Gearbox on BNB: Lending, Leverage and Loans

Gearbox is now officially live on BNB Chain! The deployment brings Gearbox's battle-tested lending pools and capital-efficient Credit Accounts to the BNB ecosystem. The instance has been curated permissionlessly by Chaos Labs, it marks a milestone first for Gearbox.

In this article, we highlight what Gearbox brings to the BNB ecosystem and how you can use the product: what assets you can passively lend, how you can earn up to 47% APY on ynBNBx, and how Gearbox maintains security and stability.

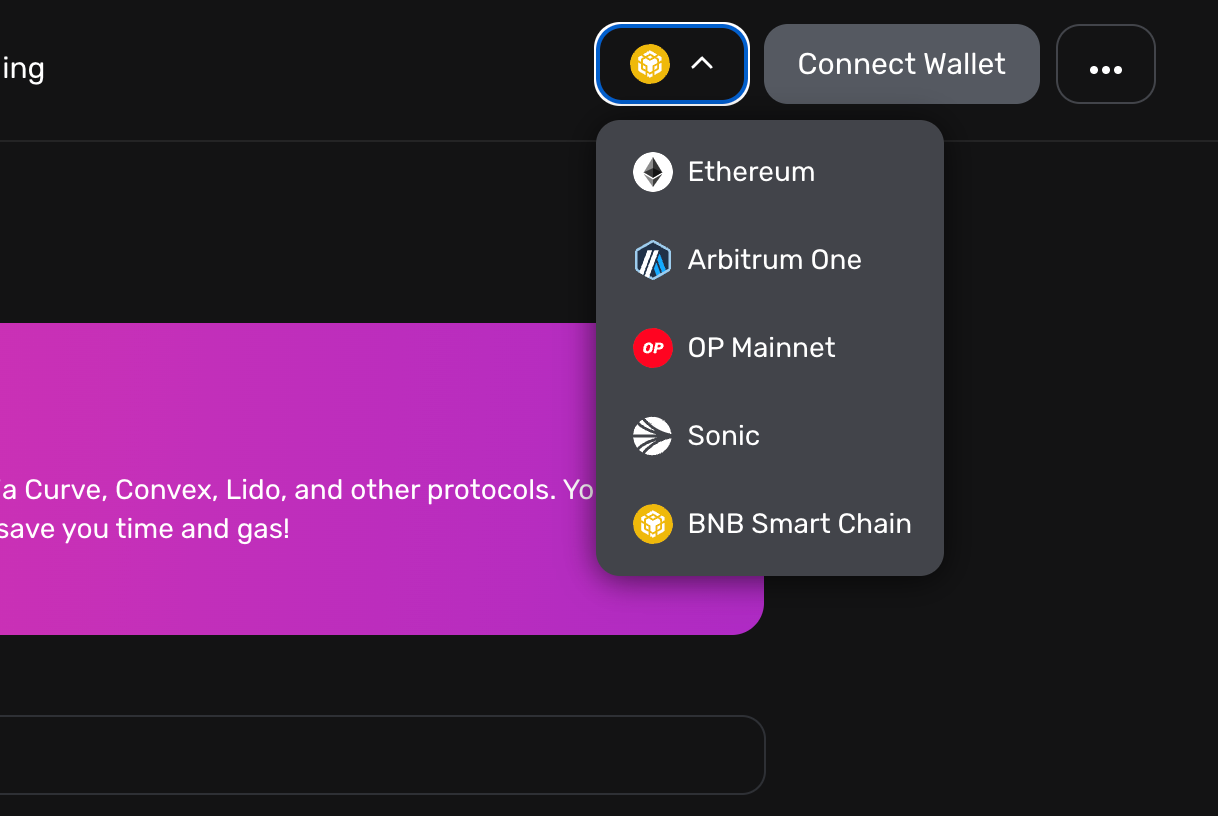

Familiar with Gearbox and want to use the protocol on BNB? Head over to the dApp and switch your network to BNB!

Lending Pools: BNB and USDT

Gearbox's lending markets provide users the ideal combination of security and passive yields. Gearbox's lending pools have been live for 3+ years without ever facing a security incident or bad-debt. Users on BNB Chain will to able to earn passive yields on: BNB and USDT lending pools.

A USD1 lending pool is scheduled to go live next week, expanding the assets users can lend and earn passive yields on.

Lending on Gearbox is designed to be incredibly lender friendly. The process of earning passive yields on Gearbox is as simple as: Deposit, Earn and Withdraw. Users choose what asset to deposit and how long they participate in lending. The pools offer yields

• Without lockups: Withdraw whenever

• Without fees: The yield you earn is yours to keep

• Without impermanent loss: Single-sided yields

The passive yields on Gearbox are generated through the interest fee paid by borrowers. Over the years, Lenders on Gearbox have earned over $15M in interest. This deployment unlocks the same opportunity for lenders on BNB.

Go ahead and maximize your passive returns by lending here.

Borrowing Opportunities: Leveraged Yield Farming, Trading and Loans

Gearbox empowers users to access credit by borrowing the assets supplied by lenders. Unlike traditional protocols, borrowers on Gearbox can borrow up to 6-9X the collateral they deposit without the need to "loop". The borrowed funds and the user's collateral are deposited into an isolated smart contract called Credit Account.

Credit Accounts act as smart wallets and ensure the funds only interact with permitted assets and that the risk parameters are always adhered to. Since these are spot assets, they can be further deployed across DeFi protocols to leverage any permitted asset or protocol. Giving borrowers access to true credit onchain.

On BNB, borrowers will be able to access the below opportunities.

Leverage Farming

Leverage farming is utilized where the purpose of the user is to earn yield or points without being exposed to directional volatility. This is made possible through correlated borrowing; you borrow an asset highly correlated to the farm you want to leverage. The following farms are now available on BNB.

ynBNBx by Yield Nest

ynBNBx is an LRT by Yield Nest designed to maximize returns on BNB and its derivatives by integrating restaking and DeFi strategies into a single, capital-efficient, composable token. While restaking serves as a core primitive, ynBNBx extends beyond traditional staking models, dynamically reallocating capital across yield-generating opportunities to unlock DeFi’s full potential. Users on Gearbox will be able to access up to 7.7X leverage for ynBNBx by borrowing BNB.

Gearbox also takes multiple measures to make your leverage farming experience peaceful and non-volatile. These include

• No DEX price volatility: The fundamental price feed for ynBNBx utilises the exchange rate of BNB deposited into the Yield Nest contract, eliminating DEX price volatility.

• No Slippage on position creation: Gearbox Credit Accounts are able to natively mint the LRT through Yield Nest contracts, eliminating slippage while opening a position. Exiting a position can incur slippage, though.

• Correlated Debt: As mentioned above, the correlation between BNB and ynBNBx further reduces volatility.

Earn these peaceful yields by switching your network to BNB Chain and heading over to the Farms tab on the dApp.

With the upcoming launch of the USD1 pool next week, leveraged farming opportunities for both sUSDX and its Pendle Principal Token (PT) will also go live.

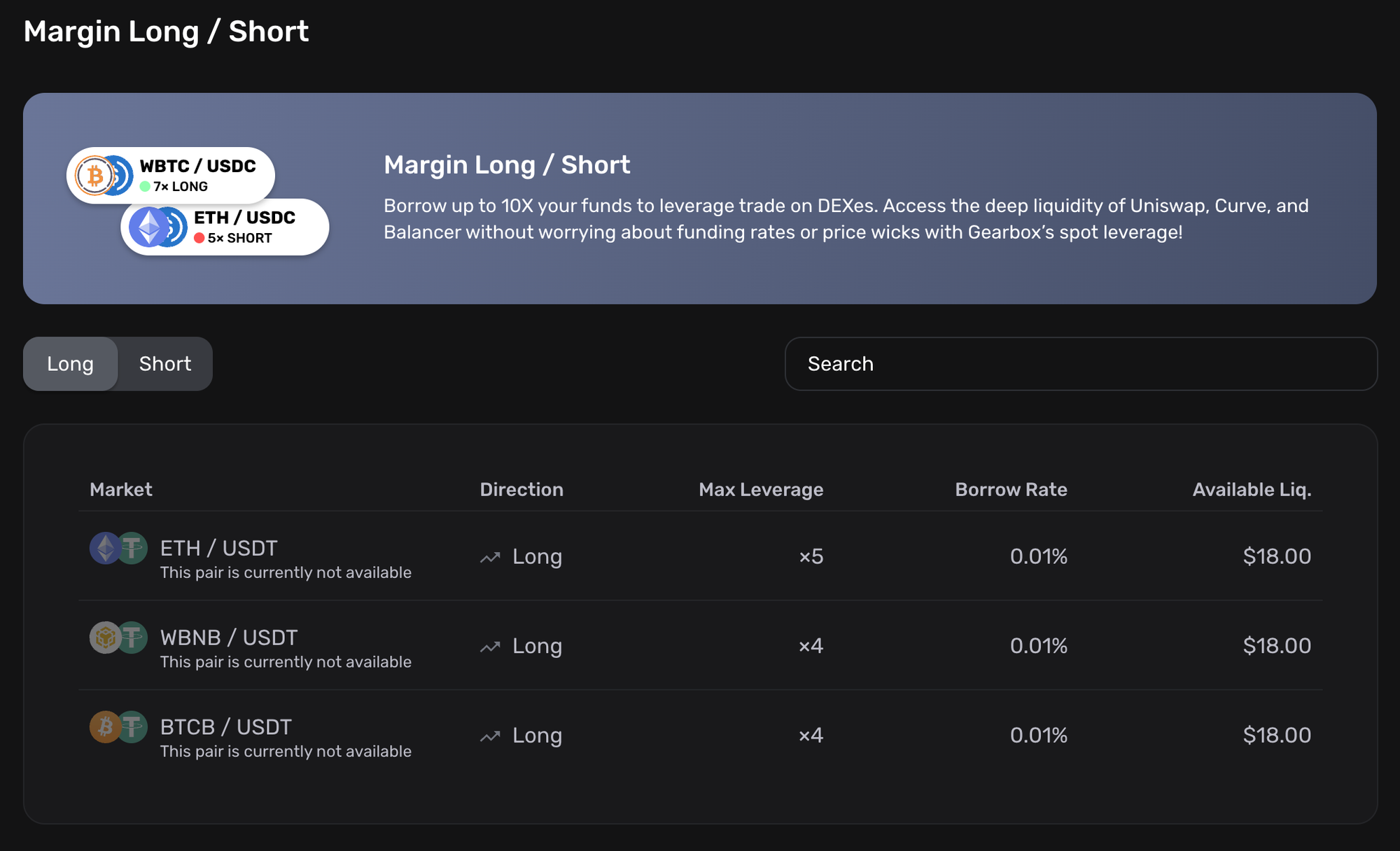

Leverage Trading

Users can also borrow USDC to leverage trade assets on BNB, this is made possible by the integration of BNB native DEXes: Pancakeswap and Thena. Traders can access leverage on:

- ETH

- wBNB

- BTCB

Leverage trading on Gearbox isn't the same as perpetuals. Users utilises real, spot assets to create leverage through Margin Trading. Gearbox CAs enable users to borrow up to 5X spot USDT and trade their position using deep DEX liquidity.

The leverage available for each asset is calculated based on the Liquidation Threshold (LT). You can find the details for each asset below.

Don't want leverage but still want to borrow against your portfolio? We have got you!

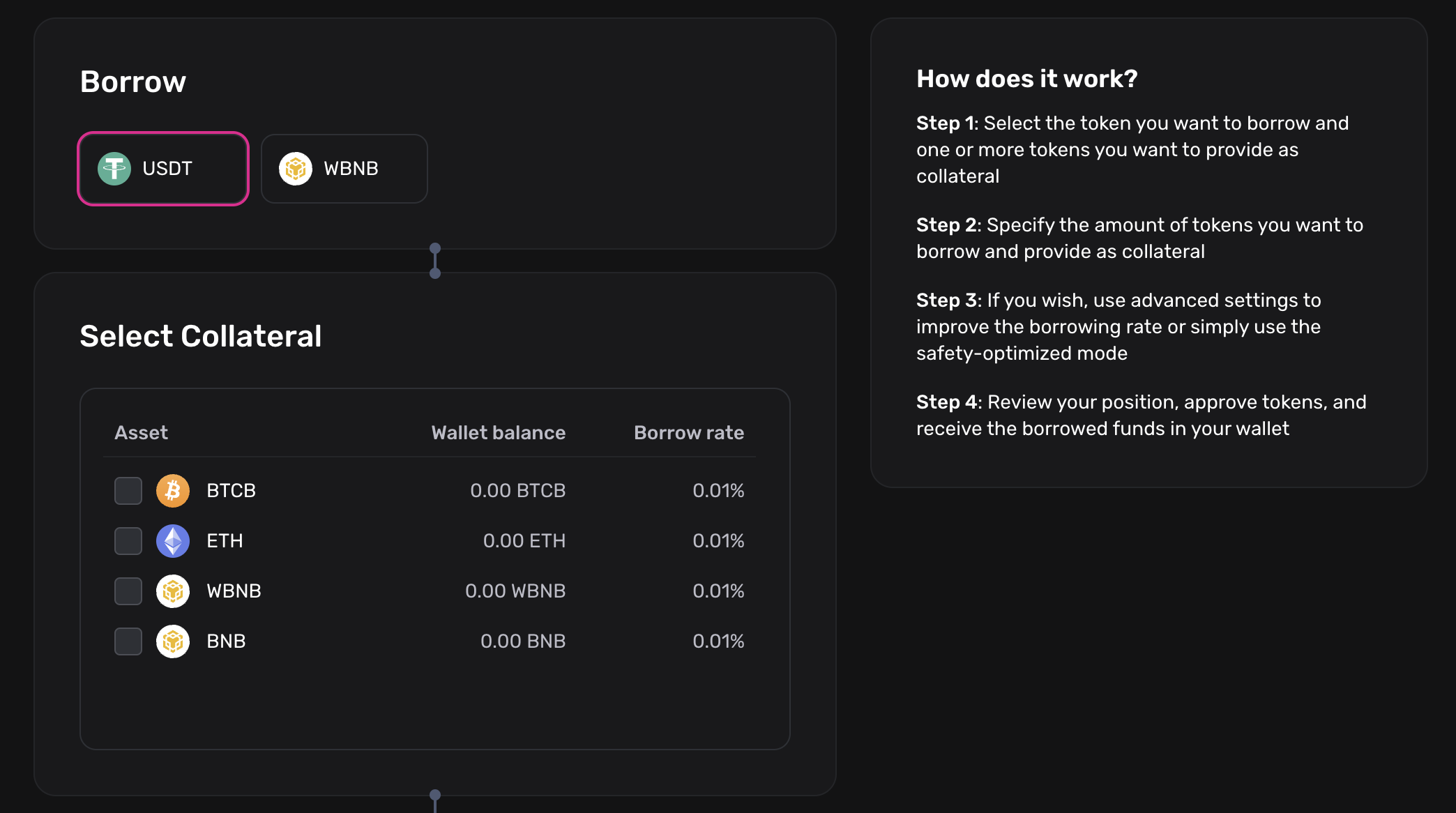

Borrow: Multicollateral Loans

For users who prefer borrowing without leverage, Gearbox offers Multicollateral Loans. These loans empower users to borrow BNB or USDC without locking their collateral in a general lending pool.

The permitted collateral is held in your isolated credit account, allowing users to swap or trade their collateral even while they borrow. Multicollateral Loans keep users' collateral completely liquid. You can read more about them below.

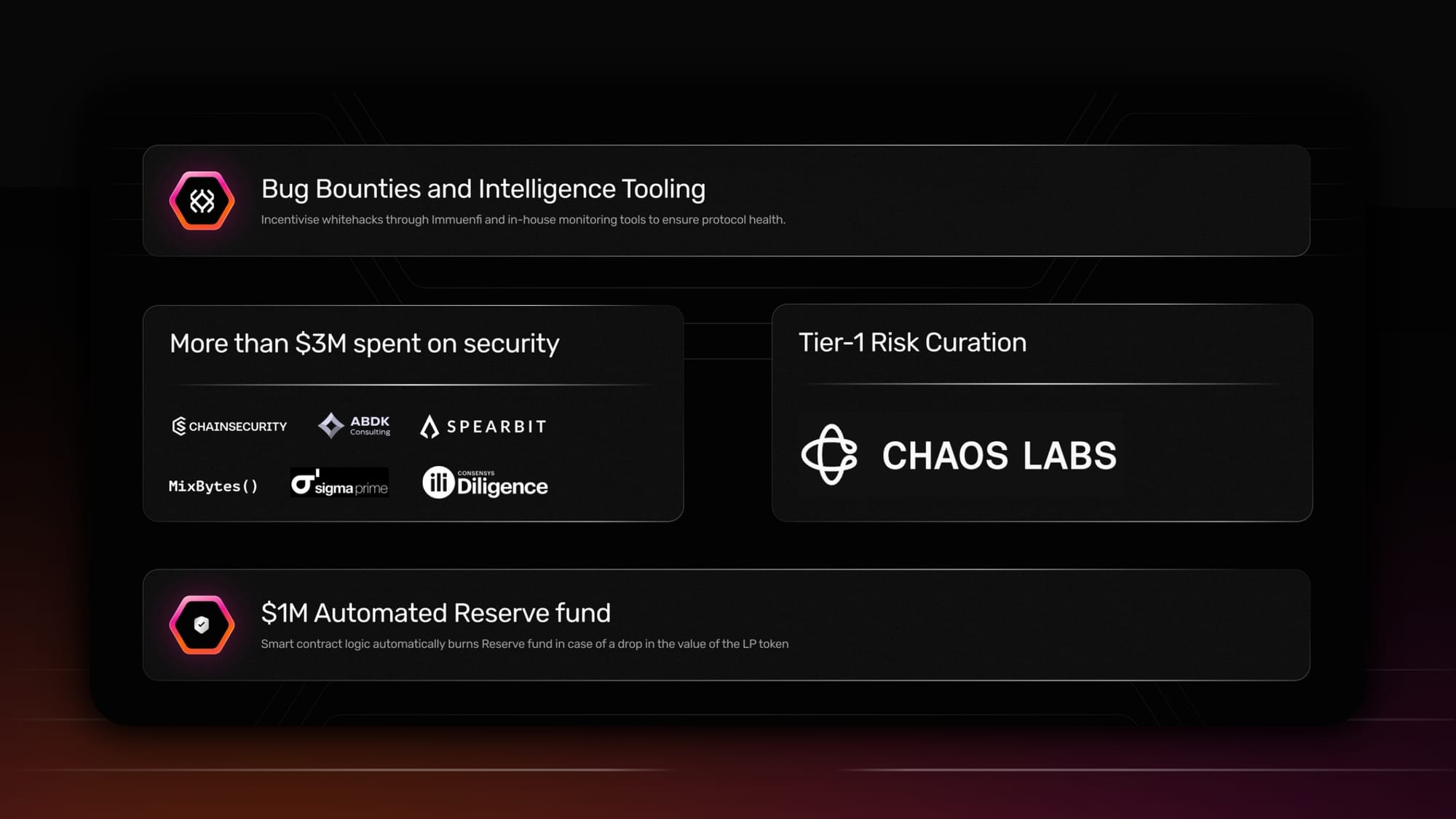

Gearbox’s Safety & Proven Track Record

Gearbox prioritizes security above all else, implementing a multi-layered approach to risk mitigation. The protocol has been live for three years without incurring bad debt or facing exploits, proving its battle-tested infrastructure. This has been possible because of

• 10+ audits from top-tier firms such as ChainSecurity, ABDK Consulting, Spearbit, MixBytes

• Bug bounties and intelligence tools

• $3M of security related spends

The protocol also features a $1M Automated Reserve Fund and risk parameters curated by Chaos Labs, a leading name in risk management, ensuring robust, data-driven safeguards. Gearbox stands as one of the most battle-tested DeFi protocols on Ethereum mainnet.

Get Started

The deployment on BNB is live! Getting started with Gearbox is as easy as heading to the Gearbox dApp and connecting to BNB by simply toggling the network.

Approve the network switch in your wallet and you can access passive lending, leverage, and loans with Gearbox.

If you are an institution and are looking to expand your operations onchain, Gearbox can offer you the credit infrastructure you require with it's permissionless protocol. Contact us on Telegram or Discord for more information. Let’s build the onchain economy together!:

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: