K3 Instance: USDT Credit Market

A significant milestone for any decentralized protocol is having its infrastructure adopted by institutions that expand their operations and services on-chain. Today, Gearbox has reached that milestone. A Gearbox instance operated and curated by K3 is now live, bringing institutional grade lending opportunities for users.

This instance empowers K3 Capital to seamlessly create a customized USDT credit market and expand their services onchain. The instance brings to lenders an institutional grade lending experience packed with risk-adjusted rates, unified-liquidity for isolated strategies and a battle-tested codebase. At the same time, borrowers can benefit by borrowing USDT to leverage yield bearing assets from Ethena, Pendle and Sky. Read more about the opportunities in the blog below!

Meeting institutional needs: K3 and Gearbox

Over the past year, with regulatory clarity improving and ETF approvals accelerating institutional attention, DeFi entered a new era. But for institutional lender participation to become a mainstay, two factors are essential:

• Lending terms tailored to institutional requirements: Asset specific risk-adjusted rates, simplified liquidity management, customisable risk curation.

• Infrastructure that facilitates curation of such onchain lending markets.

K3 Capital brings deep experience working with institutional LPs and building risk-optimized, non-directional strategies. Their expertise in market curation and risk calibration positions them to design lending strategies that meet institutional expectations.

Gearbox Protocol provides the infrastructure to power those strategies onchain. Its Credit Accounts offer features built for institutional needs, from risk-adjusted borrowing rates (versus traditional utilisation-based models), to isolated markets with unified liquidity, and fully customisable parameters.

Together, K3 Capital and Gearbox create an institution-ready lending environment, combining strategic design with scalable infrastructure. The result? A new Gearbox instance, tailored by K3 Capital, built for institutional-grade yield generation.

Details regarding how Gearbox enables risk-adjusted rates and other key features that make Gearbox institution-ready have been provided towards the end of the article.

About K3's Gearbox Instance

The goal of K3's Gearbox instance is to unlock institutional grade yields for stablecoins. K3 will be utilising their extensive experience to identify, onboard and grow specific stablecoin markets by providing USDT credit for selected assets.

Apart from determining which assets are permitted, K3 can also set borrowing limits for specific collateral types, identify the price feeds to be utilized and customise the risk paramters. K3 Capital will operate this instance entirely, providing a range of on-chain prime brokerage services using Gearbox's infrastructure.

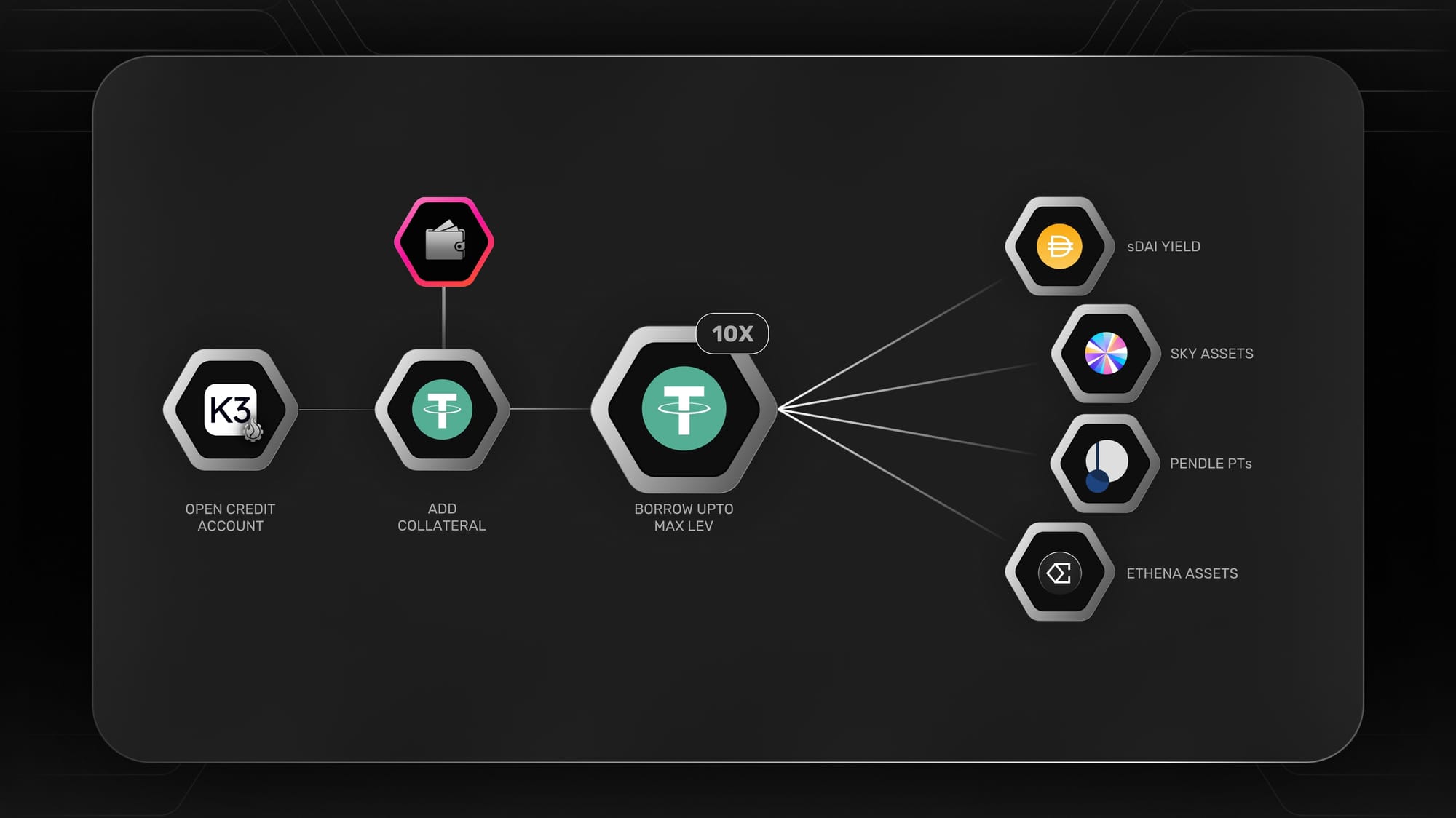

Gearbox's infrastructure empowers K3 to lend USDT for permitted services like staking, trading, and farming onchain. Users can borrow USDT by K3 by opening a Credit Account on Gearbox, and the Credit Accounts programmatically ensure the borrowed funds are used only for the permitted services. This creates a lending environment that K3 can tailor to meet institutional needs.

How can this instance be utilised by users?

The existing DAO pools will run in parallel, continue to be curated by Chaos Labs, and be governed by the DAO.

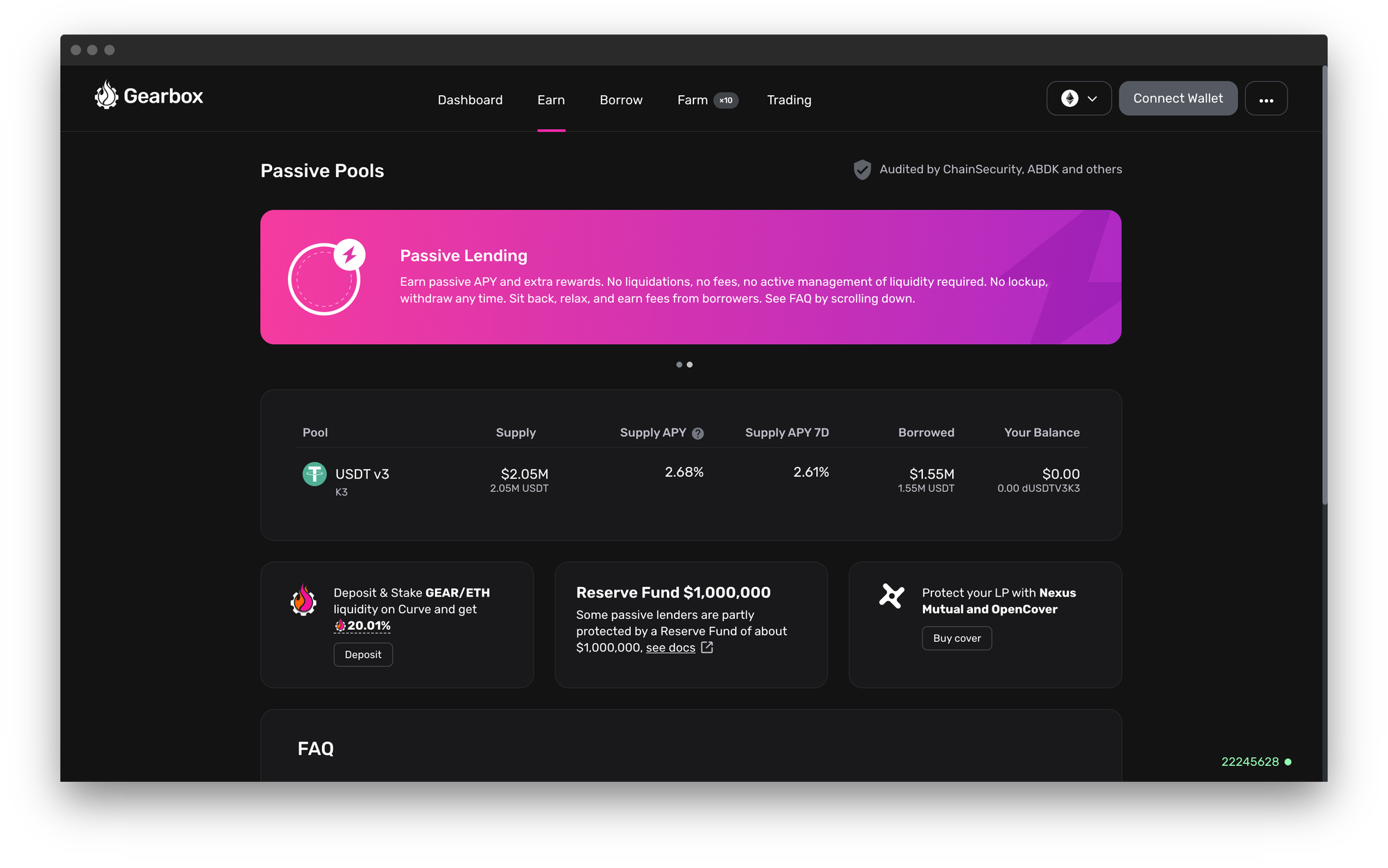

How Lenders Can Utilise The Instance

The instance brings to lenders the opportunity to access institutional grade yields for lending USDT to the pool tailored by K3 Capital. The K3 instance ensures lenders are rewarded appropriately with risk-adjusted lending rates that optimize utilisation and that lending remains competitive even at scale by seeding and growing strategies.

To make the lending experience even smoother, Gearbox's lending pools have no impermanent loss, fees or lock ups. Lenders can deposit and withdraw whenever they decide, making lending truly passive.

Users can deposit USDT to earn passive yields and additional rewards here: https://app.gearbox.fi/pools

How Borrowers Can Utilise The Instance

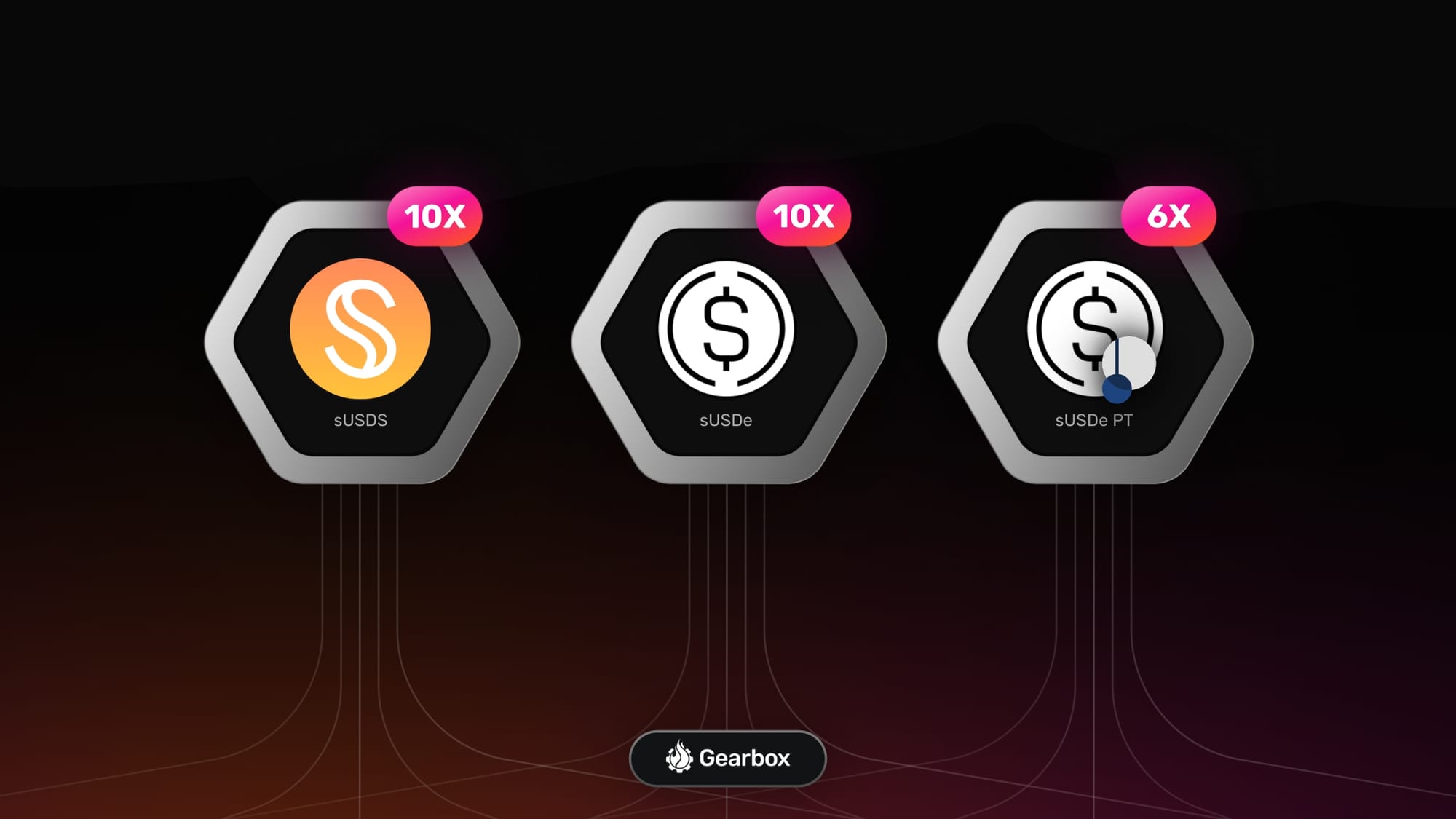

With the instance now set up, new stablecoin liquidity for USDT is anticipated to become available. Borrowers will be able to utilize this and access credit on

• Ethena's sUSDe and USDe

• Sky's sUSDS

• Pendle's sUSDe PT maturing on 29th May

The Gearbox dApp provides details regarding borrow rates, available leverage, and more. Users can access credit by choosing the K3 USDT pool as the source of debt while opening a Credit Account. Click here to find the strategies.

A UI walkthrough has been provided at the end of the article.

Governance

The K3 instance will be administered entirely by K3 Capital, making it a dedicated one. Based on their assessments, K3 can alter the parameters for strategies and pools, while Gearbox is an infrastructure provider.

How Gearbox is Institution-Ready

With onchain finance providing significant cost benefits, instant settlements and trustlessness, more institutions are likely not just to use onchain products but set up their operations onchain using the lending infrastructure. So why should they choose Gearbox?

I. Fulfilling Institutional Needs: Risk-Adjusted Rates and Liquidity Unification

Institutions expanding onchain require infrastructure supporting their lending frameworks, including risk-adjusted borrow rates, liquidity management, ensured repayments, and other factors. While multiple lending options exist on-chain, few can support this.

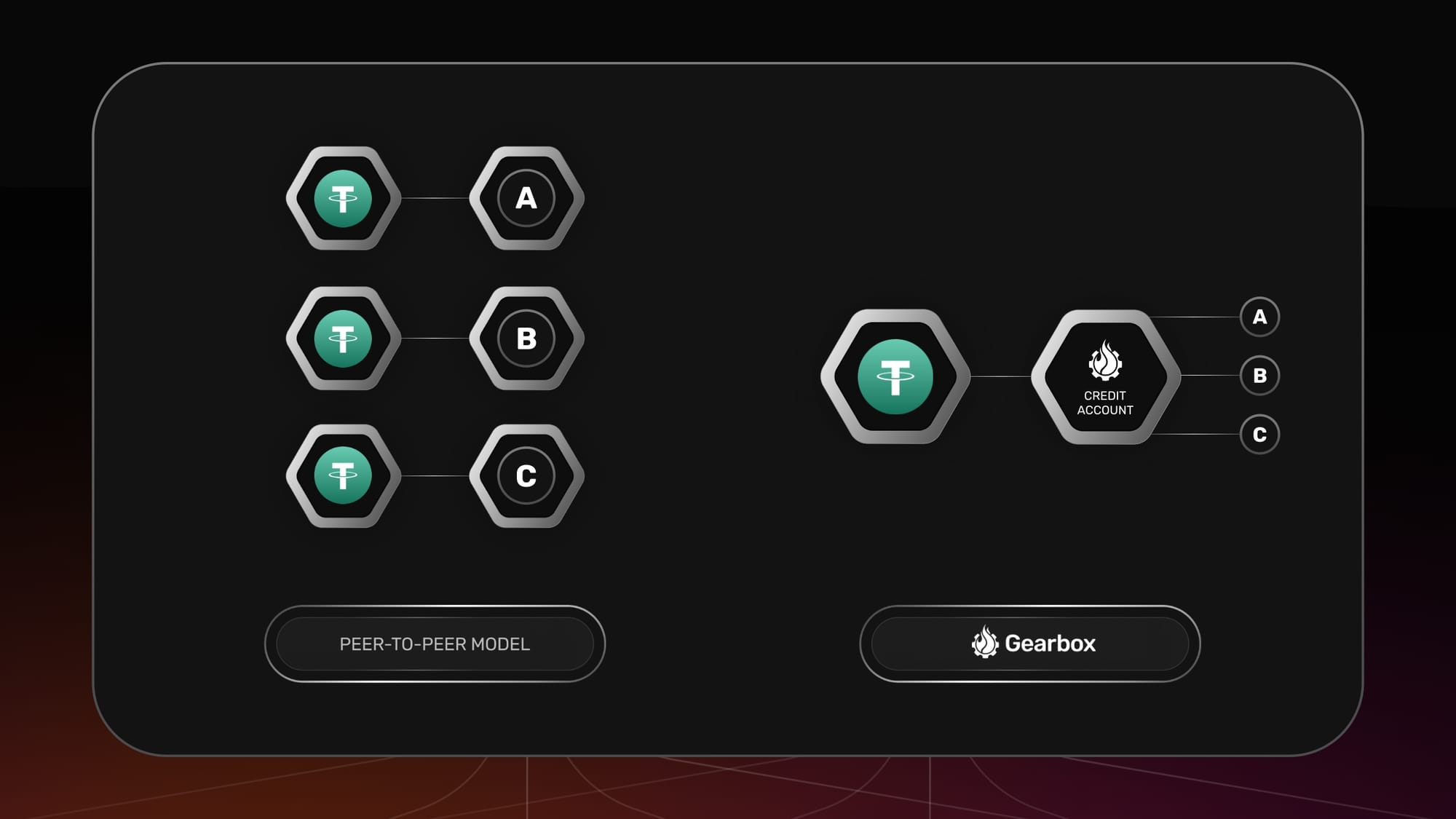

I. Pool-To-Peer model and the lack of Risk-Adjusted Rates: Most lending protocols utilize the pool-to-peer design, where users can deposit in generalized pools and borrow from other generalized pools. Since all the collateral is generalized, the interest rates can not be risk-adjusted. Whether you deposit a long-tail asset or BTC, if you borrow USDC, you pay the borrowing rate for USDC.

II. Peer-to-peer model and liquidity fragmentation: Alternately, lending protocols utilize the peer-to-peer model, where each collateral is paired and has its isolated pools. While this makes risk-adjusted rates possible, liquidity gets fragmented between multiple pools. To enable USDC lending against 10 assets, you must set up 10 different markets. This requires significant intervention and constant monitoring.

The solution: Gearbox's unique design offers institutions a significantly more customizable yet easy-to-use infrastructure. Gearbox is structured with a pool-to-account model, ensuring each borrower is isolated with a dedicated account. The account can determine the collateral a borrower has deposited and charge interest rates based on the risk associated with the collateral. Institutions can set up borrowing rates for different collateral types. At the same time, the debt for multiple collaterals can be issued through the same lending pool, removing liquidity fragmentation and the need for excessive management.

Gearbox's unique design solves both the borrow rates and liquidity fragmentation problems, making management more effortless.

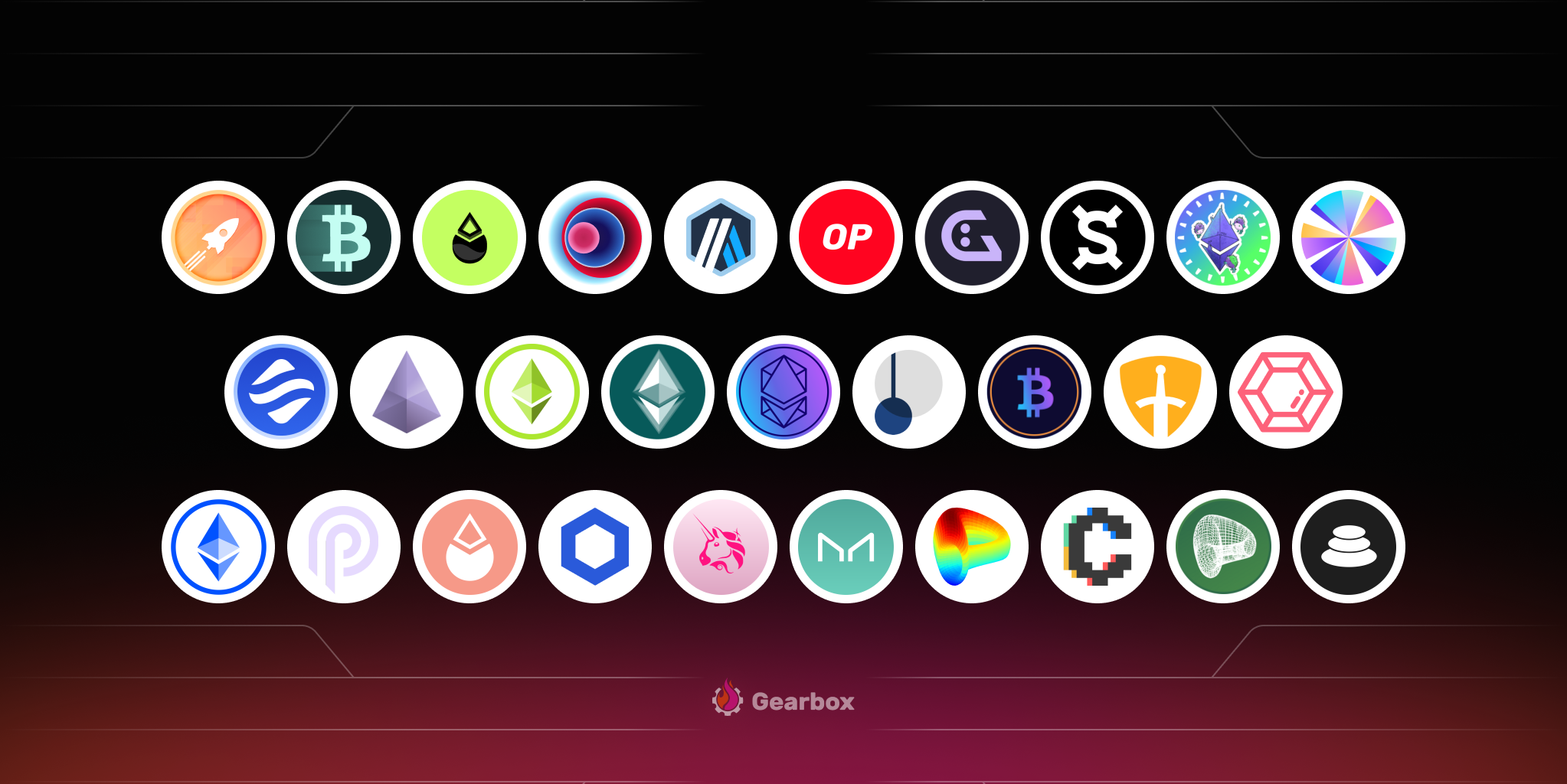

II. Instant access to 45+ Integrations

Designs like Gearbox require Credit Accounts to be permitted to interact with specific smart contracts, which further requires the logic to be designed, programmed, and audited. This cycle can take months. Thankfully, Gearbox has been live for over three years, and we offer 40+ integrations across three networks.

With most major EVM-based DeFi protocols integrated, Gearbox provides institutions with access to a wide array of DeFi platforms and services. This extensive network enables K3 and other institutions and protocols to offer diversified strategies to their clients, enhancing the value proposition and attracting a broader user base.

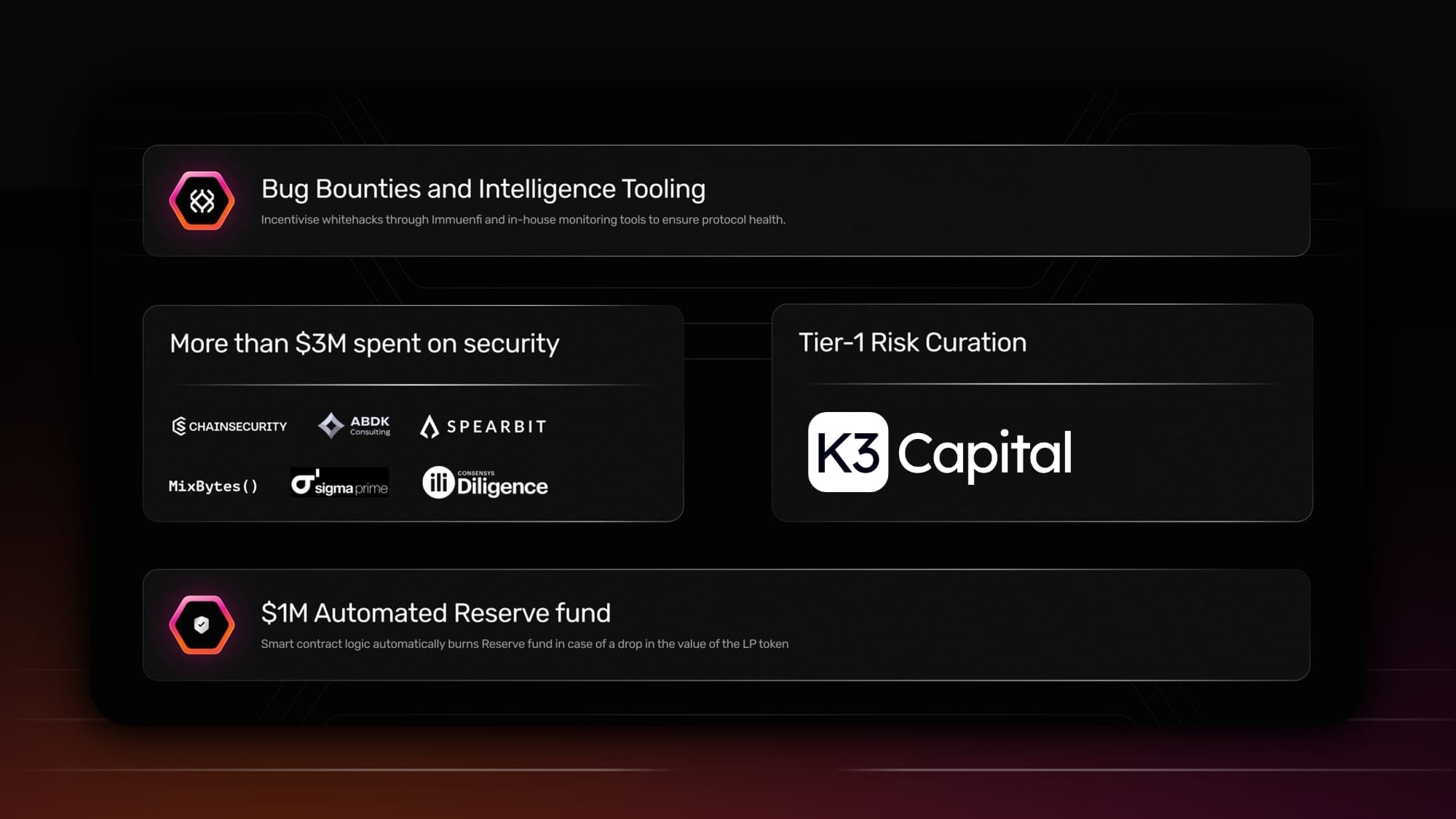

III. Battle Tested Infrastructure

Security is paramount in DeFi, and Gearbox has demonstrated a strong commitment to maintaining a secure environment. Gearbox has been live for 3+ years and has never faced any exploits. It is further backed by

• 10+ Audits

• Whitehack bug bounties

• AI-based monitoring tools

These factors provide a safe environment for protocols and institutions to expand their on-chain operations and services.

UI Walk Through

Users can access the instance through this link: Gearbox K3 Instance

- Lend USDT: To lend USDT passively, users can head to the "Earn" tab and click on the USDT pool to supply your assets and earn institutional-grade passive yields.

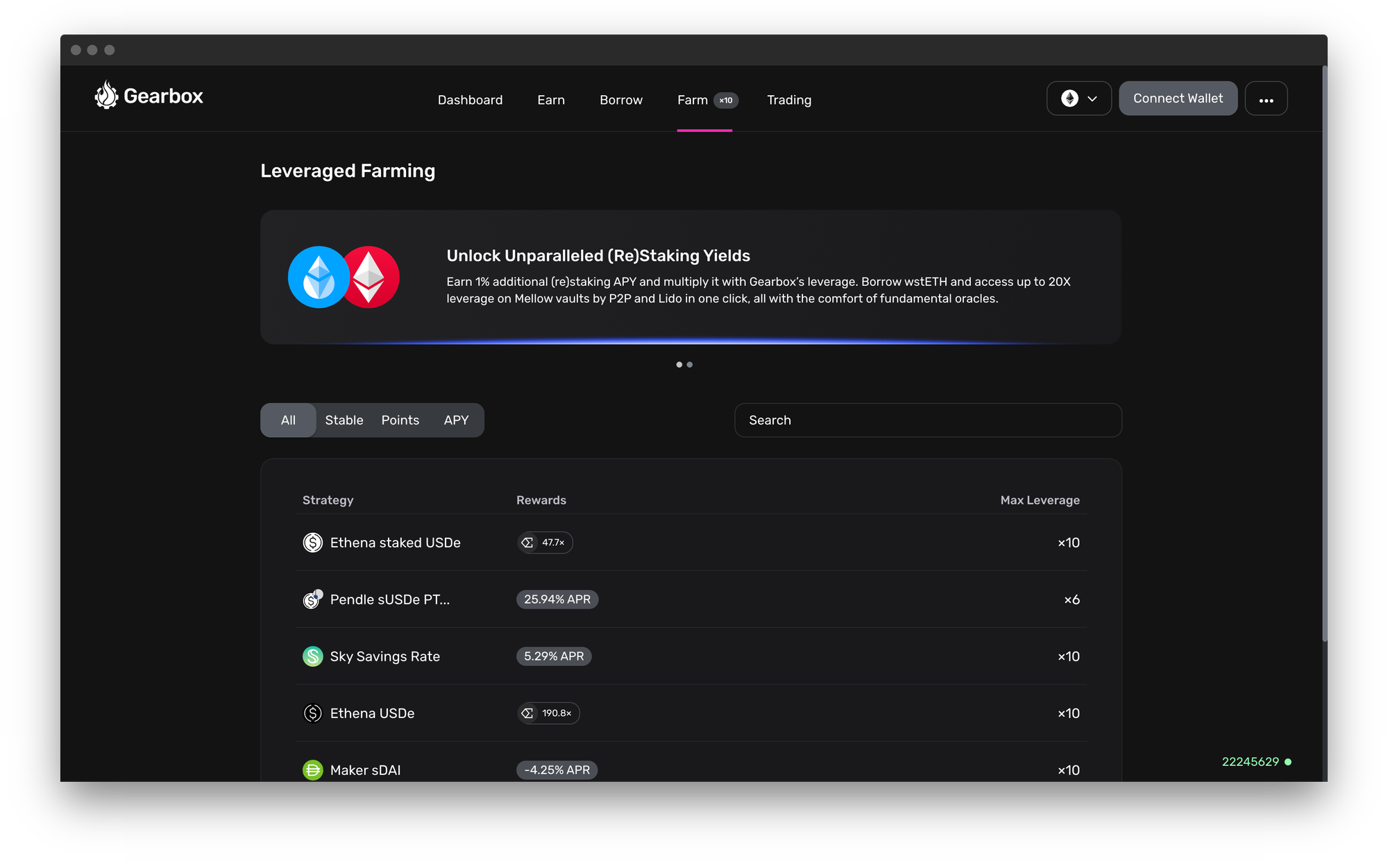

- Leverage yields: Borrow USDT and access leverage on assets from Pendle, Sky and Ethena to multiply your DeFi yields. Head over to the farms tab to access these strategies.

If you are an institution and are looking to expand your operations onchain, Gearbox can offer you the credit infrastructure you require. Contact us on Telegram or Discord for more information. Let’s build the onchain economy together!

- Website: https://gearbox.fi/

- Main App: https://app.gearbox.fi/

- Telegram: https://t.me/GearboxProtocol

- Discord: https://discord.gg/gearbox

- Twitter: https://twitter.com/GearboxProtocol

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- Notion DAO monthly reports: