Gearbox Permissionless: Adaptation, Evolution, Evaluation

Ever since being set up in 2021, Gearbox DAO has operated and governed every aspect of the protocol and the product. From deciding which assets could be onboarded to determining what collateral could be lent and under what risk parameters, the DAO ran both the protocol and the product, embodying the full-stack spirit of early DeFi.

But as DeFi matures, the world around it is shifting: regulatory clarity is emerging, institutional interest is rising, and the demand for on-chain credit rails is growing at a pace that warrants a new approach, a rethinking of how Gearbox scales: A balance between what should be permissioned by the DAO and what requires Permissionless expansion.

The article discusses evolution of Gearbox's markets from a DAO-curated model to a Permissionless model, one that empowers curators and institutions to launch no-code lending businesses directly on-chain. It’s divided into four parts:

1. Maturing DeFi: Shifting Trends

2. Evolution: How Permissionless adapts

3. Evaluation: Permissionless' performance compared to DAO led Pools

4. Migration: The final step to Permissionless

Read below to learn more!

I. Changing onchain landscape

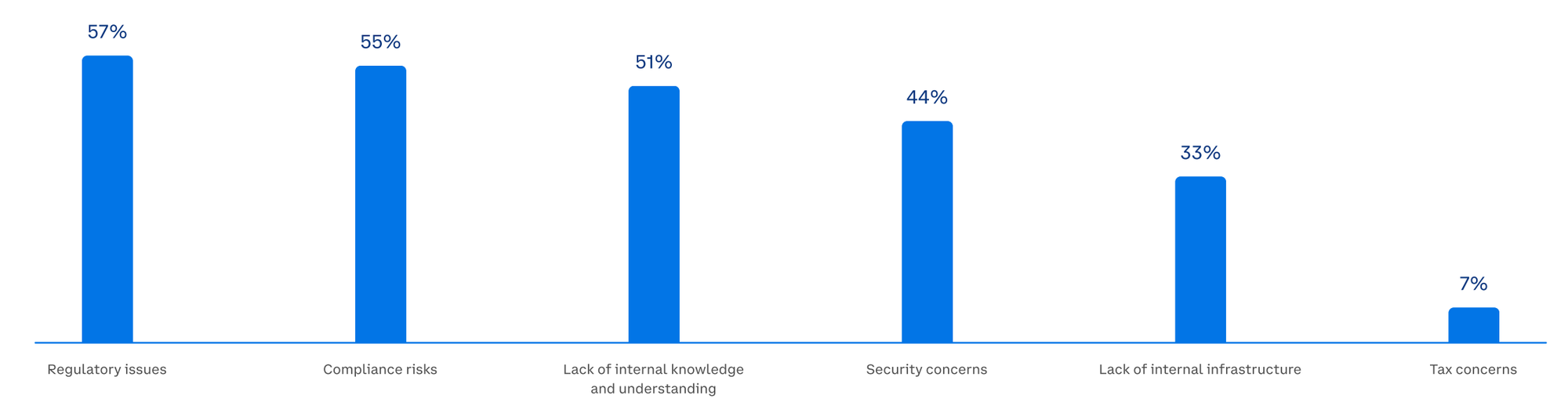

A common theme throughout this "cycle" has been the rapid shifting of long term trends. Over the past year, regulations have brought clarity, bankers have revised their stances, institutions have rewritten their theses, and even traditional players like NASDAQ are rethinking their tech stacks. Shifts like these require pro-active adjustment, something Gearbox DAO has always been open towards. The current major shifts that led to the strategic creation of Permissionless are listed below.

I. a) Institutional Demand For Lending

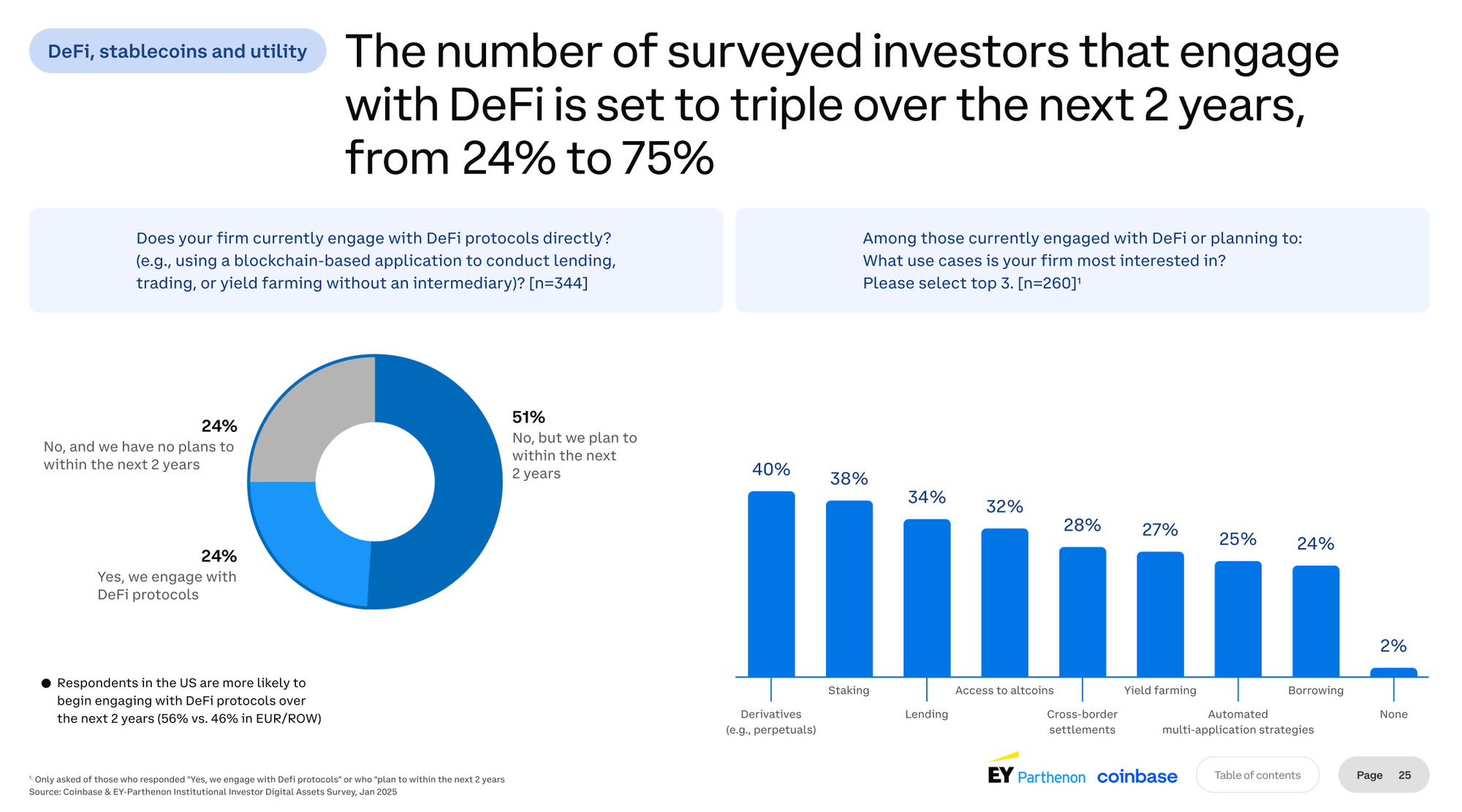

Institutions in DeFi aren't just allocating funds anymore, they are now active participants. With and through the likes of Superstate, Securitize, VanEck and more, institutions are now working to bring TradFi structures onchain. They either act as issuers of tokenised assets or allocators of capital. The current participation, though, is just the beginning. A recent report by EY and Coinbase surveying 300+ institutions suggests

• Number of key institutions onchain will more than 3X over the next 2 years

• 4 of the top 8 use cases relate to lending, borrowing, yield-farming and composable strategies.

With lowering retail participation, institutions are key for DeFi protocols to grow over the coming years. As a lending protocol, it is critical to position yourself to capture this oncoming growth.

Key to success: Institutional Grade lending with focus on composability.

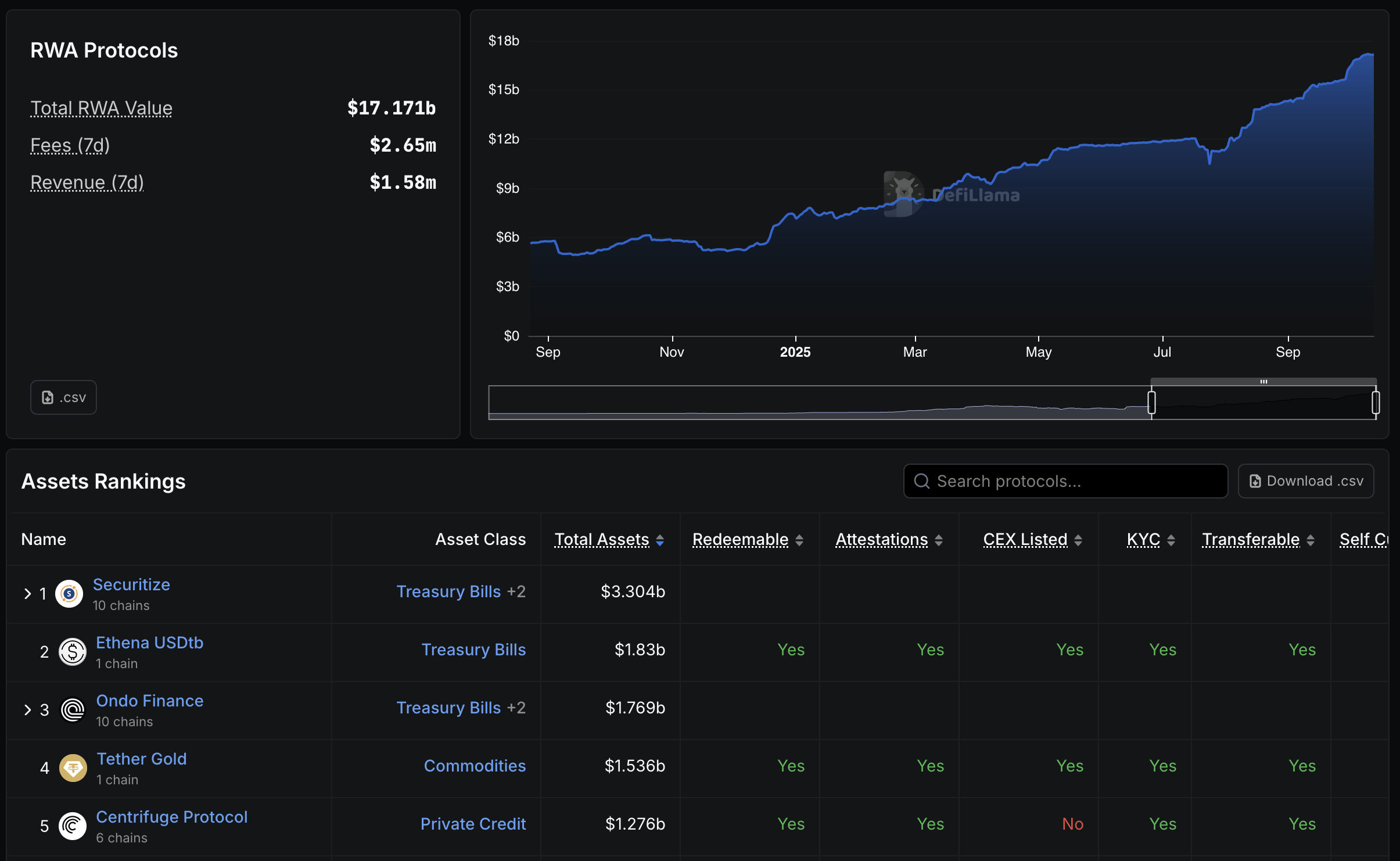

I. b) Tokenisation of Everything

In the early days of DeFi, on-chain assets were limited to stablecoins, large-cap cryptos, and LSTs. But with regulatory headwinds softening and innovation accelerating, a whole new spectrum of assets is finding its way on-chain:

• RWAs

• Tokenized equities

• Tokenized basis yield

• Private credit

These new assets are now adding Billions of dollars and 1000s of users onchain every year, as seen by the growth of RWAs and Delta-Neutral yield products. Being early to these collaterals offers significant competitive advantage. For Lending Protocols to capture this growth, adding them in a safe, timely manner is key.

Key to success: Speed to Market and Ability to add unique collateral

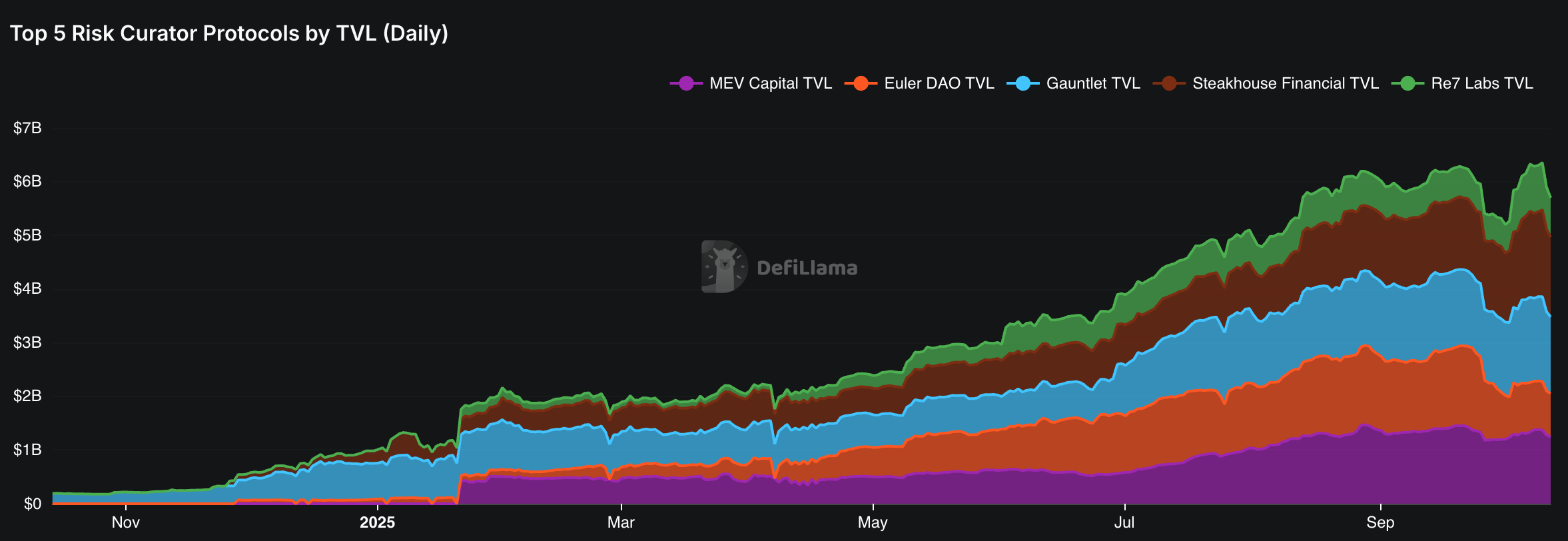

I. c) Rise of the Curator Model

On one hand, institutions are driving the next wave of demand for on-chain lending, borrowing, and leverage. At the same time, relaxed regulations are unlocking new categories of collateral that once existed only off-chain. Bridging these two forces are Risk Curators, a segment that has grown over 2,000% in a year.

Risk curators design and manage specific risk parameters for various markets on lending protocols. They aren't developers but instead excel at risk management for specific assets. Instead of the DAO deciding what assets can be listed or how risk is priced, curators set their own collateral logic, oracles, and parameters to create markets they understand best. They earn fees based on the performance of their markets.

Key to Success: No code lending market creation by seasoned curators.

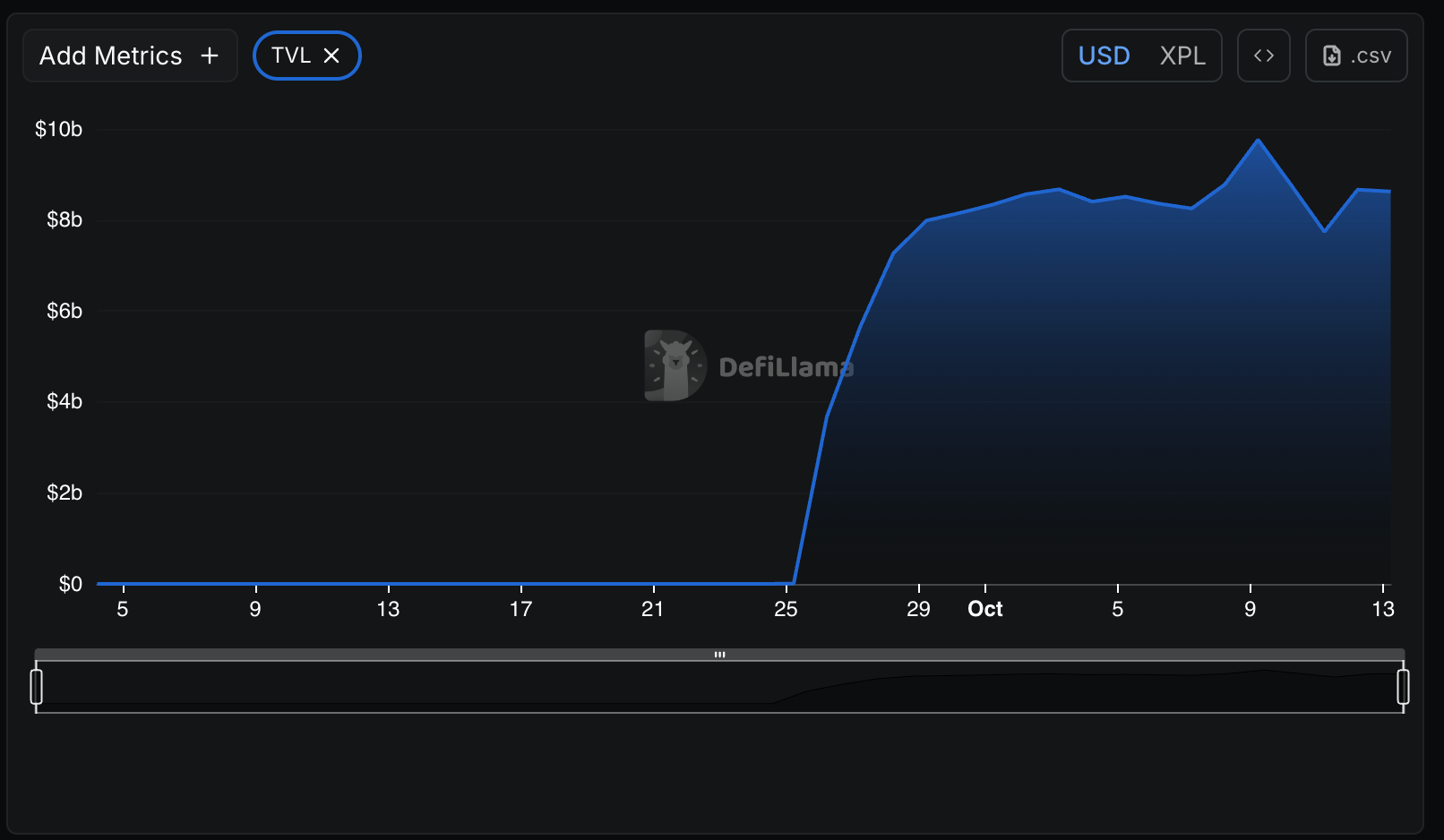

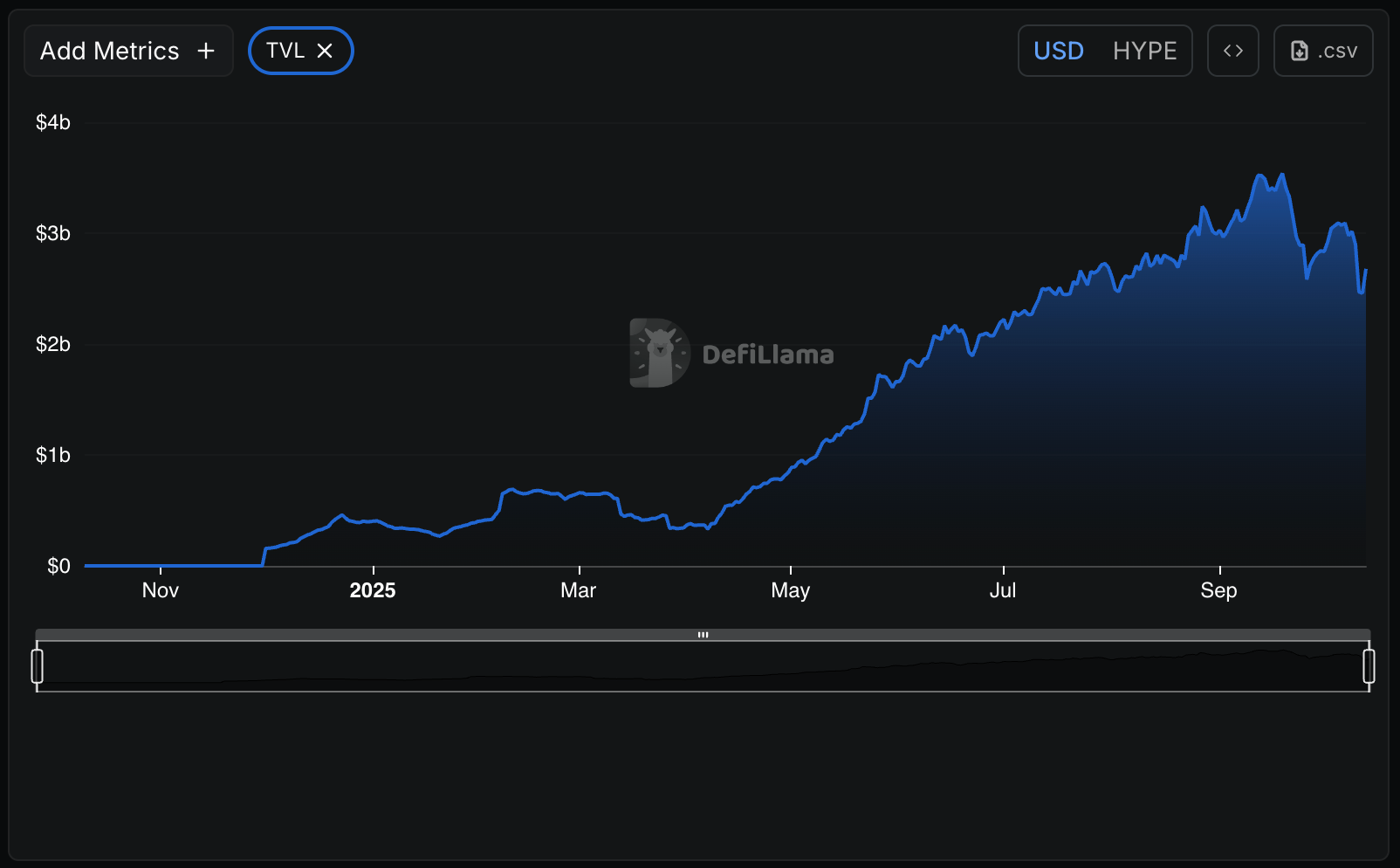

I. d) EVM led growth

The largest growing networks over the last 12 months have had 2 major things in common: They are purpose built and they utilise EVM.

• Plasma: +$8.6B

• BSC: +$6B

• Base: +$4.9B

• HyperEVM: +$2.7B

Over the last 12 months, even without accounting for ETH mainnet, EVMs have gained over $20B+ in TVL, more than what the next 5 non-EVM networks gained during the same time. Given the network of applications and tools compatible with EVMs, this trend is likely to grow democratically.

Key for success: Simplified scaling across EVMs

I. e) Compliance Requirements

As institutions increasingly explore DeFi, assets issued and capital allocated by them increasingly looks for compliant markets. Regulatory clarity and institutional mandates now demand environments where compliance, transparency, and access controls coexist with decentralization. This is evident with the KYC requirement for projects like USDtb by Ethena, Tether Gold, Superstate, Centrifuge and other assets that have added $10B+ in TVL over the last year.

For protocols, this means evolving beyond purely permissionless architectures to include gated markets, isolated pools or permissioned layers that allow KYC’d institutions to lend, borrow, and deploy capital within defined regulatory frameworks. This dual design ensures that DeFi remains open at its core while still enabling regulated entities to participate, bridging the gap between institutional scale and decentralized innovation.

Key to success: Compliance tooling where needed

These trends become critical to understand how Gearbox should evolve while the "Keys to Success" define the evaluation criteria for Gearbox Permissionless.

The landscape of DeFi is no longer defined by a single narrative. It’s expanding in multiple directions at once: institutional demand is reshaping lending, new assets are redefining collateral, curators are decentralizing risk, EVM networks are powering distribution, and compliance layers are bridging onchain and offchain capital. For protocols, these shifts can either be challenges or inflection points. And at Gearbox, we aim to side with the latter.

II. Evolution: Gearbox Permissionless

Gearbox has evolved through every major phase of DeFi, from community formation to protocol maturity. In its earliest form, Gearbox DAO embodied collective governance for the entire stack: a system where not just protocol but markets, parameters, and risk frameworks were curated through consensus. This model built resilience, ensured transparency, and shaped Gearbox into an important lending protocol in DeFi. But as the ecosystem expands, and new forms of participation emerge, DAOs must match the pace of what’s being built onchain without giving up their core ethos.

And this is where comes Gearbox Permissionless.

Meet Permissionless

Permissionless empowers institutions, curators and projects to create no-code lending markets onchain using Gearbox's institutional-grade lending stack. The stack combines capital efficiency, composability, and compliance in a way no traditional DeFi lending system has before.

Curators on Gearbox can deploy multiple lending markets with distinct risk parameters and borrow rates, all drawing liquidity from a single, unified pool. Since curators cannot move user-deposited capital, lenders operate within a more secure framework while curators access a more compliant and efficient infrastructure.

Purpose-built for institutions, Permissionless enables market setup across 20+ leading DeFi protocols including Curve, Pendle, Convex, and Uniswap. It doesn’t just allow curators to create lending markets, it allows them to instantiate their own version of Gearbox, operated end to end under their control.

And that's not all it delivers.

II. a) Credit for Non-Tokenised and Semi-Liquid Collateral

As tokenization accelerates and new assets surface onchain, so do new mechanisms. But the traditional model of tokenizing assets or yields and routing them through DEXes isn't always effiecient. Yield-bearing assets, designed to be held rather than traded, generate low volume and demand costly liquidity bootstrapping.

Issuers, though, adapt fast. Many are shifting to vault-based mint-and-redeem models like Mellow or Lido’s dvSTETH, while some skip tokenization altogether through non-tokenized yield systems like Convex staking.

As real-world assets come onchain and issuers optimize for every basis point of efficiency, these alternative mechanisms are poised to scale rapidly.

Traditional, pool-based lending protocols rely on tokens being deposited to their pools and on DEXes for liquidity to enable lending, relying heavily on the inefficient system.

Gearbox's Credit Accounts, though, act as a smart wallet that can plug in at the contract level of vaults, wrapped positions, and non-token yields. Enabling Permissionless to power lending and leverage not just for any token, but for any asset or it's representation onchain.

This feature unlocks a 1 -> 10 evolution for lending and leverage efficiencies.

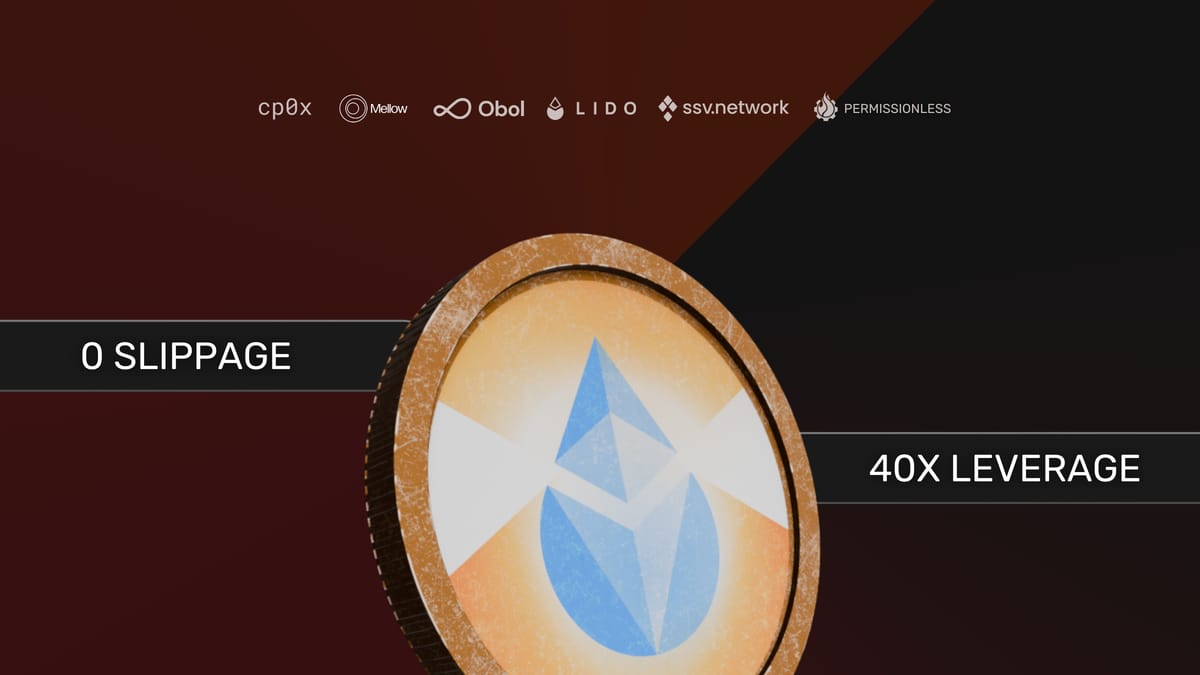

Leverage Without DEX liquidity: 0 Slippage, 0 fee, 0 friction

Traditional lending protocols don't just rely on DEXes for liquidity, they model their risk parameters as per DEXes. Since DEXes have a fraction of liquidity that contracts do and are prone to sizeable price impacts, they limit the capabilities of onchain lending. By lending directly at the contract level, Gearbox

• Reduces slippage and DEX fee to 0, saving months of yield

• Unlocks highest LTVs in DeFi, borrow more for every dollar

• Unlocks $B+ Scale, scale multiple times more than other protocols

• Lower Liquidation points, safer positions

• No DEX liquidity required, saving millions in costs for issuers

• Unwind positions in fraction of days, save costs with higher efficiency

Gearbox Permissionless can thus adapt to any asset design and let institutions scale with the highest level of efficiency.

This feature is already live for Lido's DVstETH on Gearbox, enabling users to swap in and out multiple millions without losing months of yield to DEXes. Read about it below!

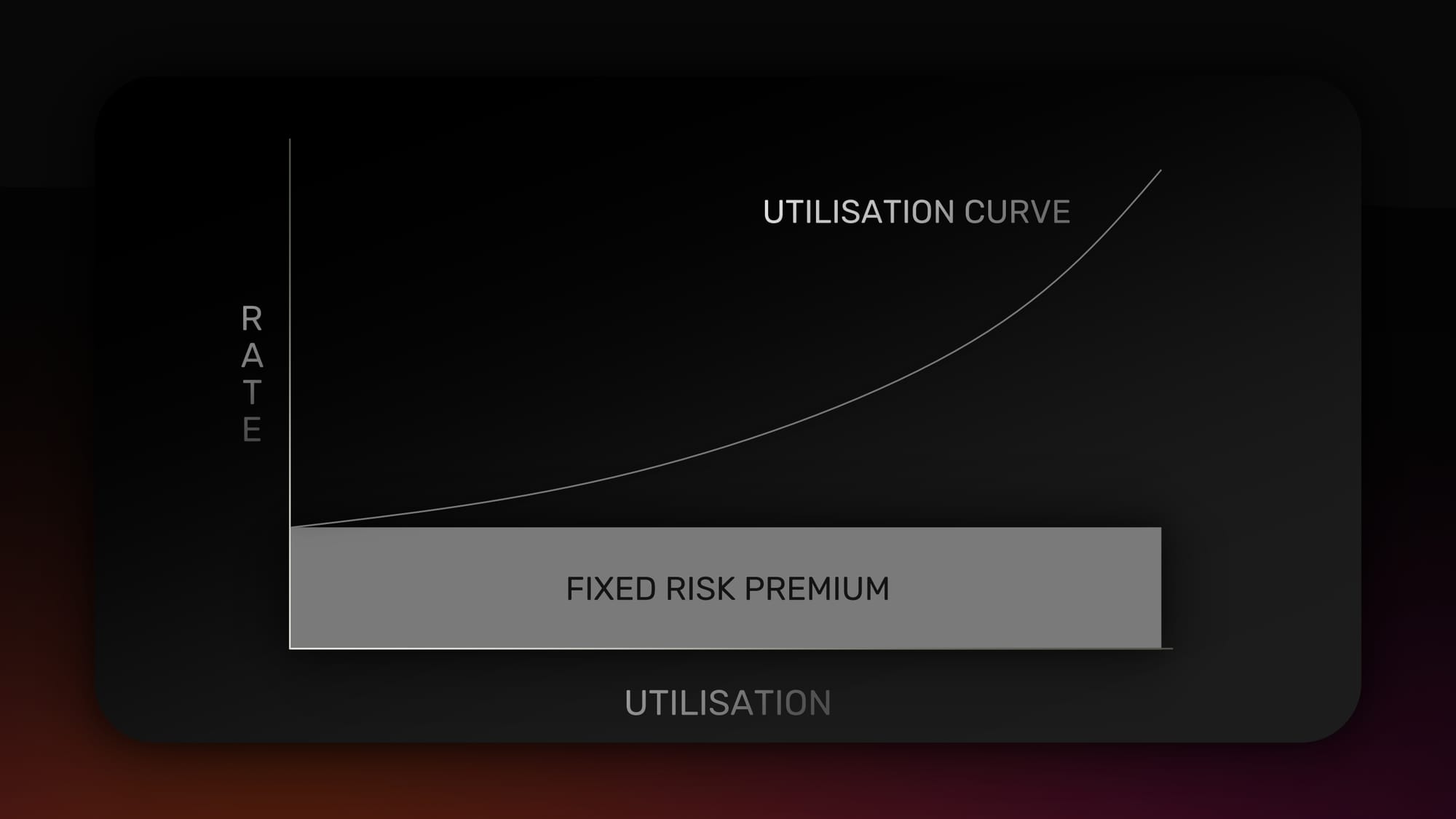

II. b) Risk Adjusted Borrow Rates for Every Collateral

For institutions to lend onchain, they must be able to recreate their lending and risk frameworks onchain. And a critical aspect of these frameworks are borrow rates. Institutional underwriters take into consideration innumerable factors to derive the borrow rates for an asset, amongst demand.

Meanwhile, traditional DeFi lending uses utilization-based interest rates, relying solely on demand while ignoring borrower-specific risk and collateral quality.

Gearbox replaces this with built-in, risk-adjusted rate modeling, letting curators mirror their off-chain underwriting models onchain.

In Permissionless, the borrow rates have two aspects.

- Utilisation Rate: These are demand based rates that increase more funds in the pool get utilised

- Fixed Risk Premium: Based on underwriting principles, curators and institutions can add a fixed premium that borrowers have to pay on top of the demand based rates.

This mechanism enables curators to recreate lending frameworks they have spent decades perfecting.

II. c) Omni-EVM architecture

The growth of L1 and L2s EVMs is unlikely to slow down, instead it is likely to be highly concentrated on a few purpose-built networks. To capture this growth, Permissionless features an omni-EVM architecture with activation on 25+ EVM L1s and L2s. Furthermore. Gearbox can be the fastest lending protocol on any new EVM we aren't already activated on.

This is made possible by Bytecode: an EVM-ready, onchain repository of Gearbox's code. Bytecode Repository powers trustless deployment of Permissionless on any EVM with minimal additional resources. To decentralise the repository, contracts uploaded to it are signed and governed by the auditors instead of the DAO. Contracts from Bytecode repo can only be deployed on an EVM if they have been signed by the auditor. This ensures trustless deployment of required contracts on any EVM seamlessly, possible exclusively on Gearbox Permissionless.

Permissionless is further equipped with features that ensure the deployment offers the best UX and functionality from Day-0.

- Day-0 oracles: Gearbox utilises Redstone's pull oracles to allow day-0 usage of feeds on any chain.

- Day-0 1 click leverage: Lending protocols usually rely on external integrations like Paraswap to create leveraged positions through flashloans. these integrations are often not live on Day-0. Gearbox Credit Accounts come with native leverage tooling from Day 0 and can offer leverage from Day-0.

II. d) Risk Management Arsenal

Gearbox has remained free of bad debt since 2021, a record we take pride in. With Permissionless, our goal is to extend the same risk management capabilities that safeguarded DAO-governed pools to Curators launching no-code markets. To make this possible, Curators are equipped with three essential tools.

Curators on Gearbox don't just access no-code lending markets, they also access an arsenal of risk mitigation tools that have kept Gearbox safe for 4+ years.

— Gearbox ⚙️🧰 Protocol (@GearboxProtocol) September 22, 2025

Learn more about Optimistic Liquidations from @0xmikko_eth's talk at @summit_defi ⚙️🧰 pic.twitter.com/RvLnzIEmDA

• Optimistic Liquidation: Optimistic Liquidations fork Ethereum’s mainnet and stress-test the protocol under black-swan conditions every 3 hours. Data from this testing helps test everything from risk parameters to external dependencies, making risk management proactive.

• Pre-Launch Testing Module: This module helps curators test their market on a fork of the blockchain before onchain execution, acting as an on-demand testnet.

• Liquidation Bots: These are automated agents that monitor markets for users with HF below 1 and liquidate them to ensure bad-debt is prevented.

These tools ensure curators don't just access no-code market creation but the complete set of tools that have kept Gearbox secure for 4 years. You can read more about them below.

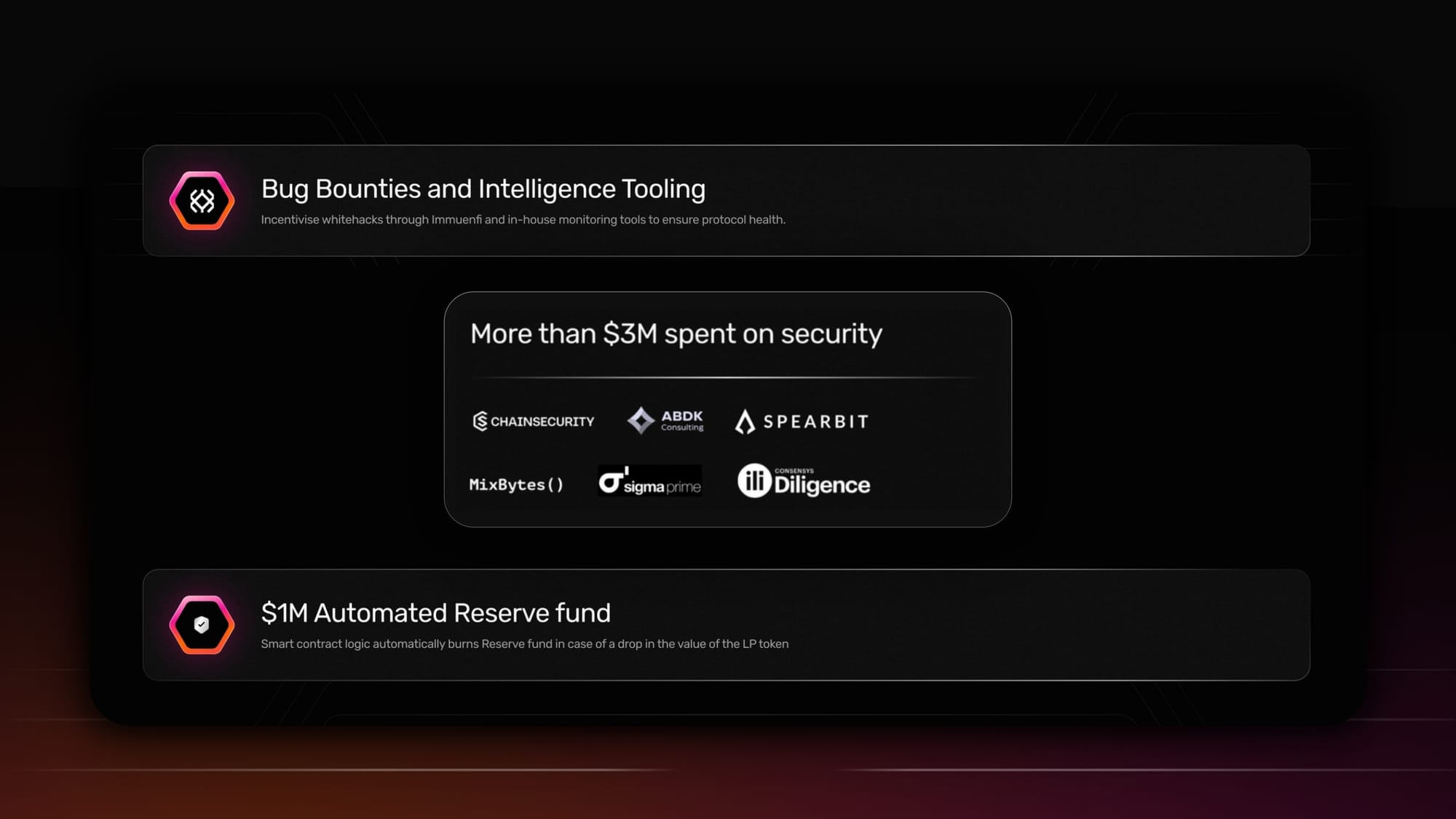

II. e) Battle-Tested Security

Gearbox is dedicated to maintaining a secure and resilient lending environment. Live for nearly 4 years, Gearbox has never faced any security exploits, placing us amongst the safest protocols in the space.

The DAO has invested more than $3M in the protocol's security. Our defenses are further reinforced through:

• 10+ Audits from top security firms like Consensys, Chainsecurity, ABDK, MixBytes, Spearbit, Watchpugs and more

• Whitehack bug bounty of $200K+

• Real time monitoring systems

II. f) Curator and User Experience Tools

While above features enable curators to set-up institutional grade lending markets for any asset across any EVM in a secure manner, Permissionless is also equipped with tools that make using the product itself seamless.

- 1-Click leverage: In built leverage tool that enables users to deploy multi-protocol strategies with leverage in one click

- Permissionless Interface: A simplified interface to help curators set up lending markets

- Permissionless Safe:

Majority of these features have been live and powering markets for 3-6 months. While Permissionless' development was in anticipation of the shifts our ecosystem is, and will be, facing, their evaluation is key to understanding Gearbox's path forward.

III. Evaluation: Permissionless Performance

Strategically, you can devise the best sounding protocol but at the end of the day, what matters is performance. Section 1 of this piece discuss trends and leaves us with "Keys to Success", these keys were laid out when we launched a Lido Specific instance in March'25. How did it go beyond that? We evaluate Permissionless' performance on the basis of those keys below.

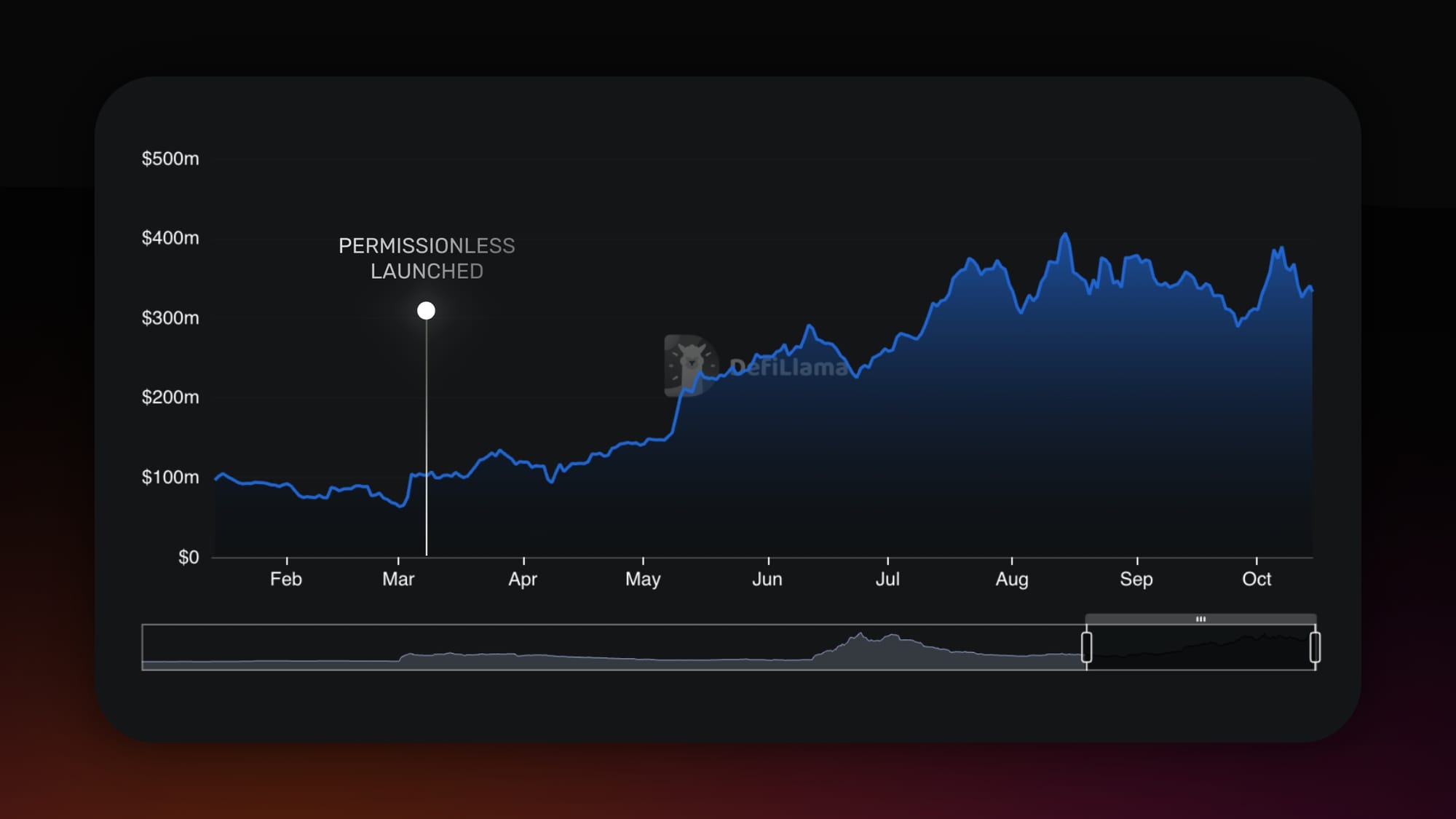

III. a) TVL Growth

Beating all our expectations, Permissionless grew the TVL by 209%, adding $224M as the Lido instance went on to become the largest ETH curated pool in DeFi.

III. b) 4X Speed to Market

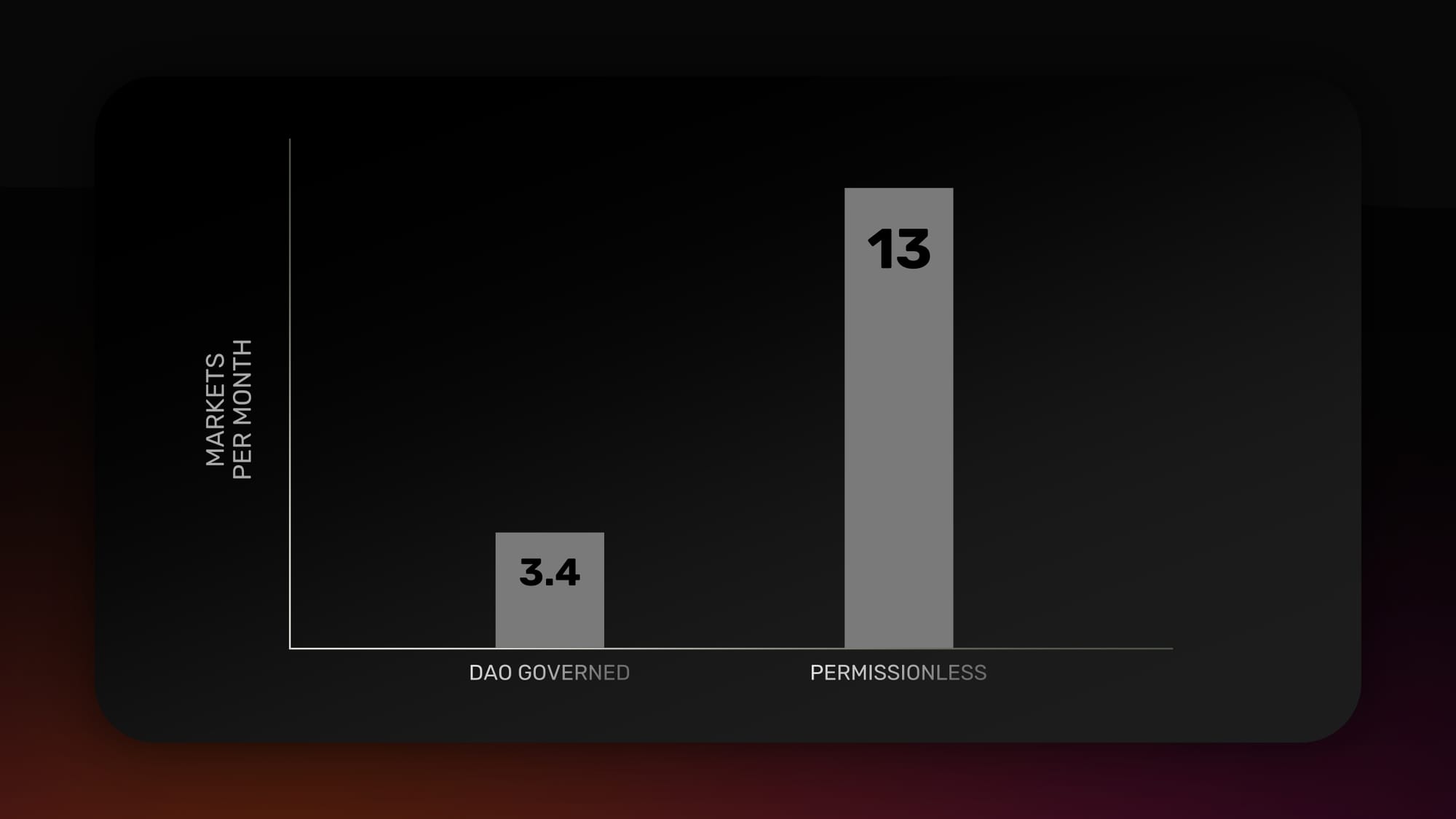

Over the last 3 months, Gearbox added more markets and networks than we did during the entirety of 2024.

Gearbox added a total of 41 markets on 3 networks during 2024. Permissionless has added 42 Markets on 5 networks in 3 months. Enabling Gearbox to offer far more opportunities to borrowers and in turn ensure borrowers access the best of yields through constant utilisation.

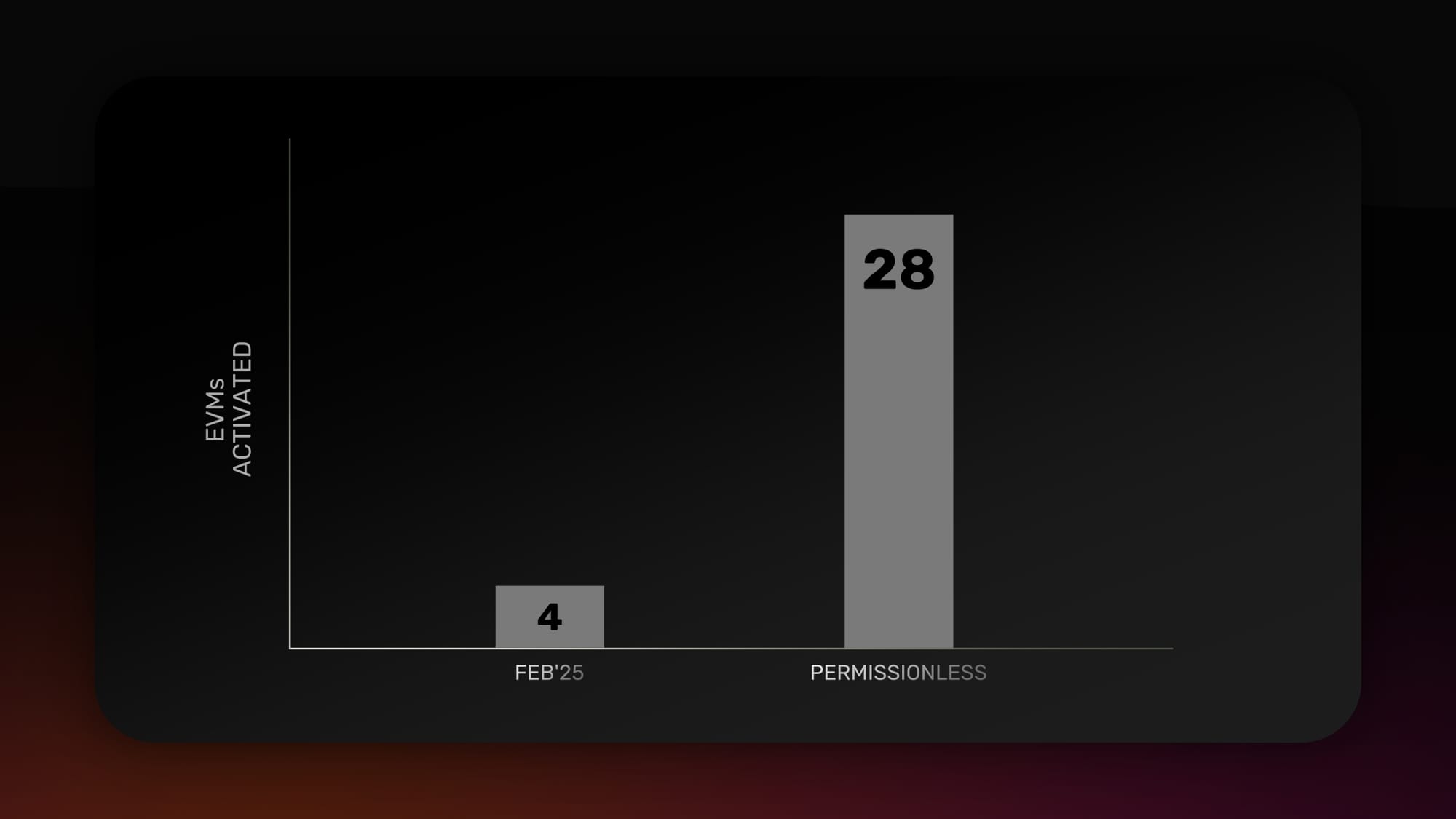

III. c) 7X More EVMs Activated

The last 6 months saw Gearbox Permissionless be activated on 28 EVMs, 7X more than we were back in March. The ability to rapidly scale on L1 and L2 EVMs enabled Permissionless to capture over $100M+ of growth.

While Gearbox is activated on 28 EVMs, it's operational on 9. This enables DAO to significantly operational costs while still being available for market creation on numerous EVMs.

The ability to rapidly and permissionlessly scale on EVMs enabled Gearbox to also capture two of the larger opportunities.

• Plasma, Curated by Invariant Group: $80M+ TVL

• Etherlink, curated by Re7: $17M+ TVL

III. d) Curator Adoption

Permissionless during this period has been able to attract 5 new curators with a combined AUM of $1.5B+

4 of the curators working on Gearbox today are amongst the top 15 curators in DeFi, a clear sign of Institutional adoption. Adding curators further compounds the speed to market and future-proofs growth.

III. e) Stress testing

Over the past six months, Permissionless has demonstrated remarkable resilience through several periods of extreme volatility, including what was arguably DeFi’s most turbulent day on October 10th.

Gearbox worked throughout the night without interruptions and continues operating 24/7 ✅

— Gearbox ⚙️🧰 Protocol (@GearboxProtocol) October 11, 2025

Despite the extreme volatility yesterday, less than $250K (or 0.07% of TVL), was timely liquidated on Gearbox. The DAO Pools saw a single liquidation while Gearbox Permissionless recorded…

Despite these events, Permissionless operated seamlessly, with no bad debt or unexpected disruptions. Events like these bolster the confidence of users and institutions.

IV. Migration: The final step

Shifting industry trends, regulatory clarity, rising institutional interest, and the demand for on-chain credit rails got the DAO to launch Gearbox Permissionless. 6 months later, Permissionless accounts for 70%+ of the TVL, has 4Xed our speed to market and future-proofed Gearbox's growth plans.

The Permissionless model was introduced in parallel to DAO-governed pools. But given the outperformance of Permissionless and the complexities with managing both products parallely, the DAO recently discussed moving primarily to the Permissionless model.

With GIP-264, the DAO voted to transition entirely to a Permissionless model and we'd love to have you transition with us. To make this transition smoother, deploying on Gearbox are two new institutional curators: Maven11 and KPK

Details regarding migration can be found below.

The above article evaluates the shifts from a business perspective and how Gearbox is adapting to them. These shifts, though, also matter at an operational level. Summing up the DAO contributors' learnings is this piece by Ivan, an early contributor at Gearbox DAO:

If you are an institution and are looking to expand your operations onchain, Gearbox can offer you the credit infrastructure you require. Contact us on Telegram or Discord, and we will guide you. Let’s build the onchain economy together!

- Website: https://gearbox.fi/

- Main App: https://app.gearbox.fi/

- Telegram: https://t.me/GearboxProtocol

- Discord: https://discord.gg/gearbox

- Twitter: https://twitter.com/GearboxProtocol

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- Notion DAO monthly reports: