Kelp on Arbitrum: 3X the rewards

Kelp DAO has grown to become one of the largest LRTs with $600M+ in TVL. A noteworthy source of growth for Kelp's rsETH has been the introduction of Kelp Miles. Miles are a mechanism to reward loyal users with a potential future token. Leverage, thus, enables users to maximise these rewards. And leverage on Gearbox now makes these rewards 27X. This is made possible with

3X Rewards

3X Miles: Kelp DAO has extended a 3X boost for Gearbox users, enabling users to earn up to 6 months worth of Miles every week. Alongside Miles, users will also earn leveraged Eigenlayer Points.

3X STIMMIES: STIMMIES is a user reward campaign, funded by an Arbitrum LTIPP grant. Users leveraging up STIMMIES will receive 3X STIMMIES for the first two weeks. STIMMIES are periodically (2-3 weeks) redeemed for GEAR and ARB tokens. You can find the details about STIMMIES below.

Earning these rewards is made safer with the implementation of friendly leverage. Read about it below.

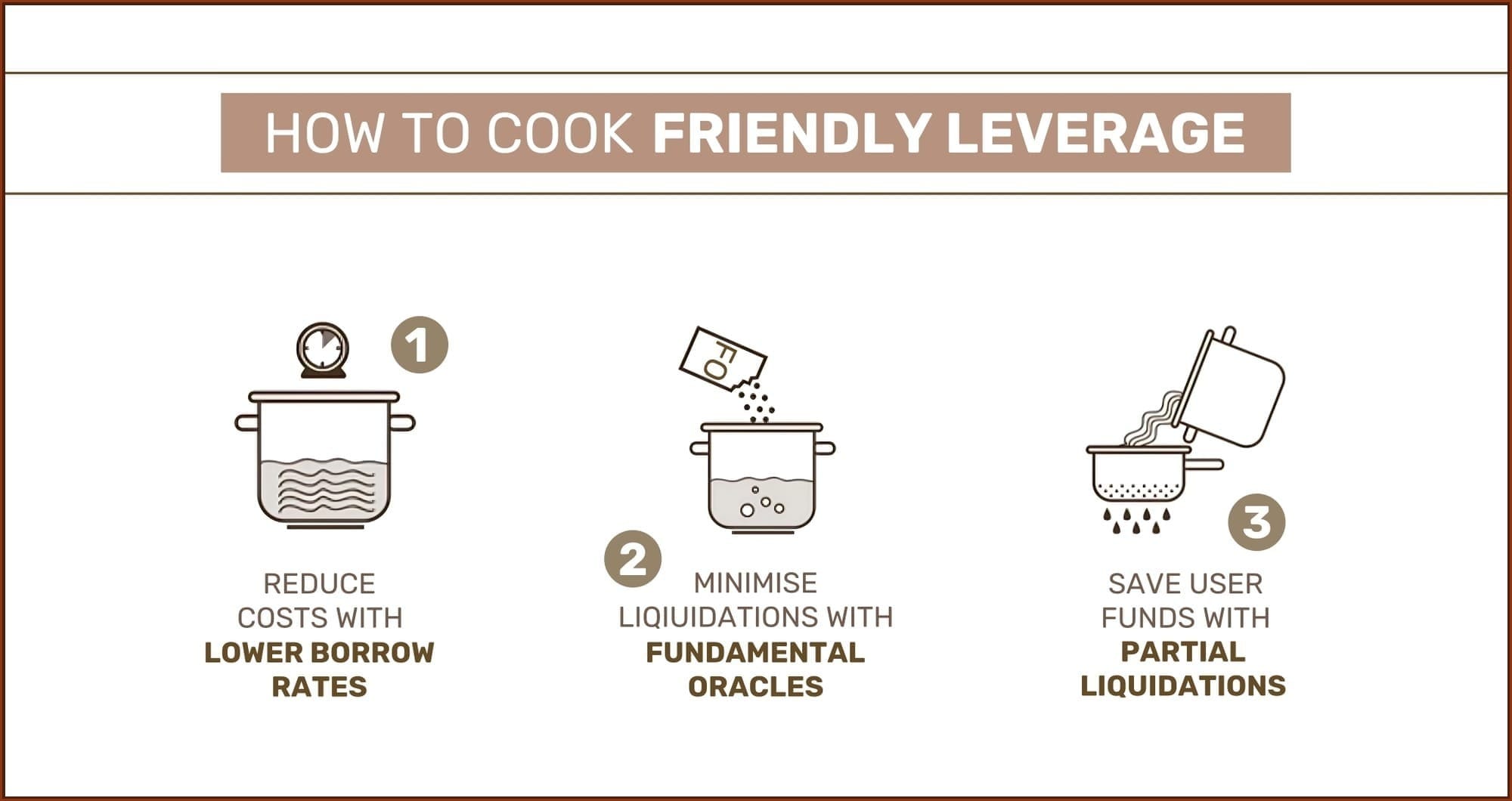

Points Made Safer with Friendly Leverage...

Friendly leverage reduces the risks arising from price volatility by using reserve prices instead of market prices. Friendly leverage not only safeguards users from volatility but also makes holding a leveraged position cheaper and more predictable.

rsETH enables Gearbox to implement Friendly Leverage owing to the below mentioned factors.

• Withdrawals enabled: ETH can be withdrawn from Kelp's restaking contract using rsETH, reducing risks.

• Deep DEX liquidity: To make the leverage farming experience smoother even at larger sizes.

• Fundamental Oracles: To replace the DEX volatility with prices based on reserve holdings.

How does this work? Read on for Quick explanations.

I. Lower Borrow (Quota) Rates

Borrow rates are the primary factor (usually the only factor) that dictates the cost of your points. Overall Borrow rates on Gearbox comprise of 2 types of rates.

- Base borrow rate: The essential cost of borrowing for a particular debt asset applied to all borrows.

- Quota rates: Gearbox democratises rates by enabling users to vote on the risk-adjusted borrow rates for a specific farm or asset through Gauges. Quota rates are applied in addition to base borrow rates to achieve comprehensive risk adjusted rates. You can read more here.

While base borrow rates are the same for all strategies, Quotas depend on factors like market demand, relative rates, perceived risk, and more. With Kelp enabling withdrawals and a fundamental oracle in place, the risk associated with rsETH is significantly reduced. Considering the additional yield through STIMMIES, the borrow rates have been decided at 19.6% by the GEAR stakers.

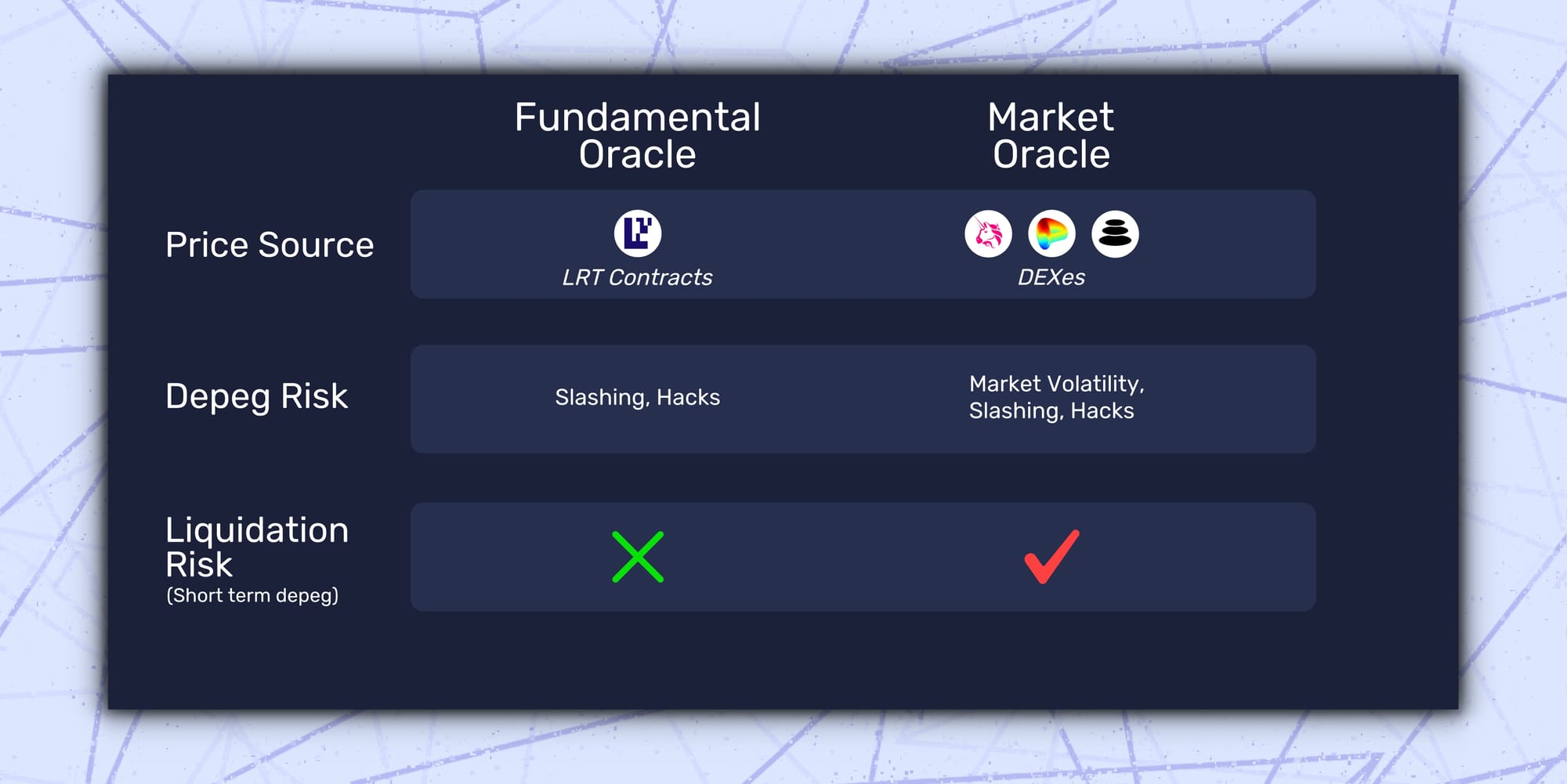

II. Fundamental Oracles: Removing DEX volatility

The primary risk for a leveraged farm is the risk of liquidation, which arises from changes in prices on DEXes. Gearbox, though, reduces the risk of liquidation by using Fundamental Oracles.

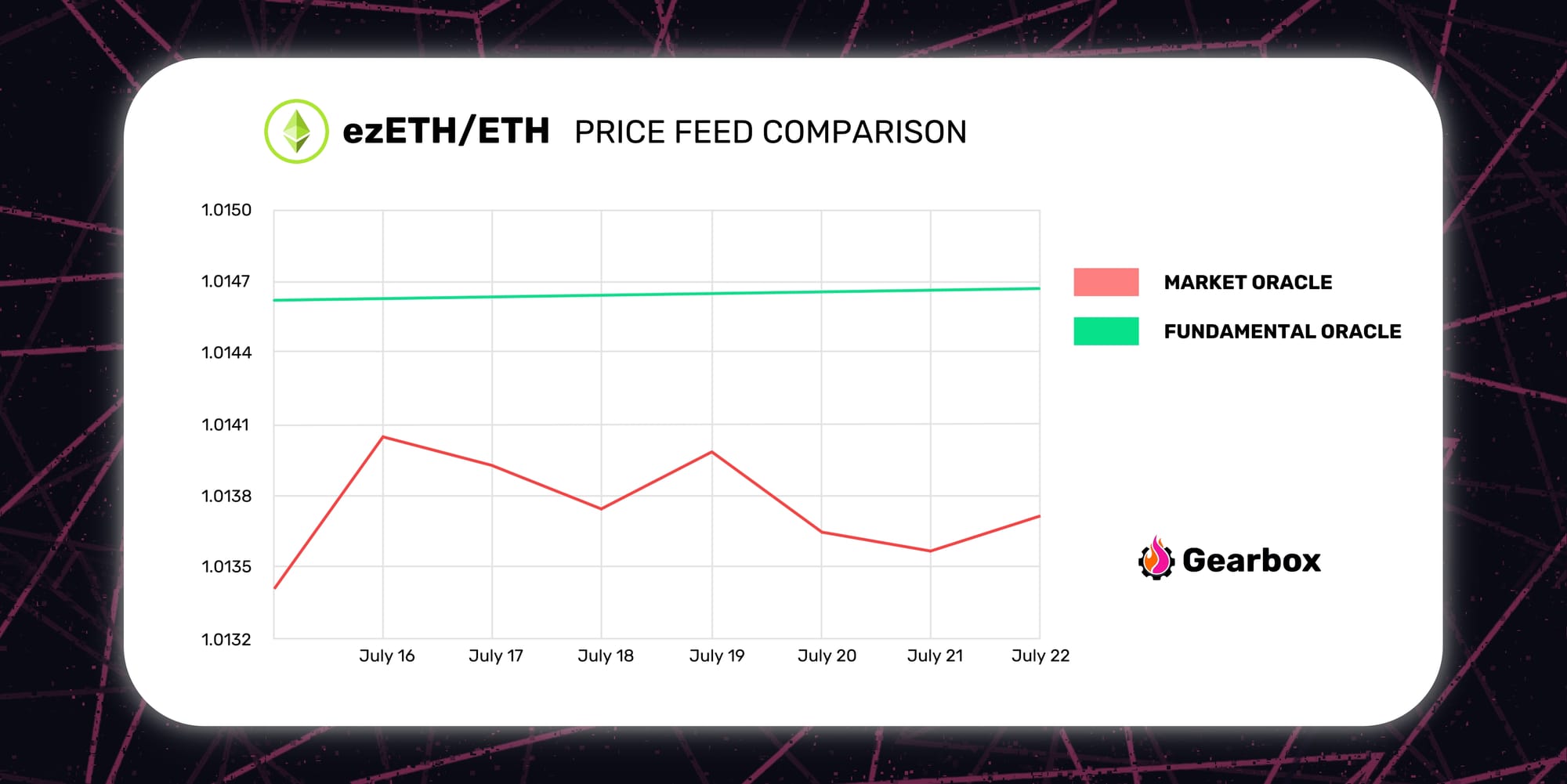

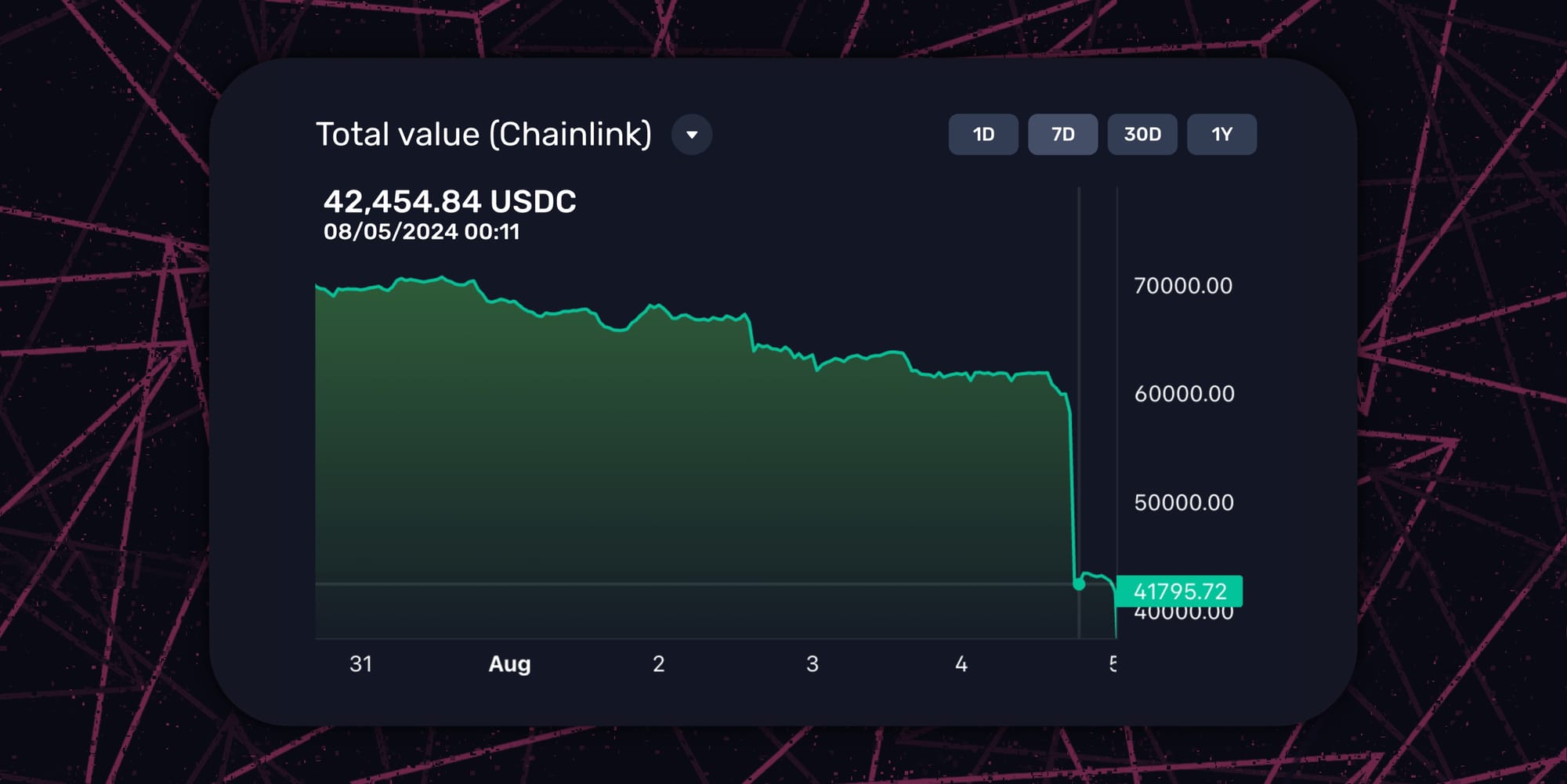

Instead of deriving the peg of rsETH using DEX sources, a fundamental oracle derives it from the ratio of the assets restaked in rsETH's LRT contracts and the total rsETH tokens minted. Impact of fundamental oracles (Green line) on the volatility of ezETH can be seen below.

Fundamental oracles effectively move the source of prices from DEXes to ETH reserves in the LRT contracts.

The effectiveness of fundamental oracles can be observed in the chart below. The green line denotes the Fundamental Oracle or reserve price, and the red line denotes the market oracle. While market Oracles remain volatile, fundamental Oracles completely muffle the volatility and make leverage friendlier.

Changing the price source also changes the source of risks. A hack or slashing of the LRT becomes the primary source of depegging risk for Gearbox's borrowers. Since LRTs have verifiable redemptions, even if a short-term depeg occurs at a DEX level, fundamentally, arbitrageurs can restore the peg in the worst case in 7 days. Thus enabling a better leveraged borrowing experience without risking bad debt.

However, slashing won't be live for a few months... So Safu?

III. Partial Liquidations

Gearbox previously had only hard liquidations. In this case, the entire position of the user was liquidated in one go when the HF dropped below 1. To improve this UX, Gearbox has now moved to partial liquidations.

Partial liquidations won't fully liquidate a user; instead, they close their position just enough for them to be back above a health factor of 1. This will reduce the losses leverage takers incur and, at the same time, ensure bad debt doesn't seep in.

So while the HF dropping below 1 gets tougher as fundamental oracles safeguard users from short term market depegs, partial liquidations will further reduce the damage a liquidation could cause.

NOTE: Additionally, Gearbox positions are fully liquid. Your collateral is not burned instantaneously, you choose when you enter, when you leave and how much you spend.

IV. Higher LT

The LT or liquidation threshold decides when a user will be liquidated. The higher the LT, the better the liquidation point. Gearbox offers one of the highest LTs in DeFi, at 90 for all the Mellow LRTs, making liquidations less likely.

This is done out of the best risk practices, proposed and confirmed by Chaos Labs.

V. Correlated Debt

Volatility, apart from the asset you hold, also depends on the debt you borrow. If you were to leverage rsETH (or any other LRT) using USDC debt, your position would be prone to price volatility. Gearbox, though, enables users to borrow ETH to leverage rsETH. Since rsETH is a derivative of ETH and is correlated, the volatility gets significantly muted.

All these factors together mute out volatility and make leverage significantly safer.

Opening a position: dApp UI walkthrough

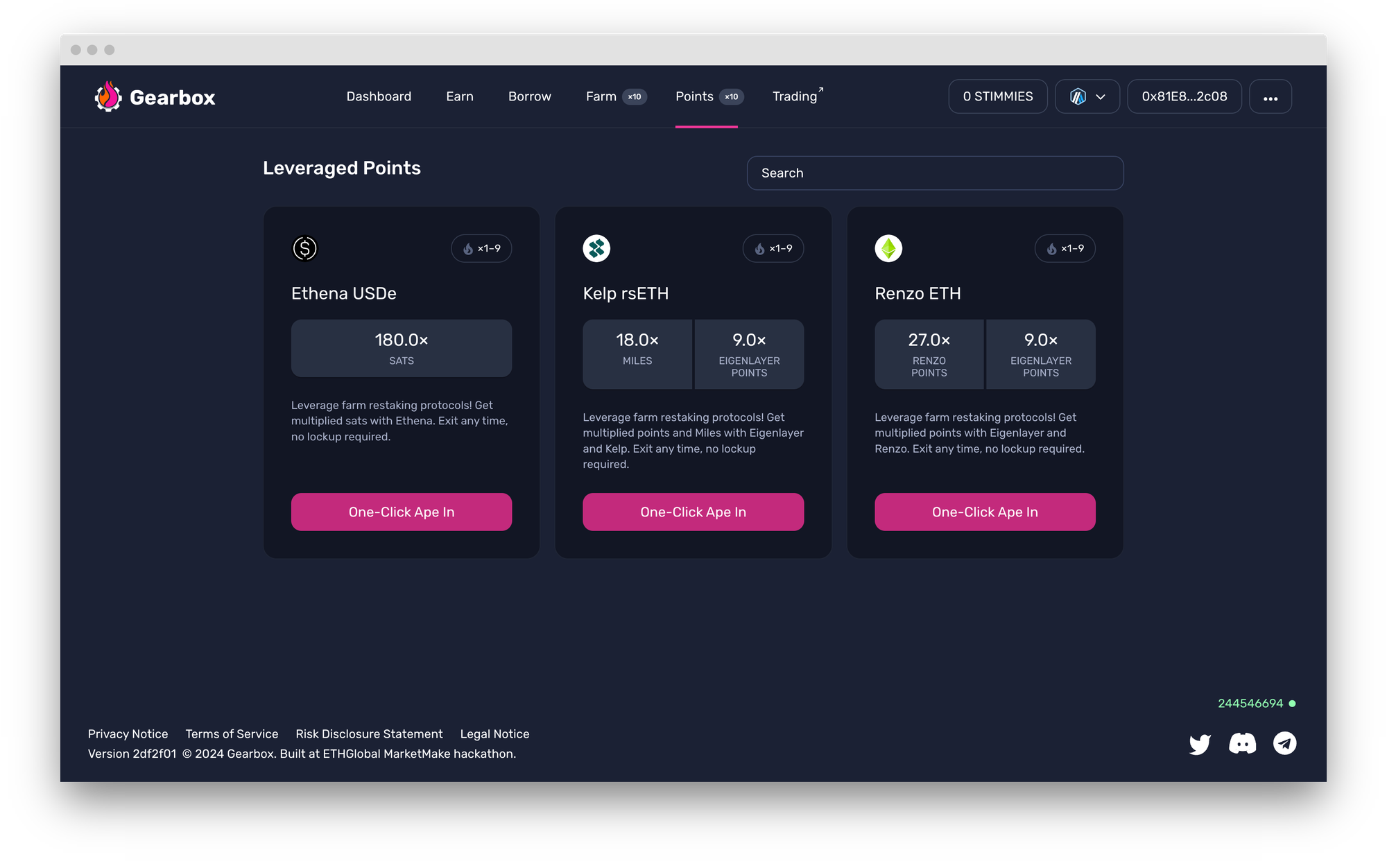

To start it all, first, go to the "Points" tab on https://app.gearbox.fi/restaking/list

then:

A. Change your network to Arbitrum to earn STIMMIES: Choose rsETH on the points page to make sure you earn the right boost.

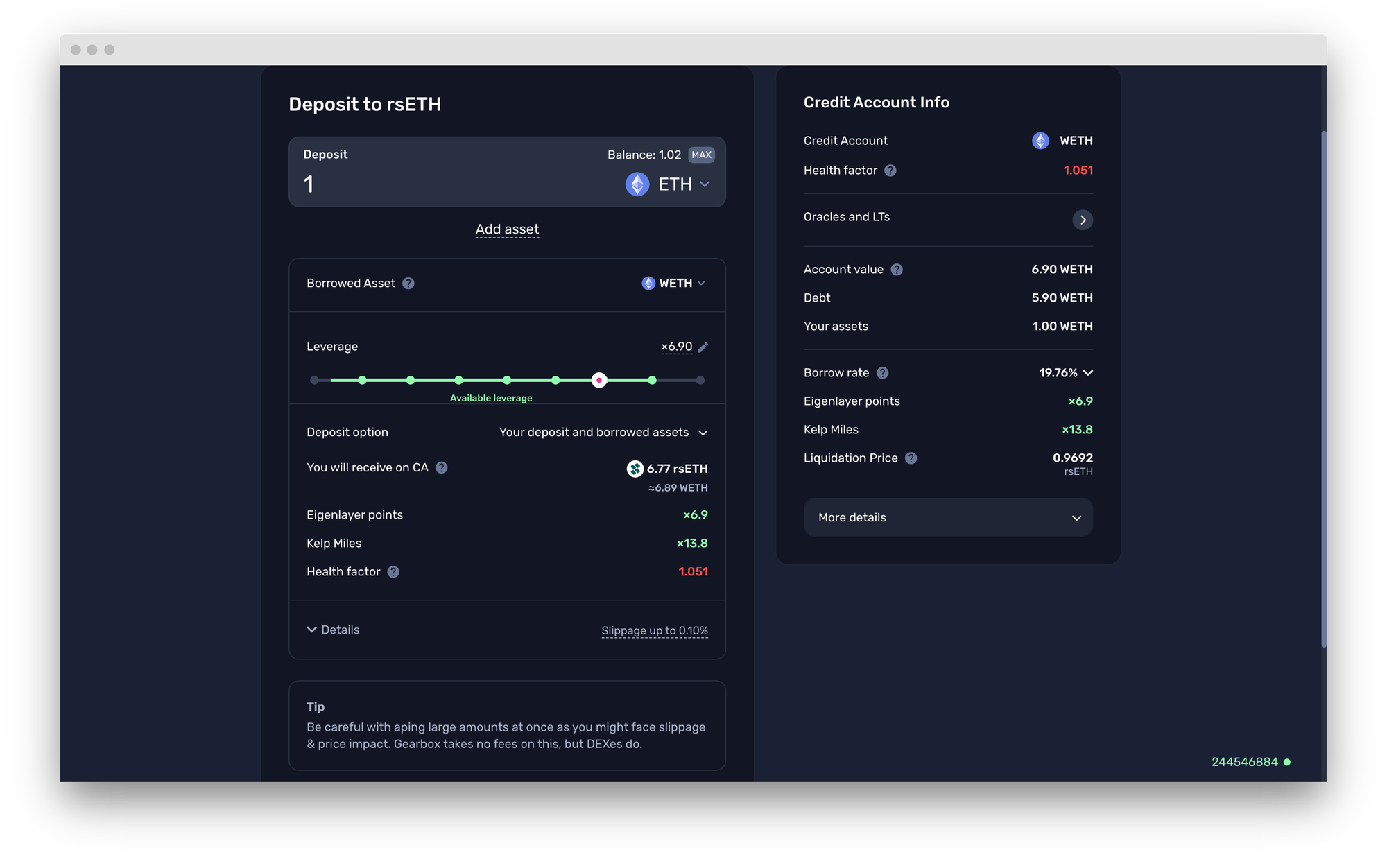

B. Choose Your Leverage: Customise the position as per your risk tolerance. The page also displays the borrow rate, the liquidation price and more to help you take an informed decision. All these details are up to you, you decide all the parameters!

C. Scroll to the bottom of the page and click on "Open position". You are now earning Kelp miles with a 3X boost and levered Eigenlayer Points. STIMMIES are earned every hour with a 3X boost till 19th August for rsETH.

And Voila! You are all set. Multicall will now execute all the required transactions in one go, using account abstraction.

Gearbox is a DAO that has no "team", what you say in the discord matters the most and is always considered. If you think there's something we suck at, come berate us. Join the DAO - just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: