Multicollateral Loans: Flexible Borrowing

Imagine you have a valuable watch collection, but there's a yacht you want to buy. Instead of selling your watches for the yacht, you convince a watch dealer to loan you money against your watch collection. You then leave your watches with the lender until you return the money.

But what if you have a watch in your collection you want to sell? What if you are no longer into watches and want to swap them for vintage cars? What if you want to rent the watches and earn passively from them while they are with the lender?

In usual circumstances, this won't be possible as your collateral gets locked when you take a loan against it. This problem stands true even for onchain borrowing options. And this is precisely what Multicollateral loans are here to change.

Evolving Onchain Credit

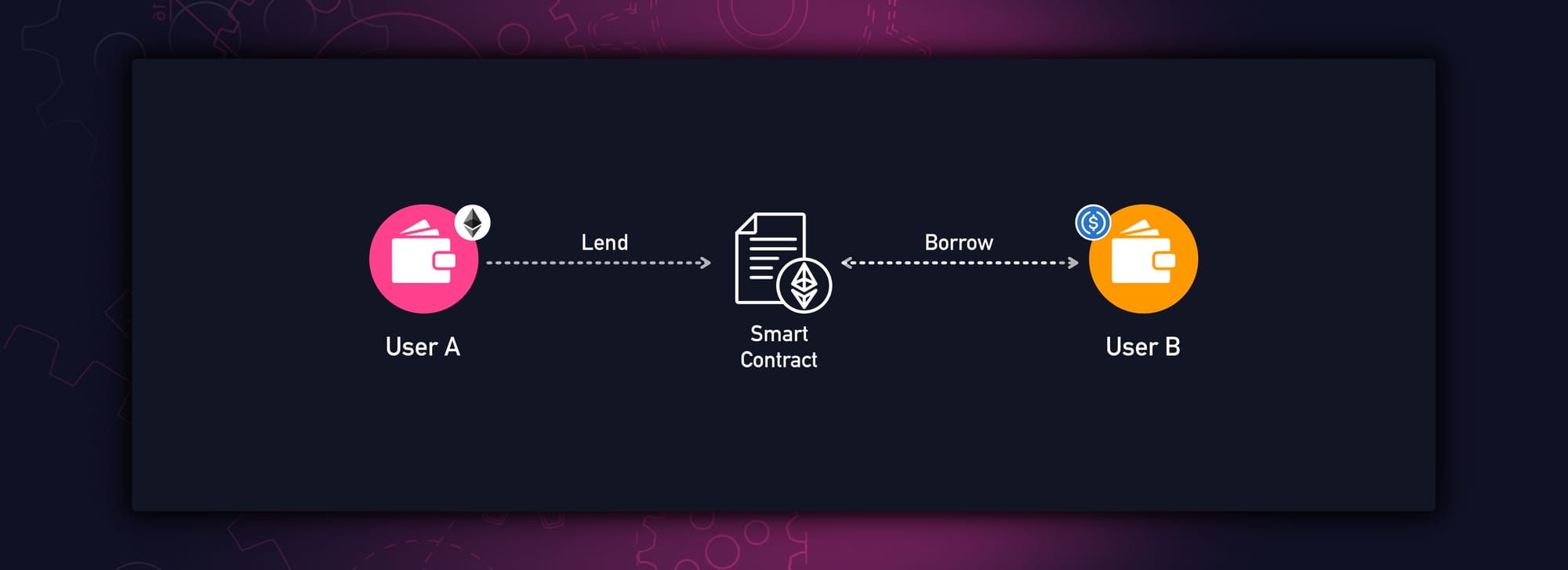

Onchain Credit was DeFi's first 0 to 1 breakthrough, starting with peer-to-peer transactions. Think of peer-to-peer transactions as you seeking a lender to borrow money from with your watch as collateral. This process was slow but kicked off an innovation avalanche onchain.

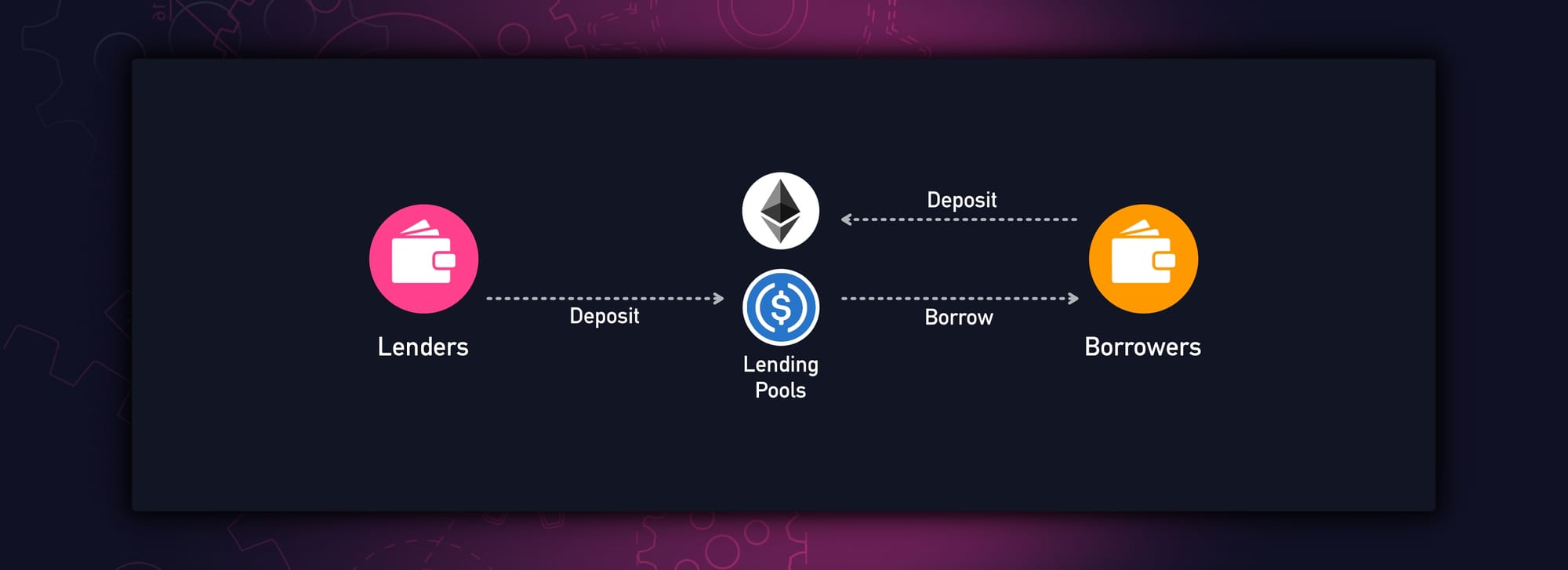

Next came the pivotal innovation: the peer-to-pool model. This model enabled watch owners to deposit their watches in a pool and borrow money from another pool using their deposits as collateral. This eliminated the need to search and wait for liquidity and made on-chain credit grow from 1 to 10.

While peer-to-pool is still the most utilised model, it suffers from the same problems as the example in the introduction. Once your assets are in a pool, you can borrow against them but can't access them for any other purpose.

Multicollateral Loans and How They Work

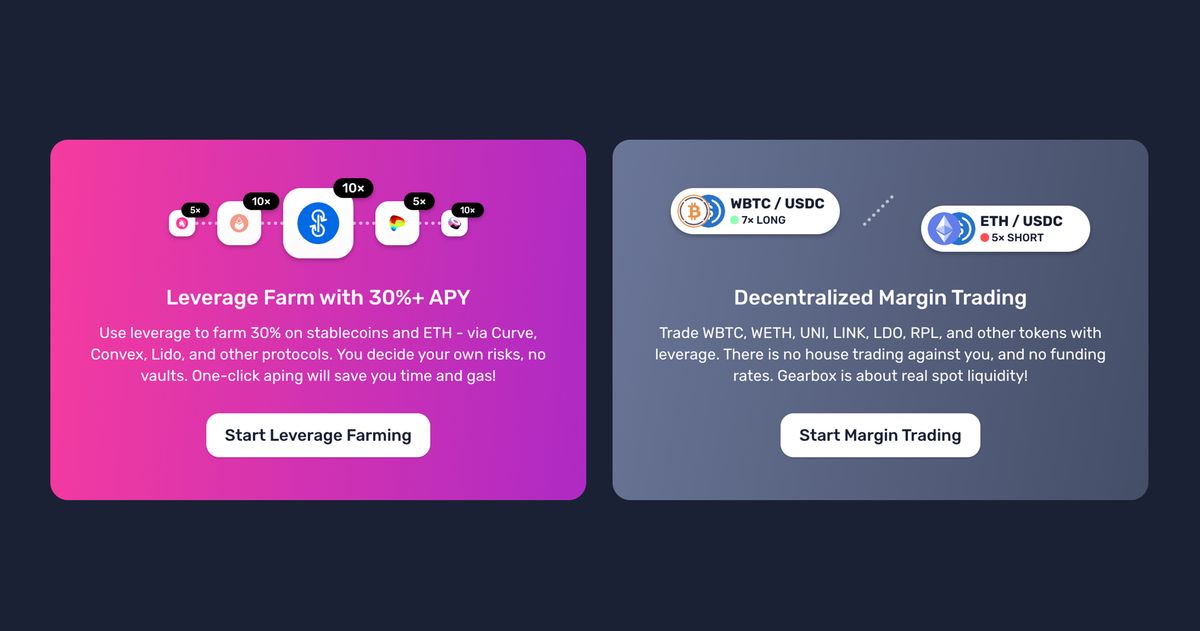

Multicollateral loans enable users to borrow against multiple assets AND use their collateral to farm, trade, stake, or do what they want across DeFi. Think of it as owing a lender money against your watch collection but still being able to trade, rent, or sell your watches so long as the lender approves it. Unlike Gearbox's spot leverage, Multicollateral loans can be withdrawn to a user's wallet and are non-levered (unless they are looped first).

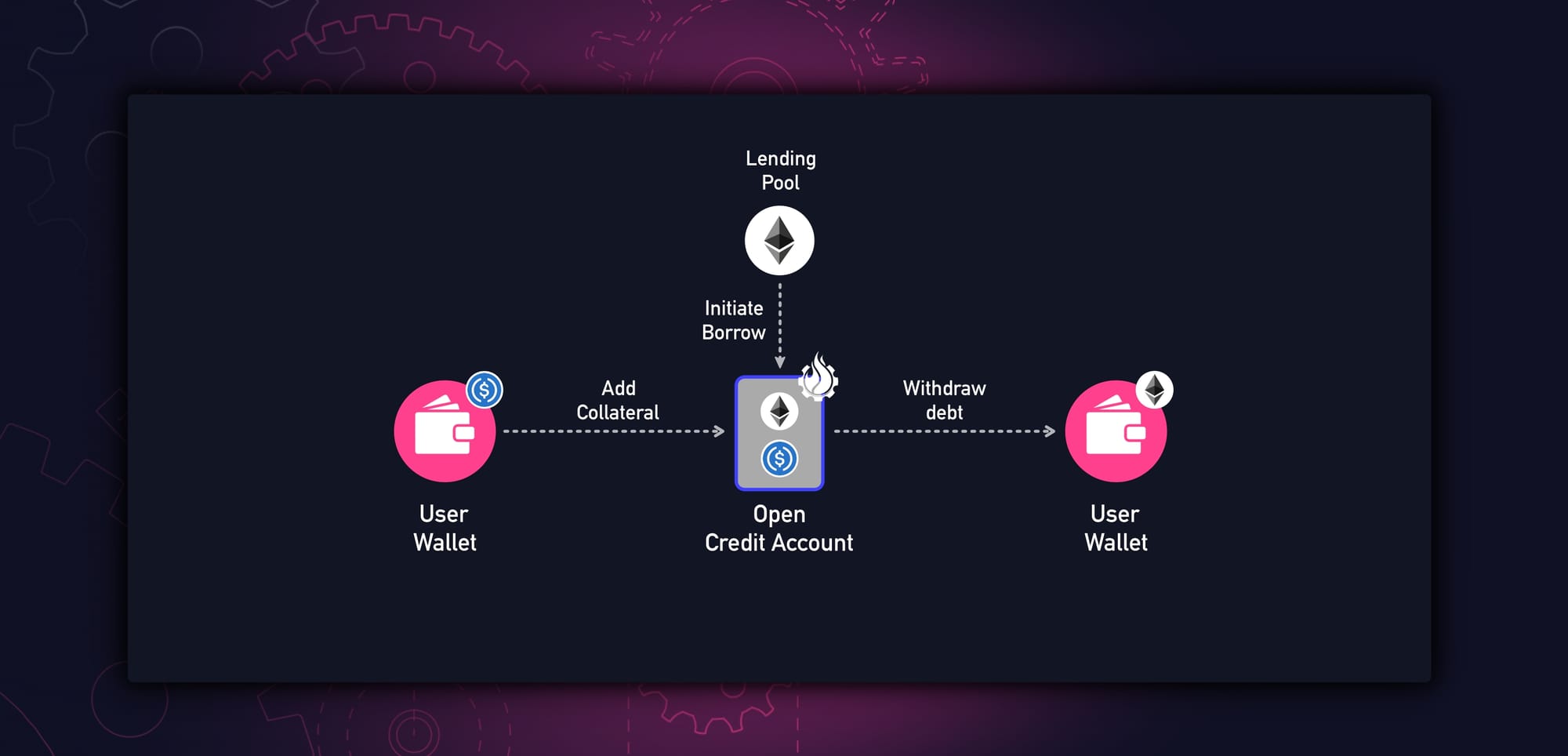

Multicollateral Loans use an isolated smart contract wallet called the Credit Account (CA) for borrowers to deposit collateral, instead of using a lending pool.. The Credit Account can borrow assets from Gearbox's lending pools till the LTV on the supplied assets is reached. The debt is then transferred to a user's wallet (EOA). Effectively:

Open a Credit Account -> Add Collateral -> Borrow from lending pool -> Withdraw debt

After the debt is withdrawn, your collateral remains in the isolated Credit Account. This enables borrowers to access their collateral for purposes like...

Flexible Collateral Management

Let's divide collateral assets into 3 broader categories: Majors, Stables, and Alts. With crypto's volatility, users often swap between the 3 to manage their portfolio. In a peer-to-pool borrowing model, the collateral you provide has no flexibility. This means you can't switch your collateral from majors to stables without first repaying your debt and then withdrawing your collateral from the lending pools.. For that, you need to use portfolio management tools like DeFiSaver. Then it’s solvable, but not as flexible or native as a user would want it to be.

Multicollateral loans, though, completely solve this problem. Since you supply your collateral to a smart contract wallet (Credit Account) instead of a pool, your collateral is isolated and remains liquid. The credit account lets you swap your collateral for any other allowed asset. Once a CA is opened, users can access all the usual operations of reducing debt, increasing it, and whatever else older-generation lending protocols allow you to do. But because of Multicollateral you can also swap from stables to alts or majors even when you have borrowed and withdrawn assets. You can move your collateral between different yield sources. Fully liquid!

Collateral-Based Borrow Rates

With older-generation lending protocols, the borrow rate for an asset remains the same regardless of what collateral is deposited. Consider two users: The first supplies CRV and LINK, while the other deposits ETH and WBTC. If they both borrowed USDC against their collateral on OG lending protocols, they would both pay the same borrow rate.

On Gearbox, this changes. Your borrow rates depend on the risk associated with your collateral. If you supply majors or stables, you are likely to pay a lower rate than the users who borrow against alts.

This is made possible through Gearbox's "Quota" rates, which align borrow rates with risk. More on that later in the article.

UI Walkthrough

Despite the backend mechanics of a Multicollateral loan being slightly complex, opening a position only takes 1 click.

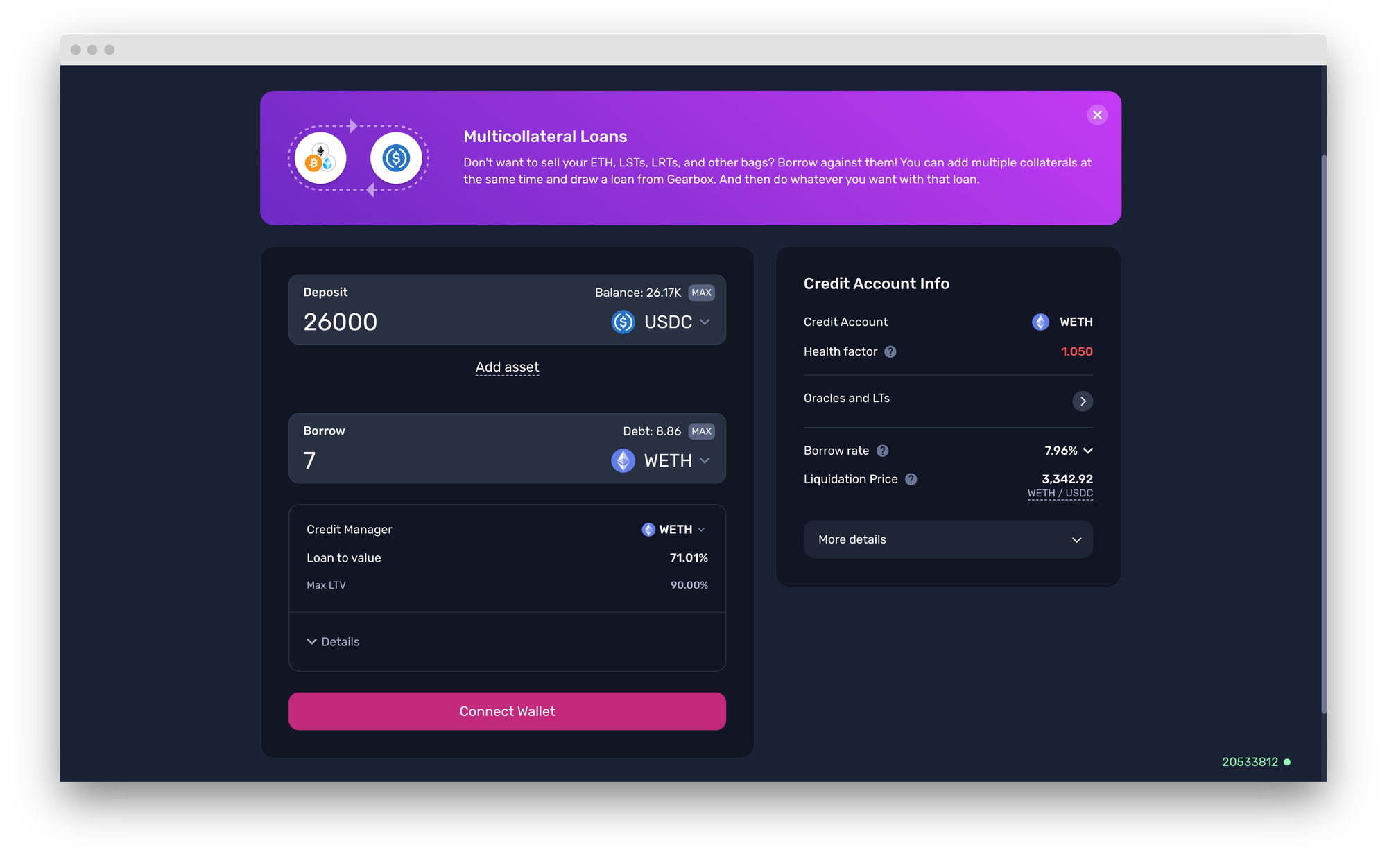

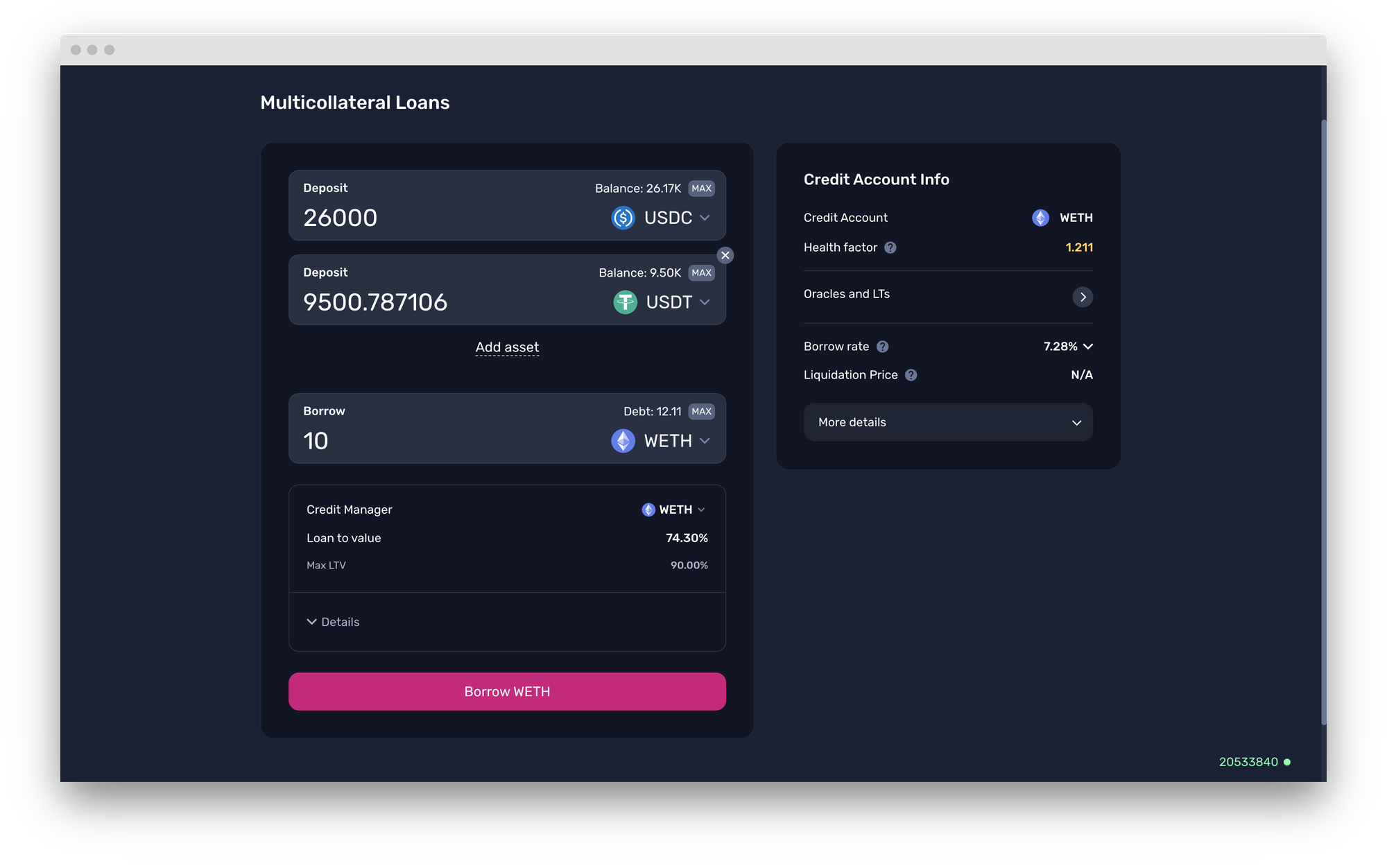

- Head over to https://app.gearbox.fi/lending, and make sure you are on the "Borrow" tab.

- Select the collateral you want to provide and the amount of debt you want to take. Note the liquidation price (on the right), and avoid withdrawing near the maximum LTV to reduce the risk of being liquidated.

- To deposit multiple assets, click on the "Add asset" option.

- Click on "Borrow Asset", approve your transaction and voila! You are all set.

You can see your borrowed asset in your wallet. Make sure you monitor your position and borrow rate periodically. A healthy LTV is the ideal way to farm!

Quick Note: The UI shows borrow rates in two ways. The default setting is to calculate the borrow rate relative to your collateral instead of your debt. You can switch this by clicking on "Borrow rate" on the right and then clicking on "Account Value." This will display borrow rates similar to other lending apps.

What You Can Borrow

You can borrow any lending pool asset with a greater than zero (0) LT with respect to your collateral. The following assets are available to borrow

- Stables: USDC, USDT, DAI, crvUSD, GHO

- Majors: WETH, WBTC

What You Can Borrow Against

Gearbox accepts over 20 collaterals across 2 networks with integrated yield strategies available for many collateral assets.

1) ETH Mainnet

- Stables: USDC, USDT, DAI, crvUSD, GHO, FRAX

- Majors: WETH, WBTC

- Alts: LINK, UNI, MAKER, CRV, CVX, LDO, FXS

- LSTs and LRTs: stETH, weETH, ezETH and rsETH

- Yield Strategies available for providing liquidity and staking in Convex

2) Arbitrum

On Arbitrum, you can borrow against 7 assets.

- Stables: USDC, USDe

- Majors: WETH, WBTC

- Alts: ARB

- LSTs and LRTs: wstETH, rETH

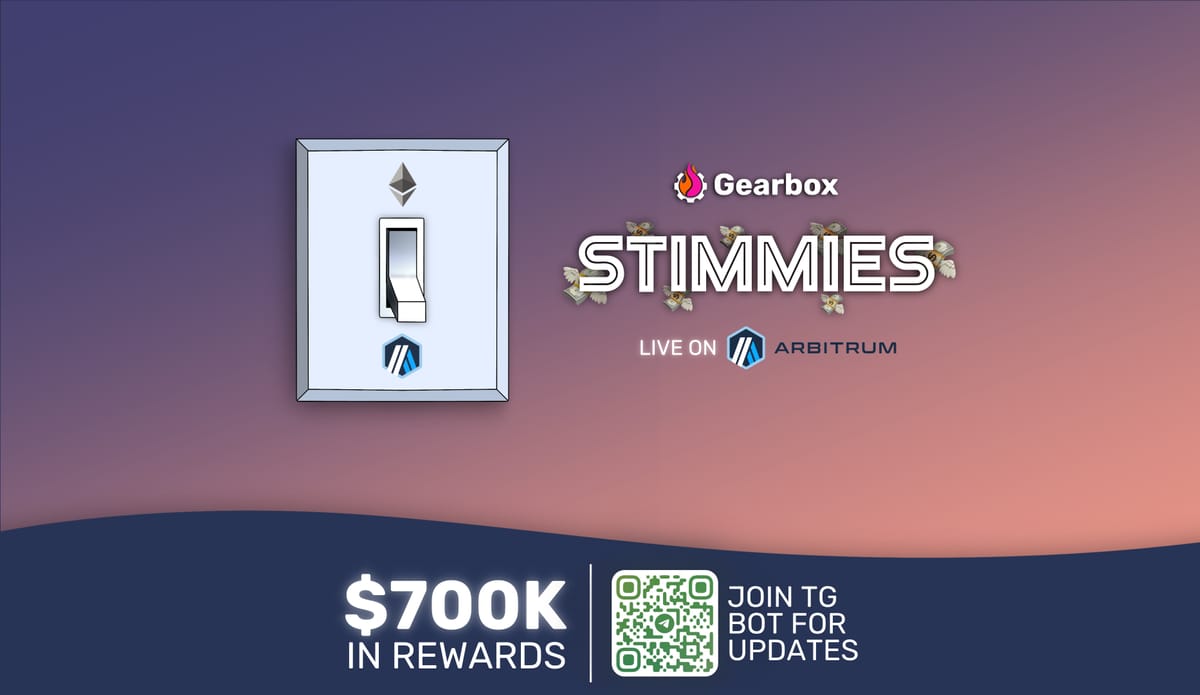

Taking a loan on Arbitrum network also earns you additional GEAR and ARB rewards with STIMMIES. Complete details below.

3) Optimism

On Optimism, you can borrow against 7 assets.

- Stables: USDC

- Majors: WETH, WBTC

- Alts: OP

- LSTs and LRTs: wstETH, rETH, ezETH

Rates on Gearbox - Quotas

Lending protocols usually determine rates based on utilisation. While this addresses an asset's supply-demand dynamics, it doesn't address the risk that different positions represent to the lenders and the protocol. To achieve this, borrow rates on Gearbox have two components.

- Base Borrow Rate: Determined by utilisation of a debt pool and remains relatively low till utilisation is greater than 90%

- Quota rates: This component addresses the risk aspect of the collateral. GEAR stakers democratically vote regarding the additional borrow rates for an asset. More volatile assets see higher quota rates, while lower-risk assets see lower quota rates. How do quota rates work, and what are gauges? Read the article below.

The above two rates combined help create a risk-adjusted rate for every collateral. This also enables Multicollateral loans to offer lower rates to users with less risky collateral. So go ahead and get borrowing, head over to:

Borrow against your cake and eat it, too. Multicollateral Lending.

If you want to join the DAO — get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion DAO monthly reports: