Leveraged Pendle PTs: Leveraged Fixed Income

Pendle Finance has established itself as a prominent fixed-yield protocol with over $4 billion in Total Value Locked (TVL) and $10 billion in total trading volume. Pendle Finance brings fixed yields to users through tokenised yield trading. While fixed yields offer users a steady source of known returns, leveraging them enables users to maximise their capital efficiency. And that's why Gearbox now brings you leveraged PTs to turn these steady yields supercharged.

NOTE: The onboarding process for Pendle PTs and their associated risk parameters has been defined in accordance with the recommendations of Gearbox's Risk Curators, Chaos Labs. Complete details can be found in the attached GIP.

Pendle PTs: Yields, Borrow Rates and Details

Pendle splits yield-bearing assets into two separate tokens:

- Principal Tokens (PTs): Represent the principal value of the asset, redeemable at maturity for the original amount.

- Yield Tokens (YTs): Represent the yield generated by the asset. The value of a YT tends to 0 as it reaches maturity.

The PTs trade at a discount to the redeemable asset but can be redeemed 1:1 for the underlying asset on maturity. This discount effectively enables users to lock in the fixed yields by buying at a discount and redeeming for the actual price on maturity. As an example, one sUSDe PT currently trades at $0.98. The same PT will be redeemable for 1 USDe worth $1 on 26th December, enabling buyers to earn 25% APYs over the next 30 days.

Gearbox enables users to borrow up to 7X their funds to purchase these PTs at a discount and supercharge these fixed yields. What do the leveraged returns look like?

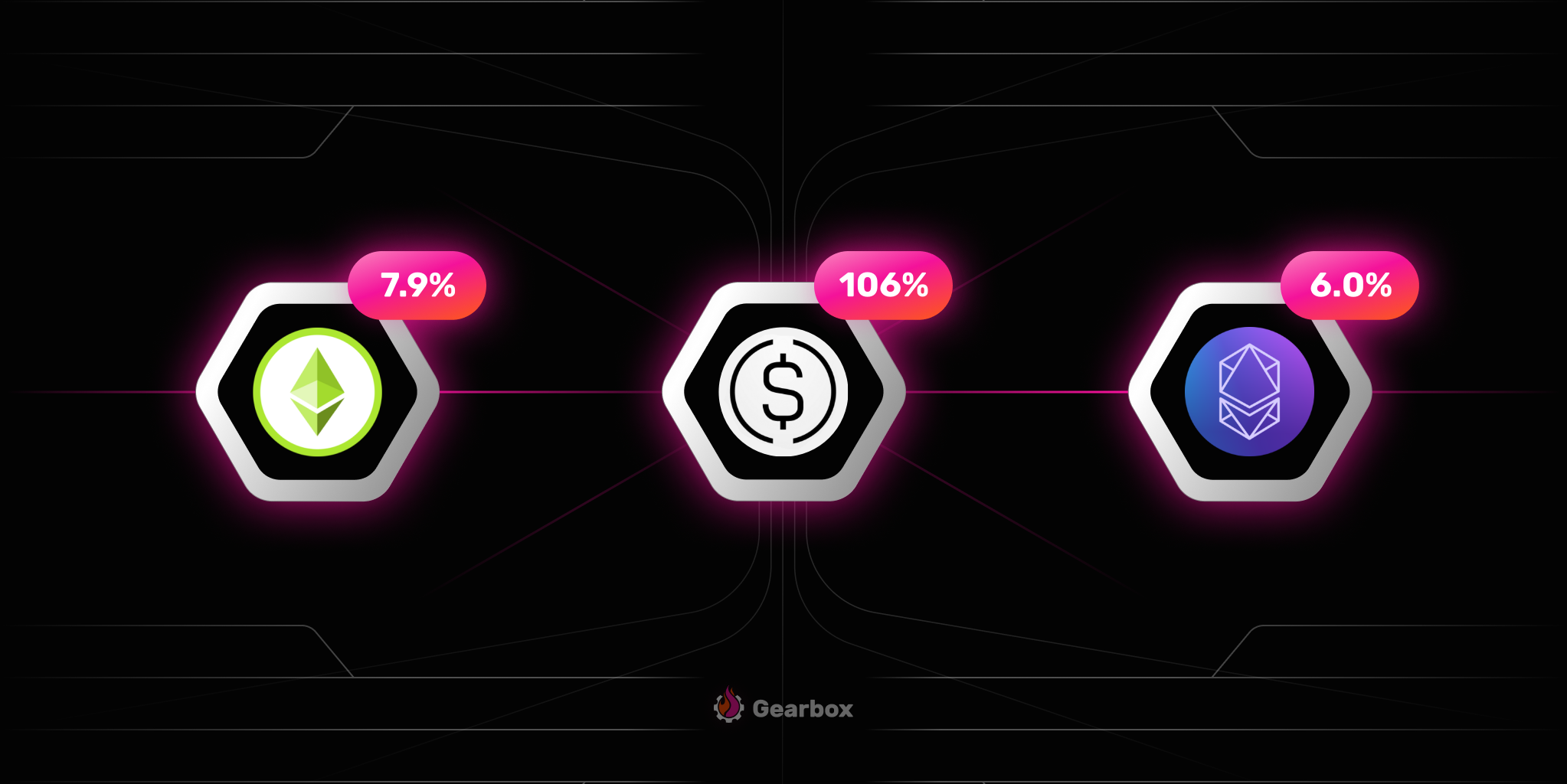

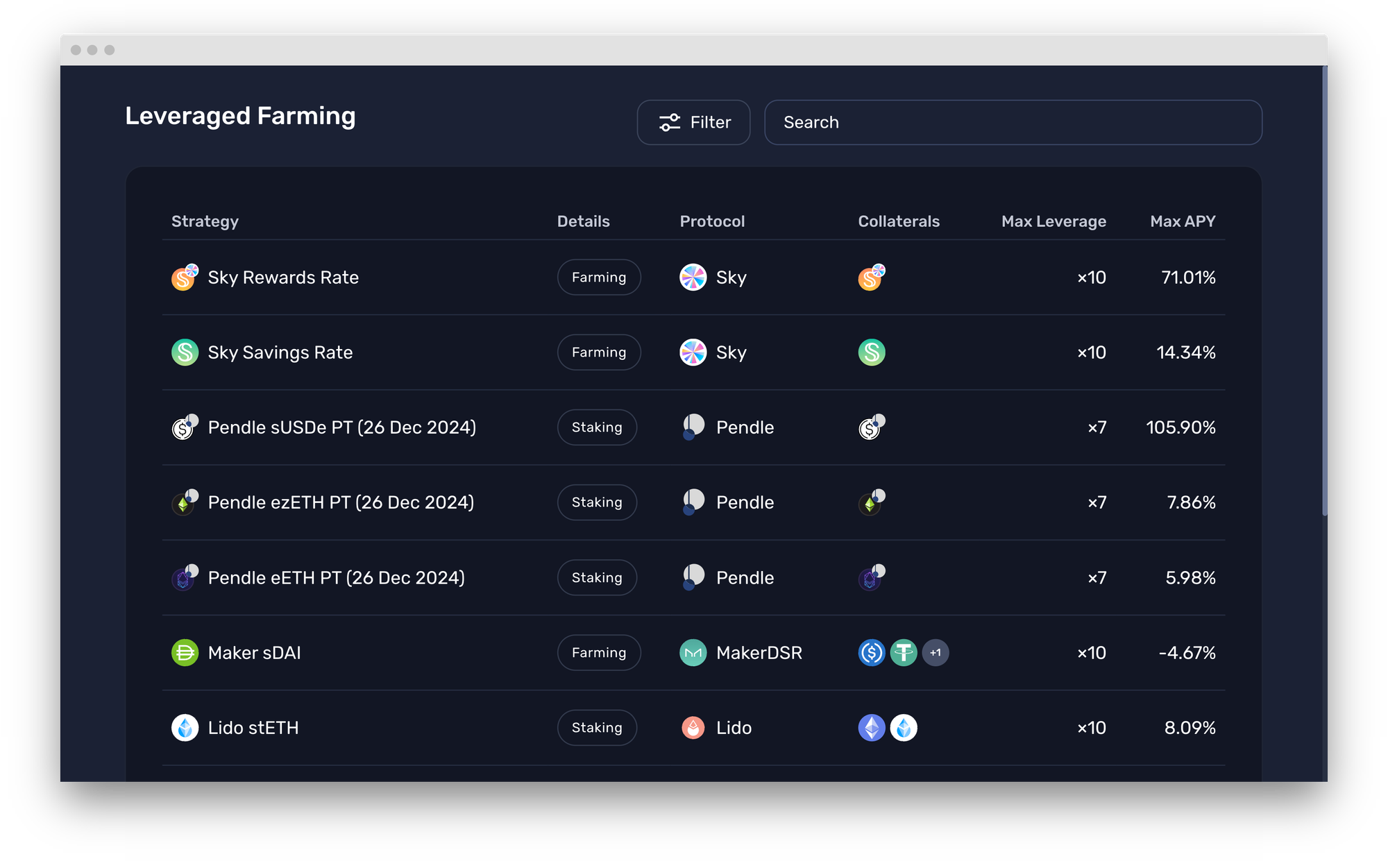

With the integration now live, users can access up to 7X leverage on

• sUSDe PT, 26th Dec and earn up to 106% APY

• eETH PT, 26th Dec and earn up to 5.98% APY

• ezETH PT, 26th Dec and earn up 7.9% APY

But how does leveraging fixed yield work when your borrow rates are variable? Is leveraging PTs as risky as leverage trading? Let us give you the details below!

Predictable Borrow Rates

To make the most of leveraged fixed yields, users require borrow rates that remain relatively stable, which is exactly what Gearbox delivers. Borrow rates on Gearbox have two key components:

- Base borrow rate: The base rate of borrowing an asset which is common to all positions. As we see in traditional protocols.

- Quota Rates: Quota rates are asset-specific and enable lenders to earn risk-adjusted and demand-adjusted rates.

With Gearbox, you can rest assured the rates will remain relatively stable within the optimal utilization curve range. The predictability of Quota rates, which change only once a week, allows you to monitor the projected rates for the coming week. This predictability empowers you to anticipate possible fluctuations in your borrow rates. You can read more about how borrow rates and Gauges work below.

If you have a different opinion on borrowing rates than what the Gauges indicate, you can always stake your $GEAR to adjust the rates as you see fit. Head over to Gauges to make your opinion count.

While that's borrow rates sorted, how is volatility taken care of?

How does Gearbox reduce volatility on leverage?

Volatility, apart from the asset you hold, also depends on the debt you borrow. If you were to leverage sUSDe using ETH debt, your position would be prone to price volatility. Gearbox, though, enables users to borrow correlated debt to buy an asset. This means

• Borrow stables to leverage sUSDe PT

• Borrow ETH to leverage eETH and ezETH PTs

Since the borrowed asset and leveraged position are highly correlated, the volatility is muted.

How do leveraged PTs work?

Gearbox enables leverage by letting users borrow real assets up to 6-9 times the collateral they deposit. The borrowed assets and the user's collateral both are deposited to an isolated smart contract called Credit Account. Each user has their own, with their own isolated security. You can see it like your credit wallet. Since these assets are real in nature, they can be further deployed across DeFi protocols to turn any allowed activity leveraged. For Pendle PTs, users can borrow up to 6X of their funds and swap them to PTs to create a Leveraged position on Pendle.

This, though, isn't limited to just Pendle PTs

Gearbox is DeFi's Credit Layer. Gearbox enables users to access up to 10X credit across DeFi; whatever protocol Gearbox integrates automatically becomes leveraged. Users can access credit on LRTs, Ethena, LSTs, RWAs, to trade on DEXes and more with Gearbox.

Find the other strategies using the different tabs on the dApp. Here's a UI walkthrough to help you navigate it with ease.

Opening a position: dApp UI walkthrough

To start it all, first, go to the Farm tab: https://app.gearbox.fi/strategies/list

then:

A. Choose the PT you want to access leverage on.

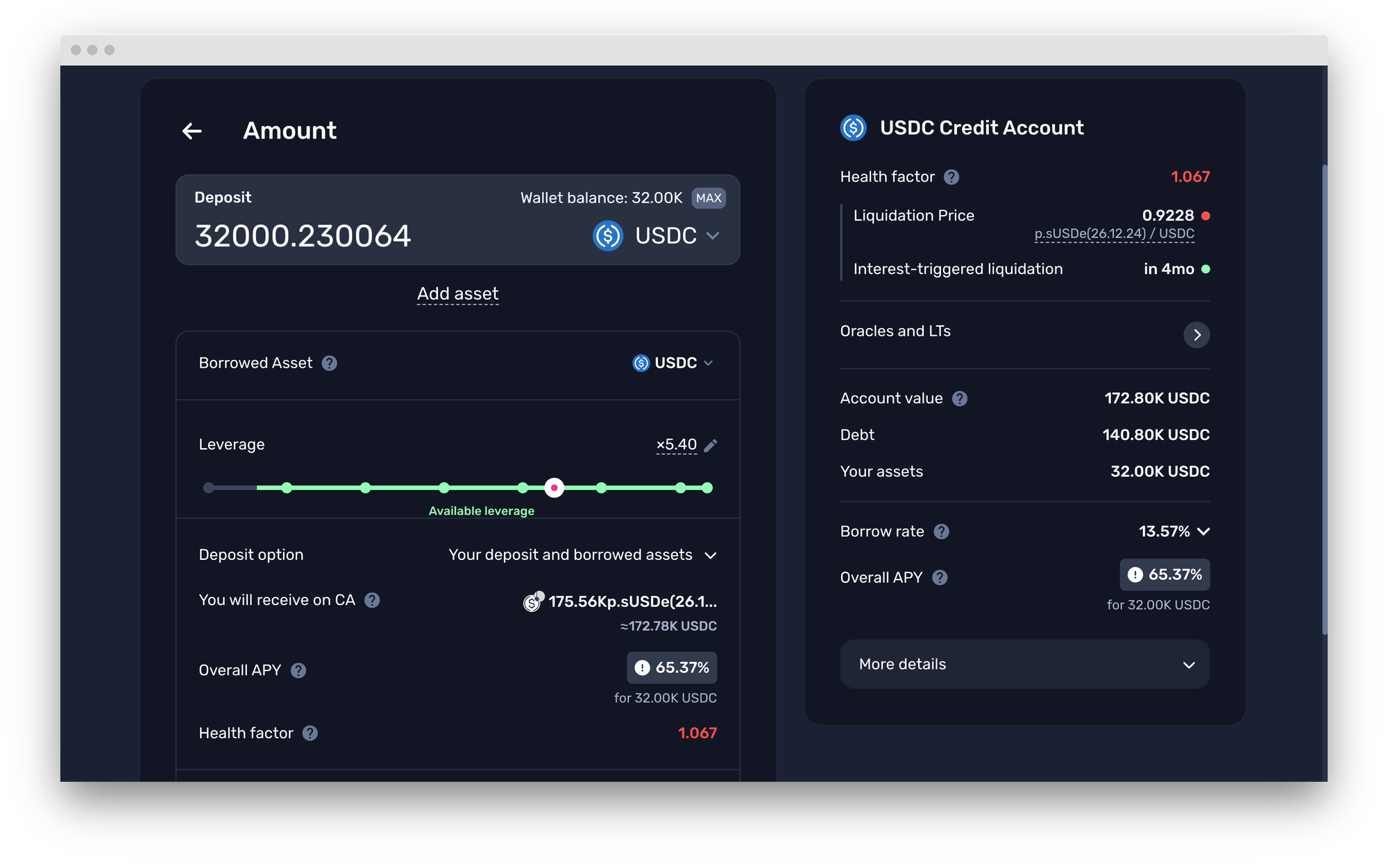

B. Choose Your Leverage: Customise the position as per your risk tolerance. The page also displays the borrow rate, the liquidation price, the overall APY you'll earn and more to help you take an informed decision. You decide all the parameters!

C. Scroll to the bottom of the page and click on "Next Step" to open the position.

And Voila! You are all set. Multicall will now execute all the required transactions in one go, using account abstraction.

You retain complete flexibility to exit your position whenever you want, your collateral isn't burned or goes to 0 (Zero). Simply close your CA to exit your position.

Audit

Security is Gearbox's utmost priority. To ensure the safety The contracts for the Pendle integration have been audited by Watch Pugs.

You can find the results of the audit in our Github Below.

Price Feeds: PT strategies utilise the Pendle TWAP oracle

Not a fan of leverage? Lend passively instead

Want to refrain from actively leveraging an asset despite correlated debt and low volatility? We get it. Lend your stables, BTC or ETH on Gearbox and earn up to 15% APYs

- Without Impermanent Loss (IL)

- Without lockups

- Without extra fees

100% passive lending: https://app.gearbox.fi/pools

Who's that protocol?

The next cohort of Pendle PTs to be onboarded has already been audited and is set to go live early next week. What will the next set of PTs be?

Join the DAO - get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments::

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: