Hello, Mellow: Symbiotic LRT Vaults

Over the year, restaking has grown sizeably. With its ability to extend Ethereum's security to different systems, restaking has grown in TVL and mindshare, sparking discussions. These discussions have ranged from how high yields are generated through restaking to the potential additional risks induced by it.

Risk management becomes crucial since restaking requires staking ETH in the AVS contracts. While LRTs have been pivotal in growing restaking, all the holders of an LRT are exposed to the same risk profile. Mellow and Symbiotic use modularity to improve this.

Mellow's user-centric approach enables multiple risk profiles to co-exist through Modular LRTs. Mellow Protocol offers a series of vault smart contracts tailored to different risk profiles and managed by curators. This empowers users to choose which LRT's risk profile is closer to their comfort zone and subscribe accordingly. Apart from the technical innovation, Mellow and Symbiotic also bring you Points.

PS: For a more detailed coverage regarding risks, why mellow matters, what symbiotic is and how risk curators for LRTs work you can read the larger piece published by Mellow below.

Update: 11th September

Mellow LRT vaults have been the most demanded integrations over the recent months. The initial 3.9K ETH borrow limit reached it's max caps in less than 20 hours and users have been asking for more ever since. With Chaos Labs recommendations, these changes are now going live.

Update 1: Addition of Re7 vault

Adding our 5th Mellow LRT, Re7 Capital's Mellow vault is now live. The vault currently holds 12K wstETH and has a max limit of 16K wstETH. On Gearbox, it'll have a 7K ETH borrow limit. You can check the details regarding the vault here.

Update 2: Limits increased by 25K ETH for existing strategies

Limit's for all other LRTs have been increased to 7K ETH EACH as well.

Update 3: No slippage while depositing

With this update, direct deposits to Mellow are now live. This means users will incur no slippage when depositing to the LRT vaults. Exiting a position still requires swapping on DEXes and will incur slippage.

This update has been audited by Decurity. You can check the complete details about the audit below.

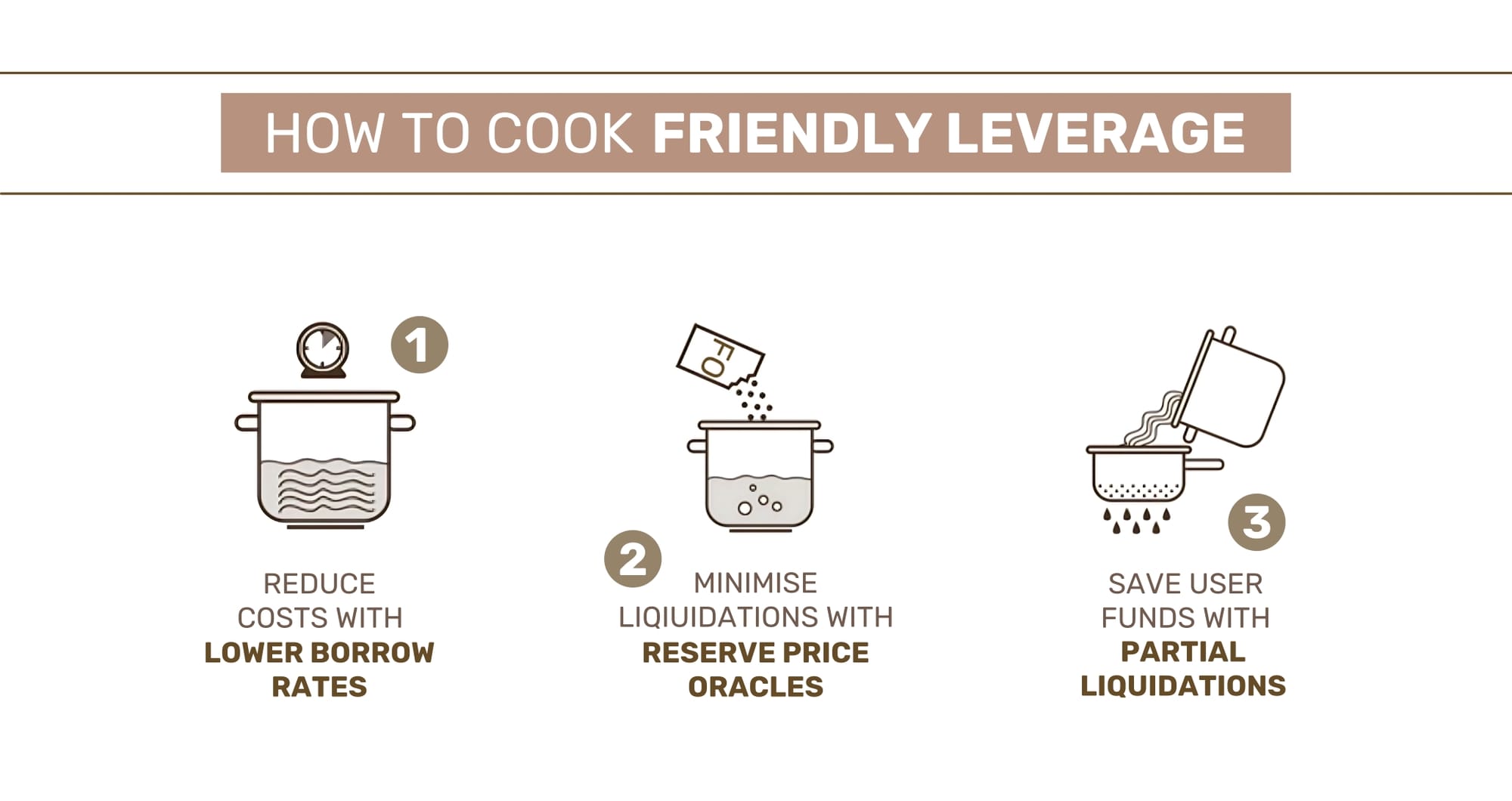

Update 4: Partial withdrawals and Partial liquidations

The update also brings more flexibility to your position and makes leverage safer.

• Partial withdrawals are now live enabling users to manage the size of their position as they like.

• Partial liquidations are live to help save users' positions in case a liquidation occurs. Though, Gearbox's friendly leverage already makes liquidations less likely by using pegs derived directly from Mellow vaults instead of DEXes. Thus, muting volatility. Partial liquidations act as an additional layer of user protection.

So take your pick and open a position

Or to know more about friendly leverage and points, keep reading.

Mellow and Symbiotic Points

The growth of LRTs over the last year can be attributed due to the value they create by making restaking liquid, but another significant factor was the incentive of Points. Mellow and Symbiotic, too, have a similar campaign now underway.

Points for Mellow have been put in place to recognise and reward healthy engagement. Users earn 0.00025 points/hour for every dollar they hold in LRT value for both Mellow and Symbiotic. (More details.)

Unless, of course, you lever it up on Gearbox.

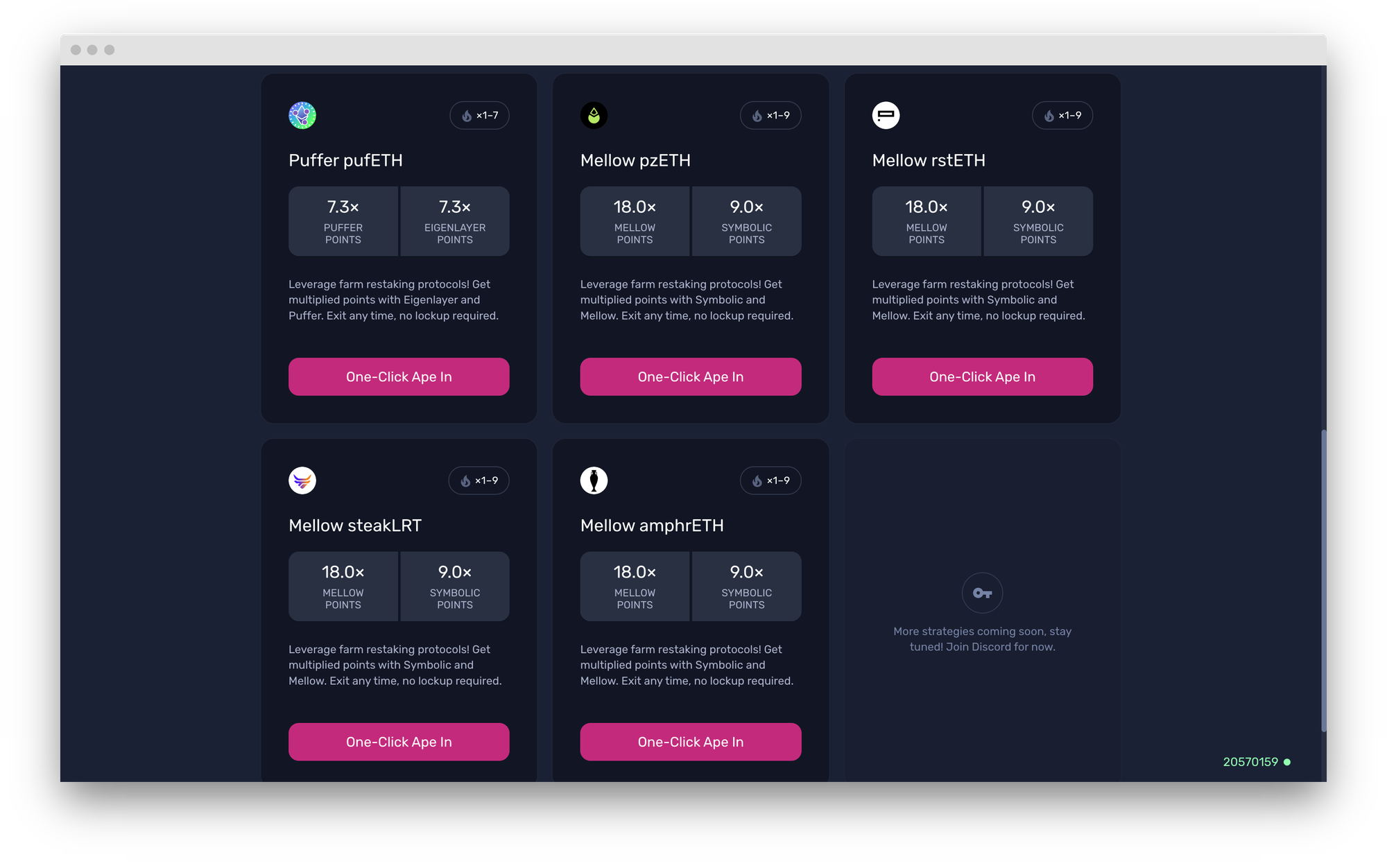

Gearbox will be onboarding the below Mellow LRT vaults, enabling users to earn up to 18X Mellow Points and 9X Symbiotic Points. Mellow points on Gearbox come with a notable 2X boost to make leverage farming experience even better.

IMPORTANT: Restaking for Symbiotic is being rolled out in multiple phases. With maximum caps in place, restaking takes place on an FCFS basis. When the caps are full, you'll be able to mint LRTs but will only receive Symbiotic points once caps increase. During the duration in which you don't receive points Symbiotic points, you'll receive 50% additional Mellow Points. Or 3X points with Gearbox's boost. Please do keep this in mind when taking a position.

But, leverage on a new asset? Isn't that too volatile? No, anon, not with...

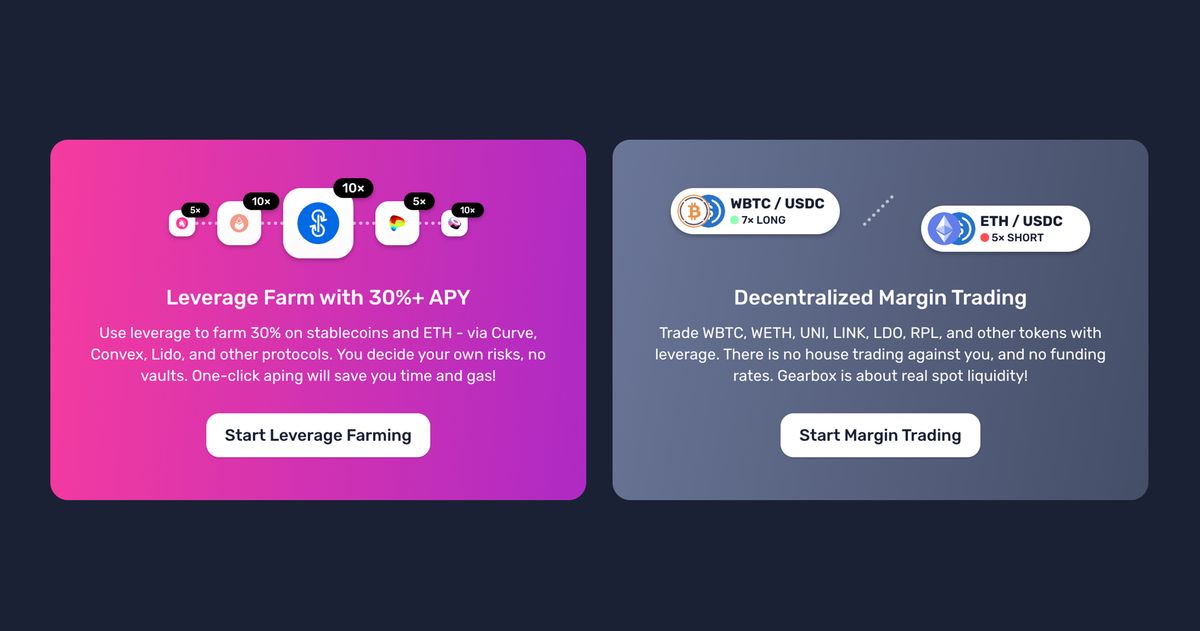

Friendly Leverage LRTs

Strategies on Gearbox that don't expose users to market price volatility are called friendly leverage strategies. How do Mellow's LRT vaults enable this?

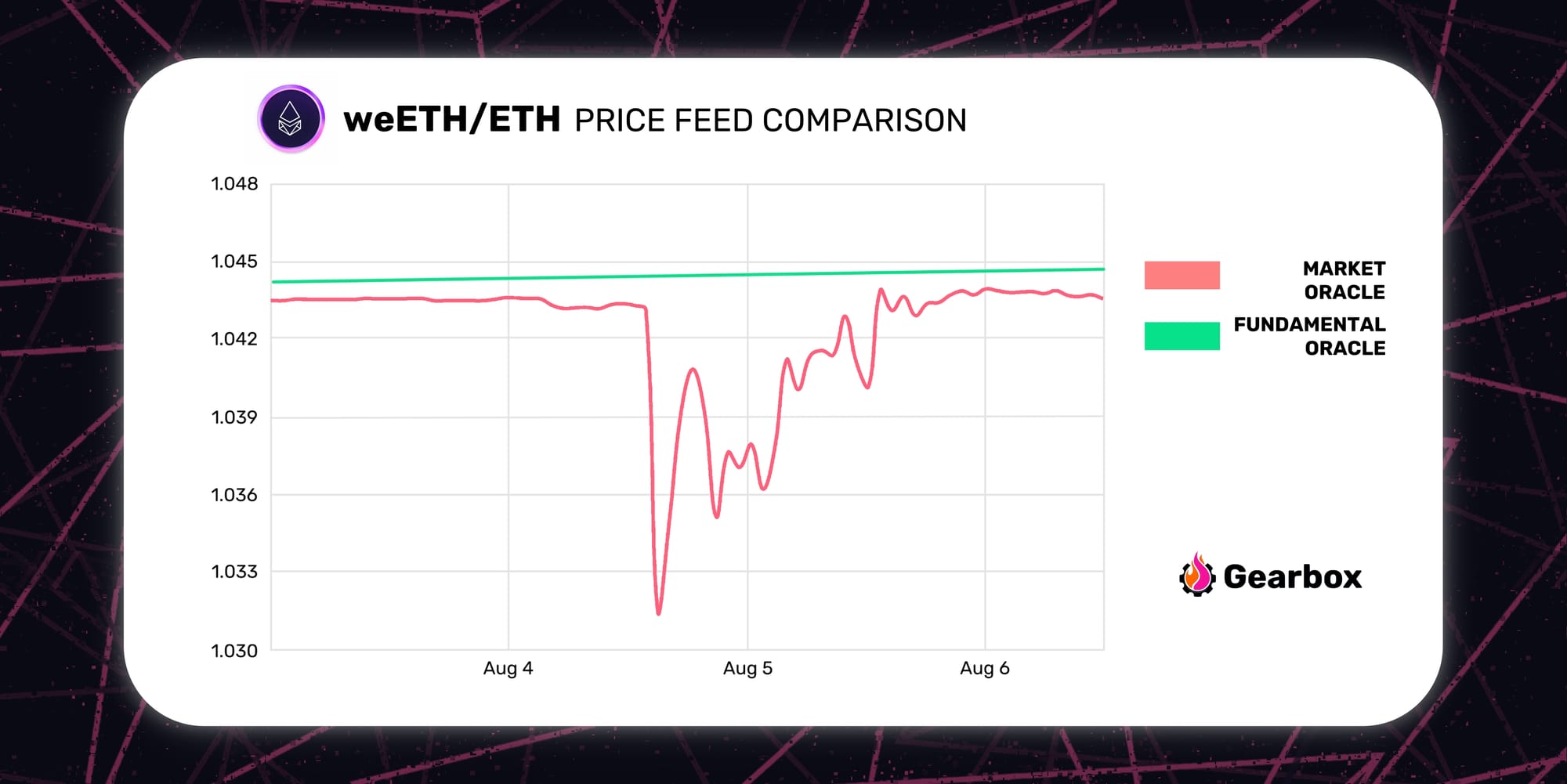

I. Reserve Price/Fundamental Oracles

Volatility usually arises through market price fluctuations. Fundamental/Reserve oracles solve this by creating a price feed using an asset's reserves instead of its DEX price. This change in the source of price helps borrowers avoid short-term volatility.

To put it simply, if DEXes see price drop on Mellow LRTs while the ETH backing of the LRT remains stable, Gearbox users will remain safe. This can be seen in weETH's example below. The fundamental oracle (green line) remained stable even when market prices fluctuate.

NOTE: While the price feeds remain stable, the DEX liquidity has been volatile for Mellow LRTs. This volatility won't cause liquidations till reserve prices remain stable but can lead to slippage. Make sure you monitor slippage when entering/exiting a position. When leveraging large amounts, try executing in multiple transactions.

II. Correlated debt

Volatility, apart from the asset you hold, also depends on the debt you borrow. If you were to leverage pzETH (or any other LRT) using USDC debt, your position would be prone to price volatility. Gearbox, though, enables users to borrow ETH to leverage pzETH. Since pzETH is a derivative of ETH (backed by LSTs) and is correlated, the volatility gets significantly muted.

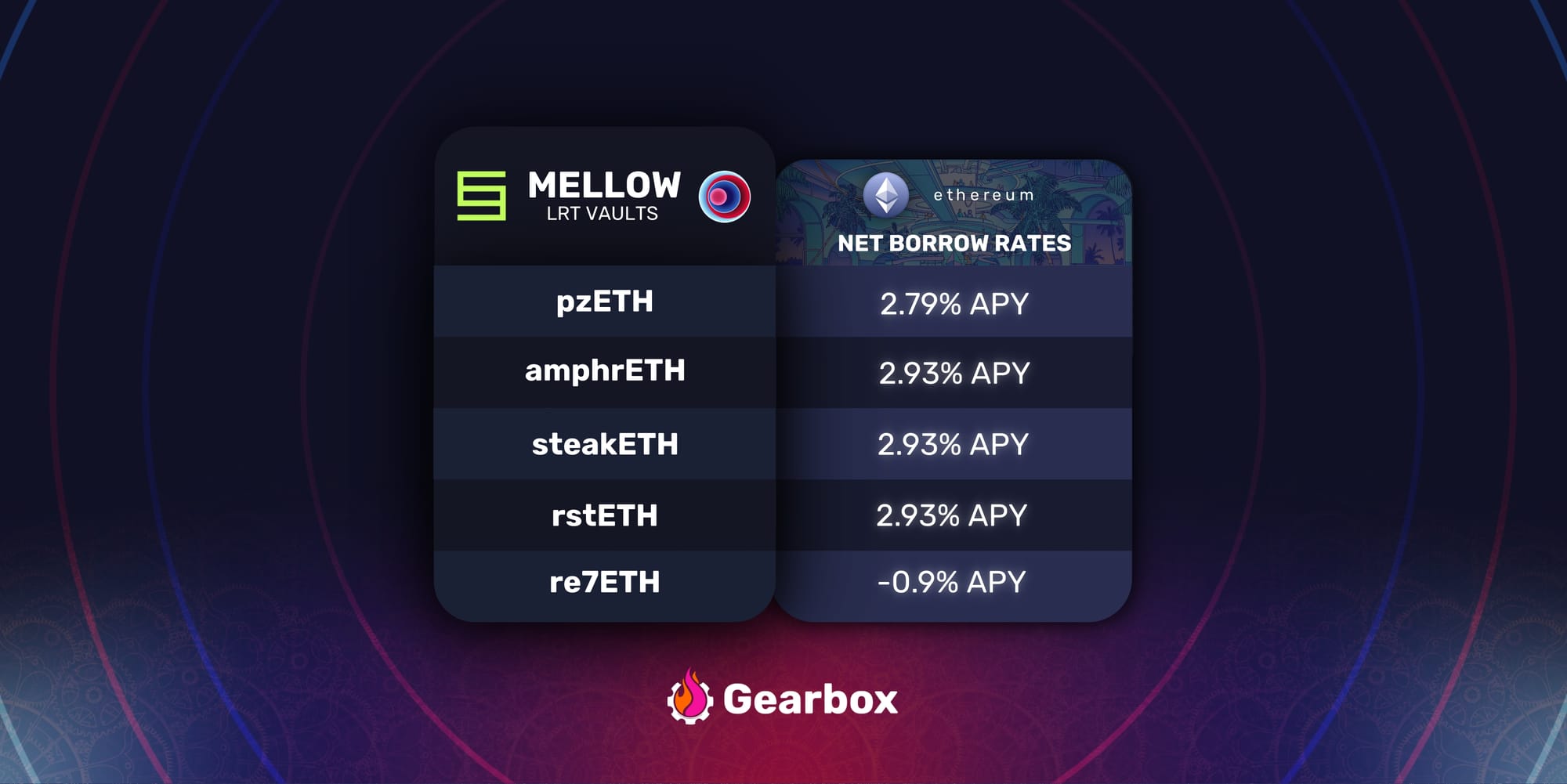

III. Lower and predictable borrow rates

Borrow rates are crucial to making leverage semi-passive. Sudden spikes in borrow rates can require active management. Borrow rates on Gearbox, though, remain predictable over the week and only update every Monday. Borrow rates on Gearbox only spike when the utilisation of a pool goes beyond 90%. Users can monitor current and future borrow rates through gauges.

Updated, 11th Septmber

For the first week, you effectively get paid to leverage Re7's Mellow vault. The strategy at the moment yields a net 0.9% positive APY. Enabling users to earn up to 8% APY while farming points. This rate is likely to change next Monday but incentivises early borrowers.

Other LRTs can be levered for rates as low as 2.79% APY.

IV. Partial liquidations

If, despite the above measures, the LRTs with friendly leverage depeg, Gearbox has another measure for user protection. Partial liquidations reduce a borrower's debt enough to bring their Health factor above 1 without completely liquidating them. This helps reduce a borrower's losses, as experienced by this borrower on Arbitrum:

V. High LT

The LT or liquidation threshold decides when a user will be liquidated. The higher the LT, the better the liquidation point. Gearbox offers one of the highest LTs in DeFi, at 90 for all the Mellow LRTs, making liquidations less likely.

This is done out of the best risk practices, proposed and confirmed by Chaos Labs.

And of course, the 2X boost makes this friendly leverage even friendlier. Make sure you open a position before borrow limits are reached.

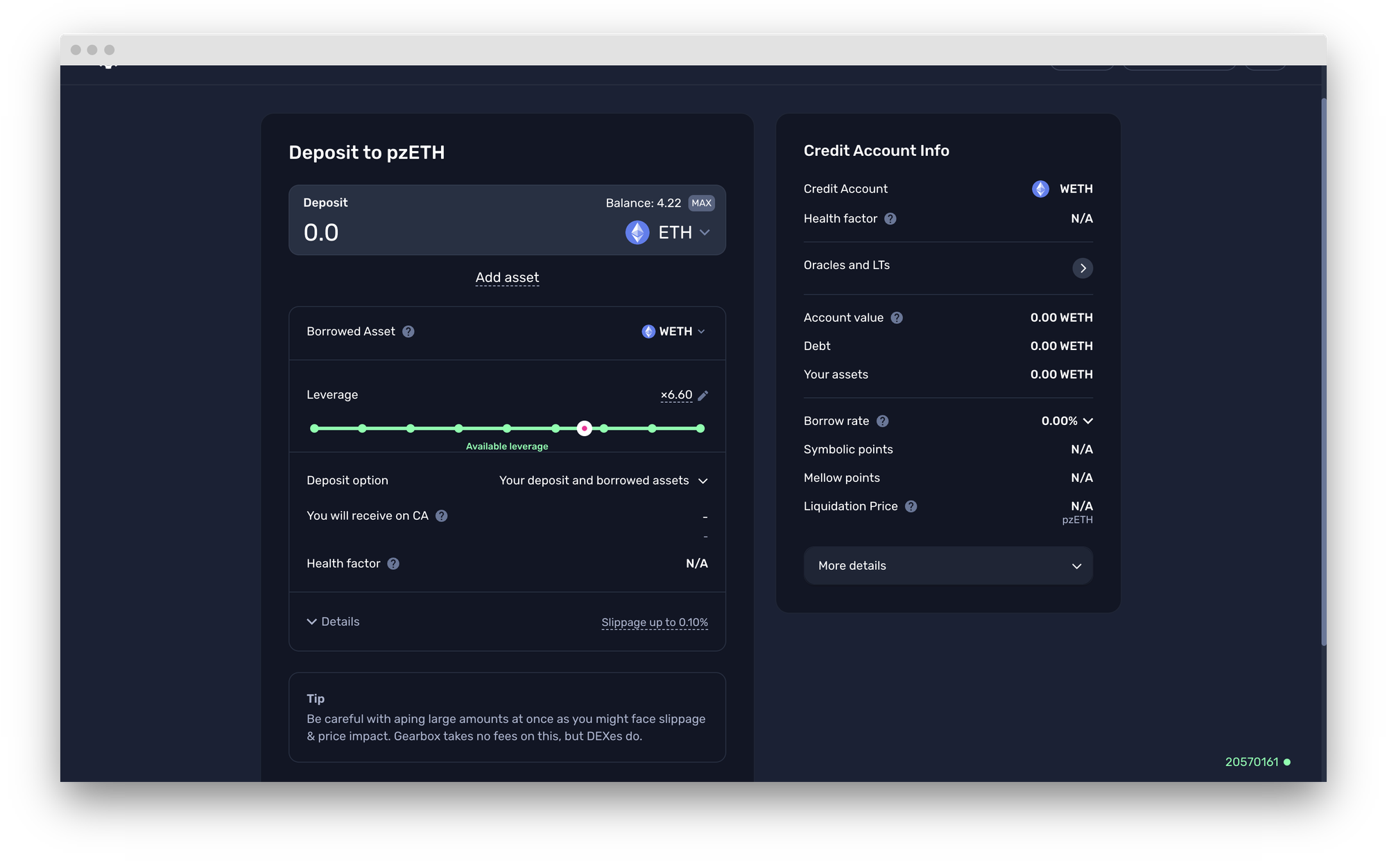

Opening a position: dApp UI walkthrough

To start it all, first, go to https://app.gearbox.fi/restaking/list

then:

A. Choose the network you want to open a position on and go to "Points": Which should bring you to this page. Choose any of the LRTs as per the risk framework you align with the most.

B. Choose Your Leverage: Customise the position as per your risk tolerance. The page also displays the borrow rate, the liquidation price and more to help you take an informed decision. All these details are up to you, you decide all the parameters!

C. Scroll to the bottom of the page and click on "Open position".

And Voila! You are all set. Multicall will now execute all the required transactions in one go, using account abstraction.

Gearbox is a DAO that has no "team", what you say in the discord matters the most and is always considered. If you think there's something we suck at, come berate us. Join the DAO - just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: