is utilized where the purpose of the user is to earn yield or points without being exposed to directional volatility. This is made possible through correlated borrowing; you borrow an asset highly correlated to the farm you want to leverage.

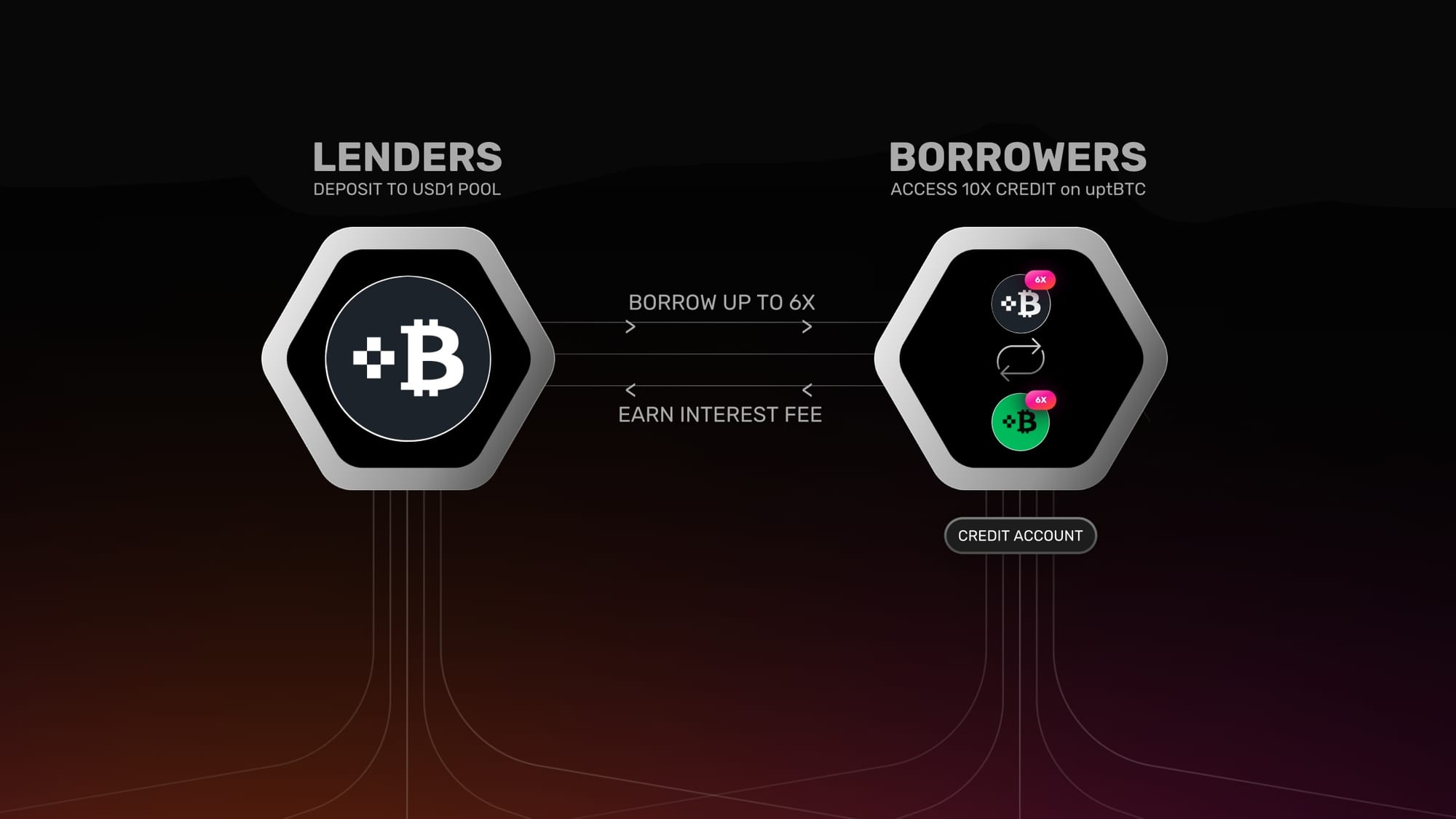

How Gearbox enables Leverage Farming

Gearbox empowers users to access credit by borrowing the tBTC supplied by lenders. Unlike traditional protocols, borrowers on Gearbox can borrow up to 6X the collateral they deposit without the need to "loop". The borrowed funds and the user's collateral are deposited into an isolated smart contract called Credit Account.

Credit Accounts act as smart wallets and ensure the borrowed tBTC only interacts with assets permitted by Re7. Giving borrowers access to true credit onchain.

Don't want leverage but still want to borrow against your portfolio? We have got you!

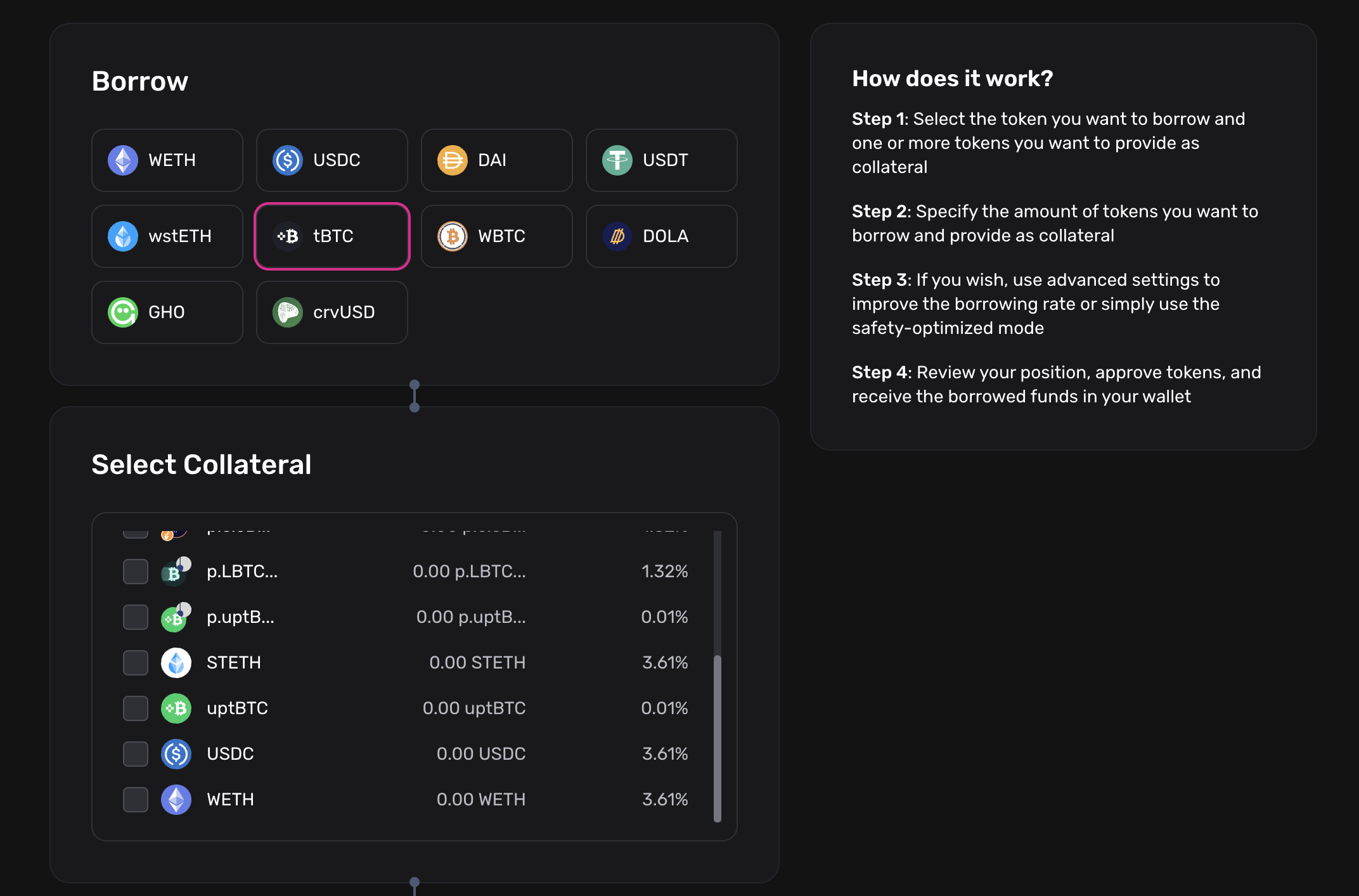

Borrow tBTC: Multicollateral Loans

For users who prefer borrowing without leverage, Gearbox offers Multicollateral Loans. These loans empower users to borrow tBTC against their existing uptBTC and uptBTC PT holdings. All without locking their collateral in a general lending pool.

The uptBTC collateral is held in your isolated credit account, allowing users to swap or trade their collateral even while they borrow. Multicollateral Loans keep users' collateral completely liquid. You can read more about them below.

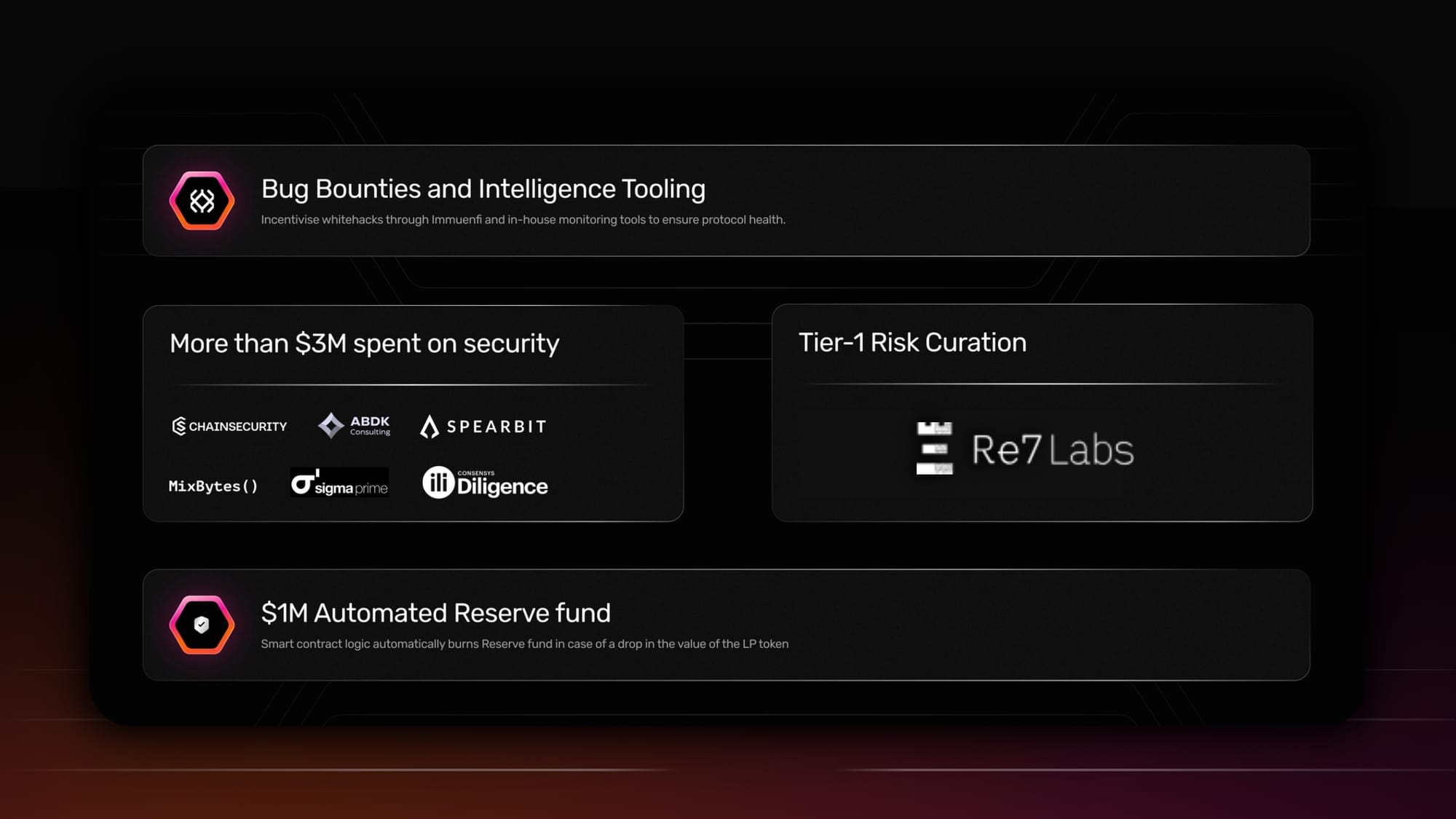

Gearbox’s Safety & Proven Track Record

Gearbox prioritizes security above all else, implementing a multi-layered approach to risk mitigation. The protocol has been live for three years without incurring bad debt or facing exploits, proving its battle-tested infrastructure. This has been possible because of

• 10+ audits from top-tier firms such as ChainSecurity, ABDK Consulting, Spearbit, MixBytes

• Bug bounties and intelligence tools

• $3M of security related spends

The protocol also features a $1M Automated Reserve Fund and risk parameters curated by Re7, a leading name in risk management, ensuring robust, data-driven safeguards. Gearbox stands as one of the most battle-tested DeFi protocols on Ethereum mainnet.

Why Gearbox Permissionless for Curators

Re7’s tBTC lending market runs on Gearbox Permissionless; a lending architecture purpose-built for DeFi curators to set up lending markets however they want. Gearbox's mechanism offers unique propositions that no other legacy protocol can, including

- No active liquidity management:Unlike legacy protocols that require constant liquidity rebalancing between fragmented lending markets, Gearbox Permissionless eliminates that overhead entirely. Curators can set up multiple lending markets from a single, unified pools. They don’t need to manually direct funds or manage pool depth, liquidity is unified and borrowers draw from it seamlessly. This reduces operational complexity, avoids compliance pitfalls, and delivers a smoother, capital-efficient experience for both lenders and traders.

- Unique Borrow Rates: Curators configure custom borrow rates for each collateral asset, enabling precise control over yield dynamics. For Re7, this enables them to set separate borrow rates for uptBTC and its BTC and still lend from the same pool. Something only possible on Gearbox.

- Day-0 Oracle & Multi-Chain Support: Curators can launch on new chains without waiting for oracles, AMM depth, or Safe support. Gearbox’s infrastructure includes its own router/aggregator and supports modular oracle stacks (Chainlink, RedStone, Pyth), allowing seamless, fast deployments with accurate pricing from day one on any EVM.

- Battle-Tested Security: With over four years of mainnet performance and zero bad debt, Gearbox offers some of the most battle-hardened lending contracts in DeFi. Permissionless also offers optional compliance tools like whitelisted borrower lists, KYC gating, and configurable collateral caps, making it suitable for both public and gated deployments.

Gearbox permissionless already has logic built in for 20+ integrations like Pendle, Curve, Uniswap, Morpho and more.

The complete roll out of permissionless is planned over the coming months but if you are a curator who would like to get hands on to set up bespoke markets, feel free to get in touch.

Get Started

The deployment of the tBTC pool is live! Getting started with Gearbox is as easy as heading to the Gearbox dApp

To Lend

- Head over to https://app.gearbox.fi/pools and choose the tBTC pool by Re7.

- Enter the amount you would like to lend and click on "Supply"

- You should now receive diesel tokens which reflect the ownership of supplied assets to the pool.

To Leverage

- Head over to https://app.gearbox.fi/strategies/list and choose the uptBTC or its PT strategy.

- Fill in the amount you want to put as collateral and the leverage you want to access. Click on "Open Position" to deploy your leveraged position in 1 click.

Easy as that! Approve the transaction and you can access passive lending, leverage, and loans with Gearbox.

If you are an institution and are looking to expand your operations onchain, Gearbox can offer you the credit infrastructure you require with it's permissionless protocol. Contact us on Telegram or Discord for more information. Let’s build the onchain economy together!:

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: