Gearbox Expands to Sonic: Lending, Leverage, and Points

Gearbox is now officially live on Sonic! This deployment brings Gearbox's battle-tested lending pools and highly capital-efficient leveraged yield farms to Sonic's ecosystem, benefiting lenders, who earn passive yields, and borrowers, who can access leverage to trade or farm efficiently.

In this article, we'll explain why Gearbox is deploying on Sonic and what we bring—what assets you can passively lend, what opportunities for borrowers are available, and how Gearbox maintains security and stability.

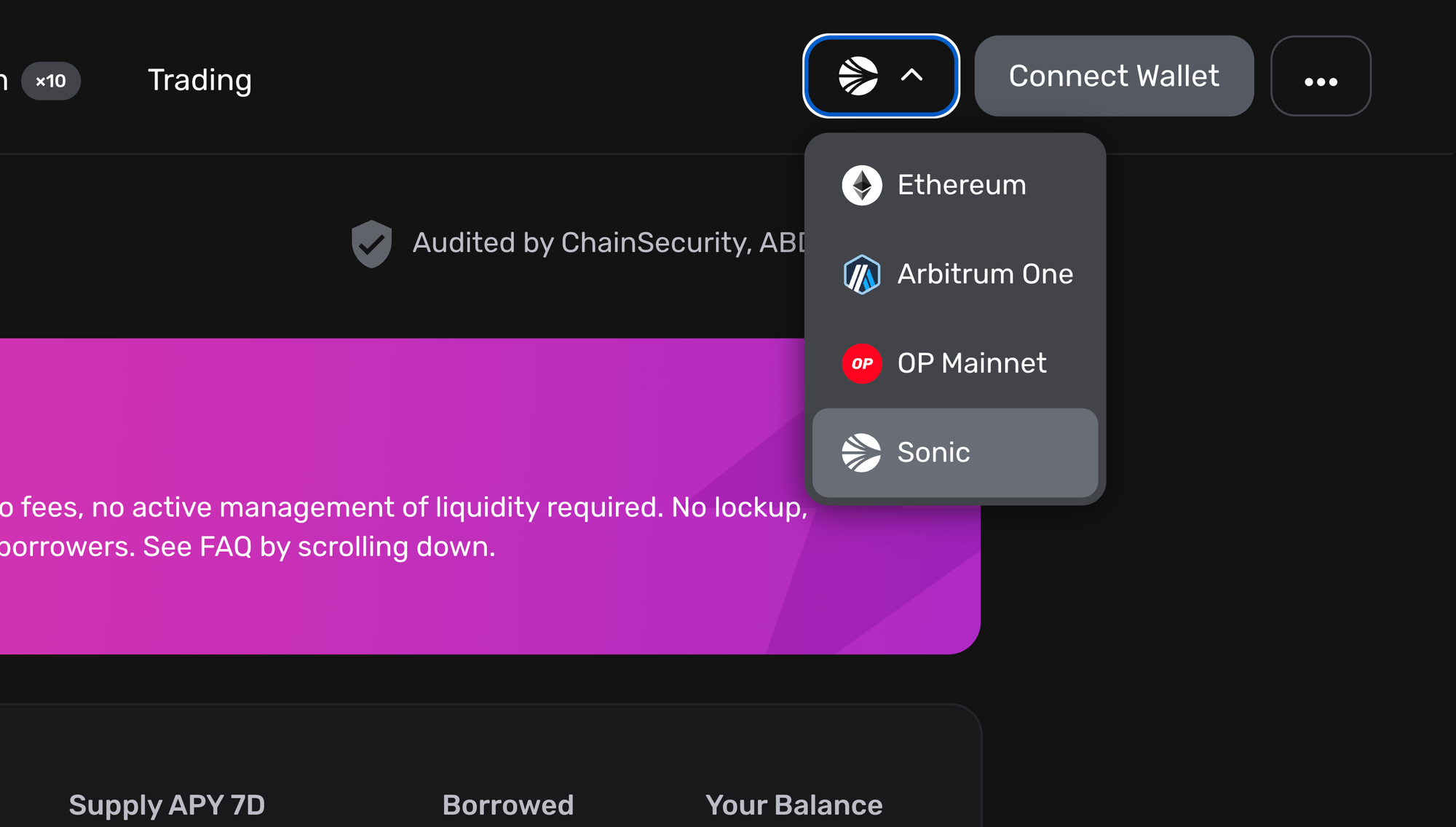

Familiar with Gearbox and want to use the protocol on Sonic? Head over to the dApp and switch your network to Sonic!

Why Gearbox on Sonic?

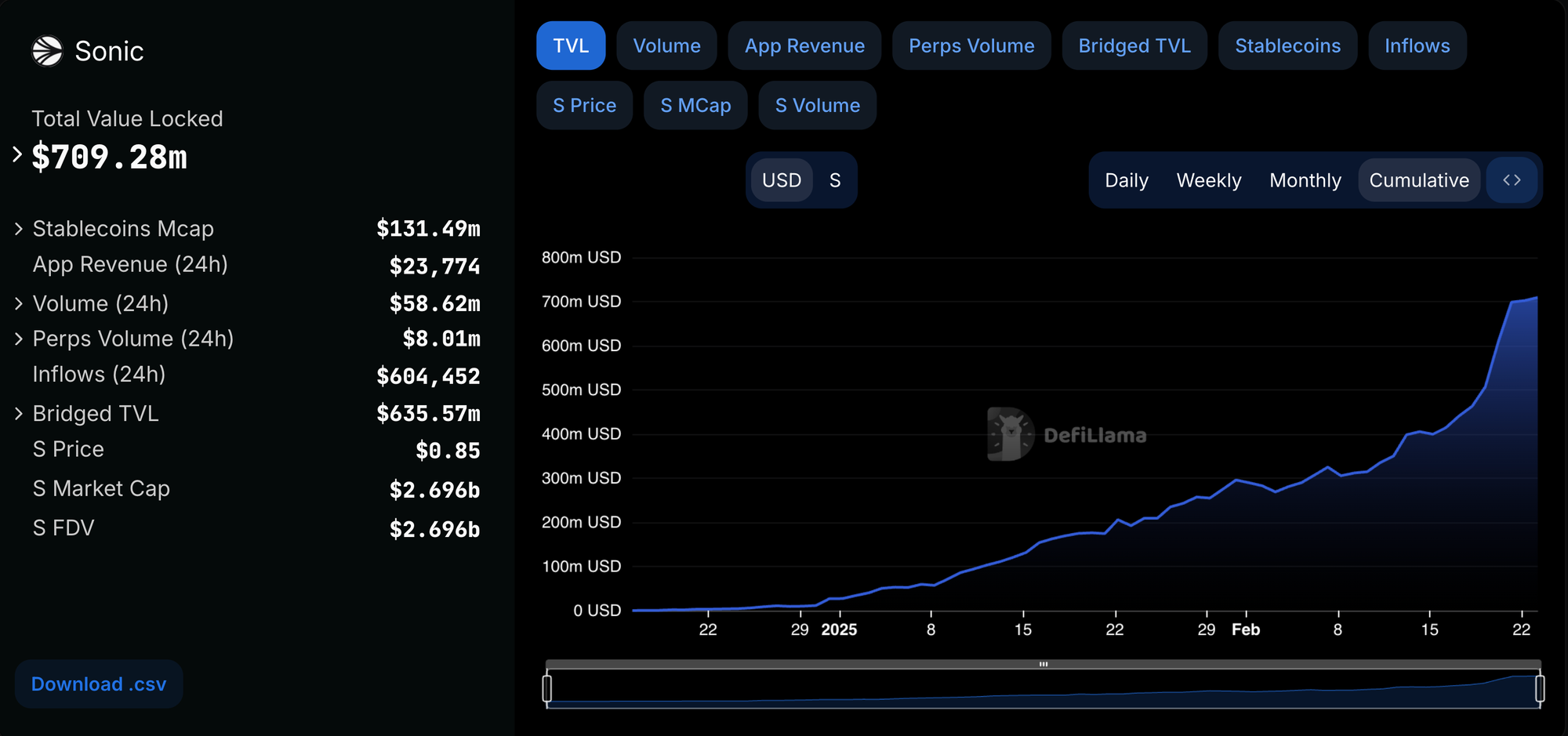

Sonic has seen tremendous growth, rapidly gaining users and TVL. This growth comes from a blazing-fast onchain experience and specific attention to DeFi, making Sonic a great growth avenue for Gearbox. The decision to deploy is further supported by new DeFi protocols emerging on Sonic, creating more opportunities for users.

By deploying on Sonic, Gearbox extends its battle-tested protocol to a new ecosystem. The codebase deployed by Gearbox on Sonic has been on ETH mainnet for 3+ years, bringing users some of the safest smart contracts to lend, borrow and leverage on. But precisely what would be possible? Read below.

Lending Pools: USDC & wS

Looking for the perfect combination of safety, passive earning and Sonic Points? We got you! Users can lend the following assets to Gearbox's battle-tested lending pools.

- wS Lending Pool – Earn 8X Sonic Points

- USDC Lending Pool – Earn 10X Sonic Points

By depositing to Gearbox's lending pools, users can earn boosted Sonic Points AND the yield generated through the interest borrowers pay. Gearbox's lending pools have been live on ETH mainnet for three years without incurring bad debt or facing exploits, making them some of the most resilient lending pools. The pools make lending completely passive through

• No lockups: Withdraw whenever

• No fees: The yield you earn is yours to keep

• No impermanent loss: Single-sided yields

Secure, truly passive and rewarding, maximize your passive returns by lending here.

Discussions regarding a possible $GEAR LM to boost rewards and bootstrap on Sonic are ongoing; follow our X to stay updated on additional rewards and news.

Borrowing Opportunities: Leveraged Yield Farming, Trading and Loans

Gearbox empowers users to access credit by borrowing the assets supplied by lenders. Unlike traditional protocols, borrowers on Gearbox can borrow up to 6-9 times the collateral they deposit without the need to "loop". The borrowed funds and the user's collateral are deposited into an isolated smart contract called Credit Account. Credit Accounts act as smart wallets and ensure the funds only interact with permitted assets and that the risk parameters are always adhered to. Since these are spot assets, they can be further deployed across DeFi protocols to leverage any permitted asset or protocol. Giving borrowers access to true credit onchain.

On Sonic, borrowers will be able to access the below opportunities.

Leverage Farming

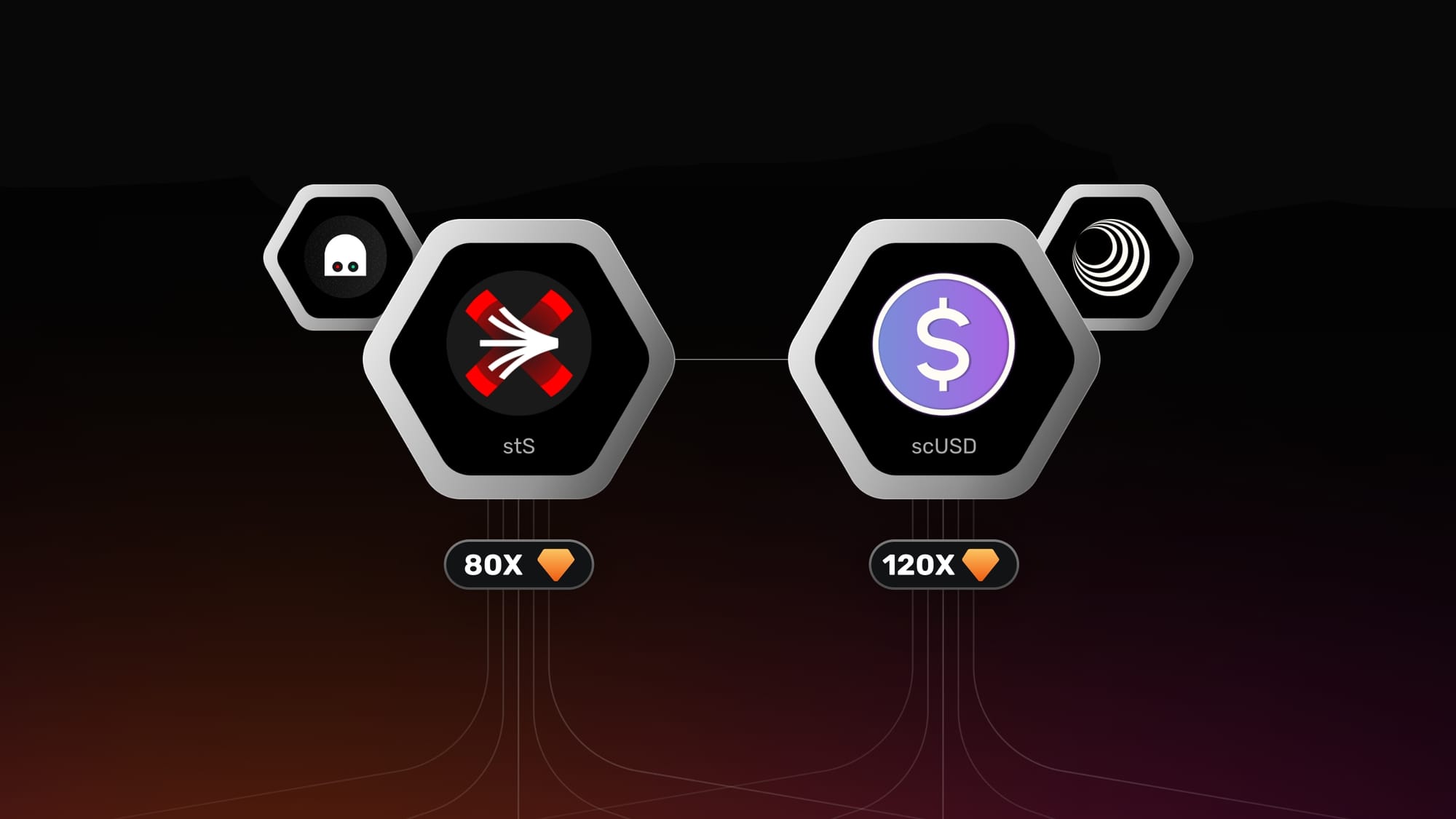

Leverage farming is utilized where the purpose of the user is to earn yield or points without being exposed to directional volatility. This is made possible through correlated borrowing; you borrow an asset highly correlated to the farm you want to leverage. The following farms are now available on Sonic

- scUSD points farm: scUSD is a stablecoin by Rings which generates yields by allocating liquidity across DeFi protocols on Sonic. Borrowers on Gearbox will be able to access up to 10X leverage on scUSD by borrowing USDC and earning up to

• 120 X Sonic Points

• 240 Rings per day per dollar value - stS yield and points farm: stS is a liquid wrapped token for staking Sonic by Beets. Users can borrow wS and maximise their yields and points with up to 10X credit. Currently the asset yields up to

• 80X Sonic Points

• 29% APY

The stS farm enables users to earn leveraged Sonic points AND get paid for it. Access these opportunities by switching your network to Sonic and heading over to the Farms tab on the dApp.

Leverage Trading

Users can also borrow USDC to leverage trade assets on Sonic, this is made possible by the integration of Sonic native DEXes: Equalizer and Shadow. Traders can access leverage on:

- wETH

- wS

- stS: Trade AND farm

A standout feature is stS leverage trading, which allows users to leverage trade S while farming its yields, creating a unique dual-income strategy.

The leverage available for each asset is calculated based on the Liquidation Threshold (LT). Based on the proposal parameters (snapshot reference), the following leverage is available:

| Asset | Liquidation Threshold (LT) | Maximum Leverage |

|---|---|---|

| stS | 82.5% | 5.71x |

| WETH | 85% | 6.67x |

| wS | 82.5% | 5.71x |

This means borrowers can maximize capital efficiency while maintaining a safe margin based on risk parameters.

Borrow: Multicollateral Loans

For users who prefer borrowing without leverage, Gearbox offers Multicollateral Loans. These loans empower users to borrow wS or USDC without locking their collateral in a general lending pool. The permitted collateral is held in your isolated credit account, allowing users to swap or trade their collateral even while they borrow. Multicollateral Loans keep users' collateral completely liquid. You can read more about them below.

Gearbox’s Safety & Proven Track Record

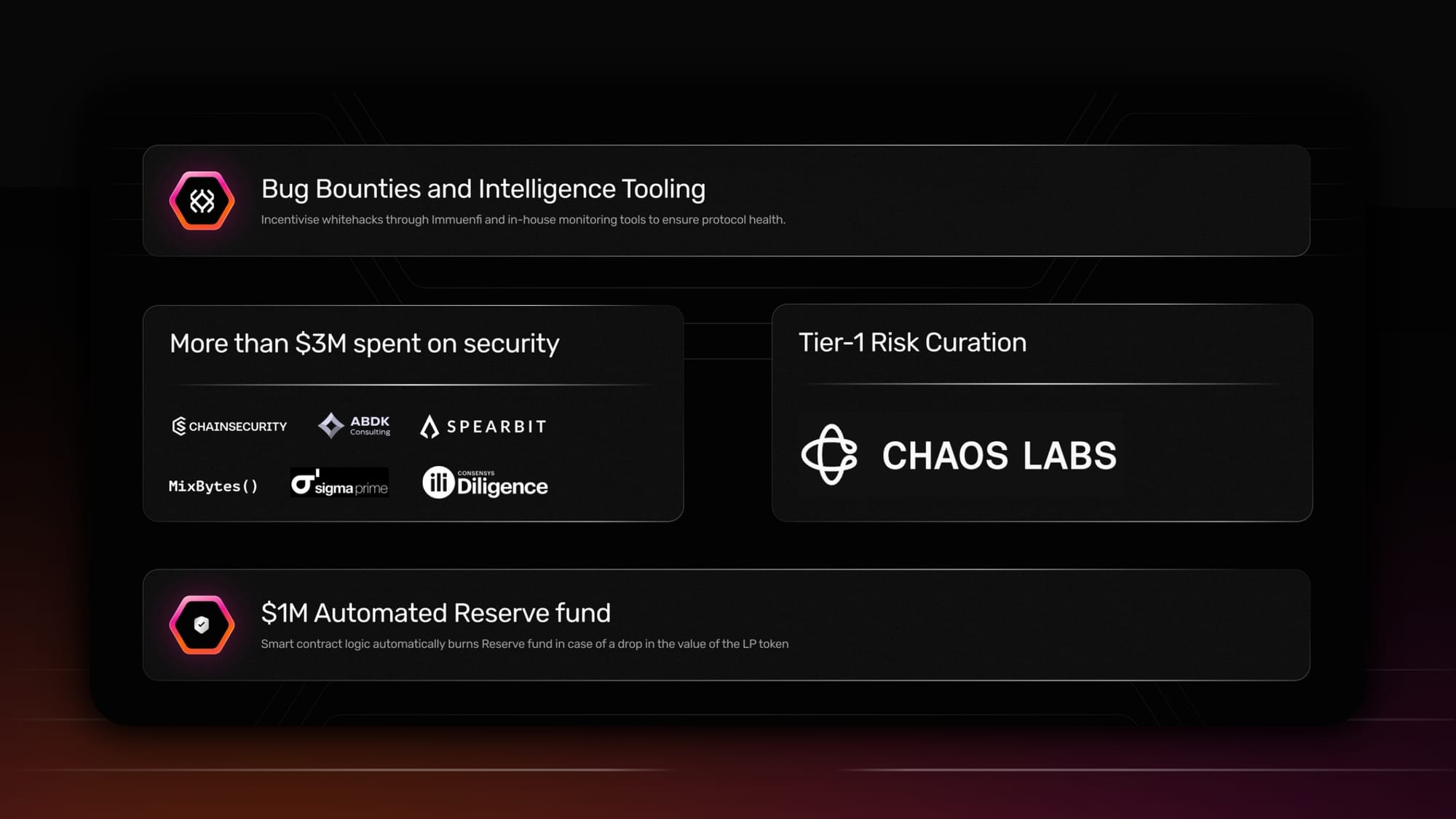

Gearbox prioritizes security above all else, implementing a multi-layered approach to risk mitigation. The protocol has been live for three years without incurring bad debt or facing exploits, proving its battle-tested infrastructure. This has been possible because of

• 10+ audits from top-tier firms such as ChainSecurity, ABDK Consulting, Spearbit, MixBytes

• Bug bounties and intelligence tools

• $3M of security related spends

The protocol also features a $1M Automated Reserve Fund and risk parameters curated by Chaos Labs, a leading name in risk management, ensuring robust, data-driven safeguards. Gearbox stands as one of the most battle-tested DeFi protocols on Sonic.

Get Started

The deployment on Sonic is live! Getting started with Gearbox is as easy as heading to the Gearbox dApp and connecting to Sonic by simply toggling the network. With this simple process, you can access passive lending, leverage, and loans with Gearbox.

Join the DAO - get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments::

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: