Gearbox V3 Launch Steps

STRAP IN, STRAP ON… hol’ up, hold up! Excuse my excitement. After all, this is a serious establishment! At least the developer & the security people of Gearbox DAO. Others and writers… Well, those are totally deranged people. As a result, we apologize for a 1 hour long piece that is ahead of you, but we hope you enjoy it.

V2->V3, let’s go!

The article below is a full recap of the V3 deployment, the governance process that comes with it, and product stages that could be coming in the next days-weeks. Please keep in mind that the below steps are not guaranteed unless they pass through governance. However, if governance approves the steps as outlined below, you can expect it to work that way.

TLDR for those who won't survive the hour-long read

- V3 brings a new product: margin trading with PURE liquidity. No perps, no funding rates - a totally unique way. There will be specialized UIs for margin trading and for farming.

- The first step is to launch it in December and then add farms to V3 in January;

- Liquidity Mining for passive pools will reduce and gradually move from V2 to V3, on an opt-in basis. You can decide for yourself.

- GEAR staking is coming, governing the new revenue source. There is no concrete model for the feedback loop just yet, so contribute your ideas!

- After the full transition from V2 to V3 in January, the goal is to remove LM, grow organic rates with better integrations and margin trading, add new assets for margin trading that perps can’t, deploy on L2s, and so on… TBD!

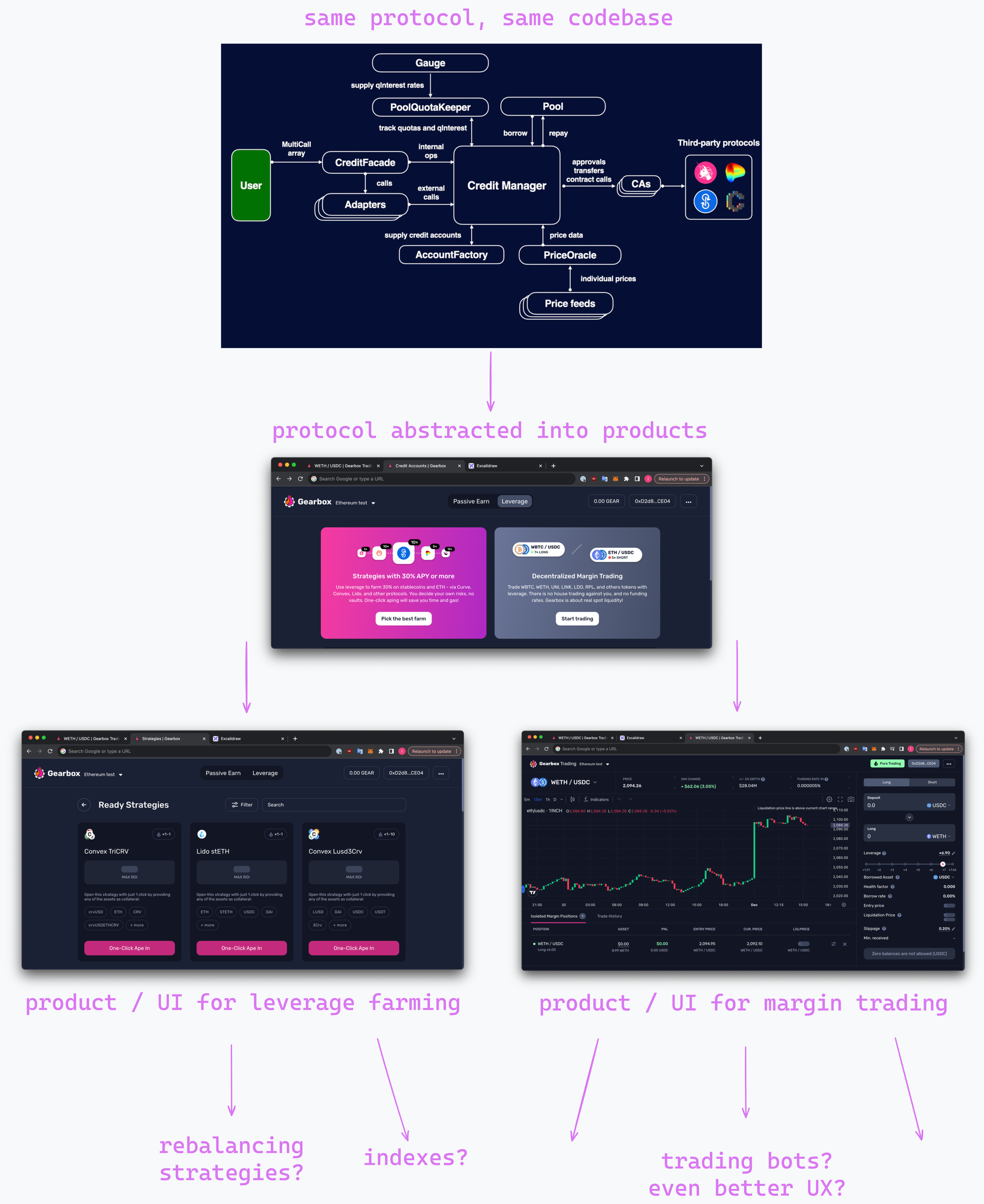

Intro: Protocol vs Product

Let’s start with narratives. Narratives come only in big scope: the future of payments, the fastest blockchain, composable leverage 2.0, etc. The “one ring to rule them all” vibes. And that’s correct, because the vision must be big. Who wants to be a part of a shawarma stand? Very few. But a platform for shawarma stands across the world? Hell yeah, sign me up!

As such, the protocol needs to be generalized: accommodate different types of assets, segment risks, segment rates, and so on. But that’s also a lot of work, a lot of contracts, monitoring… Which we have been doing since 2021! And V3 is a culmination of that, which we are very proud of. I mean, devs are proud, and we are proud of devs, so we get the proudness centipede?

Here is the catch though: while a protocol is generalized, big in scope, big in narrative - the product(s) can’t be that. You are probably familiar with interfaces that have 100 buttons:

I don’t know why Google gave me this picture, I hope it’s not offensive, but the point stands: an interface looking like this would be a disaster. While the protocol and the stack having all these features and being able to do that much would be cool! And again, we did that!

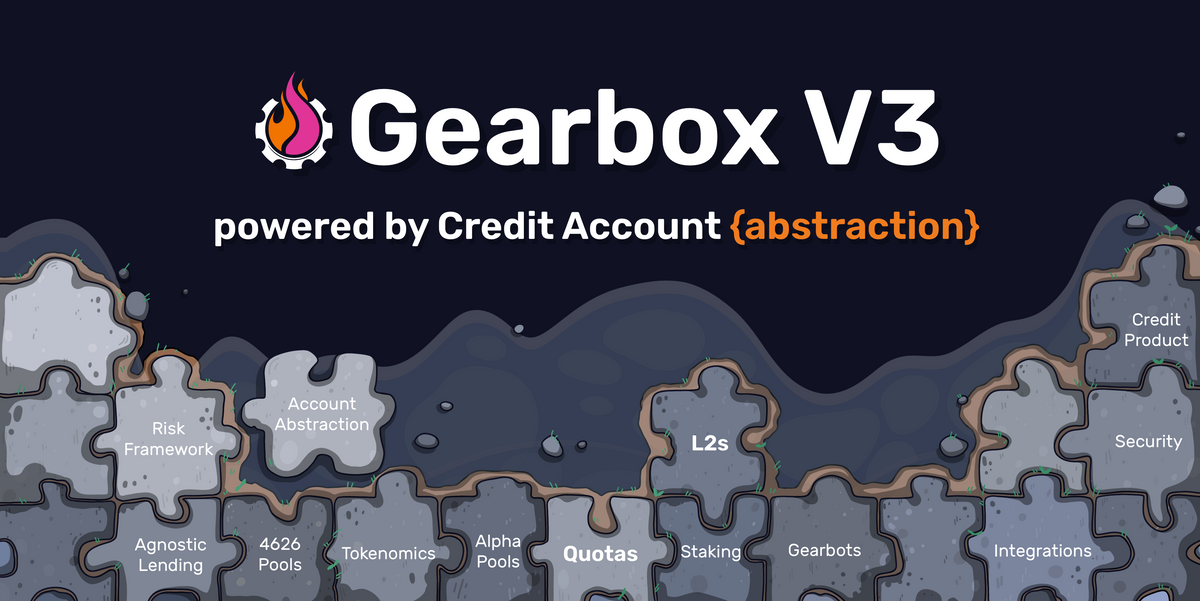

1.1 Modular protocol architecture

V3 has an even more modular architecture than V2! With Gearbox, you can:

- Have different pools, governed by GEAR or by another DAO;

- Split risks among pools and have different asset LTVs;

- Have an RWA or KYC pool even, with segmented risks;

- Have collateral limits for each asset and different rates for them;

- You get the point, right? Modular, big in scope. It can give leverage to trading, to farming, to leveraged NFTs, to leveraged RWA, and whatever else. That’s the core!

Read more about it in here:

And also here:

1.2 But how to narrow it down to one-button?

That’s the struggle: turning a generalized protocol into a one-button interface product. Especially for DeFi, where you usually have to do both things at once with limited resources. And you can’t argue with this, it’s a fact. Any attempt to make the underlying protocol super simple and primitive - simply offloads the work to the layer on top. As such, someone will have to do it anyway. So you either have infinite developers or infinite money to sponsor external ones.

The job is to connect modular architecture to different pieces of the product (interface). But in doing so, we need to avoid forcing an elephant onto a penguin :(

And that's what we hopefully managed to do, or are in the process of doing.

The most obvious applications of leverage are leverage farming (what V2 did) and margin trading. Beyond that, you can have Staking(Already integrated), RWA, NFTs, whatever. But those are the two core things. And that’s what V3 is about! Expanding the applications of composable leverage / onchain credit.

The protocol underneath is the same (new core V3) for both of these, but the interfaces will be split to allow for better UX as the two user groups are totally different in nature. One seeks leverage for higher semi-passive delta-neutral yields, another one takes directional exposure.

- Leverage Farming: where YOU choose what protocols and assets to farm with. No vaults or locking up capital. You have control over it all. Similar to V2, but better. Curve, Convex, Aura, Balancer, Yearn, Velodrome, GMX, and whatever else you can imagine. Not at first though, building those safely takes time, and deploying on L2s is a task on its own.

- Margin Trading: where you trade with real PURE assets. No derivatives, no funding rates. You trade against infinite dex liquidity of Uniswap, Curve, and others. Woah!

- Indexes: one-button leverage positions, self-rebalancing vaults… build it?

Now let’s get to the practical steps on how to V3…

V3 Launch Steps

As discussed earlier (see here), it is proposed to launch Gearbox V3 with focus on the Margin Trading use case at first. This does not mean at all that the protocol itself will be focused on this use case only. Quite the contrary, the modular architecture of v3 solves risk management issues and makes the passive lender model more fair in terms of risk/rewards.

However, launching a new protocol is always quite a complex task, so we want to reduce this complexity at the time of launch. Shortly after (within a month or two after the launch), leverage farming will also be moved from v2 to v3. Which farms and with what parameters exactly, should be decided and confirmed by the DAO later in January. Today, we discuss the setup and parameters for margin trading specifically, and Credit Managers related to it.

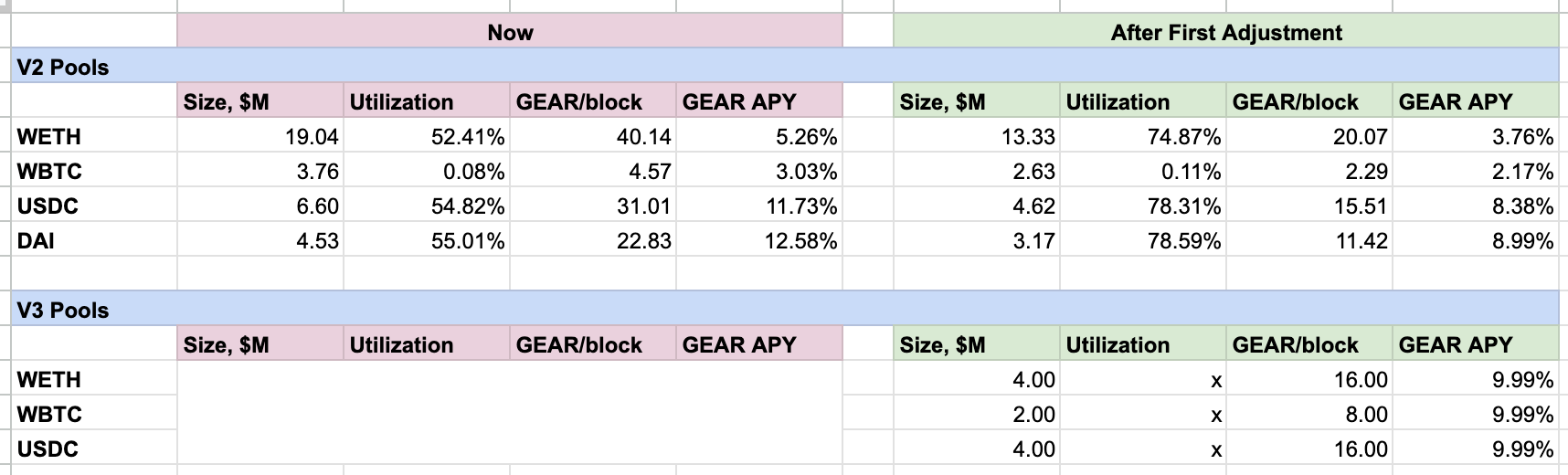

Overall, Gearbox devs and DAO don’t have access to user funds. So there is no way (nor should there be) to simply move assets of passive lenders or leverage borrowers. As a result, it’s an opt-in process from either side. The goal is to migrate the liquidity and users from V2 to V3 gradually over the course of December and January, with the help of a shifting LM program.

2.1 Passive lenders: Opt-into V3

Passive lenders have full control over their capital. Nobody can move their funds without their consent. So if some passive lenders prefer to never withdraw from V2, then be it. However, as the proposal of migrating Liquidity Mining program + organic rates gets approved step-by-step, it might be logical for everyone to jump into V3. A safer, more utilized protocol, hopefully.

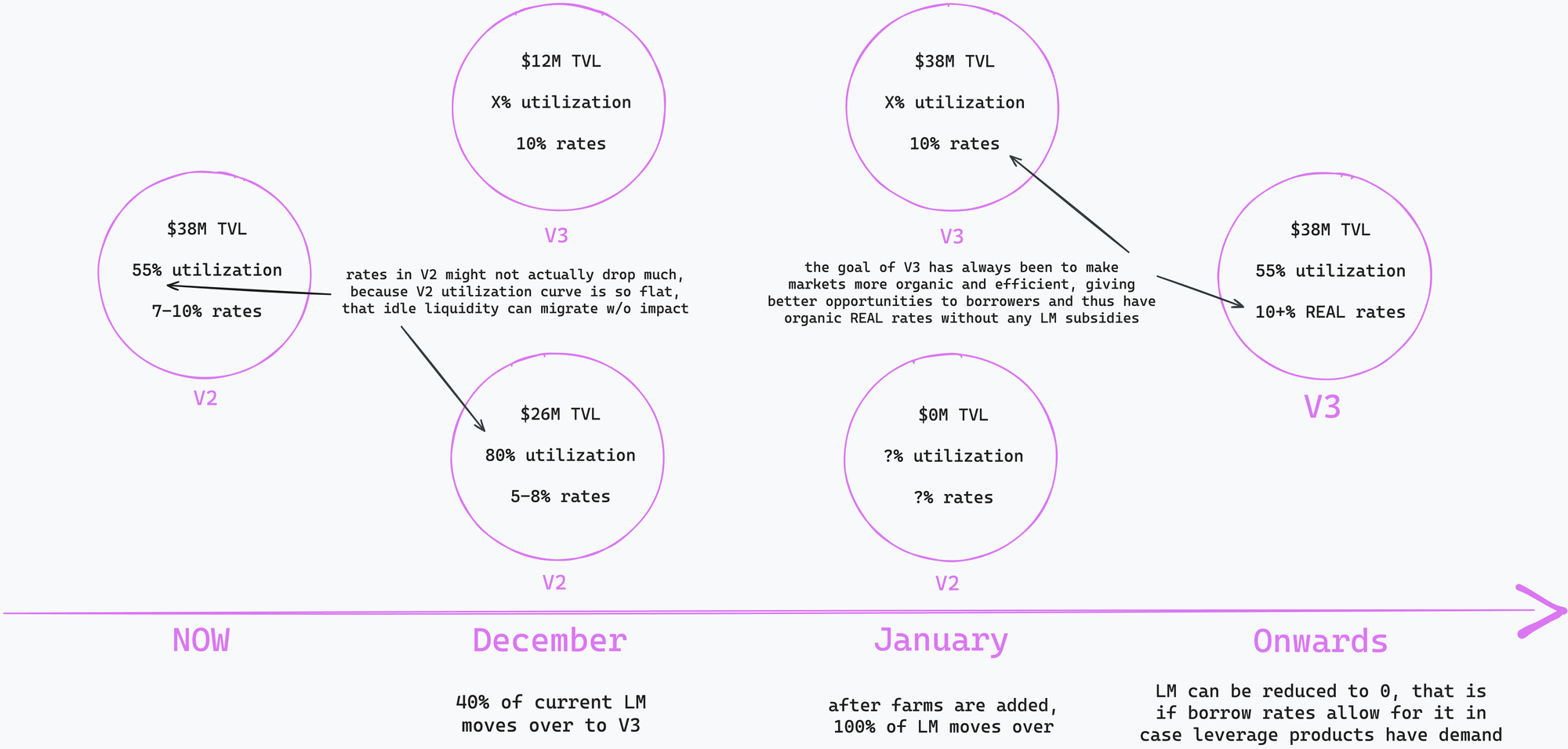

Liquidity Mining isn’t shifting all at once, it will be gradual, as the proposal outlines. The idea is to move about 40% of the current LM, and later on move it fully in January or even sooner. The goal eventually, as soon as possible, is to almost fully turn off any LMs and have close to 0 GEAR emissions! However, we are still in the bootstrap stage, so an LM is a necessary evil.

Discussion on partial LM movement!

The speed depends on how fast utilization grows in V3. It could take until January, because at first only Margin Trading PURE will be available. In January, farms from V2 should migrate as well and help with the utilization.

When you go to the new interface, if you have some V2 passive liquidity, the interface will suggest to you to move it. That’s all, 1-2 buttons at max. Stay in it for ages!

The new liquidity mining contracts are based on the 1inch ones, so there wouldn’t be any semi-manual merkle tree stuff anymore. Vesting contracts would accumulate your GEAR that you’ll be able to claim. The way it works is that an interface suggests to stake your dTokens (passive lender side tokens) into sdTokens. Very simple, the way you are used to it everywhere.

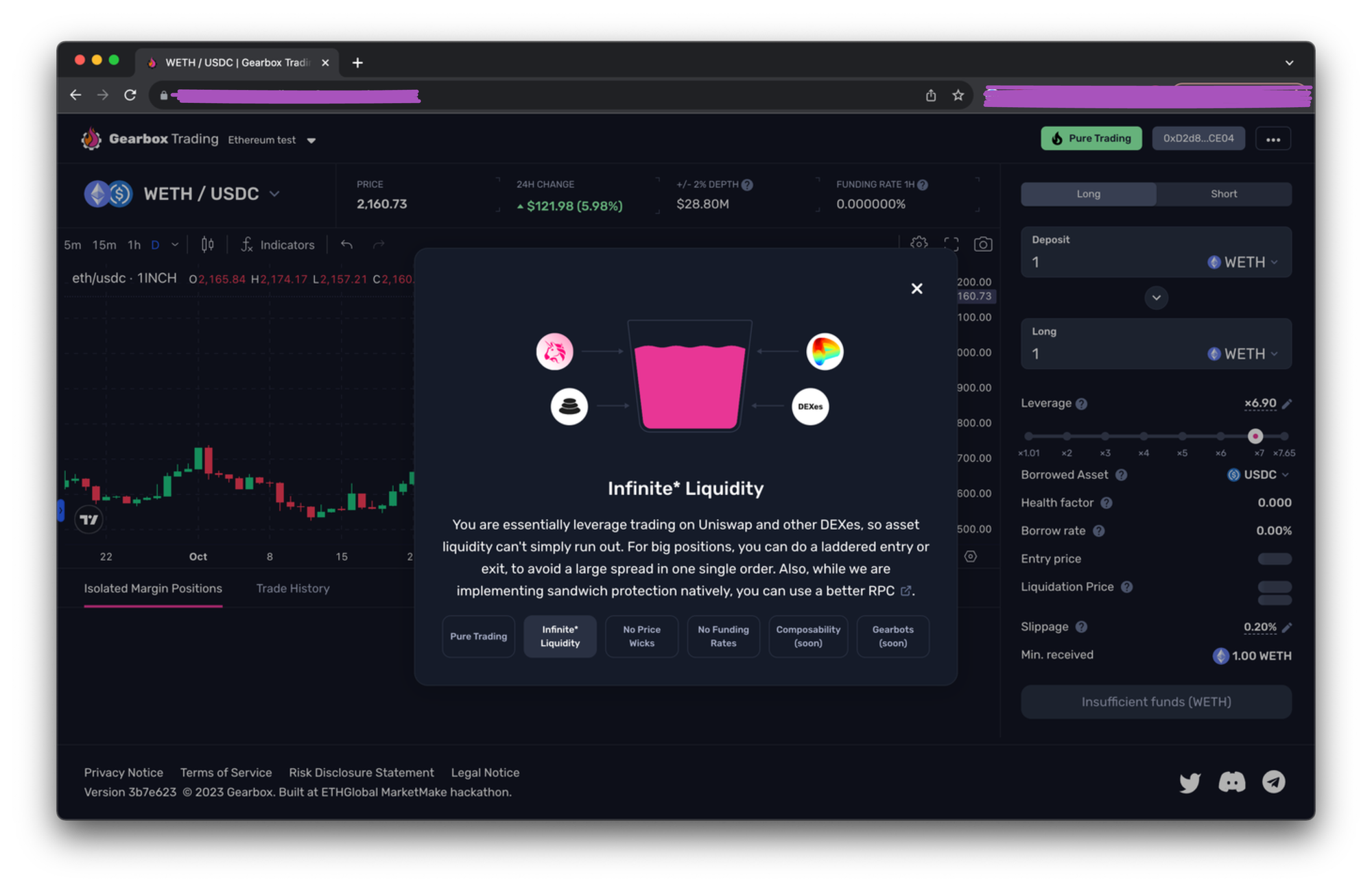

2.2 V3 starting with PURE margin trading

While the contracts will be deployed for everything at once, polishing two interfaces at the same time can be a difficult endeavor. As such, the first “product” to start with - will be margin trading. Margin trading will allow long or short x10 ETH and WBTC, about 5x long for LINK, LDO, CVX, APE, MKR, and some other main Chainlink oracle tokens. Nothing fancy at first.

- 9x long or short ETH and WBTC + make those farm at the same time!

- 5x long LINK, LDO, UNI, MKR, FXS, CRV CVX, APE etc.

Because this is PURE real spot liquidity, you can’t short something that doesn’t have a passive pool to borrow from (borrow -> sell). Therefore, apart from stables / ETH / WBTC, you can’t short the altcoins. But who needs shorting huh, supercycle in tact? Jokes aside, shorting can be enabled later (by making passive pools of those assets), just not at first.

The new V3 allows the protocol to add medium and even long-tail assets, segregate risks into different pools, and so on… So the potential applications are amazing! But give it time, please, as these iterations are not immediate. But the core codebase allows for it, which is great.

All of that comes with a huge twist: these are not perps, and no funding rates!

- Forget about price wicks and funding rates! Gearbox offers leverage (onchain credit) with pure spot liquidity from across many DEXes, including Uniswap and Curve. A familiar interface, yet with a safer engine underneath and PURE liquidity.

- You are trading with all the available DEX liquidity worldwide. There is no isolated virtual AMM here. All calculations are based on Chainlink spot oracle prices, which derive information from many DEX and CEX, thus helping avoid price manipulation and wicks.

- Since Gearbox is about pure onchain liquidity, there is no need to maintain both sides of the book with extra fees. As such, no funding rates - only borrow rates. On an annual basis, borrow rates are almost always cheaper!

- You are essentially leverage trading on Uniswap and other DEXes, so asset liquidity can't simply run out. For big positions, you can do a laddered entry or exit, to avoid a large spread in one single order. Also, while we are implementing sandwich protection natively, you can use a better RPC, MEVBlocker.

- Gearbox reimagines leverage 2.0 by offering you more than just long-short. You can have your short position farm stables, or your ETH long in a leverage staking pool at the same time. You can trade alts against stables, WETH, or WBTC. Composability!

Here is the proposal text to see all the details:

V3 Launch Paramters Discussion

Open Access - No Ninja SBT

Speaking of which, trading-related Credit Managers, if approved, will have no Ninja SBT list. A fully open access without the mumbo jumbo. As for farming Credit Managers a few weeks after launch, it is advised to keep the Ninja SBT model due to the higher safety requirements with farming and large borrow limits. But that will be discussed in a separate proposal later.

2.3 V3 Farming and Current CA Users

V3 VIBES coming to help

As noted above, V2 isn’t going anywhere, but it might start shrinking if LM is moved over to V3. Passive lenders would migrate, rates would skyrocket, as such, borrowers would be incentivized to close their positions. Again, it’s a choice.

This of course is a nuisance to the current leverage Ninjas, apologies for this! The goal is to now migrate to V3 and never have to go through these hoops again, hopefully. In the process of closing / reopening you might incur slippage that you didn’t otherwise plan to.

As a result, the V3 VIBES is holding a vote to compensate you for your trouble and for being amazing users and community members for so long. The goal of V3 VIBES isn’t to give free money away, but to bake in possible slippage / gas fees that come with migrating over the positions. They will be able to assist you with all the steps and send you some GEAR as a “thank you”. The exact amount is currently TBD. Please reach out on Discord!

If you wanna read about VIBES (other things it does), check this out:

Farming to migrate in January

Since farms from V2 to V3 will only be ported in January, you might not be able to close and reopen right away. However, since LM is only moving to V3 at about 30-50% of current rates, it shouldn't be an issue overall as the other passive lenders might stay until the end.

You can basically decide to take no action and remain in your leverage positions until then (just keep an eye on the borrow rates). When the full migration will be ready, you can close your positions and reopen them with V3. We’ll make sure to give your Ninja SBTs in advance!

Enlarge the picture to the get the steps:

2.4 GEAR Staking and Gauges

GEAR has gotten a few sinks throughout the year, and V3 will bring a major one: staking (freezing for 28 days) your GEAR to decide on the extra rates. These extra rates are taking effect every epoch, being once a week. You can decide whether you think a borrower should pay more for asset X or less, with an interesting game theory emerging as a result.

Those extra fees, an extra revenue source in fact, are then split between the lenders (to make the yields more organic and competitive) and the DAO new fee multisig. You can imagine protocols stocking up GEAR to lower the fee for their own strategies!

These gauges have nothing to do with inflation, like in the ve-Curve model. Quite the opposite, gauges are aimed at chipping away from the most profitable leverage positions that borrowers take. However, one shouldn’t bill borrowers beyond market rates, or the protocol becomes uncompetitive. Yet again, game theory!

This GEAR staking will be available through the interface from the very beginning. Currently, there is no reward mechanism that would compensate GEAR stakers for their time and gas fees, apart from more governance control. However, that’s TBD to anybody to design. You’d probably want to jump in this conversation and put some thoughts in there:

Summary, again!

Summary as follows:

- V3 brings a new product: margin trading with PURE liquidity. The protocol can now offer more! There will be specialized UIs for margin trading & for farming.

- The first step is to launch it in December and then move farms to V3 in January

- Liquidity Mining for passive pools will reduce and gradually move from V2 to V3, on an opt-in basis. You can decide for yourself

- GEAR staking is coming, governing the new revenue source. There is no concrete model for the feedback loop just yet, so contribute your ideas!

- After the full transition from V2 to V3 in January, the goal is to remove LM, grow organic rates with better integrations and margin trading as a product, add new assets for margin trading that perps physically can’t, deploy on L2s, and so on…

Jump into the DAO Call this Wednesday in Discord, let’s go!

As you can see, there are a lot of exciting things to build + protocol features to govern. So don’t be afraid to ask questions, and let’s build it together <3

Come join the DAO if you would like to contribute or just vibe — just get involved on Discord or Telegram. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better.

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And, of course, Notion monthly DAO reports: