Leveraged Lombard: Unlock BTC Yields

Through a decade of apprehensions, boating accidents, and laser-eyed belief, BTC has now become a $1 Trillion asset. While BTC is still on course to cement its status as a global store of value, the asset's market size creates significant opportunities— opportunities for BTC to become productive and for ecosystems supporting BTC to grow.

Babylon and Lombard aim to capture these exact opportunities. Through Babylon, native BTC gets staked to secure PoS systems and earns yield. Lombard unlocks liquidity for the staked BTC by issuing LBTC, a liquid, yield-bearing representation of Bitcoin, bringing native BTC yields to the Ethereum Ecosystem.

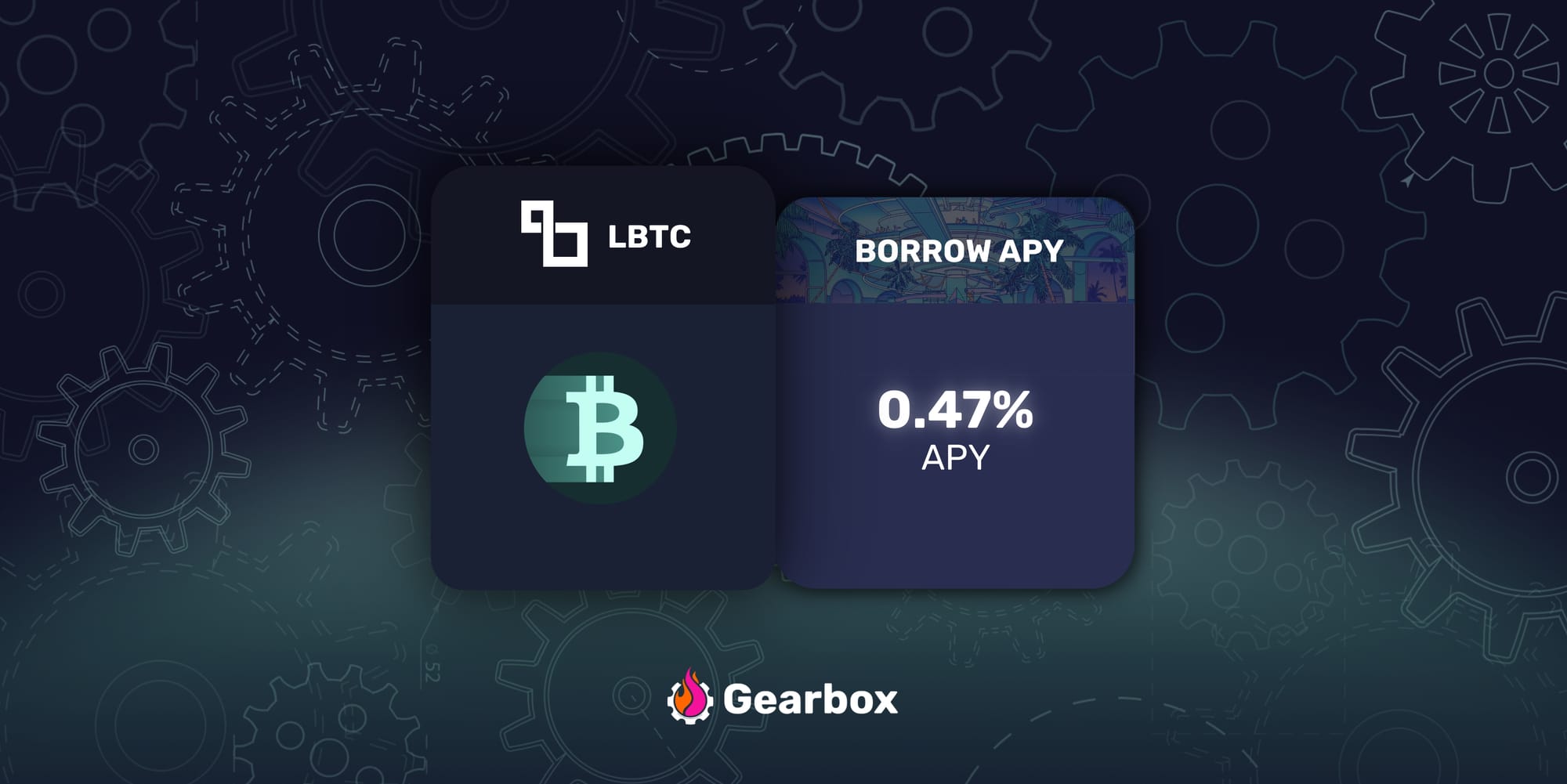

Starting today, you can access leveraged BTC yields through Gearbox.

NOTE: The onboarding of LBTC and the associated risk parameters are defined as per the recommendation of Gearbox's Risk Curators, Chaos Labs. You can find the complete details regarding this in the GIP attached below.

Lombard and Babylon: Details and Points

Points are often used by projects to recognise and reward healthy engagement. Usually, users are rewarded with a share of the project's token depending on the points they earn. All of this, though, is subject to the project's discretion. Gearbox's leveraged points strategies enable users to earn up to 9X the points and any underlying yield the asset generates. Lombard will be incentivising the lending and leverage side both.

Early users will be rewarded with Lombard Lux. Users leveraging LBTC on Gearbox will earn 3X the Lux. Users will receive upto 3,000 Lux every day for every LBTC they hold on Gearbox. With leverage, users will be able to earn upto 27,000 Lux a day on their collateral.

WBTC passive lenders, too, will be able to earn Lux, with a 2X boost. For every WBTC you supply to the Gearbox lending pools, you will receive 2,000 Lux every day. Gearbox's lending pools are truly passive without any locks, IL or fee. Simply lend your assets, earn yields and withdraw whenever you want to. And for the coming weeks, also earn Lombard Lux.

Leverage users will also be able to earn Babylon points but for the initial weeks, not all users will receive these points. Details in the note below.

IMPORTANT: The Babylon protocol will be rolled out in multiple phases. In the first phase, up to 1,000 BTC can be deposited into the protocol. The timing for the subsequent phase has not been yet communicated. Thus, beyond the initial 1,000 BTC limit, LBTC stakers won't receive Babylon incentives. Users will continue earning Lombard points with the boost.

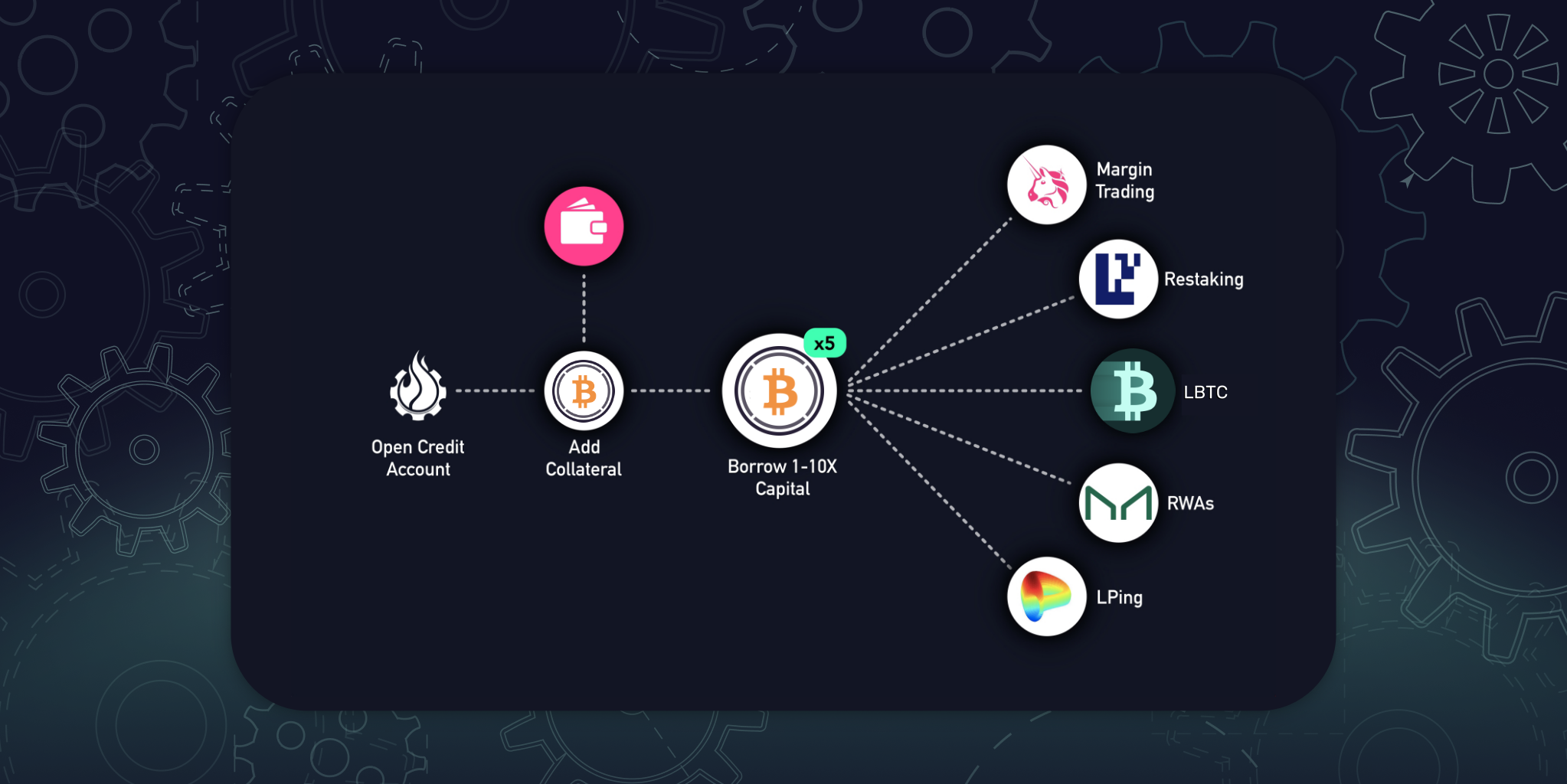

How does leveraged LBTC work?

Gearbox creates leverage by letting users borrow real assets up to 9 times the collateral they deposit. The borrowed assets and the user's collateral both are deposited to an isolated smart contract called Credit Account. Since these assets are real in nature, they can be further deployed across DeFi protocols to turn any allowed activity leveraged. For LBTC, users can borrow upto 9X WBTC to their CA and swap it to LBTC to create a Leveraged LBTC position.

This, though, isn't limited to just LBTC

Gearbox is DeFi's Leverage Layer. Think of it as plug and play leverage, whatever protocol Gearbox integrates automatically becomes leveraged. An evolution of onchain credit with composability. Users can access leveraged LRTs, Ethena, LSTs, RWAs, Trading on DEXes and more.

Find the other strategies using the different tabs on the dApp. Here's a UI walkthrough to help you navigate it with ease.

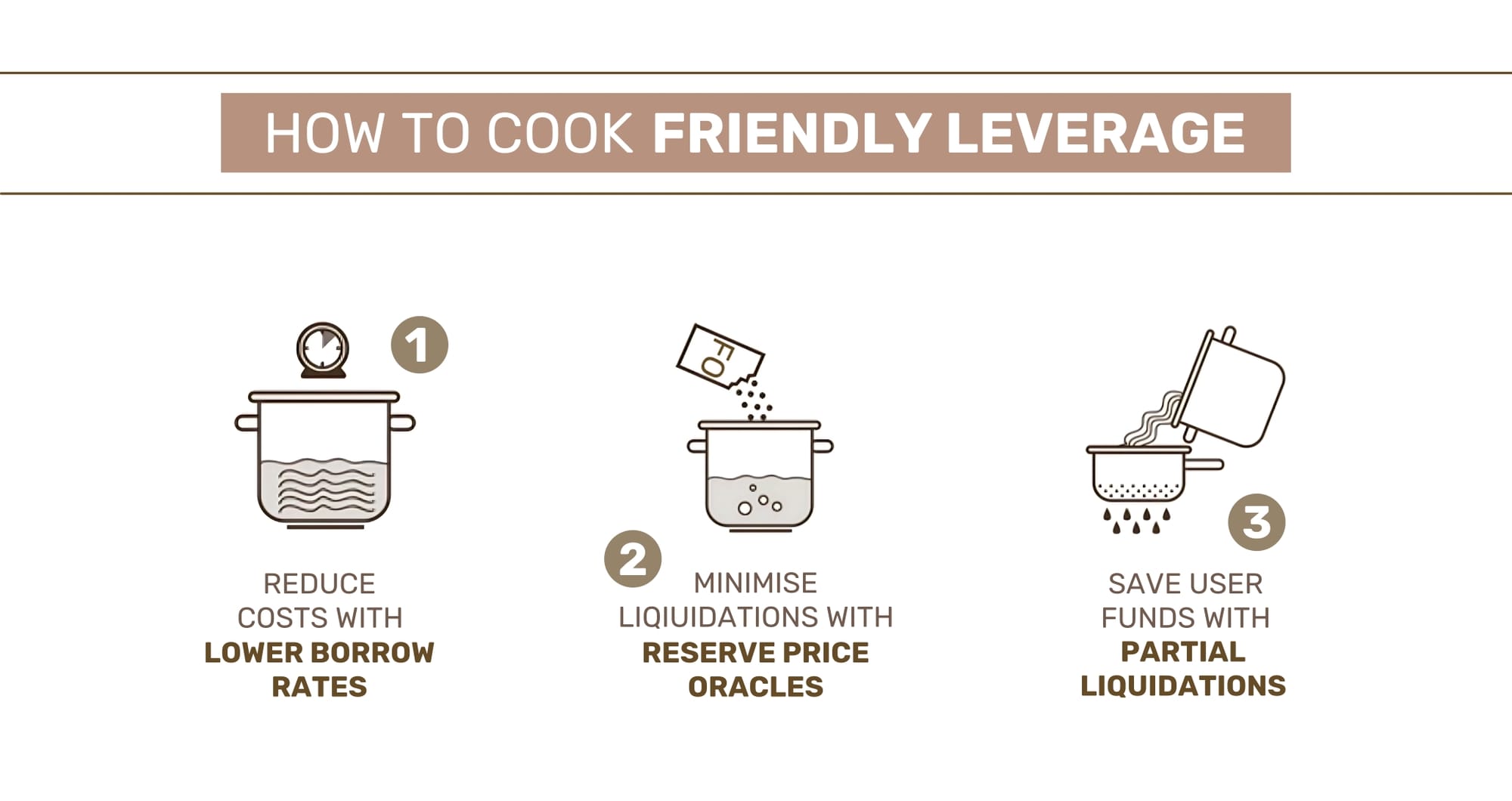

Friendly Leverage LRTs

Strategies on Gearbox that don't expose users to market price volatility are called friendly leverage strategies. How does LBTC offer users friendly leverage?

I. Reserve Price/Fundamental Oracles

Volatility usually arises through market price fluctuations. Fundamental Oracles/Reserve price solve this by creating a price feed using an asset's reserves instead of its DEX price. This change in the source of price helps borrowers avoid short-term volatility.

To put it simply, even if the peg of LBTC drops on DEXes while it's BTC (WBTC, tBTC) backing remains stable, Gearbox users will remain safe. This is because the price source for Gearbox users, the reserve, won't report a deviation.

NOTE: While the price feeds remain stable, the DEX liquidity has been volatile for LBTC. This volatility won't cause liquidations till reserve prices remain stable but can lead to slippage. Make sure you monitor slippage when entering/exiting a position. When leveraging large amounts, try executing in multiple transactions.

II. Correlated debt

Volatility, apart from the asset you hold, also depends on the debt you borrow. If you were to leverage LBTC using USDC debt, your position would be prone to price volatility. Gearbox, though, enables users to borrow WBTC to leverage LBTC. Since LBTC is a derivative of WBTC and is correlated, the volatility gets significantly muted.

III. Lower and predictable borrow rates

Borrow rates are crucial to making leverage semi-passive. Sudden spikes in borrow rates can require active management. Borrow rates on Gearbox, though, remain predictable over the week and only update every Monday. Borrow rates on Gearbox only spike when the utilisation of a pool goes beyond 90%. Users can monitor current and future borrow rates through gauges.

IV. Partial liquidations (To be live soon)

Partial liquidations reduce a borrower's debt enough to bring their Health factor above 1 without completely liquidating them. This helps reduce a borrower's losses, as experienced by this borrower on Arbitrum:

Partial Liquidations though require a market price oracle to be executed safely. Since a market price oracle for LBTC is not available yet, partial liquidations are not yet live. Partial liquidations will go live as soon as a market price oracle is live.

V. High LT

The LT or liquidation threshold decides when a user will be liquidated. The higher the LT, the better the liquidation point. Gearbox offers one of the highest LTs in DeFi, at 90 for LBTC, making liquidations less likely.

This is done out of the best risk practices, proposed and confirmed by Chaos Labs.

And of course, the (update) boost makes this friendly leverage even friendlier. Make sure you open a position before borrow limits are reached.

Opening a position: dApp UI walkthrough

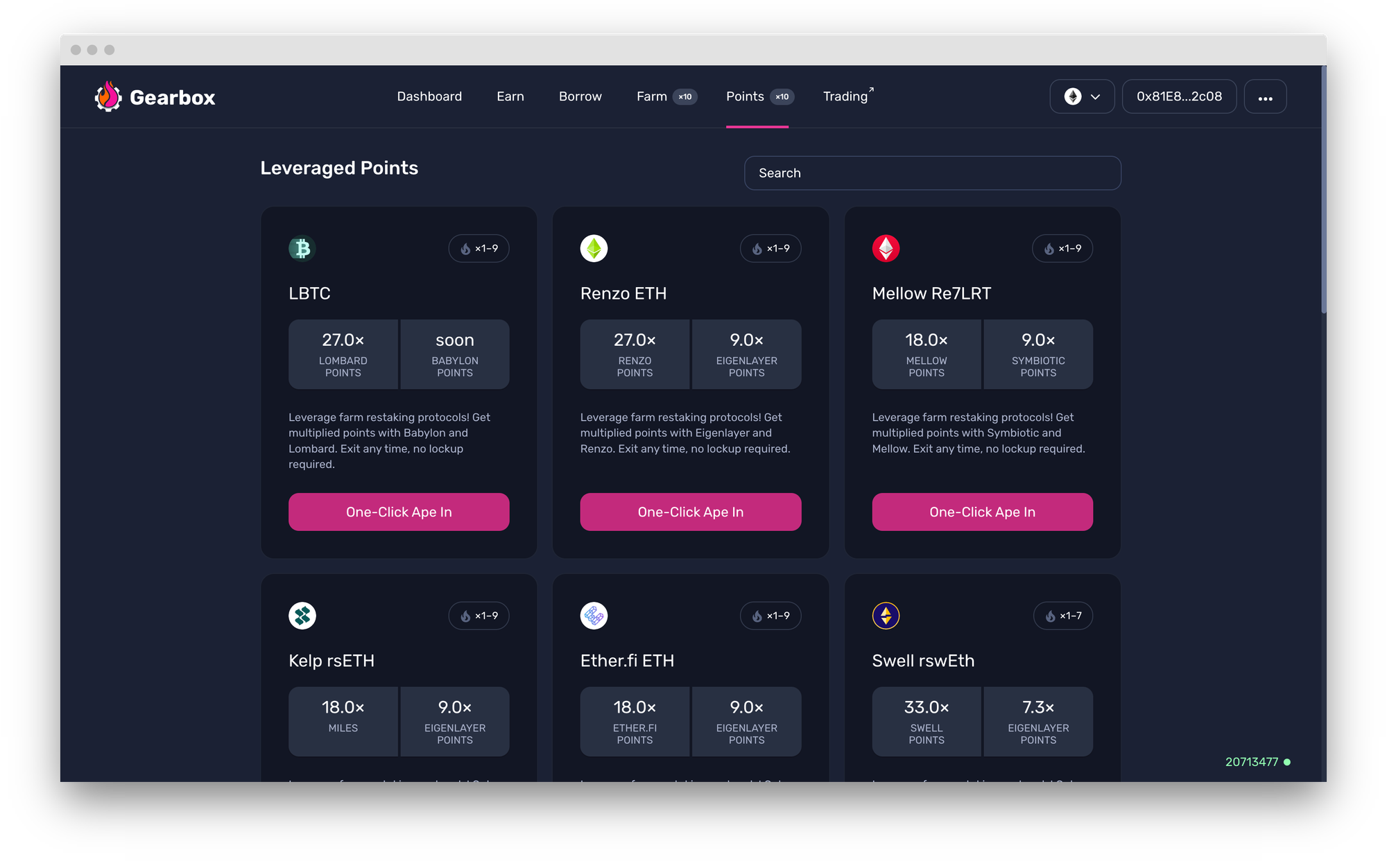

To start it all, first, go to the Points tab: https://app.gearbox.fi/restaking/list

then:

A. Choose the network you want to open a position on: Which should bring you to this page. Choose LBTC

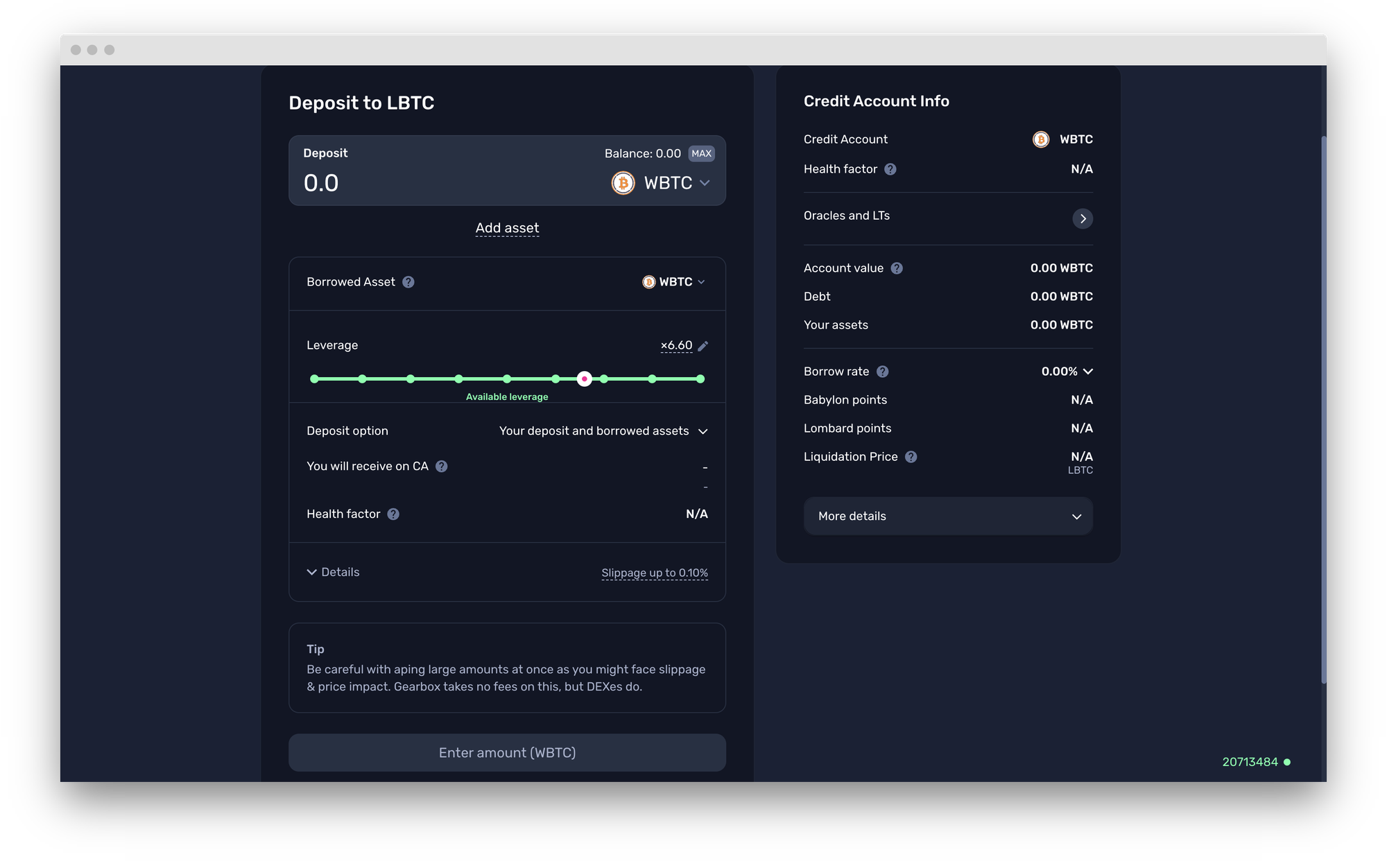

B. Choose Your Leverage: Customise the position as per your risk tolerance. The page also displays the borrow rate, the liquidation price and more to help you take an informed decision. All these details are up to you, you decide all the parameters!

C. Scroll to the bottom of the page and click on "Open position".

And Voila! You are all set. Multicall will now execute all the required transactions in one go, using account abstraction.

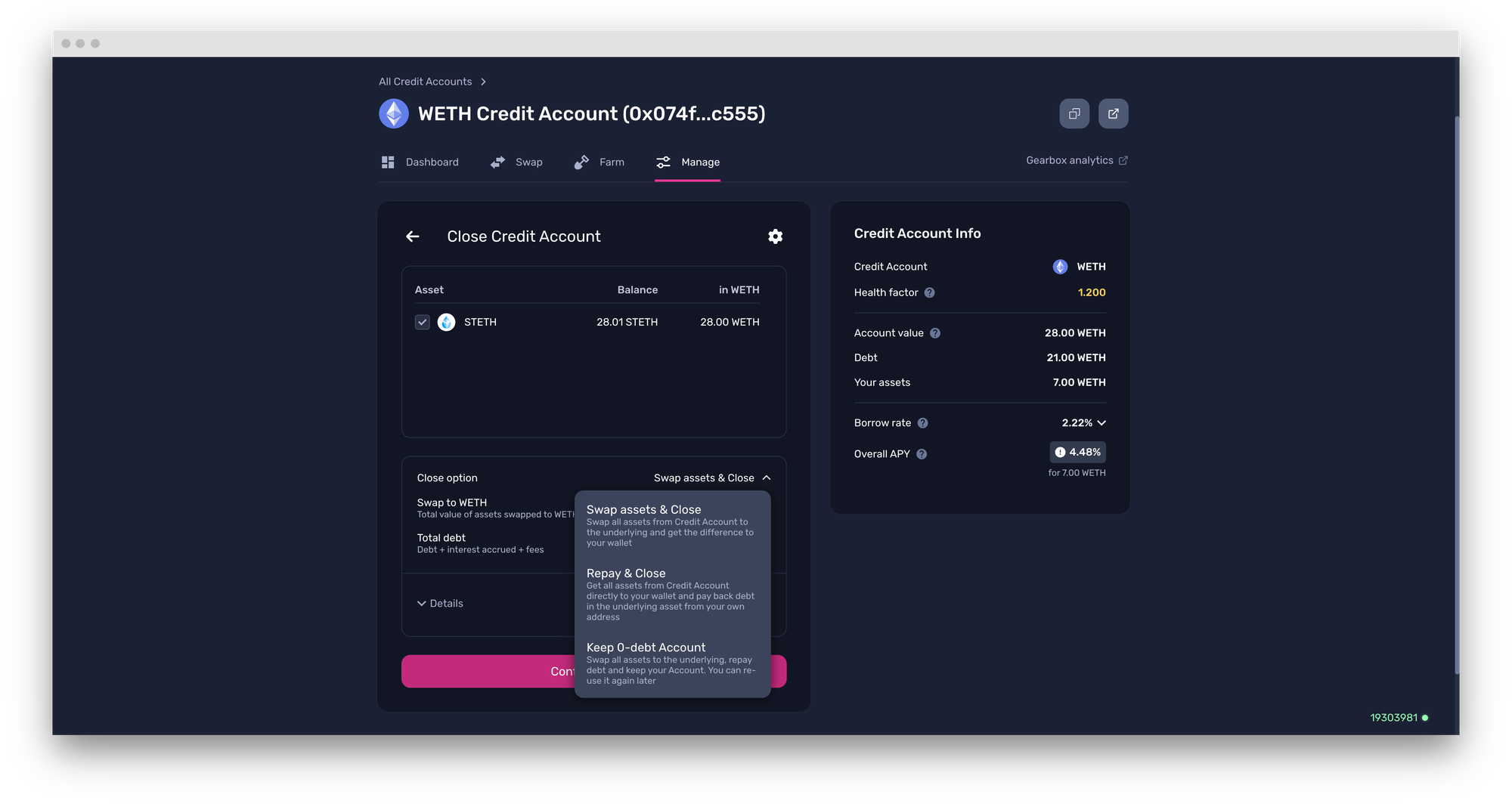

D. If you want exit your position and still want to retain access to the Credit Account you opened, simply exit using "Keep 0-Debt" account.

Gearbox DAO has no "team", what you say in the discord matters the most and is always considered. If you think there's something we suck at, come berate us. Join the DAO - get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: