How may I Kelp you? 3X Friendly Miles

Points have been one of the most profitable opportunity in 2024. Leveraged points have further gone on to produce over $30M worth of incentives for Gearbox users. This value creation has led to a demand surge for LRTs. So how do Kelp and Gearbox intend to fulfil your demands and make your point farming experience even better?

Friendly Leverage meets Kelp Miles boost 🤝

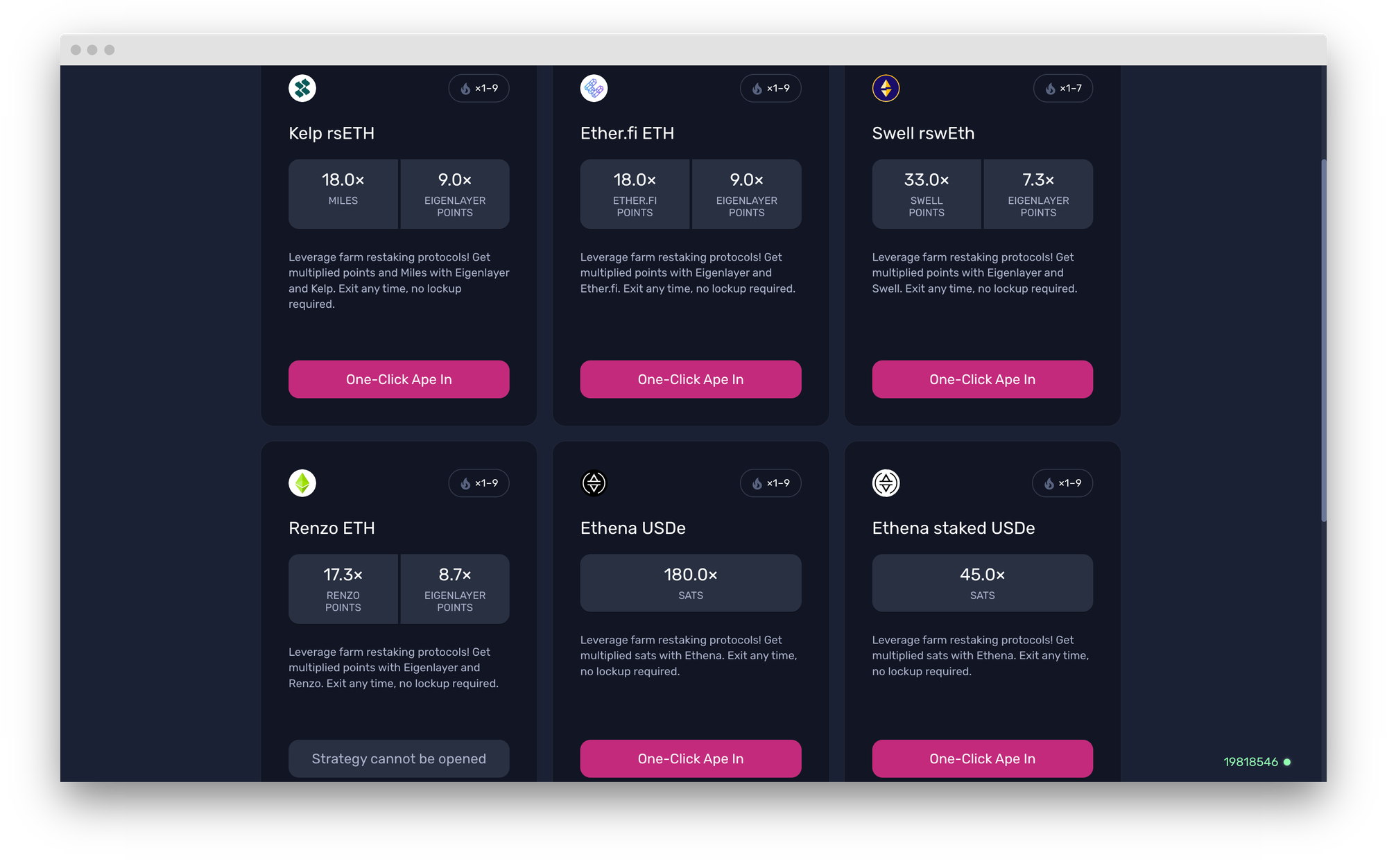

3X Miles boost on Gearbox

The 2X boost on Kelp Miles has always been there. But for the next 10 days, if you open a new rsETH position on Gearbox, you can become eligible to earn 3X the Kelp Miles.

How do you become eligible for 3X Miles? In 3 easy steps.

- Open a leveraged rsETH position before 12AM UTC, 1st June.

- Hold the position for a minimum of 1 month.

- Earn 3X the Kelp Miles for the duration of the campaign.

That's it! Leverage -> Hold for a month -> Earn 3X Miles. Simply enter the position within the next 10 days. And to make it easier for you to join, the borrow limit for rsETH has been increased to 10K ETH. With liquidity available in lending pools, opening a position shouldn't be an issue. Simply go ahead and click on the link below to join in.

Any attempt to exploit loopholes/manipulate the rules or closing your position prior to 30 days(720 hours) will result in disqualification for this promotion.

And since you earn 3X on leverage, you can effectively earn upto 27X Kelp Miles during this campaign. 🤯 Don't get scared by leverage though, we have made it friendlier. How? Read on!

And these come with Friendly Leverage

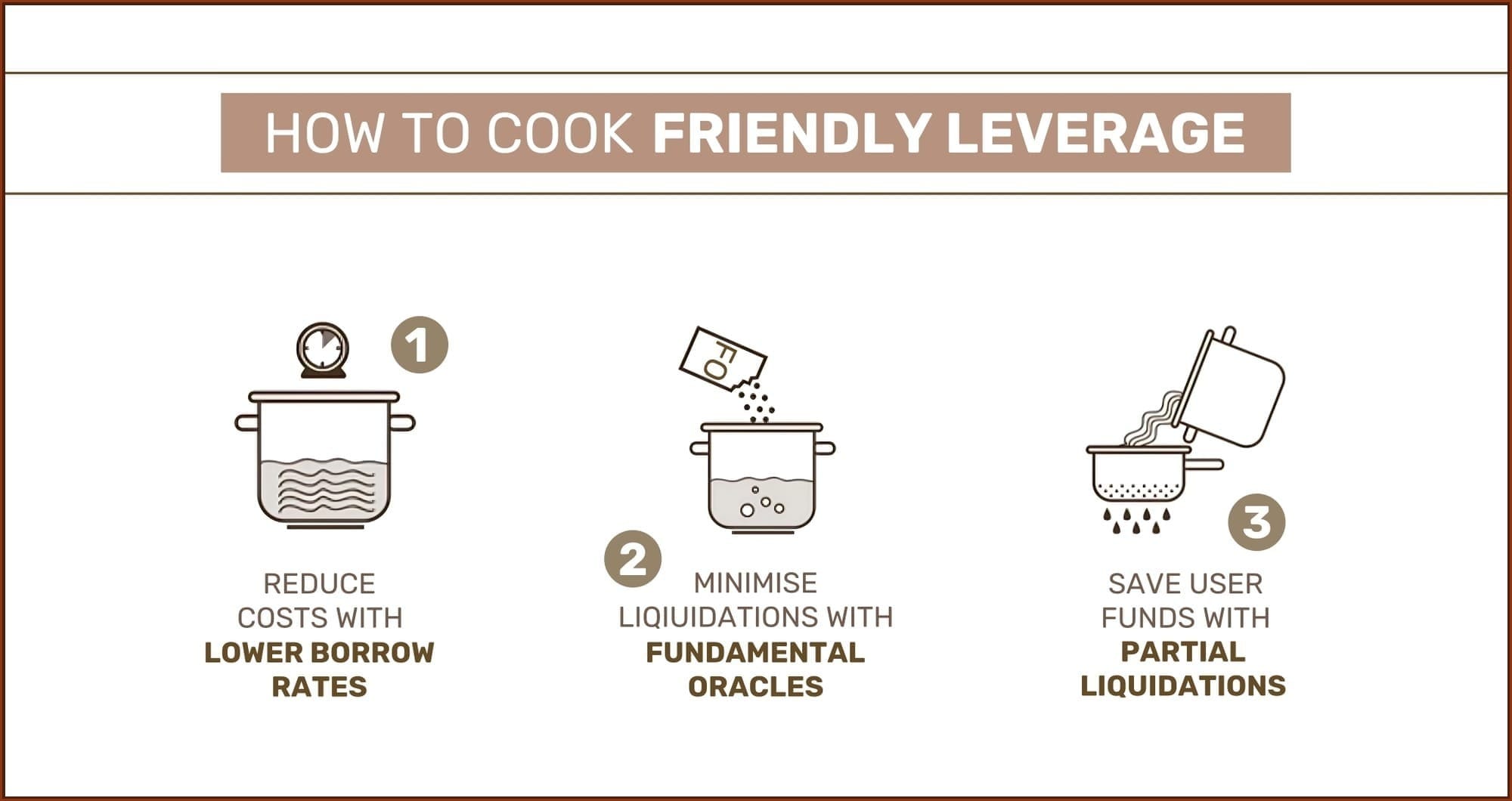

Friendly leverage is made possible due to fundamental offerings of Kelp and Gearbox's recent changes. It's based on 3 simple fundamentals.

Reduce costs -> Reduce the likelihood of liquidations -> Reduce losses during liquidations.

Let's dive into quick explanations!

I. Lower Borrow (Quota) Rates

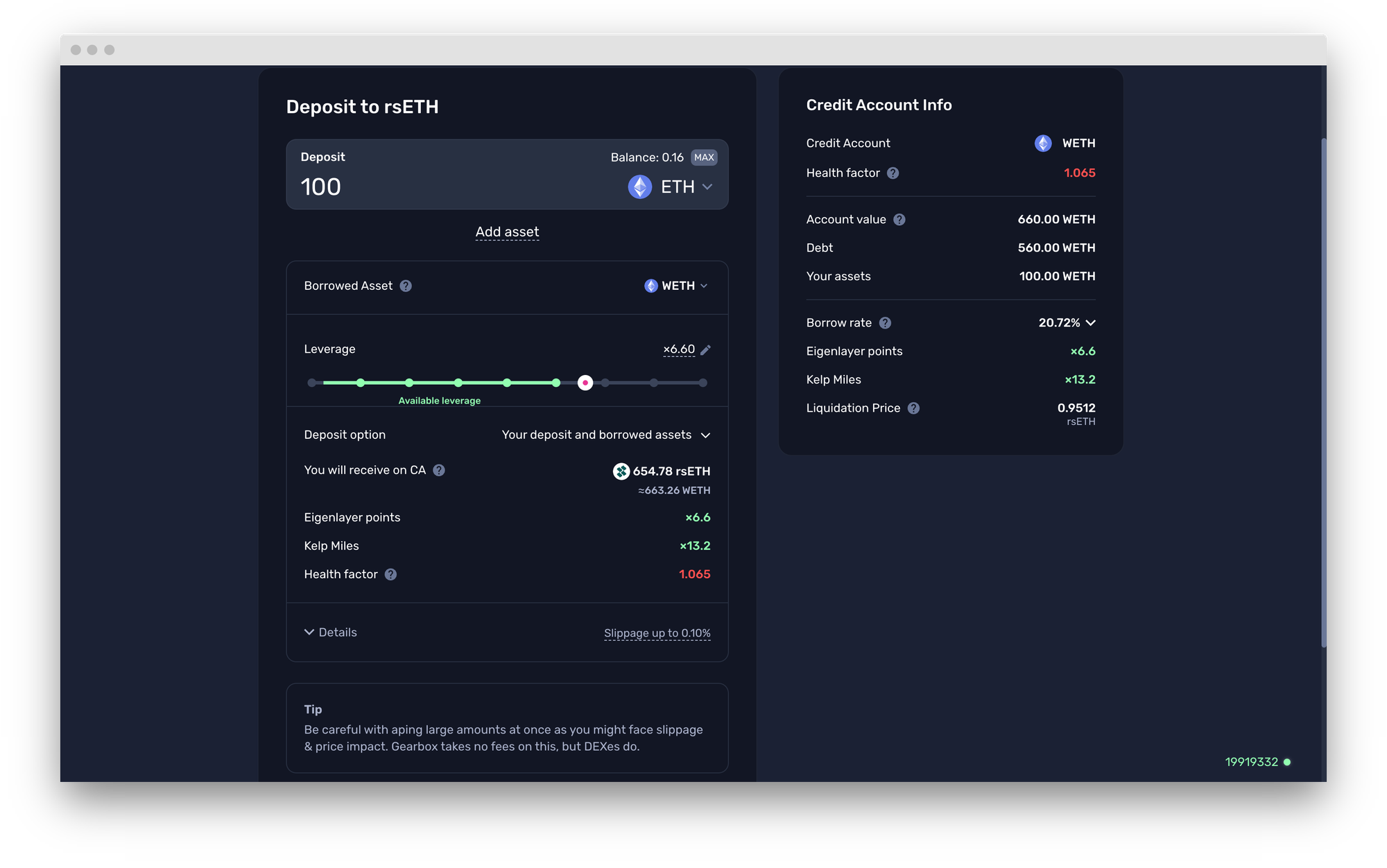

Borrow rates are the primary factor (usually the only factor) that dictates the cost of your points. With the recent volatility , the borrow rates on Gearbox have already been reduced. From 32%+% weeks ago to 20% Borrow Rate now for rsETH. Making it significantly cheaper.

That currently includes both the utilization borrow rate and the quota rate. You can read more here.

II. Fundamental Oracles

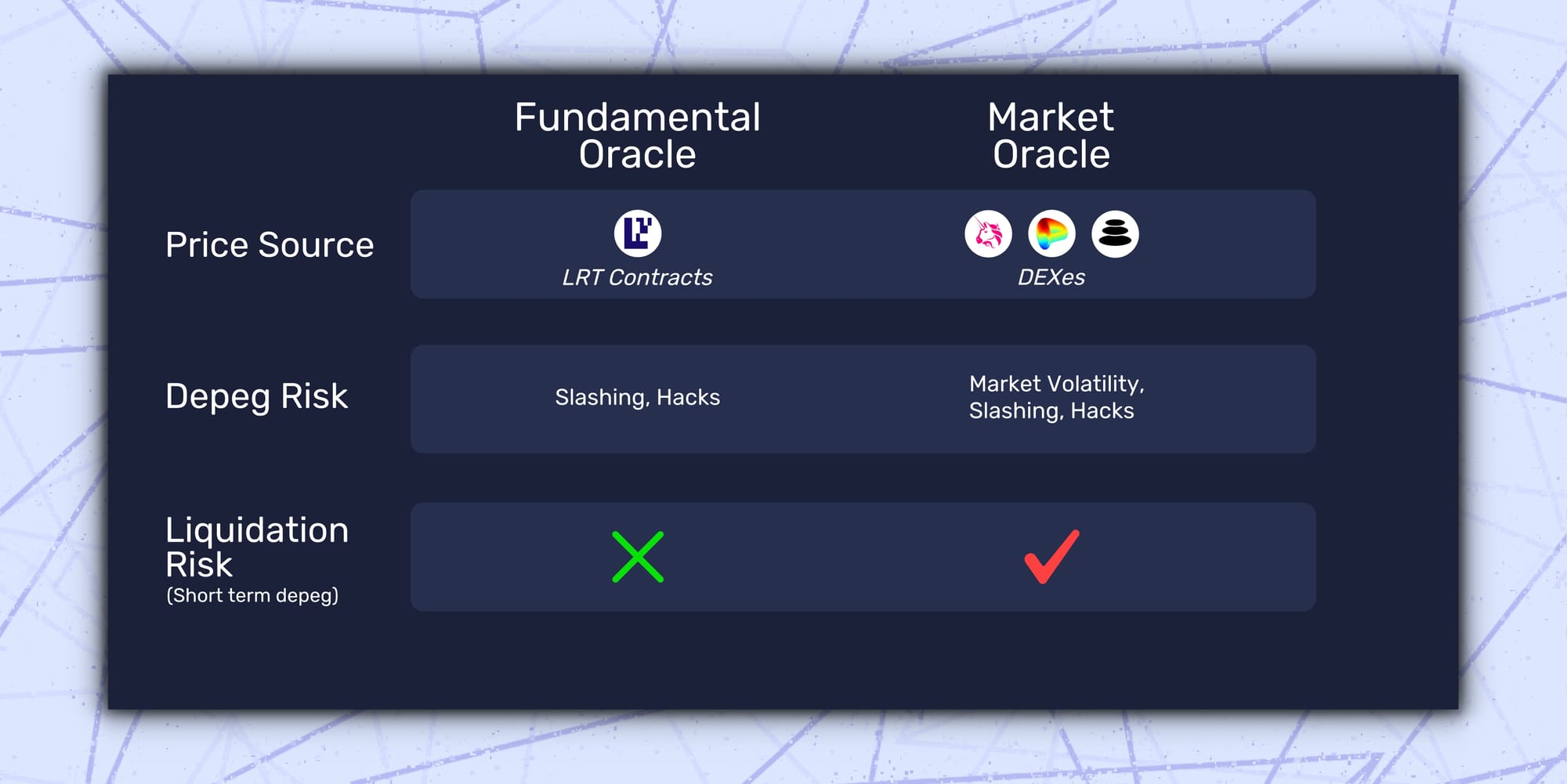

The peg for rsETH can be obtained by oracles in 2 manners. Either through:

- DEXes: The open market source where users can buy and purchase rsETH instead of directly liquid restaking and minting rsETH. These sources have liquidity risks and are prone to market volatility as we saw with the ezETH depeg recently. Market Oracles are based on aggregated DEX price reporting for assets.

- Locked in restaking: This source looks at the total assets locked in EigenLayer Contracts by Kelp vs the total number of rsETH tokens. While the DEX based peg is affected by a change in liquidity of the pools during volatility, the EigenLayer level peg is based solely on the backing of rsETH. These pegs are reported through Fundamental Oracles.

rsETH makes leevrage safer by having Fundamental Oracles.

To simplify, if in case of volatility rsETH sees outflows, leading to it's DEX liquidity to reduce and in turn peg to fall for a short term, Gearbox users are unlikely to be affected. This will hold true as long as the assets locked in EigenLayer by the Kelp maintain a peg. Since Kelp has verifiable redemptions, even if a short-term depeg occurs, fundamentally arbitrageurs will be able to back the peg in the worst case in 7 days. Thus, enabling a better levered borrow experience without risking bad debt.

Though, a hack or slashing scenario is where Leveraged borrowers will now face depegging risks. Removing short-term market volatility risks. This movement significantly reduces risk for leveraged borrowers. However, slashing won't be live for a few months... Safu?

III. Partial Liquidations

Gearbox previously had only hard liquidations. In this case, the entire position of the user was liquidated in one go when the HF dropped below 1. To improve this UX, Gearbox has now moved to partial liquidations.

Partial liquidations won't fully liquidate a user but instead, close their position just enough for them to be back above a health factor of 1. This will reduce the losses leverage takers incur in such scenarios and at the same time ensure bad debt doesn't seep in.

So while the HF dropping below 1 gets tougher as fundamental oracles safeguard users from short term market depegs, partial liquidations will further reduce the damage a liquidation could cause.

NOTE: Additionally, Gearbox positions are fully liquid, as the market changes its stance on an LRT you can choose to increase or decrease your size. Your collateral is not burned instantaneously, you choose when you enter, when you leave and how much you spend.

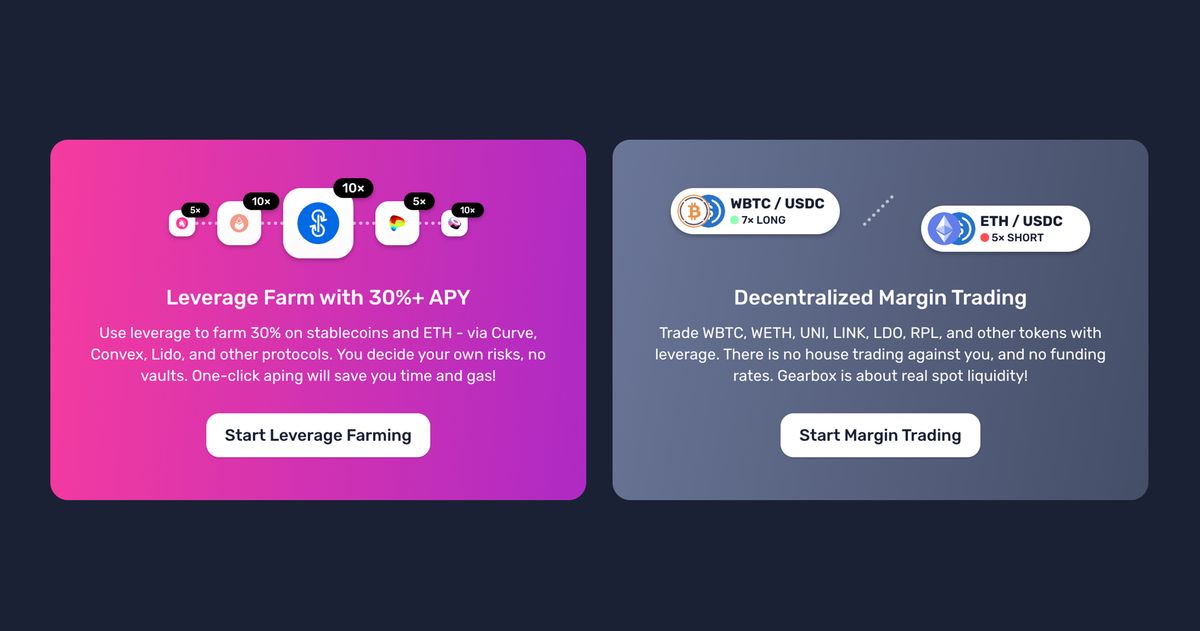

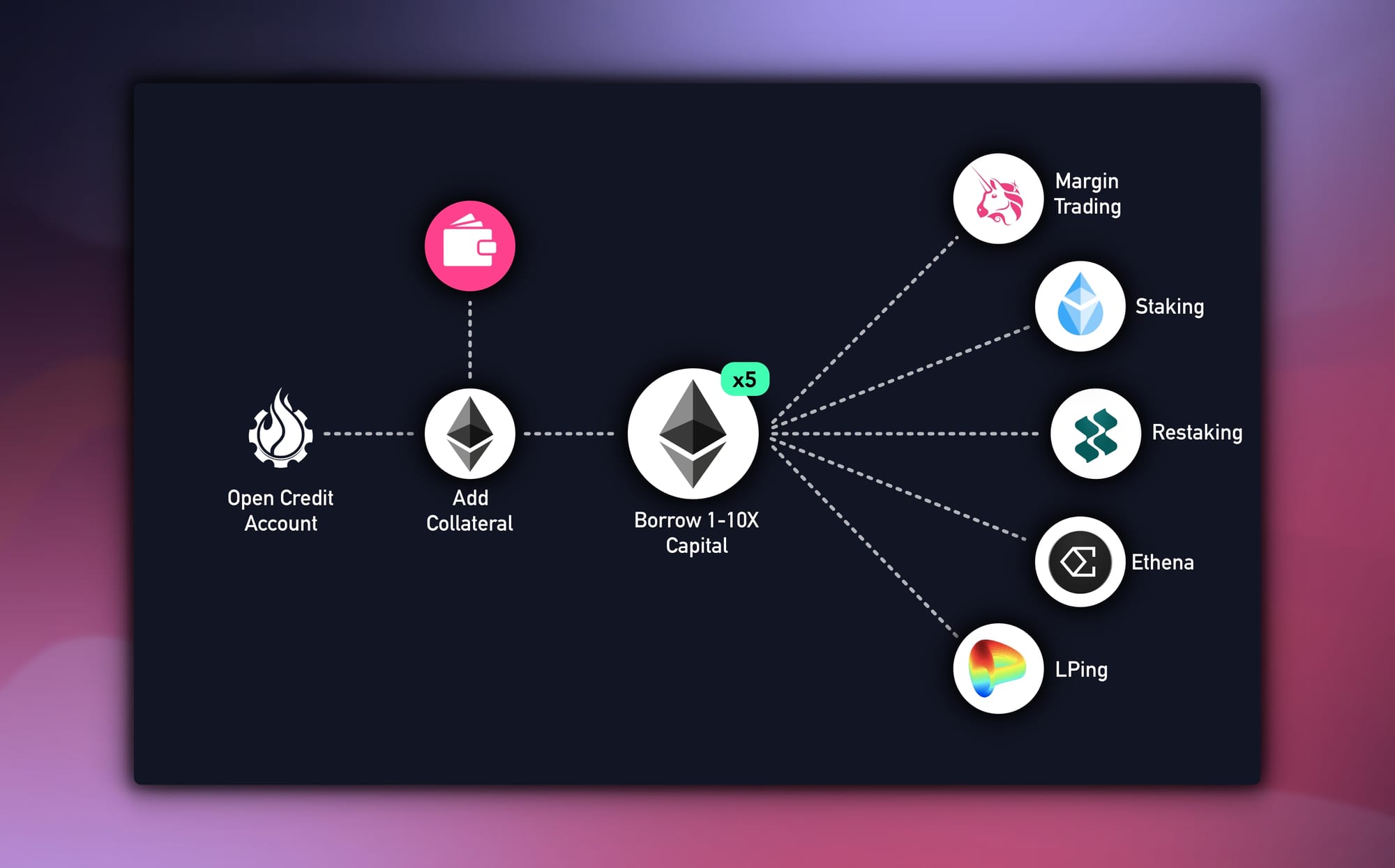

How does Gearbox make leveraged points happen?

Gearbox creates leverage by letting users borrow real assets up to 10 times the collateral they put up. Since these assets are real in nature, they can be further deployed across DeFi protocols to turn any allowed activity leveraged. For restaking, these borrowed assets can simply be swapped to rsETH (Kelp) to get access to Leveraged Eigen Points and Kelp Miles.

This is made possible by Gearbox's innovation called Credit Accounts(CAs) which function as leveraged smart contract wallets. The funds you borrow and the collateral you put up is sent to a CA that you open. The CA is programmed to allow usage of these funds only to certain assets, protocols and pools to ensure the borrowed funds aren't at risk. See integrations list (being updated).

In case of losses being incurred, when a user's losses lead to their collateral being exhausted, the position is liquidated and the borrowed funds are auto-returned to the lending pools. This ensures that Gearbox lenders never face bad debt.

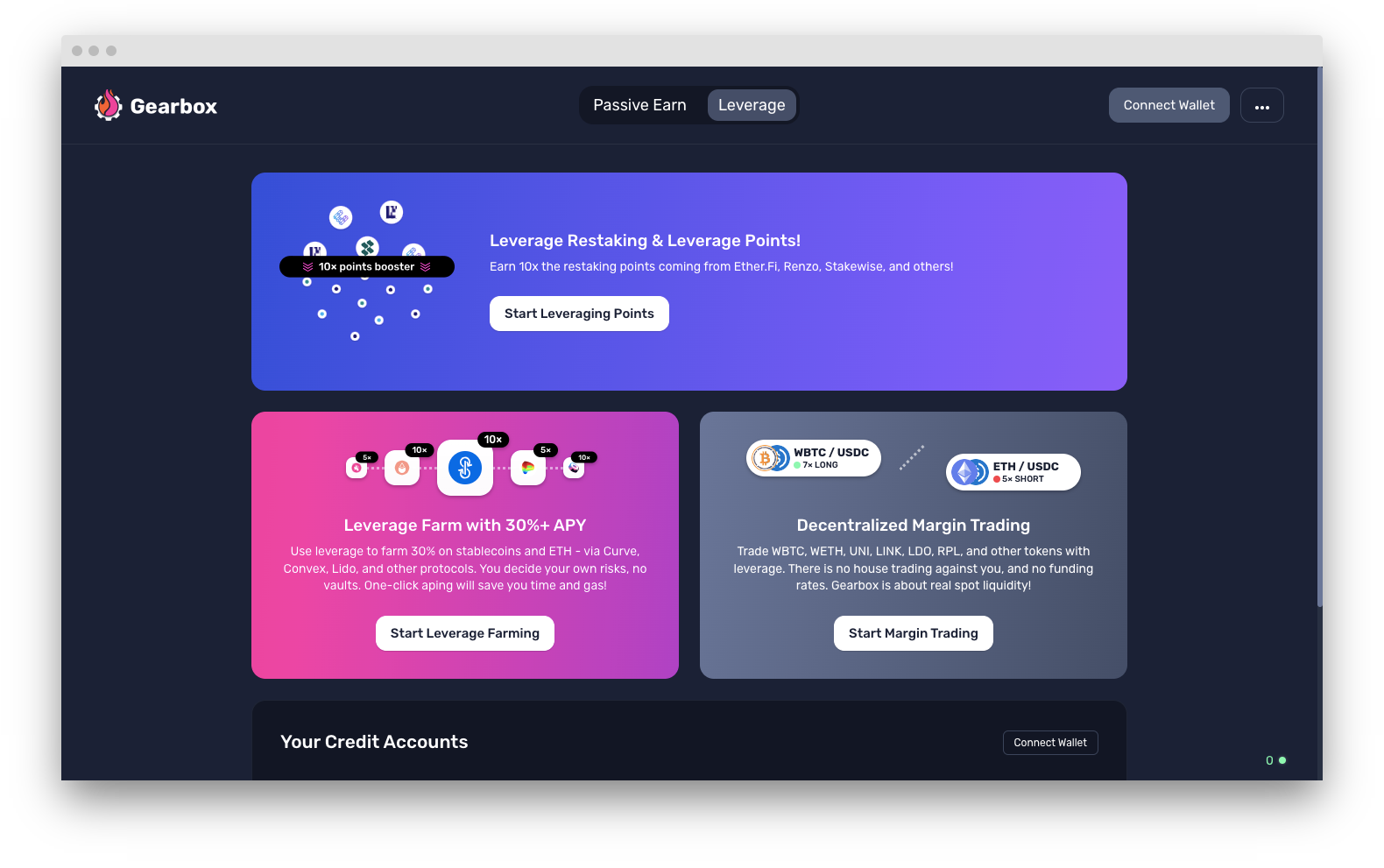

This, though, isn't limited to just Restaking for Kelp

Gearbox is DeFi's Leverage Layer. Think of it as plug and play leverage, whatever protocol Gearbox integrates automatically becomes leveraged. An evolution of onchain credit with composability.

Opening a position: dApp UI walkthrough

You can learn this the easy with this amazing tutorial by Krypto Cove which covers all risks, gives tips and walks you through how to open a leveraged farming position.

In case, you are in a hurry though, just follow the UI screencaps below.

To start it all, first, go to https://app.gearbox.fi/accounts

then:

A. Choose the Leveraged Restaking option: Which should bring you to this page. Choose rsETH to make sure you earn the right boost.

B. Choose Your Leverage: Customise the position as per your risk tolerance. The page also displays the borrow rate, the liquidation price and more to help you take an informed decision. All these details are up to you, you decide all the parameters!

C. Scroll to the bottom of the page and click on "Open position".

And Voila! You are all set. Multicall will now execute all the required transactions in one go, using account abstraction.

Gearbox is a DAO that has no "team", what you say in the discord matters the most and is always considered. If you think there's something we suck at, come berate us. Join the DAO - just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: