Gearbox Protocol: 2024 Recap and Wind of Change

Gearbox began with the idea of “composable leverage” in 2021, empowering DeFi users to maximize capital efficiency. Gearbox continues delivering on that vision to date.

Over the years, it grew to more than that. For example, offering multicollateral loans on your portfolio in just one click. This product has been live since summer, and it utilizes the same audited financial infrastructure of Gearbox and the same Credit Accounts. That's right; the underlying Gearbox lending infrastructure is really powerful beyond just leverage.

While leverage remains valuable, it’s becoming increasingly common across lending protocols. Most protocols, further, compete for the same small set of users, but Gearbox offers so much more than that! So for DeFi to grow, it’s necessary to bring in more users, to make onchain credit more accessible, to make protocols more discoverable. And that’s why Gearbox must be…

More than just leverage.

How? Read about Gearbox’s upcoming 2025, a teaser for the permissionless credit layer, token utility strengthening plans, and a quick recap of Gearbox in 2024.

2024: Gearbox Recap

This month sees Gearbox turn 3!

Below are the key takeaways from our 3 years of building before we dive into how the industry has changed over the same period. The metrics shared are for Gearbox V3, introduced towards the end of 2023 with the goal to expand new integrations and support credit beyond bluechip assets. Here’s how it went...

The DAO previously shared a self-evaluation blog– giving a comprehensive overview of DAO operations, areas of improvement and other initiatives. You can find that blog below. Full transparency.

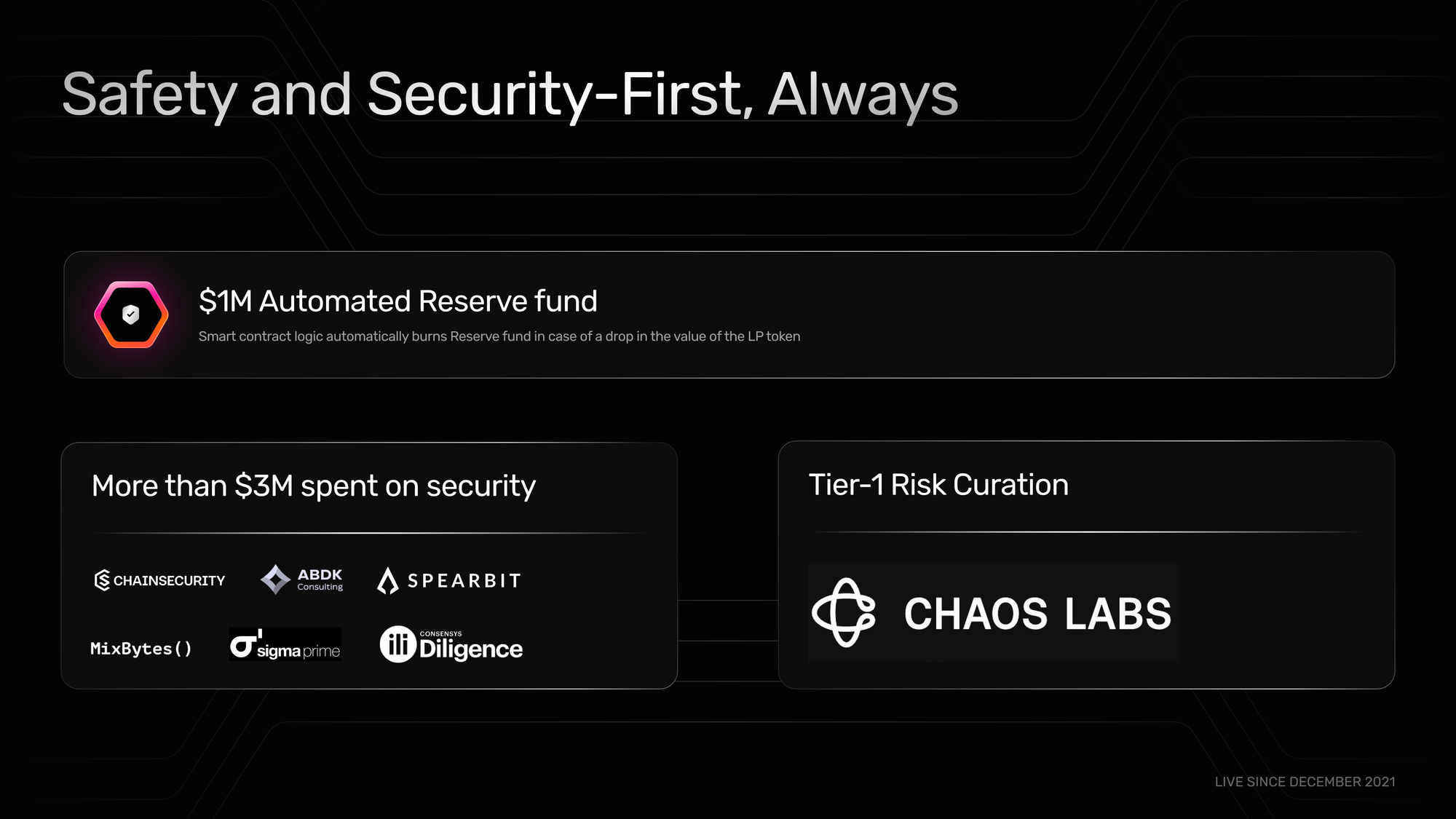

1. No Exploits, $0 Bad Debt Since 2021

The most important task for a DeFi protocol is to ensure that user funds remain safe. Which is why Gearbox’s most coveted achievement remains never incurring bad debt or being exploited despite processing over $7B in volume and being live since 2021. This has been made possible through:

- $3M+ spends on security and risk management

- 10+ audits

- Whitehack and community support

- Devs who live and breathe security

- Multiple protocol health monitoring tools

- Rigorous pre-deployment testing processes

Being live for 3 years in DeFi without any exploits or bad debt requires utmost attention to risk and security and that is exactly what you get with Gearbox. While DeFi and smart contracts remain an unexplored forest, multiple teams work day and night to secure Gearbox as much as possible. You can dive into security here.

2. Integrations: Ethena, LRTs, BTCfi, LSTs, and more

Integrating more protocols, networks and assets enables the protocols to onboard more users and deepen the network effects. V3 empowered the DAO to integrate high-demand protocols, and over the course of the year, the DAO integrated 40+ new assets and expanded to Arbitrum and Optimism.

You can read about why we prioritised network effects and what exactly they mean for Gearbox from our post here.

These new integrations enabled the DAO to capture significant growth throughout the year. Some notable integrations and their peak TVLs were:

• Renzo: $118M

• Ethena: $98M

• EtherFi: $75M

• Symbiotic: $29M

3. Rising Number of Users

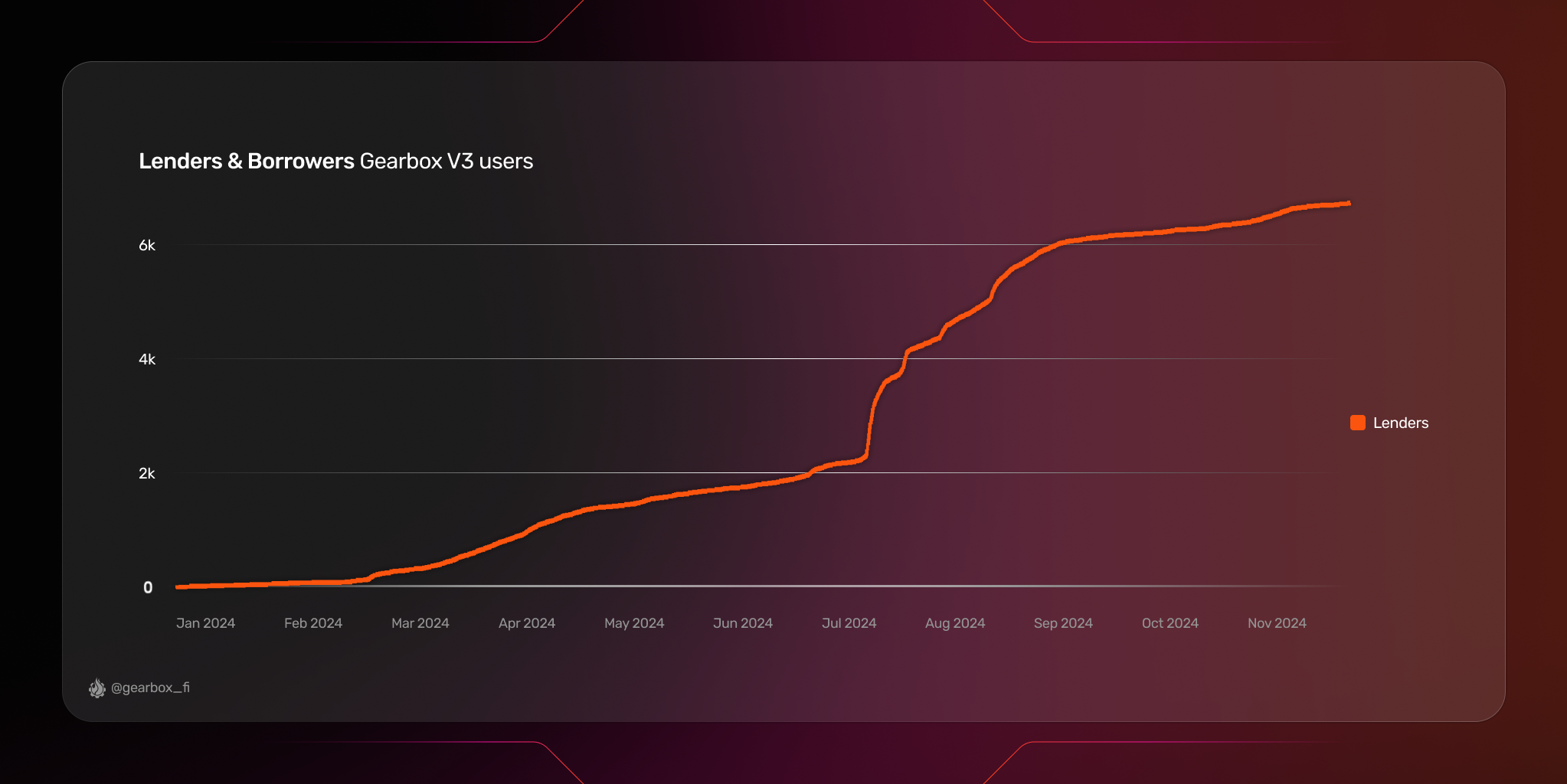

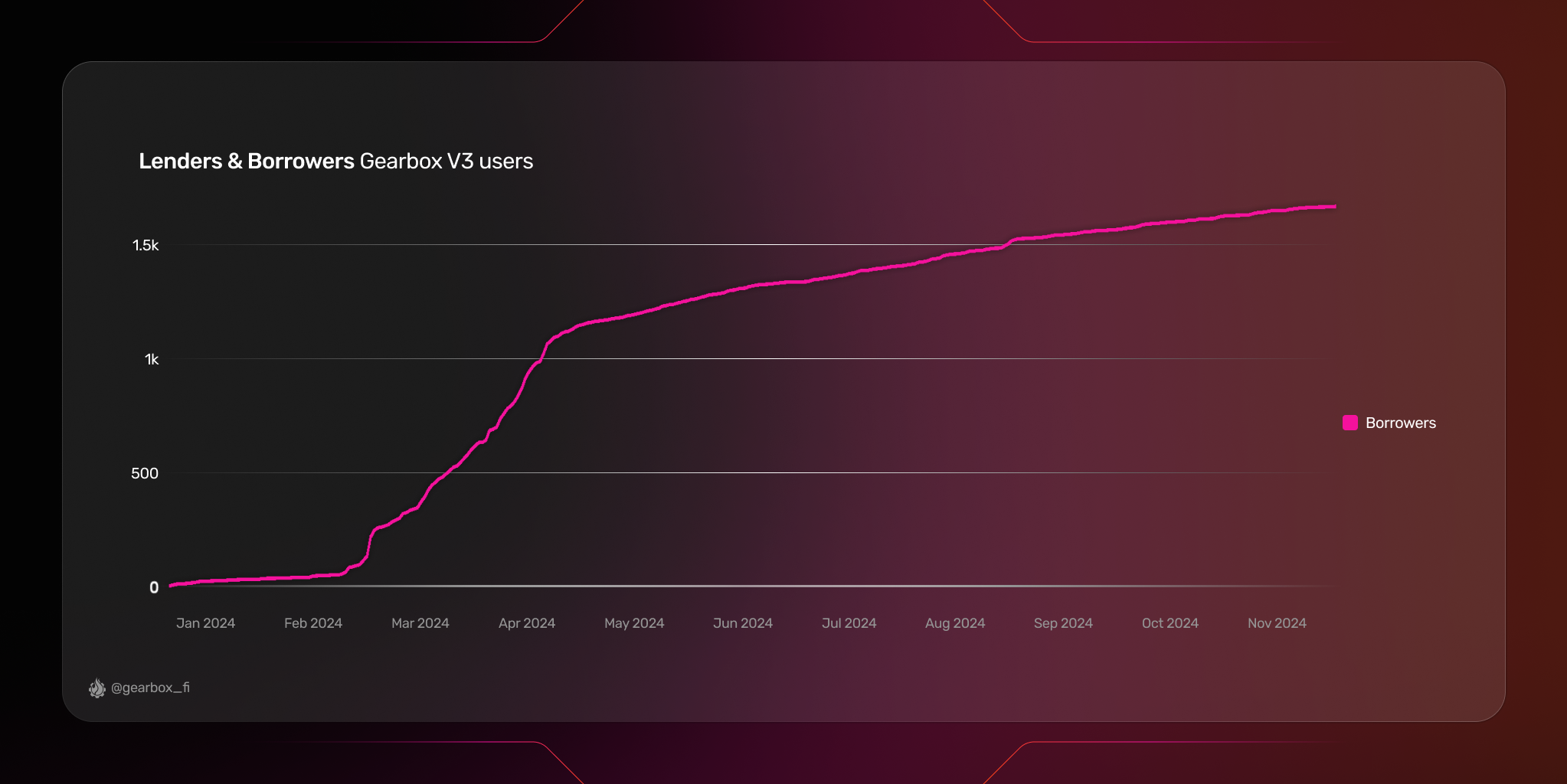

The new integrations enabled the protocol to capture significant network effects. These effects have translated into a 300% increase in TVL from V2 to V3. The number of users on Gearbox, too, saw a similar effect.

• 4X more lenders. The new opportunities led to an increase in demand which enabled more lenders to supply passively.

• The borrowers on Gearbox 30Xed post introduction of new additions. Rising from ~60 in January to 1800 in June. 1900+ Credit Accounts still remain active.

4. The Highest Utilization Among Lending Protocols

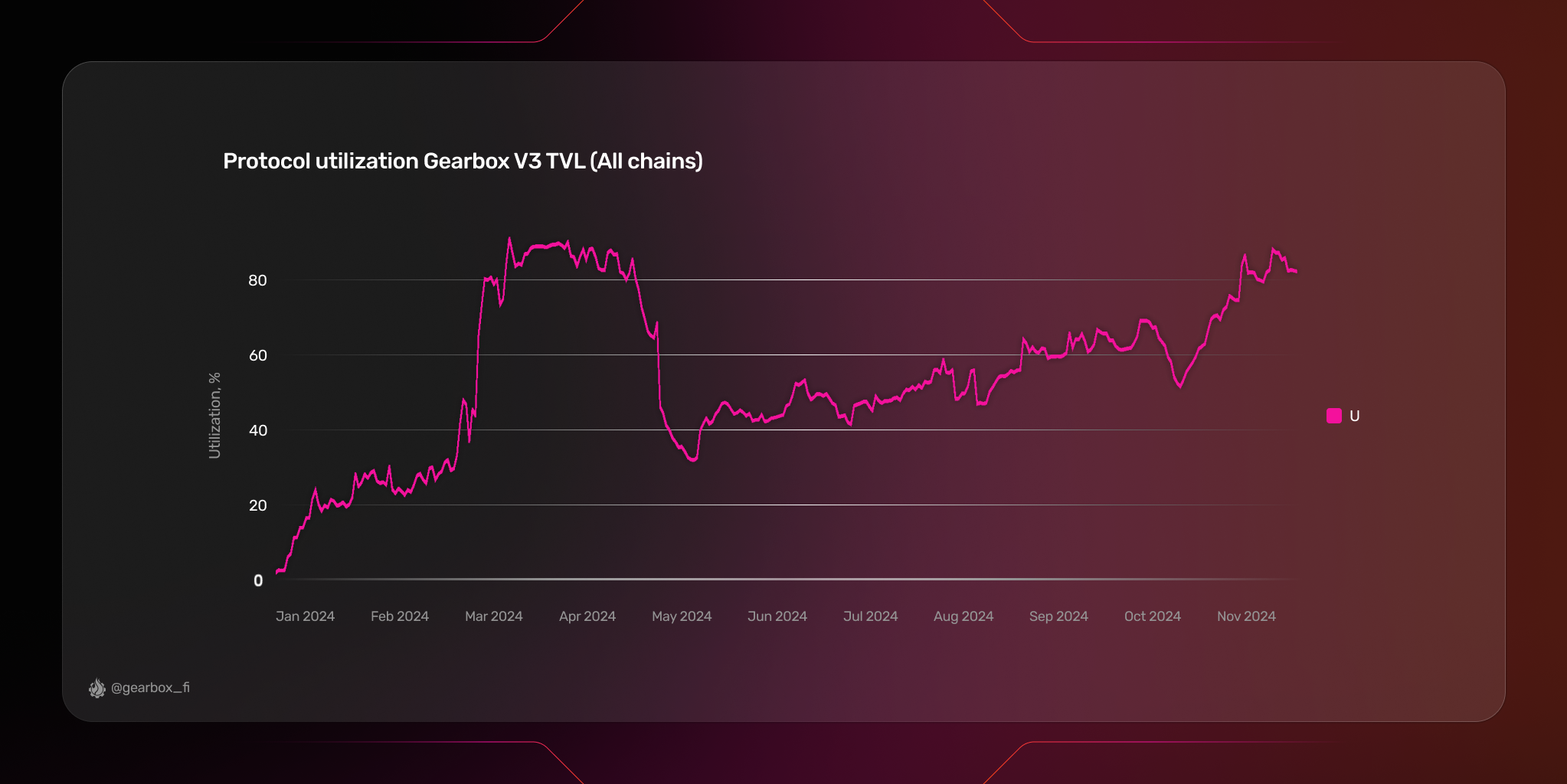

The growth in TVL and users directly boosted the DAO's financial health, with the protocol earning over $4M in revenue throughout 2024 since V3 went live.

During the same phase, the protocol saw lending pool utilisation rise to 80%+ and reach ATH. A higher utilisation is necessary to ensure TVL growth, revenue generation and overall growth. Despite a choppy summer, the utilisation is now near ATHs at 80%+. Owing to high utilisation through new integrations, lenders on Gearbox earned $12M+ in 2024.

Want to go through some stats? We have a charts-analytics tool for that.

5. Partners and Transparency

As a credit protocol, your top priority is security and risk management. This becomes even more important as you aim to ramp up integrations. To further strengthen our risk and transparency measures, the DAO onboarded 3 key partners.

5.1 Chaos Labs: Risk Management

The robustness of your risk parameters determines the robustness of your protocol during volatile times. To ensure risk parameters on Gearbox are deeply analysed and tested, the DAO onboarded Chaos Labs. Chaos Labs also manages risk for other major DeFi protocols such as Aave, DyDx and others. You can find an example of the depth of research they do to onboard as asset in the blog below.

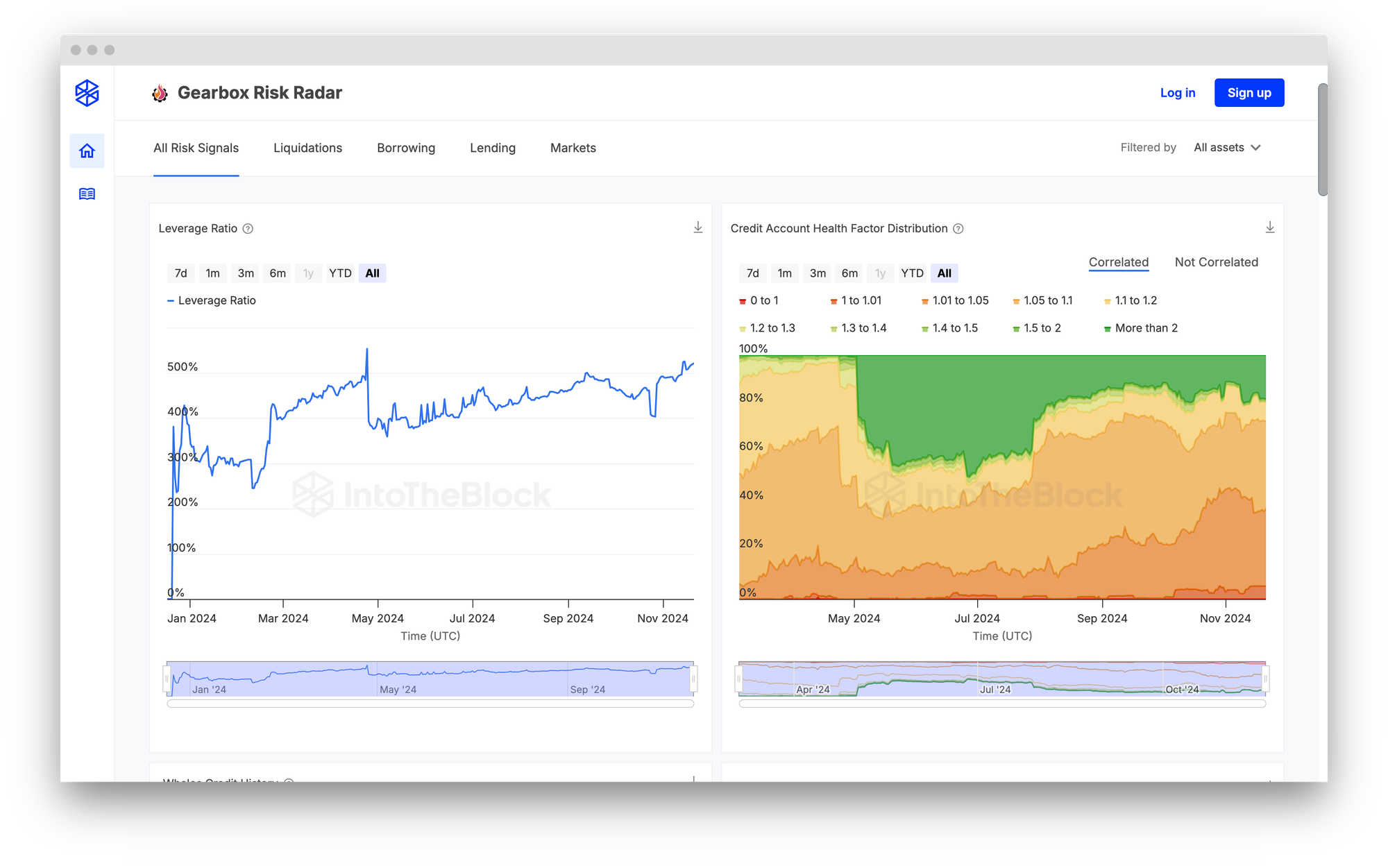

5.2 IntoTheBlock: Risk Transparency

As crucial as risk is, evaluating risk onchain is not extremely user-friendly. Going back to first principles, the DAO didn't want users to simply trust the recommended risk parameters but also be able to verify the risk in the system. To make this happen, the DAO partnered with ITB to create an institutional-grade Risk Radar which enables users to transparently verify risk metrics.

5.3 Token Logic

To enhance the financial transparency of the DAO, TokenLogic is creating a financial dashboard for Gearbox to assist users in assessing the DAO's revenue, runway, and overall financial health.

While that's what has happened the DAO and the protocol, what matters is how we grow from here. To do that, we have to understand what's currently happening better...

The Convergence of DeFi

Since Gearbox launched in 2021, DeFi has evolved significantly. Over the three years, we have seen the introduction of fixed-income protocols, basis-yield derivatives, restaking, BTCfi and more. The three years have also seen clear leaders emerge within these segments and the concentration of users and TVL happen for certain protocols.

For the DeFi lending space, the innovations have largely been related to the architecture of the protocols. The majority of the protocols today differ in the mechanism in which they deliver lending. We previously wrote about these architectures, you can read them below.

While these innovations in mechanisms help the protocols achieve differentiated features, from an end-user perspective, the focus remains simple: the ability to borrow and/or achieve leverage. This is where we see DeFi converge.

Lending protocols, usually, rely on external collaterals and assets to grow. Because the last few years have seen dominant assets rise, the most demanded assets across protocols have become the same:

• Stable Borrowing: Driven by sUSDe across protocols

• ETH Borrowing: Driven by LRTs across protocols

In this situation, we see multiple lending protocols compete for the same set of users and for TVL through the same assets. The LTVs and the process of using the protocols might be different, but for the end user what matters is the capital efficiency they achieve.

This means that for protocols today, growth isn’t just about building efficient technology—it’s about distributing that technology to users and scaling its impact.

2025: The Way Forward [Teasers]

2025 for Gearbox, thus, will be about better distribution of the protocol, bringing in new users to DeFi and transitioning from a leverage protocol to a full stack onchain credit layer. What you will read below is just a small subset of the ongoing developments and initiatives. There is so much more to it!

For example:

- ongoing integrations with new protocols & assets;

- new chains and ecosystem rewards;

- third-party permissionless Gearbox instances;

- deeper technical research not explained below;

- and more... but for now, let's go through the few things we know.

1. Credit Account Abstraction

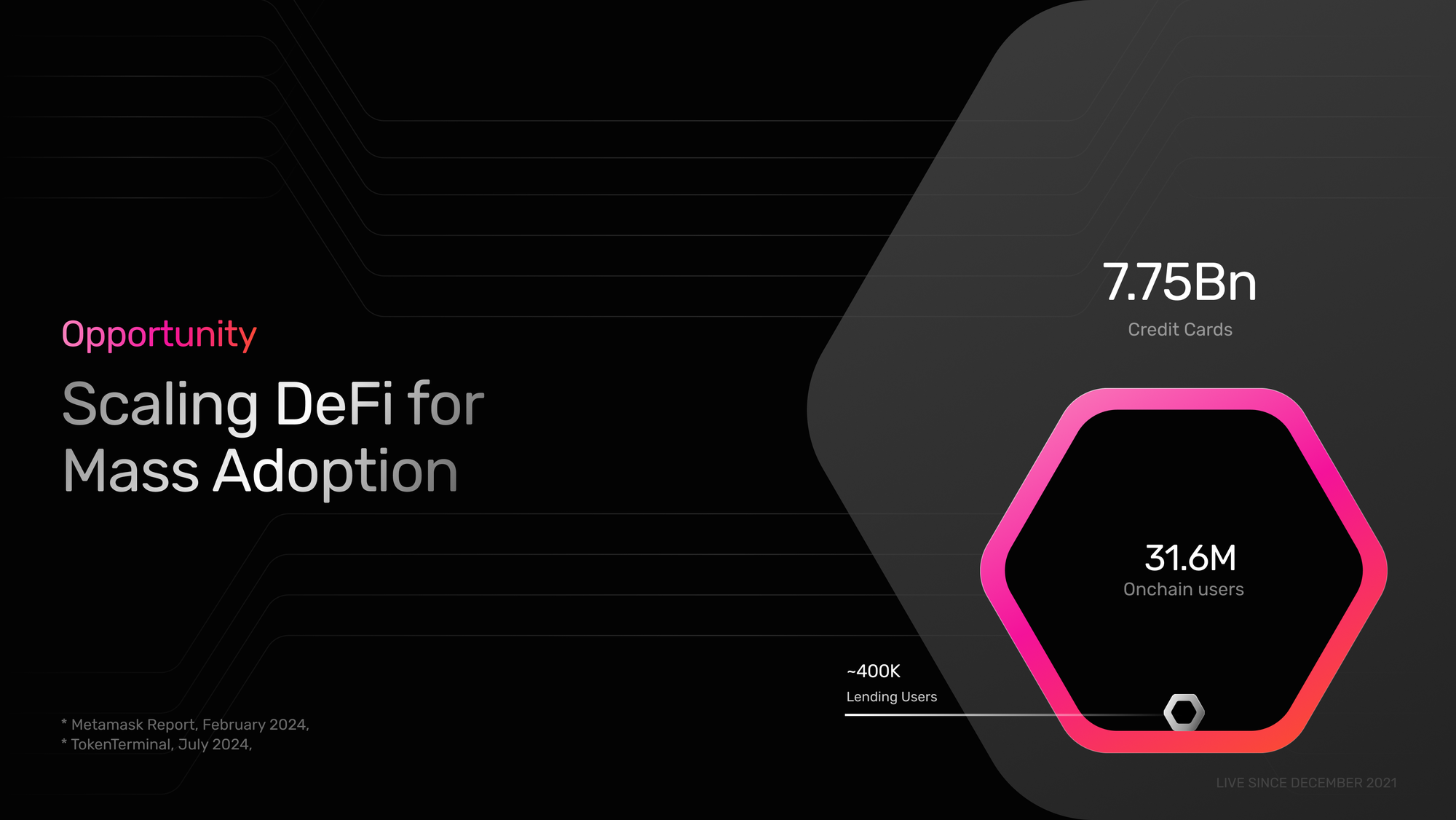

Where does the untapped distribution come from? Time to zoom out.

Active onchain users are not always recruited as DeFi users. While segments like memecoins and gaming attract more participants, DeFi—especially beyond decentralized exchanges (DEXes)—often doesn't become a part of every user's onchain experience. However, one aspect of the journey that remains consistent across all segments being onboarded is the use of wallets.

The penetration of DeFi continues to be less than 2%, while a lot of people are already in crypto and are already onchain. So the task is to make them get to DeFi. Through Credit Account Abstraction, Gearbox intends to reimagine the lending and credit experience by enabling them natively inside any wallet.

It's not a separate integration for a wallet, it doesn't lock a user's collateral in some third-party contracts, and it's enabled natively. More details to follow as we approach the new year. There is a ton of research and integration information to ship. If you are a wallet team or work with wallet SDKs and want to chat - just ping in the community Telegram (link at the end).

The research is already ongoing with some of the industry-leading teams in the Account Abstraction and Wallets space. We'd love to and we need to chat to more teams. Do reach out if this sounds intriguing.

You can read more about this from the innovator of Gearbox, 0xMikko:

— 0xmikko.eth 📍DevCon 🇹🇭 (@0xmikko_eth) December 17, 2024

2. More Than Just Leverage: Permissionless Credit Layer

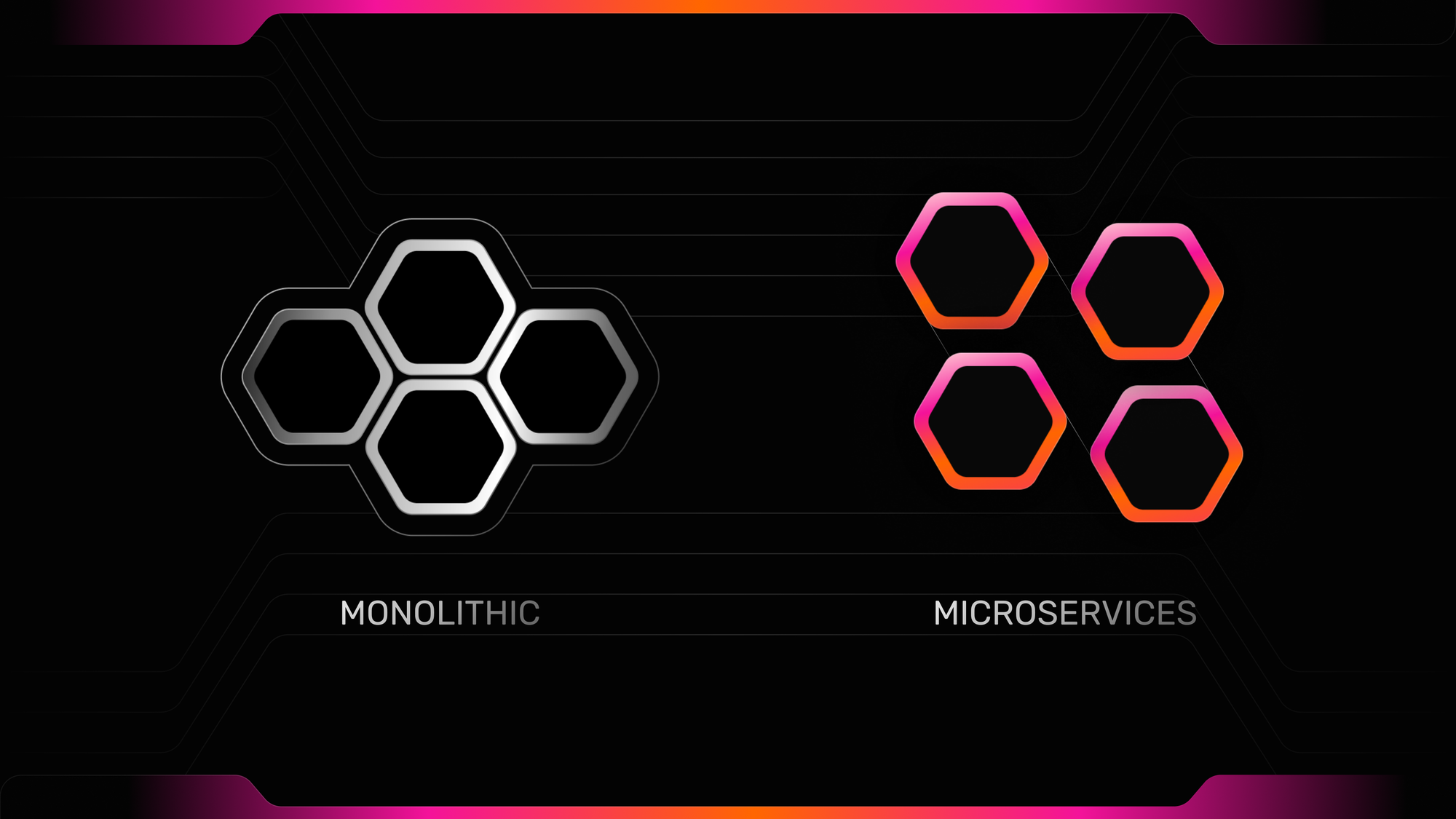

To make the credit layer vision a reality, the said layer needs to be available across networks, which for EVM means multiple itss. Traditionally, deployments on L2s require significant dev resources, time and can be costly. This has been true because of how most protocols were built: in a monolithic design. The monolithic design treats the protocol as a whole and requires all of the codebases to be configured and deployed together to work.

Gearbox has been spearheading the Microservices-based architecture and is taking that further. Microservices break down a DeFi protocol into smaller, independent services (e.g., pricing, lending, collateral management). Each can be developed, deployed, and scaled independently.

This eliminates the need to reconfigure the entire codebase when deploying to an L2 and makes deployments easier, faster, and cheaper. Thus, Gearbox can soon scale easily and soon even permissionlessly.

How does the architecture work? Learn some snippets below:

3. Improving UX: Where AI meets DeFi

While scaling increases the ease of credit access, the UX of utilising credit onchain or managing your strategy requires significant manual interventions. Gearbox's 0xMikko published their research and a working prototype of how AI agents in DeFi can be used to make deterministic decisions and carry out tasks.

Decentralized Autonomous AI Agents: The Future of Smart Contracts

— 0xmikko.eth 📍DevCon 🇹🇭 (@0xmikko_eth) November 11, 2024

Truly gamifying DeFi with AI… omg buzzwords, ban+report?! Not quite. We can make strategies, gamified entries-exits, conditions for positions, etc. All are accessible via simple text. Intelligent DeFi made real.… pic.twitter.com/jcGqpWPjcw

This research is crucial to bring automation and a CEX like in-app UX for users. A user's input on when a position should be closed, switched or opened automates the UX and makes it more CEX-like. The DeFi AI agents can work as an AVS on EigenLayer. Stay tuned for more research!

Eigenlayer will accelerate the onchain AI agent economy.

— Sreeram Kannan (@sreeramkannan) November 13, 2024

—————————

Why?

—————————

AI agents are too complex to run onchain, and too hard to do zk proof for.

—————————

Cryptoeconomic security is the only framework for them.

In this talk @0xmikko_eth from @GearboxProtocol builds… https://t.co/dNRwL8X8UQ pic.twitter.com/gCDqHJGmF4

4. GEAR Tokenomics

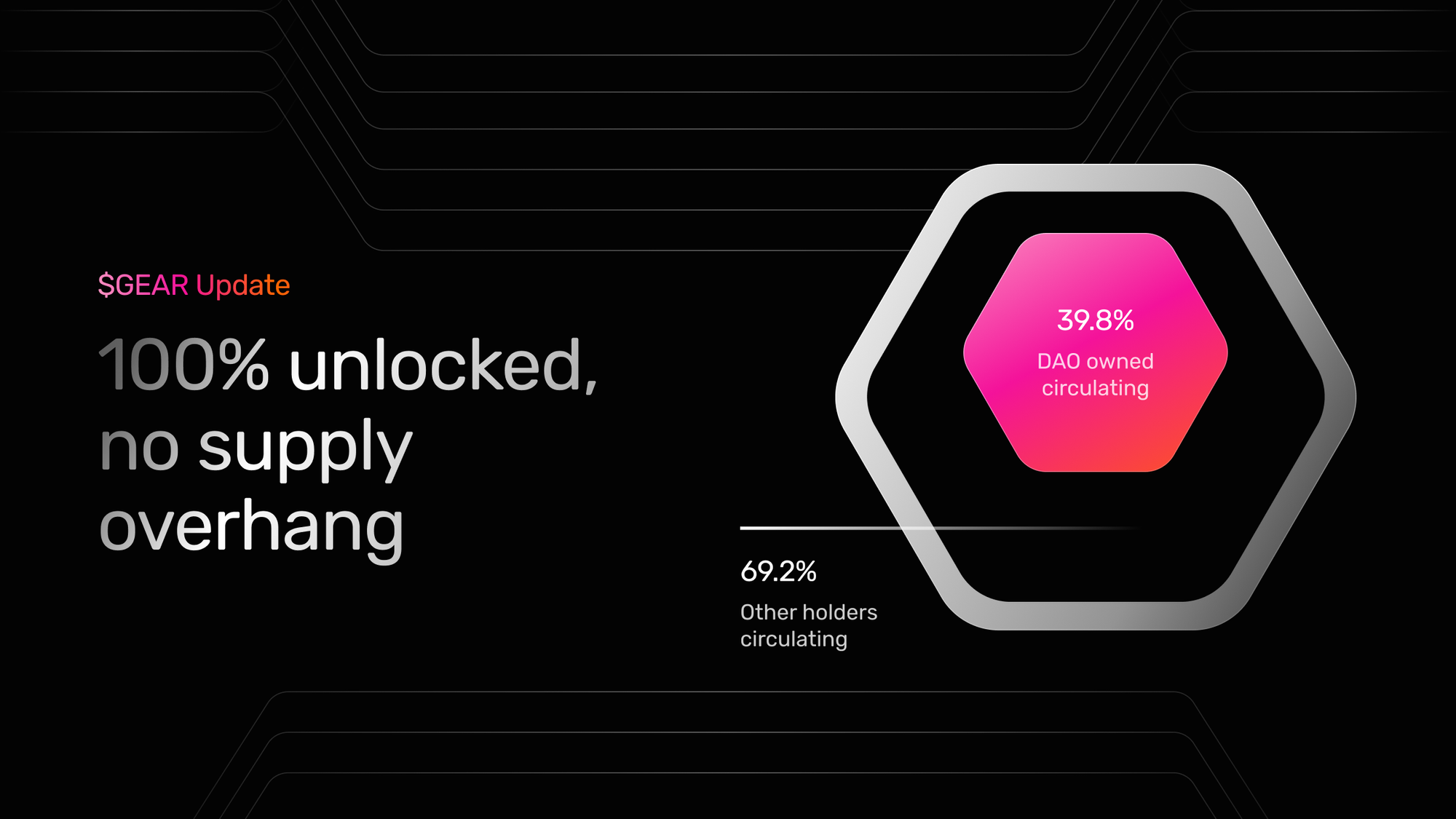

In recent months, a key piece of community feedback has been the need to enhance tokenomics. Many DAO members and contributors share this perspective, and discussions have been ongoing since late last year. With the introduction of Gearbox V3, $GEAR staking was made available through Gauges, allowing $GEAR stakers to vote democratically on interest rates and ensure they remain predictable. Ten months later, over 3% of the total $GEAR supply is now staked.

The mechanism was introduced as Minimum Viable Tokenomics, with the goal of facilitating value accrual for $GEAR as the DAO's revenue improves. With revenue projected to exceed $4 million in 2024 and utilization reaching all-time highs, discussions are underway to enhance the tokenomics.

Burn, POL, Buy Backs... Join the discussion in our discord below:

2024 also saw $GEAR token vestings end and the token become 100% circulating; where 39.8% of this supply is held by the DAO. However, token expenditures in the form of passive LM were also reduced by 67%, reducing annual emissions by ~1.8% of the supply. Overall, even slower than L1 schedules.

5. Communications Update

2024 marks the 3rd year of Gearbox building in public and building transparently. When we started in 2021, the average DeFi user was a hardcore early adopter. They tested out any new DeFi innovations and were crucial to get DeFi up and running. Those were the times of "Waifus" and "Degens" and that's what Gearbox based its initial communications around.

Over the years, with ETFs clearing, institutions joining and degeneracy paving the way for secure and battle-tested products, the demographic significantly changed. Keeping that in mind, the branding for Gearbox henceforth will reflect the tones preferred by the new-age DeFi lenders.

While that's from a broader comms perspective, another community feedback has been to improve the degree of open communication.

You shall see many improvements over the coming weeks already. And while we are at it, have you already seen the new landing page? There is more coming!

Your feedback and questions are always welcome, so jump into the community chats and ask away. If you are an asset manager or a team willing to use or integrate the Gearbox permissionless credit layer, ping us on Telegram or Discord, and we will guide you. Let’s build together!

- Website: https://gearbox.fi/

- Main App: https://app.gearbox.fi/

- Telegram: https://t.me/GearboxProtocol

- Discord: https://discord.gg/gearbox

- Twitter: https://twitter.com/GearboxProtocol

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- Notion DAO monthly reports: