Gearbox's Lido Instance: Isolated (Re)Staking Market

With over $1 Billion in volume, 2 years of being live and proven adoption, the most utilised protocol on Gearbox now gets its own instance. Unlocking unparalleled capital efficiency for staking, a dedicated Lido instance of Gearbox is now live!

The dedicated instance provides users the opportunity to borrow wstETH to maximise their Mellow LRT and Lido Community Staking rewards. Making these opportunities more fruitful are incentives from P2P.org, learn more about them below. With the instance, Lido will no more just be a part of Gearbox's offerings but will be supporting its own credit market using Gearbox's infrastructure.

About Lido's Gearbox Instance

Gearbox's infrastructure enables users and institutions to lend their assets for a set of permitted services onchain. Users can borrow these funds by opening a Credit Account on Gearbox, and the Credit Accounts programmatically ensure the borrowed funds are used only for the permitted services.

A dedicated instance effectively allows Lido and Mellow to establish a tailored version of Gearbox using the existing protocol. Within the instance, a wstETH pool will be set up with Chaos Labs curating the risk parameters for the pool.

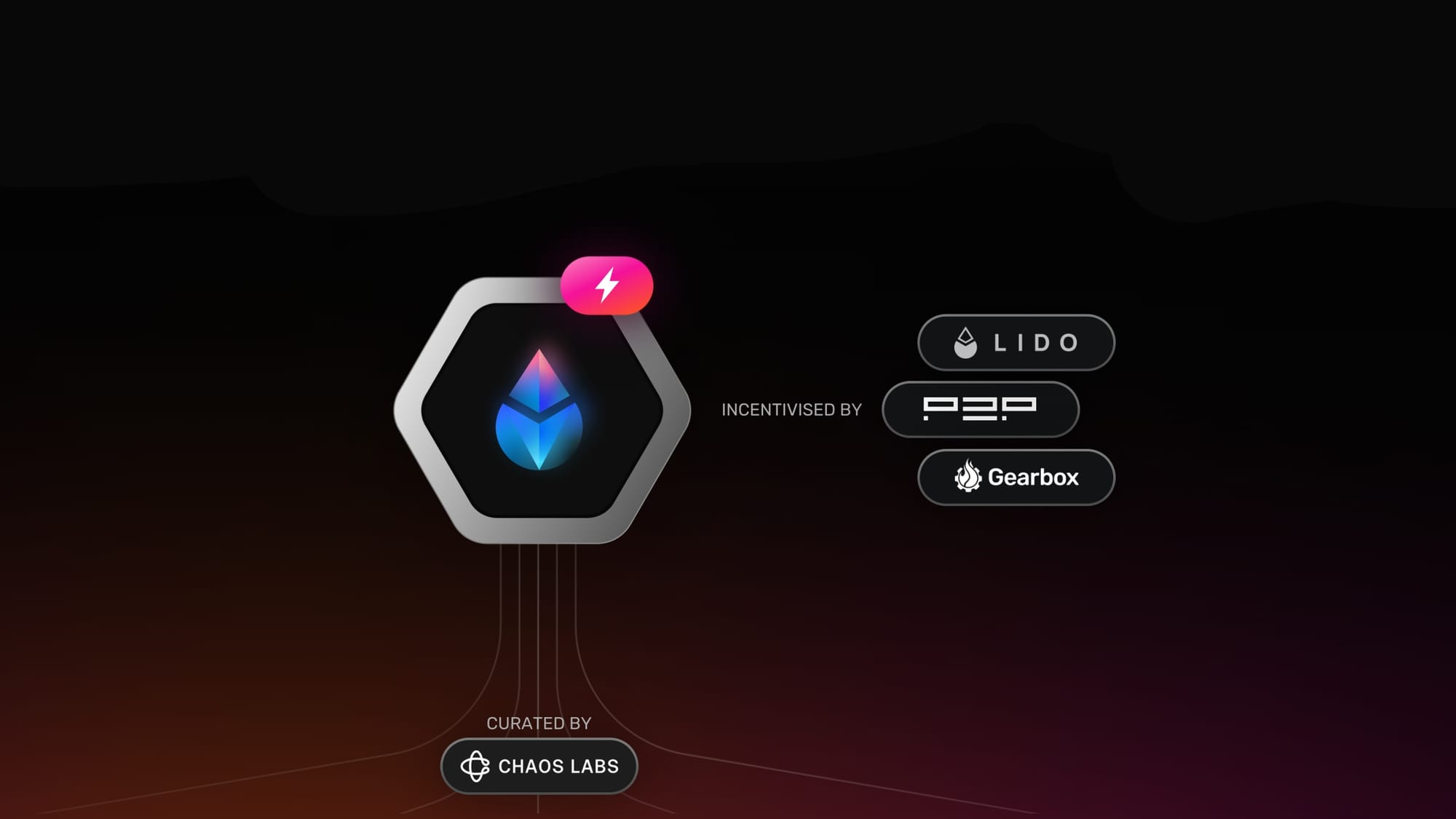

Meanwhile the borrowers will be able to borrow wstETH to earn boosted yields on rstETH and dvstETH. Both, borrowers and lenders, will be incentivised with additional rewards from Gearbox, Lido and P2P.org.

The Opportunity For Lenders

The instance brings lenders the opportunity to earn the underlying yield from wstETH, additional lending rates through utilisation by borrowers AND the incentives, creating one of the best onchain lending opportunity for wstETH. And all of this completely passively.

Gearbox's lending pools have no impermanent loss, fees or lock ups. Lenders can deposit and withdraw whenever they decide, making lending truly passive.

Users can deposit wstETH to earn passive yields and additional rewards here: https://app.gearbox.fi/pools

How Borrowers Can Utilise The Instance

Borrowers will able to utilize the lent wstETH to access credit on Mellow Vaults. Borrowers, too, will be incentivised by P2P.org for borrowing wstETH. The assets held by the borrowers will yield 1% APY additional to their underlying yield, boosting their returns.

The wstETH supplied passively will enable borrowers to access credit on

• DVstETH: DVstETH is a Liquid Staking Token (LST) enabling users to stake their ETH through Lido's infrastructure while participating in decentralized validator technology (DVT) initiatives.

• rstETH: rstETH is a Liquid Restaking Token (LRT) introduced by Mellow Protocol. The LRT utilises Symbiotic's restaking infrastructure to restake ETH. While rstETH positions will be eligible for P2P.org's incentives, they'll receive 65% lesser points.

The Gearbox dApp provides details regarding borrow rates, available leverage, and more. Users can access credit by choosing the Nexo USDT pool as the source of debt while opening a Credit Account. Click here to find the strategies.

Borrowers can find the DVstETH and rstETH strategies and deploy them in one click here: https://app.gearbox.fi/strategies/list

Governance

The instance will be administered by the Gearbox DAO– DAO votes will remain necessary to alter the parameters for strategies and pools. Lido and P2P.org will remain key to Pre-GIP discussions.

Why Gearbox suits Protocols and Institutions

Credit markets are crucial for an asset, especially LSTs and LRTs, to increase adoption. Gearbox instances provide protocols with the opportunity to set up isolated credit markets for their assets using Gearbox's lending infrastructure. While other lending protocols also enable this, Gearbox offers significant advantages over the traditional pool-to-peer model protocols.

I. Ease of Operations

Institutions and protocols expanding onchain require infrastructure that can support customisable lending frameworks without complicating operations. While multiple lending options exist on-chain, few can support this.

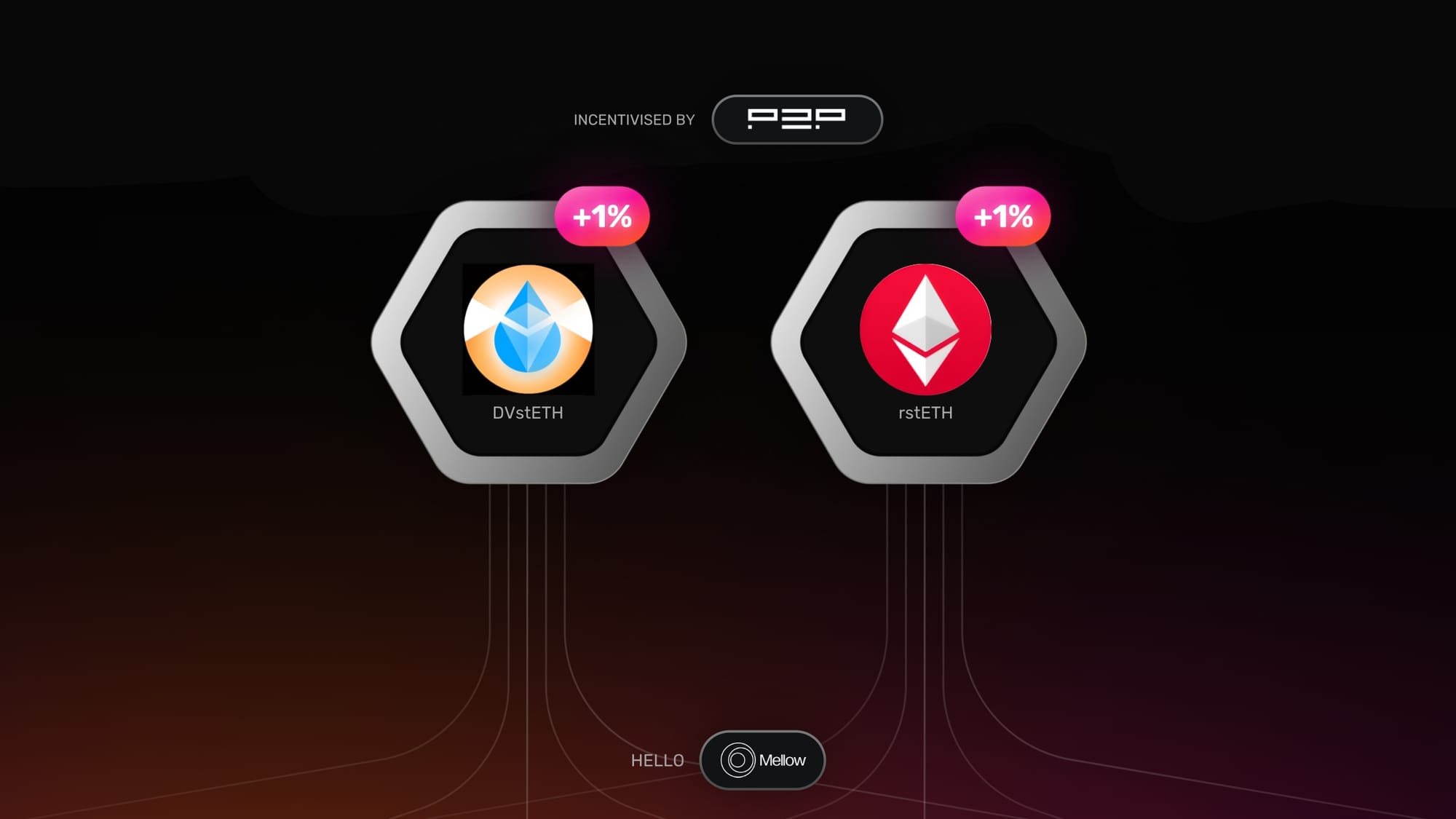

I. Pool-To-Peer model and the lack of Risk-Adjusted Rates: Most lending protocols utilise the pool-to-peer design, where users can deposit in generalised pools and borrow from other generalised pools. Since all the collateral is generalised, the interest rates can not be risk-adjusted. Whether you deposit a long-tail asset or BTC, if you borrow USDC, you pay the borrowing rate for USDC.

II. Peer-to-peer model and liquidity fragmentation: Alternately, lending protocols utilise the peer-to-peer model, where each collateral is paired and has its own isolated pools. While this makes risk-adjusted rates possible, liquidity gets fragmented between multiple pools. To enable USDC lending against 10 assets, you must set up 10 different markets. This requires significant intervention and constant monitoring.

The solution: Gearbox's unique design offers institutions a significantly more customisable yet easy-to-use infrastructure. Gearbox is designed with a pool-to-account model where every borrower is isolated and has a dedicated account. The account can determine the collateral a borrower has deposited and charge interest rates based on the risk associated with the collateral. Institutions can set up borrowing rates for different collateral types. At the same time, the debt for multiple collaterals can be issued through the same lending pool, removing liquidity fragmentation and the need for excessive management.

Gearbox's unique design solves both the borrow rates and liquidity fragmentation problems, making management more effortless.

II. Instant access to 45+ Integrations

Designs like Gearbox require Credit Accounts to be permitted to interact with specific smart contracts, which further requires the logic to be designed, programmed, and audited. This cycle can take months. Thankfully, Gearbox has been live for over three years, and offers 40+ integrations across three networks.

With most major EVM-based DeFi protocols integrated, Gearbox provides institutions with access to a wide array of DeFi platforms and services. This extensive network enables Nexo and other institutions and protocols to offer diversified strategies to their clients, enhancing the value proposition and attracting a broader user base.

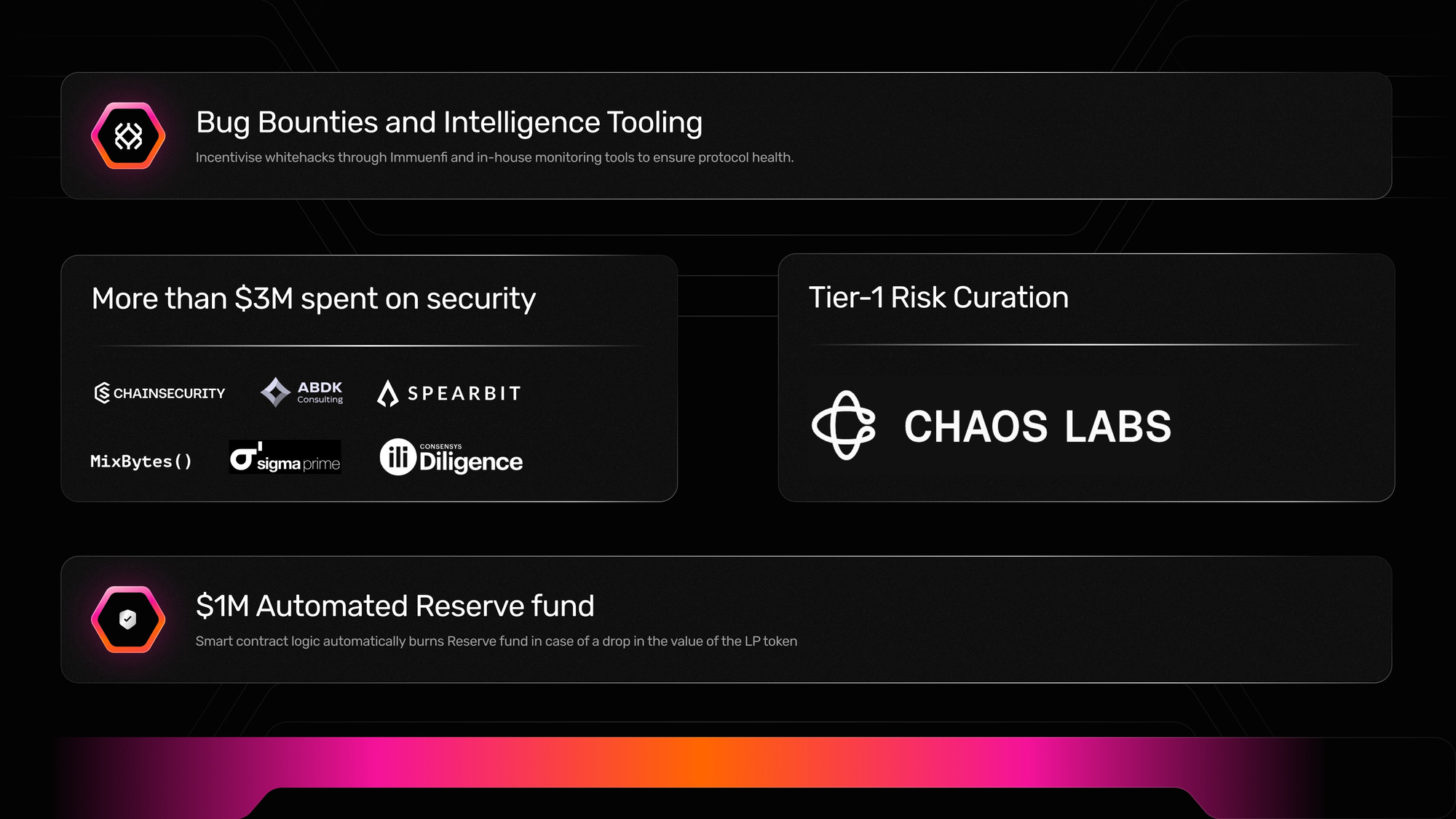

III. Battle Tested Infrastructure

Security is paramount in DeFi, and Gearbox has demonstrated a strong commitment to maintaining a secure environment, spending over $3M on security. Gearbox has been live for 3+ years and has never faced any exploits. It is further backed by

• 10+ Audits

• Whitehack bug bounties

• AI-based monitoring tools

These factors provide a safe environment for protocols and institutions to expand their on-chain operations and services.

If you are an institution and are looking to expand your operations onchain, Gearbox can offer you the credit infrastructure you require. Contact us on Telegram or Discord, and we will guide you. Let’s build the onchain economy together!

- Website: https://gearbox.fi/

- Main App: https://app.gearbox.fi/

- Telegram: https://t.me/GearboxProtocol

- Discord: https://discord.gg/gearbox

- Twitter: https://twitter.com/GearboxProtocol

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- Notion DAO monthly reports: