Leveraged Ethena: Earn up to 90X Shards

Ethena's USDe and sUSDe are now live with upto 9X leverage on Gearbox. This addition follows EtherFi, Renzo, Curve, Yearn, Uniswap and multiple other protocols and assets Gearbox has enabled leverage on as we keep working to create DeFi's leverage layer.

The below article gives you an overview of Ethena's leveraged strategy and how you can still earn double digit APYs by passive lending USDC.

What are USDe and sUSDe?

USDe is a synthetic USD denominated instrument created by a yield generating delta neutral position. Ethena labs achieve this by taking on decentralized collateral in the form of stETH and combining it with a short ETH futures position of the same notional value. Thus, creating a synthetic digital dollar position with an embedded yield.

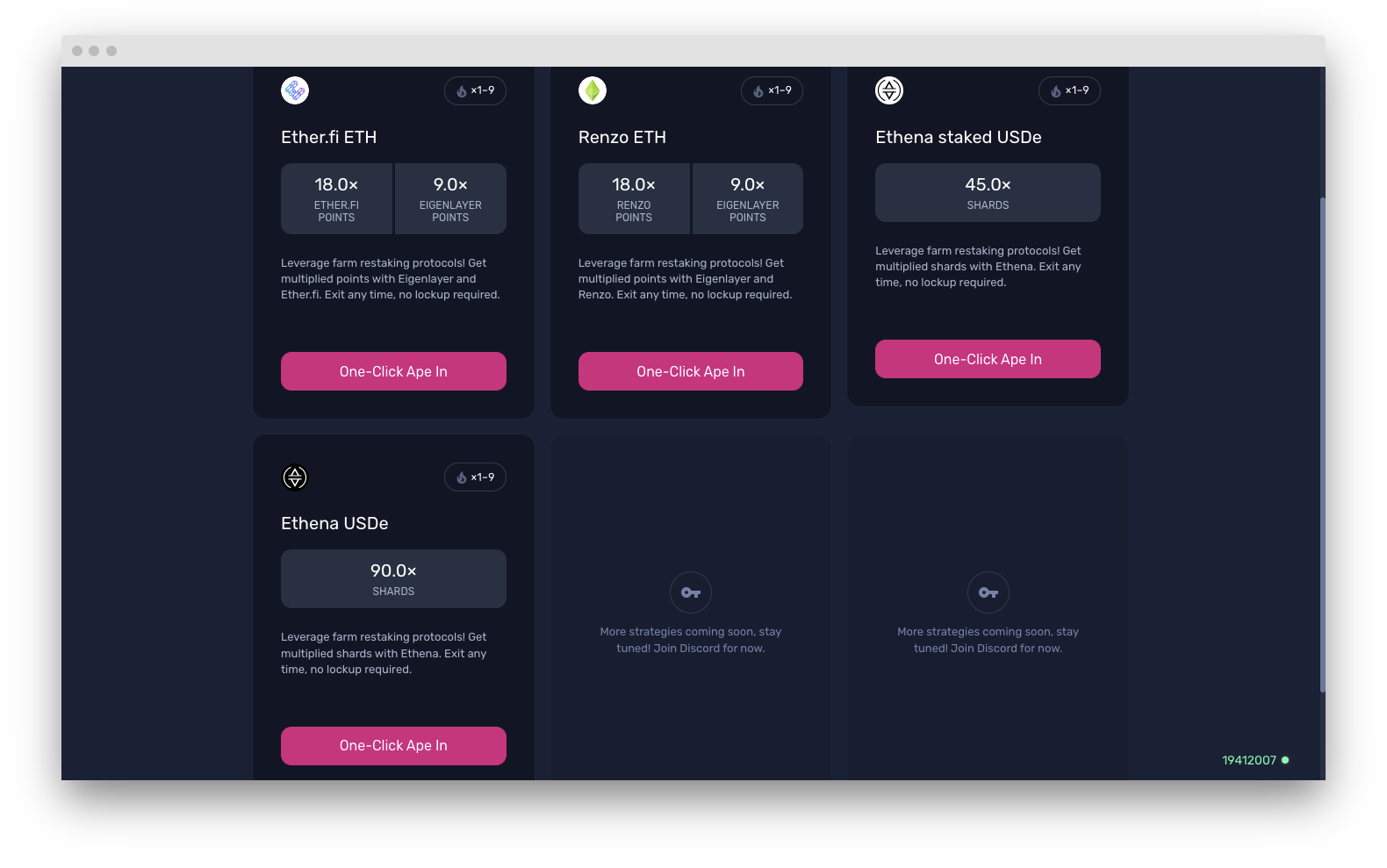

This yield is shared with USDe's staked form called sUSDe. This means that when you lever them up:

- On USDe, you are purely point farming to earn up to 90X shards

- On sUSDe, you can earn up to 45X shards and the leveraged yields generated

The higher shard rewards have been made possible courtesy of a boost by Ethena Labs on both the offerings.

How does Gearbox make leveraged points happen?

Gearbox creates leverage by letting users borrow real assets up to 10 times (or more) the collateral they put up. Since these assets are real in nature, they can be further deployed across DeFi protocols to turn any allowed activity leveraged. For ethena, these borrowed assets can simply be swapped to USDe or sUSDe to get access to Leveraged shards and in case of sUSDe, also earn leveraged APYs.

This is made possible by Gearbox's innovation called Credit Accounts(CAs) which function as leveraged smart contract wallets. The funds you borrow and the collateral you put upstays in your CA. The CA is programmed to allow usage of these funds only to certain assets, protocols and pools to ensure the borrowed funds aren't at risk. See integrations list (being updated).

In case of losses being incurred, when a user's losses lead to their collateral being exhausted, the position is liquidated and the borrowed funds are auto-returned to the lending pools. This is the model so that Gearbox lenders do not face bad debt.

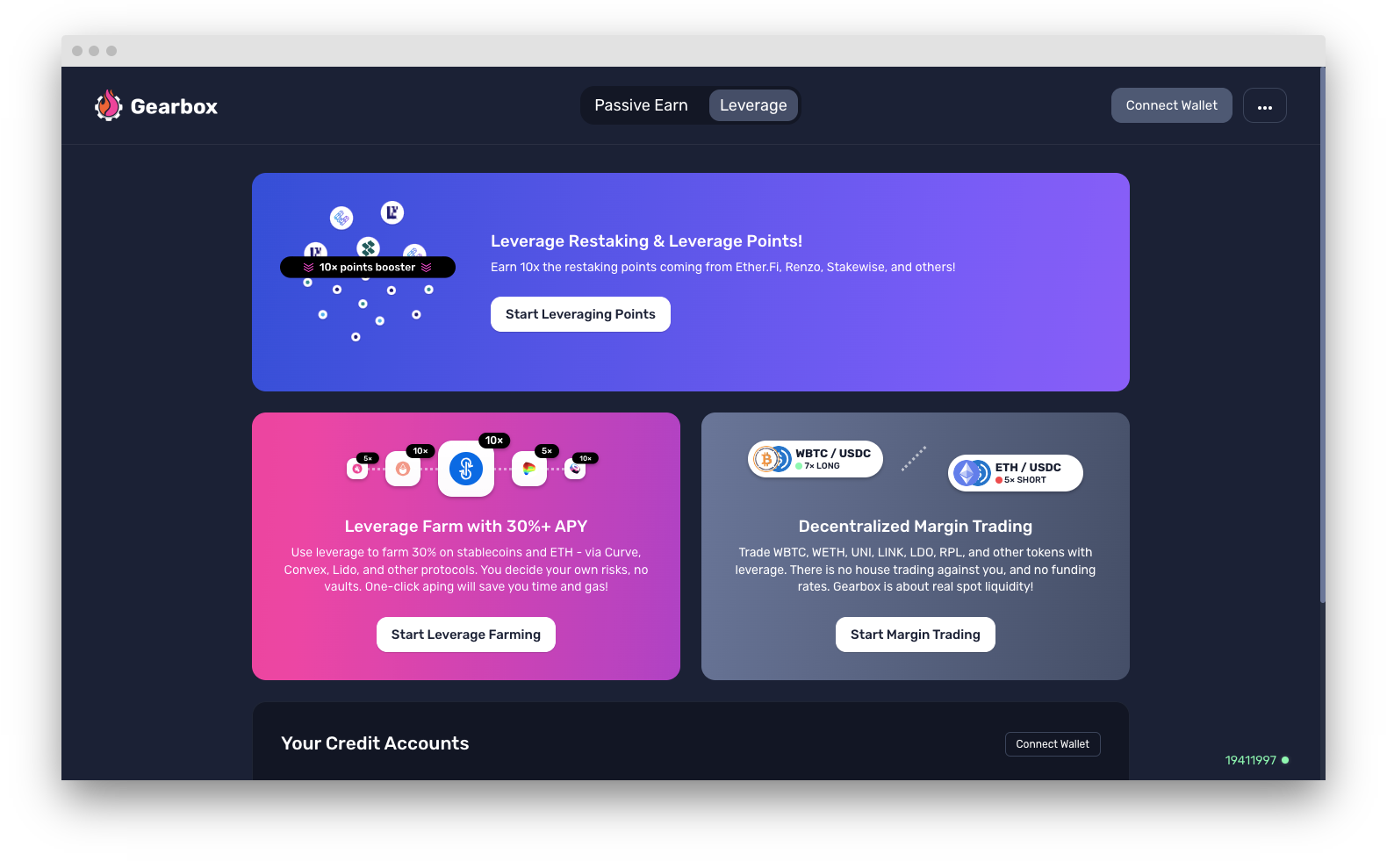

This, though, isn't limited to just Ethena

Gearbox is DeFi's Leverage Layer. Think of it as plug and play leverage, whatever protocol Gearbox integrates automatically becomes leveraged. An evolution of onchain credit with composability.

Quick FAQ

Gearbox's leverage is inherently different from the leverage we are used to, especially for farming. So here's a quick FAQ to help you out

Q. Is this as risky as leveraged trading?

Leverage on USDe and sUSDe is only available against a debt of USDC. Since both your borrows and debt are fluctuating around $1 USD, they are highly correlated. Your liquidation thus depends entirely on the peg USDe and sUSDe maintain. With Leveraged Restaking, we have observed this to not be as risky. In recent volatility, when traders saw $1B+ liquidated in a day across crypto, our LRT farmers had 0 liquidations.

Q. What collateral do I need to start with?

Almost any major asset: USDC, USDT, even ETH if you want.

In general, OG DeFi users are accustomed to think of collateral as "my idle asset, sits there and affects my borrowing power for better or worse, but doesn't change". With Gearbox, it's not exactly like that. That is because the entire composition of your Credit Account, whatever you have on it - be it sUSDe or a farm token - acts as collateral to your debt at the same time. Read here.

Q. How do 90X shards become possible?

USDe generates 5X shards while sUSDe generates 1X shards, Ethena has further provided a boost to Gearbox users to make it 10X Shards on USDe and 5X shards per day. When you leverage this up, it enables 90X max shards on USDe and 45X shards + leveraged APYs on sUSDe. You can learn more about shards in the post below.

Q. Does Gearbox burn your capital?

No, you position is completely liquid, exit and enter anytime you like. You simply pay the borrow fee for the amount of time you hold a position. In case of USDe, this borrow fee reduces your capital as it has no yield but in case of sUSDe, you also earn leveraged yields + leveraged shards.

Q. What if the borrow rates extremely high?

Borrow rates aren't too volatile until (1) Utilisation reaches 90% and/or (2) GEAR stakers increase quota rates. For the first scenario, the UI auto caps borrowing till 90% utilisation to ensure rates don't moon but if a lender withdraws funds then a rate increase is possible. As for the 2nd case, you can always monitor next weeks projected rates on the gauges page: https://app.gearbox.fi/gauge

To learn more about gauges and how they bring utility to $GEAR, read the thread below.

Over the last month, lenders and traders would have observed a variation in rates on Mondays. Why does this happen and why is it needed? And how can you influence the rates for the coming Monday?

— Gearbox ⚙️🧰 V3 LIVE (@GearboxProtocol) February 3, 2024

🧵 pic.twitter.com/gW45t3RD1R

Q. Do users retain shards when they exit?

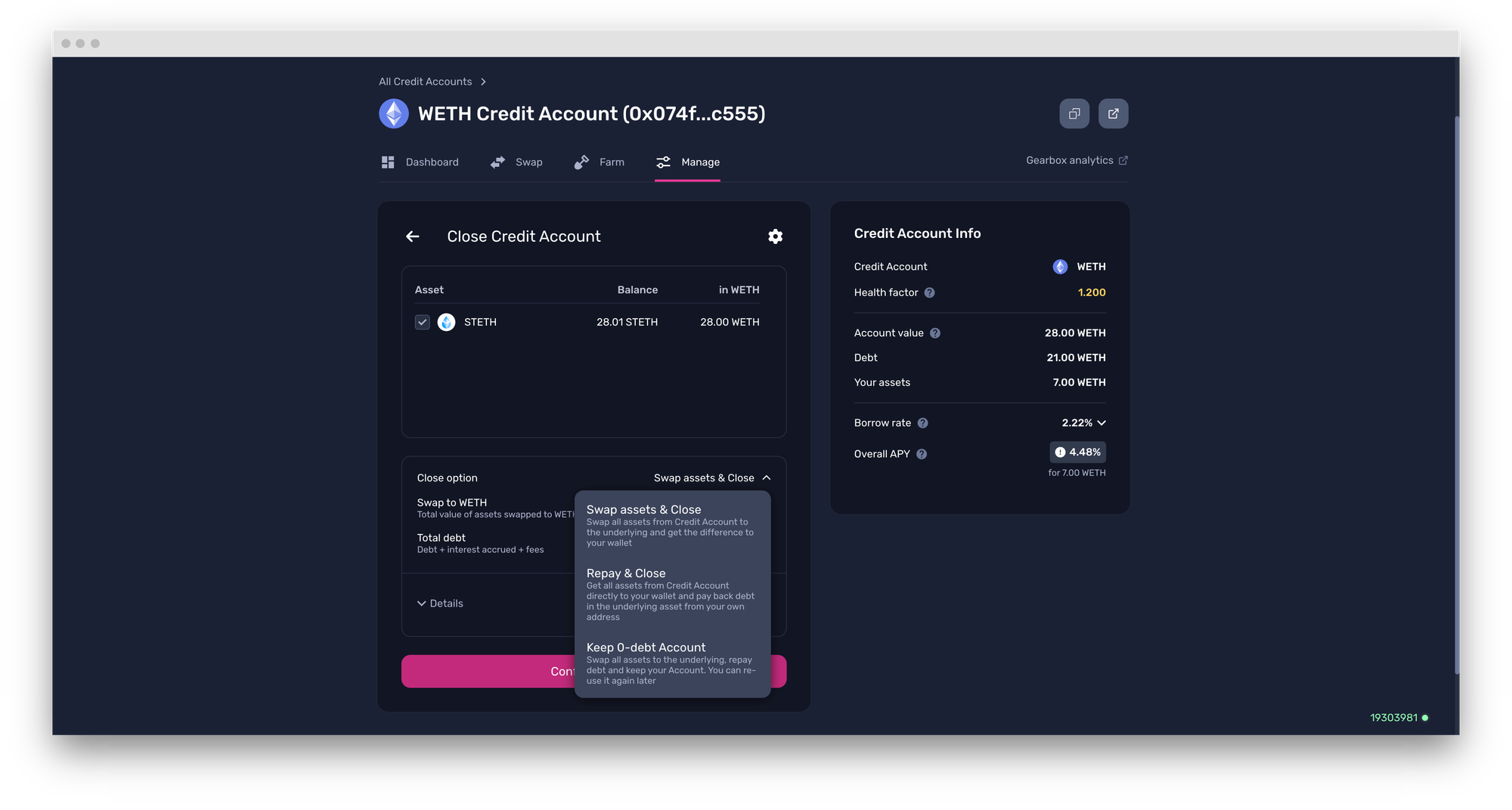

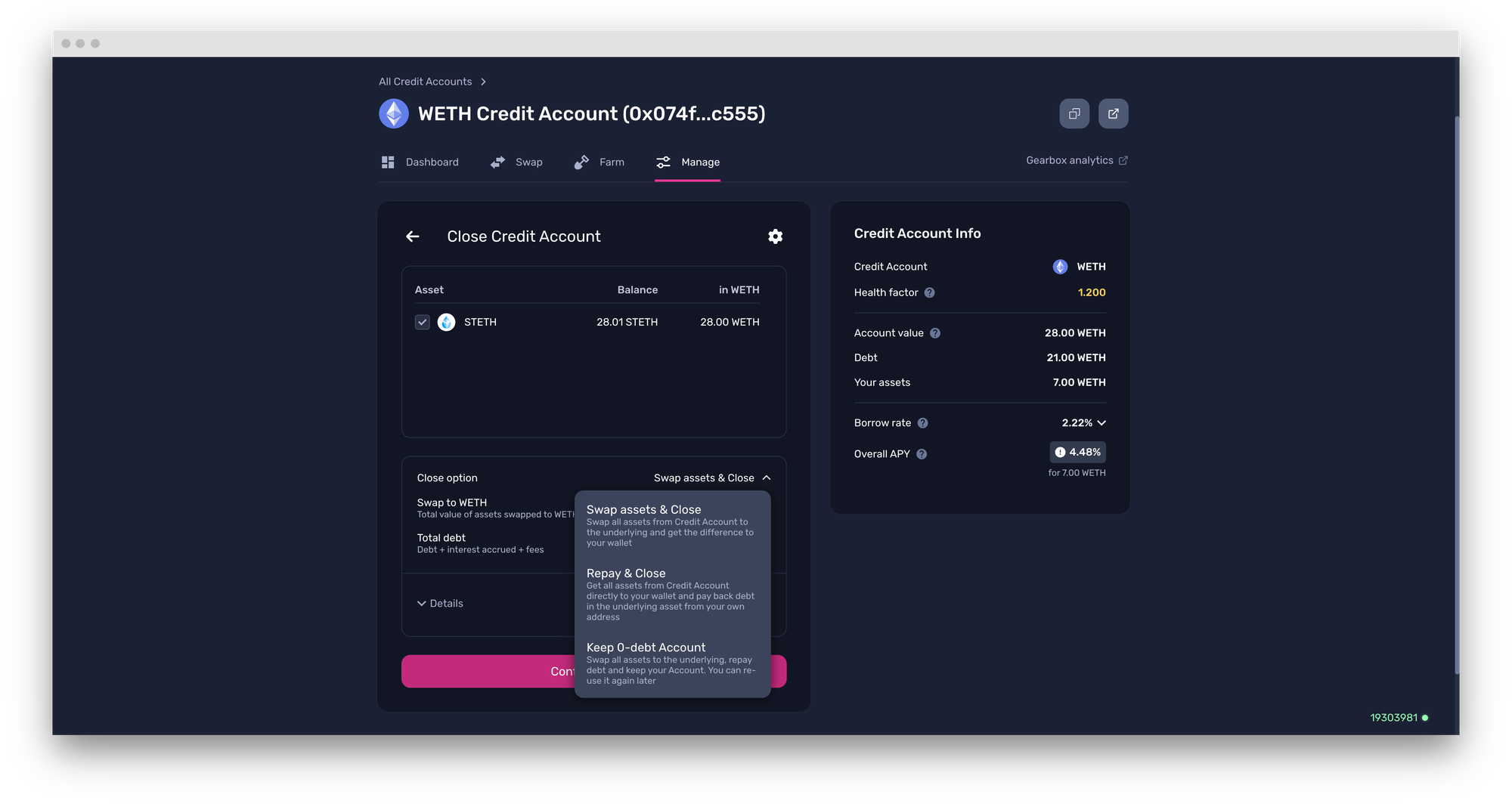

Absolutely, yes! To retain the points you earn, make sure you close your position with the "Keep 0-Debt Account" option. This will enable you to claim your points at a later date even if your position has been closed. Or just switch to some other strategy.

Q. What's the minimum borrow requirement to open an account?

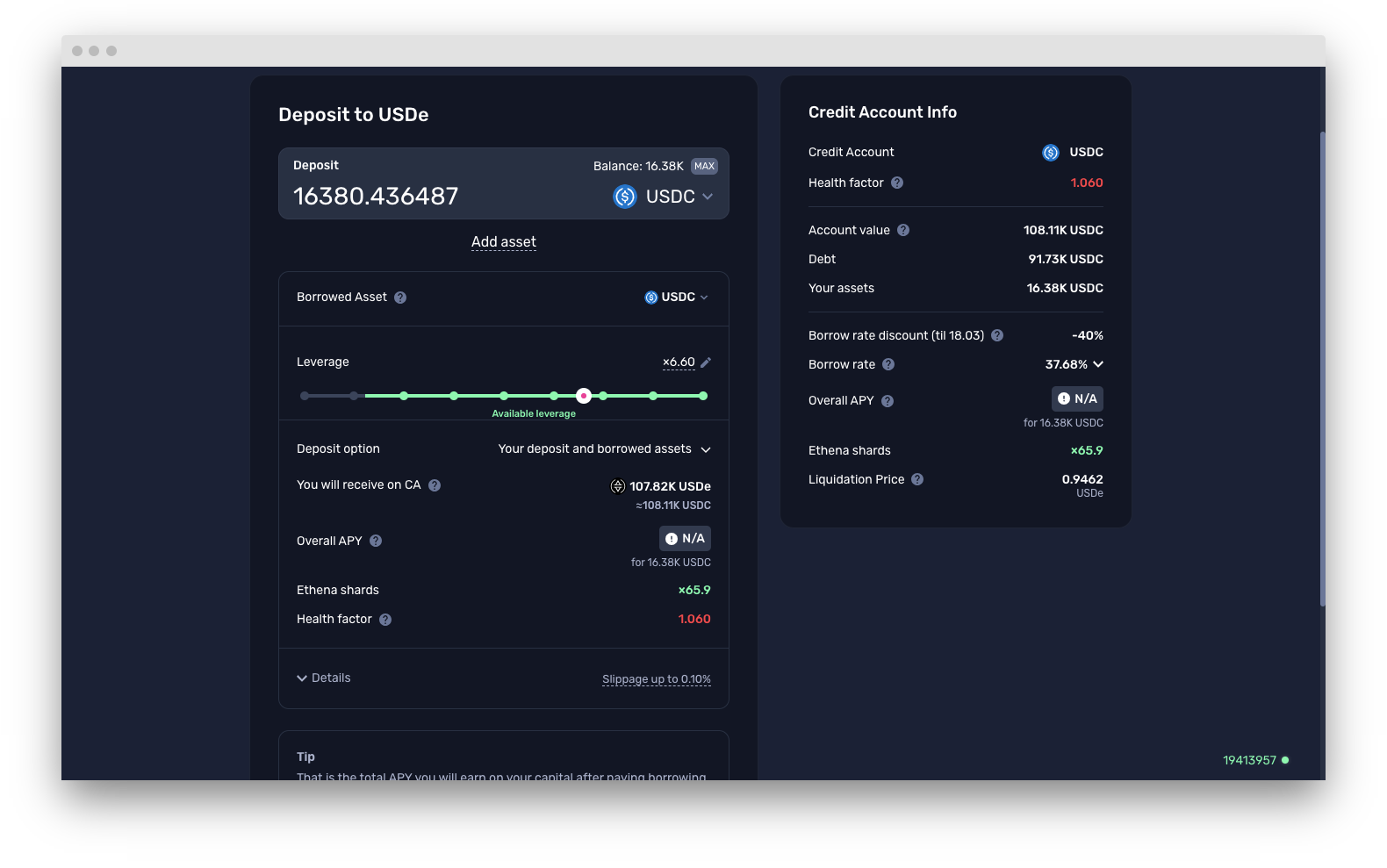

You need to borrow a minimum of 20K in USDC to open an account, the max borrow per CA is 1M USDC. 20K is like 3.4K * 7 leverage. Or 6.7K * 4 leverage.

Q. What's the cap for sUSDe and USDe?

The initial cap is $3M each for sUSDe and USDe which can be increased to $15M each. Don't worry about these limits as much, it's more for risk assessors.

Q What are the risks associated with USDe?

You can read about this on Ethena's gitbook:

Now that most of your questions are answered, lets get to the actual aping.

UI walkthrough

You can learn this the easy with this amazing tutorial by Krypto Cove which covers all risks, gives tips and walks you through how to open a leveraged farming position.

In case, you are in a hurry though, just follow the UI screencaps below.

- To start it all, first go to https://app.gearbox.fi/accounts

- Go to the "Leveraged Points" section and choose the USDe or sUSDe

- Set up the leverage and collateral size you want and click on "Open position". Since Gearbox uses account abstraction, all the required transactions will be batched and executed in 1-transaction! The magic of multicall.

- Your position is all set. And it's completely flexible. Feel like you don't want to farm shards anymore? Go ahead and close your position, though, to make sure you retain the points, choose the "Keep 0-debt account", this will enable you to keep the account you farm with without having to pay any fee on your debt.

That's it on the leverage side. But what if you don't want to leverage farm? We got you..

Earn 20%+ passive yields w/o leverage on USDC

The borrow fee on USDe and sUSDe is over 20%. This fee directly generates the yields for the USDC lending pool which is completely passive in nature. You supply your USDC

- Without any impermanent loss

- Without locks, withdraw whenever

- Without any fee

It's really as simple as supply -> earn -> withdraw(but why would you?). If you see the graph of what happened to yields on ETH passive lending post LRT integration, something similar is possible for the USDC pool with the Ethena demand.

So go earn completely passive yields here:

Come join the DAO if you would like to contribute or just vibe — just get involved on Discord or Telegram. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better.

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And, of course, Notion monthly DAO reports: