Gearbox crvUSD Pool: Llama LM

New day and we already have the Llama's making it a GM with a special CRV boosted LM for the crvUSD pool. The crvUSD pool is now the 5th stablecoin pool to go live on Gearbox's lending market. The pool aims at giving lenders more choice in terms assets they can deposit, more options to borrowers in terms of the debt they want to take and to integrate the Llama's towards Gearbox's lending side as well.

How will the integration work? What are the additional LM rewards? What can the debt be used for and what's a probable organic APY users can look at? Read this article to learn it all.

While this is on the passive side, leverage on Curve pools and convex has been enabled from V2 days. You can check those strats and earn 70%+ APYs here.

The TLDR earn first, read later

crvUSD is now live on Gearbox with a double LM, enabling users to earn 20%+ estimated APYs.

The APYs are composed of 3 major parts

- Organic APY: Averaging at 12.96% APY for comparable stables with similar borrow strategies.

- GEAR APY: Made possible with 4.5M GEAR rewards approved by the DAO in GIP-122.

- CRV APY: 150K CRV to be earned over 90 days, made possible by a grant from Curve's Michael.

And you can earn this completely passively by simply depositing crvUSD in Gearbox's crvUSD Lending Pool.

All without IL, fee or any lockups. Simply deposit, earn and withdraw whenever.

That's the TLDR. Want the complete details on what and how? Read on!

Lending crvUSD on Gearbox and how it works

Our goal while designing the lending side for Gearbox was fairly simple: Make it truly passive. In essence, as a lender all you do is

Supply -> Earn -> Withdraw

Particularly for crvUSD, this is how lending would work:

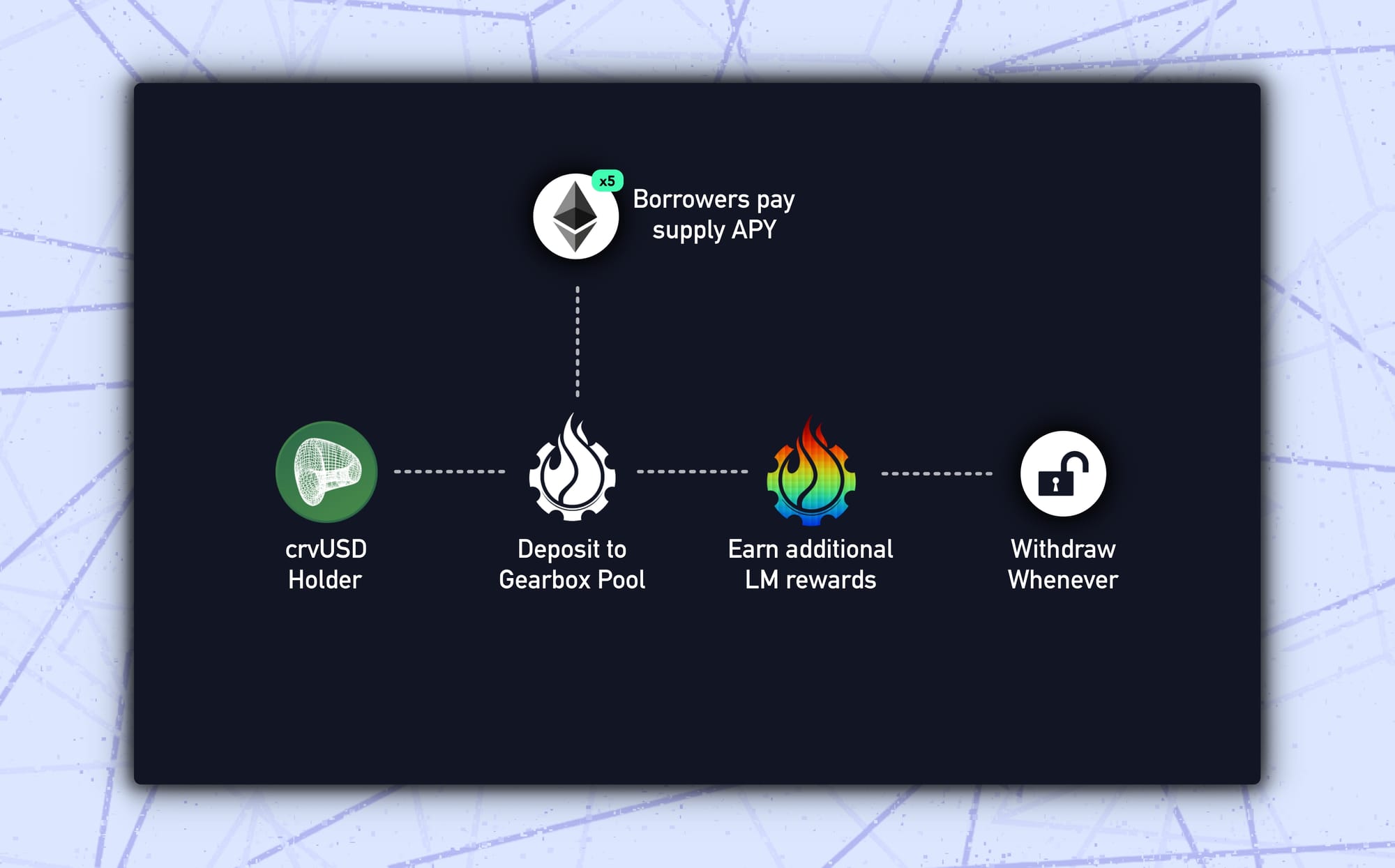

- Supply crvUSD: Simply go to https://app.gearbox.fi/pools and click on "Supply". This will deposit your crvUSD to Gearbox's pool and you will receive dTokens or Diesel Tokens in return which acknowledge your share of the pool. The tokens follow the ERC-4626 implementation.

- Borrowers generate yield: Gearbox's borrowers then borrow crvUSD and pay a borrow rate on it, generating yield. The yield will reflect in the price of your dTokens appreciating and all happens passively.

- Additional LM: crvUSD pool goes live with a double LM. You earn GEAR + CRV rewards on top of the passive yield that is generated. The GEAR required for this have been approved by the DAO. While the CRV have been granted to the DAO by Michael from Curve DAO.

- Withdraw with yield: That's it really. There are no locks, no IL, you supply, you earn, you leave whenever. But why would you?

There is no active management of a lending position that you need to take care of. That's not to say there is no risk management happening though, Gearbox's foremost priority is security and managing risk. It's why we have never faced bad debt or an exploit in 2.5 years of Gearbox being live. How we do this?

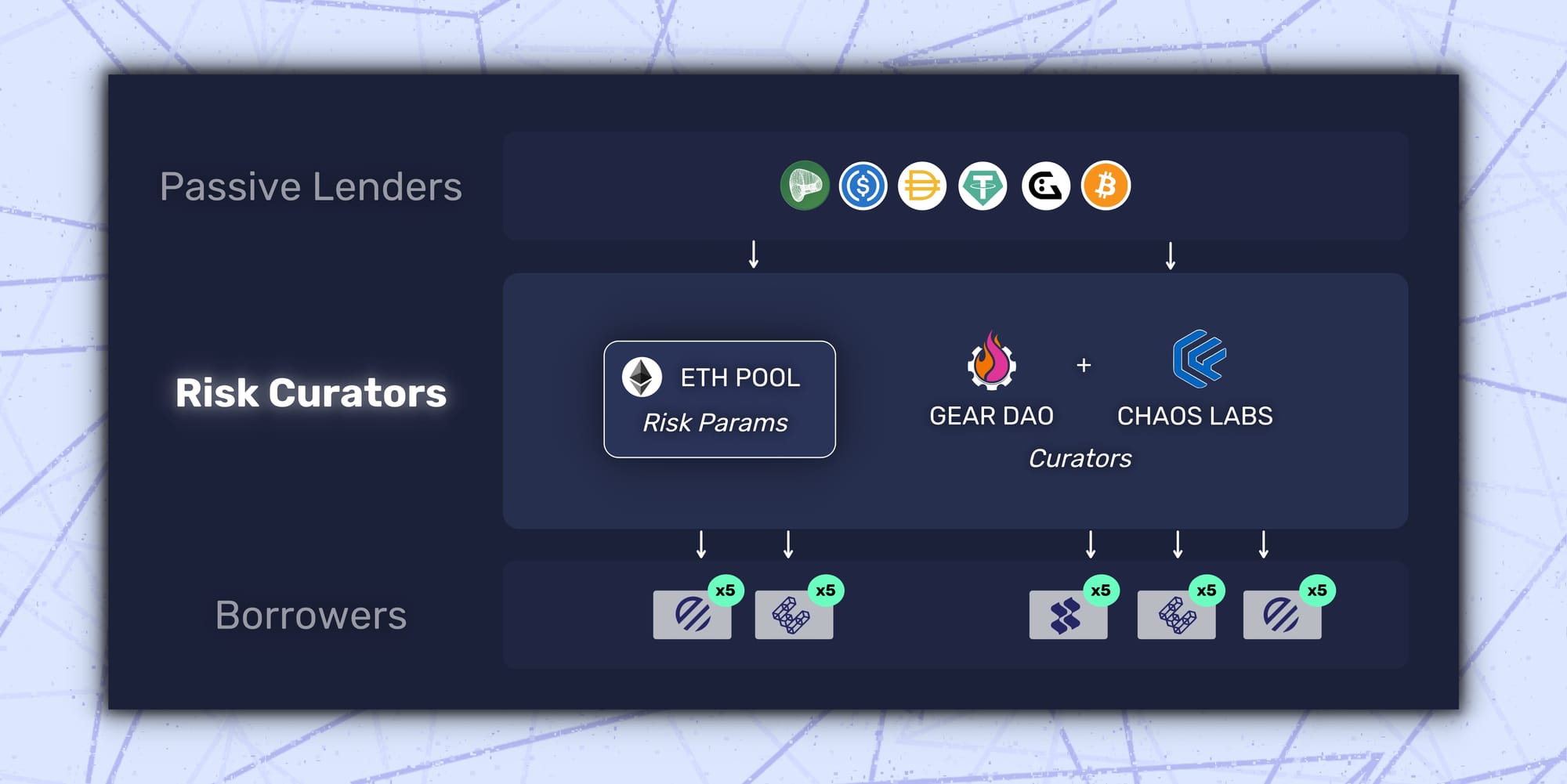

Modular lending to improve risk management

Gearbox makes lending passive by abstracting the complexities to a different layer called Risk Curators. Parameters such as LTV, borrow limits, liquidity management require risk modelling and quantification to ensure tested safety. Gearbox ensures this by onboarding seasoned curators who act as additional operators apart from lenders and borrowers.

Chaos Labs are the current risk curators for Gearbox and recommend the Risk Params which are then discussed and voted on by the DAO for different strategies. They effectively help manage the kind of leverage users are able to access while ensuring lender safety.

Chaos labs also work with Curve, Compound, DyDx, Aave and multiple other DeFi protocols to manage risk and ensure protocol safety.

The reason to have risk curators is to make UX better for lenders and borrowers and at the same time create a safer yet more flexible protocol. You can read about the modular lending approach below.

Yield, Yield, Yield

As stated above, the source of yield for the lenders comes through the rates paid by the borrowers. These rates further depend on the strategies that the borrowed funds can be utilised for. For crvUSD, borrowers will be able to use the funds for some of the highly utilised strategies on Gearbox.

- USDe: Currently holds over 50M+ in borrows through stables and has a 15%+ borrow rate. Comes with a boosted 20X sats and thus has seen constant demand. This comes in with a 5M limit for the crvUSD pool.

- sDAI: Maker DAO's savings DAI at the moment pays a 9% DSR. With borrow rates at 5%+, both the lenders and borrowers are able to generate positive APYs.

- sUSDe: sUSDe currently has a 15%+ borrow rate as well. The strategy though has a 22%+ positive yield + 5X boosted sats from Ethena. The borrow limit for the strat is 2M for crvUSD

The exact configuration of the risk parameters for the pool will the same as that of the GHO/DAI/USDT pools for the mentioned strategies. You can check them here.

What kind of yields might be possible to generate out of these strats? Lets find out...

Organic Yield

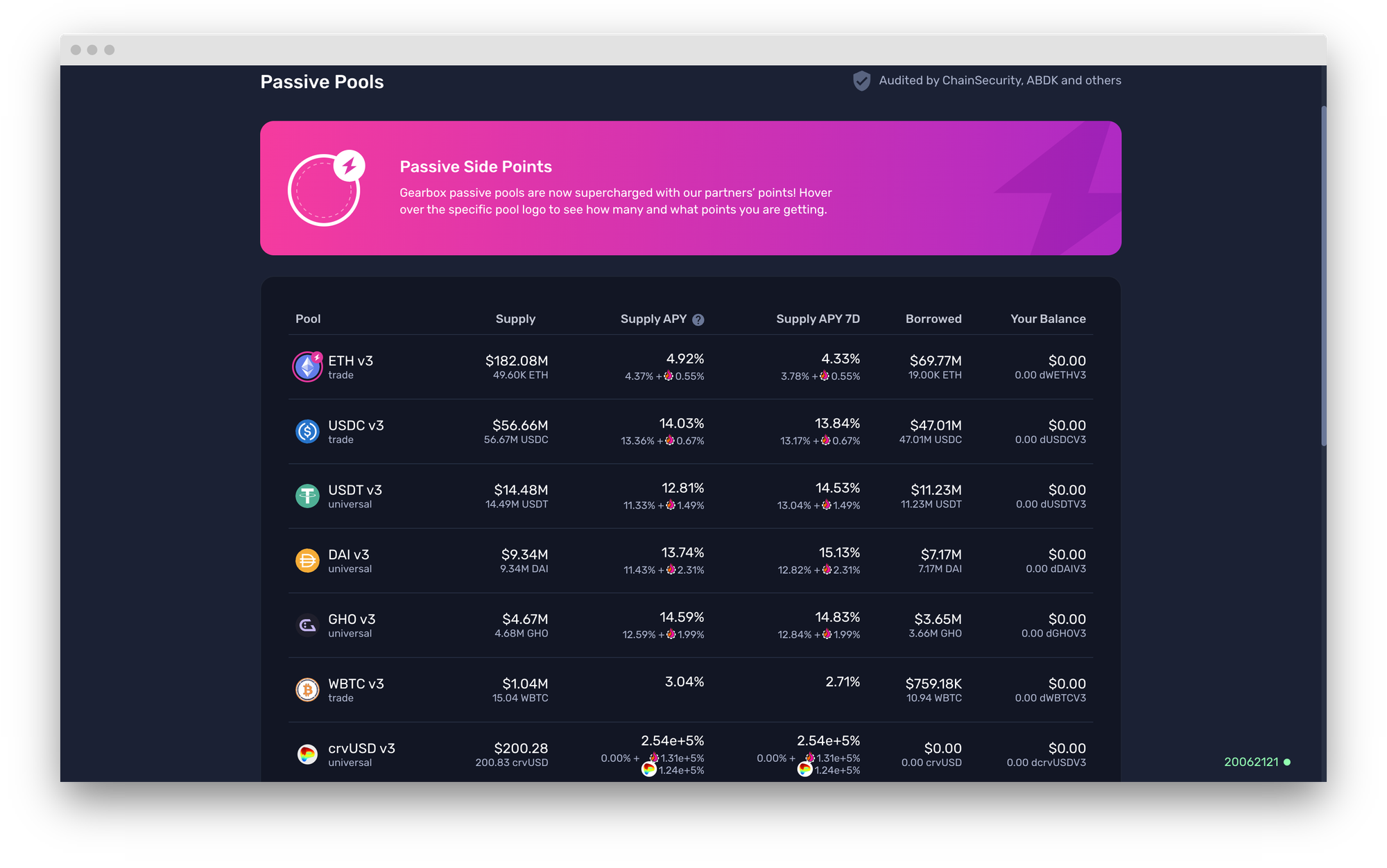

Given the strats are similar to those of the other stable pools, an organic yield in the similar range is likely once the pool reaches similar utilisation. Taking a look at organic yields across stables...

The average 7D organic yield generated through the borrow rates paid by the borrowers comes to 12.97% APY. If crvUSD were to achieve similar utilisations, a similar yield level can be assumed given other factors(yields for borrowers etc) remain similar.

LM and Overall Yield

The LM yield is going to be generated through 2 tokens:

- 150,000 CRV given as a grant by Michael from Curve DAO

- 4.5M GEAR from GEAR DAO

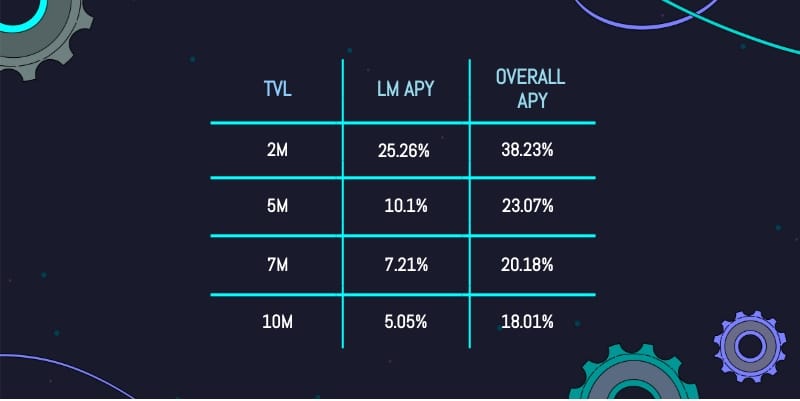

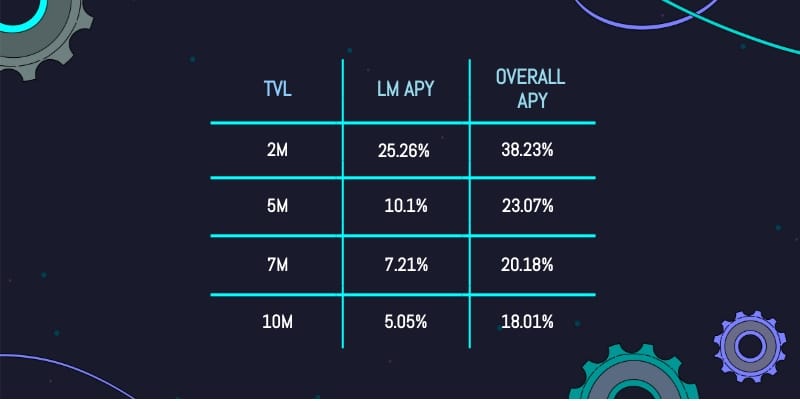

The cumulative value of these tokens at the moments is $124.6K and the duration is 90 days. Across TVL levels this translates to...

At a 7M TVL, this translates to 20%+ APY on crvUSD. All earned passively, how do you earn it though?

Walkthrough

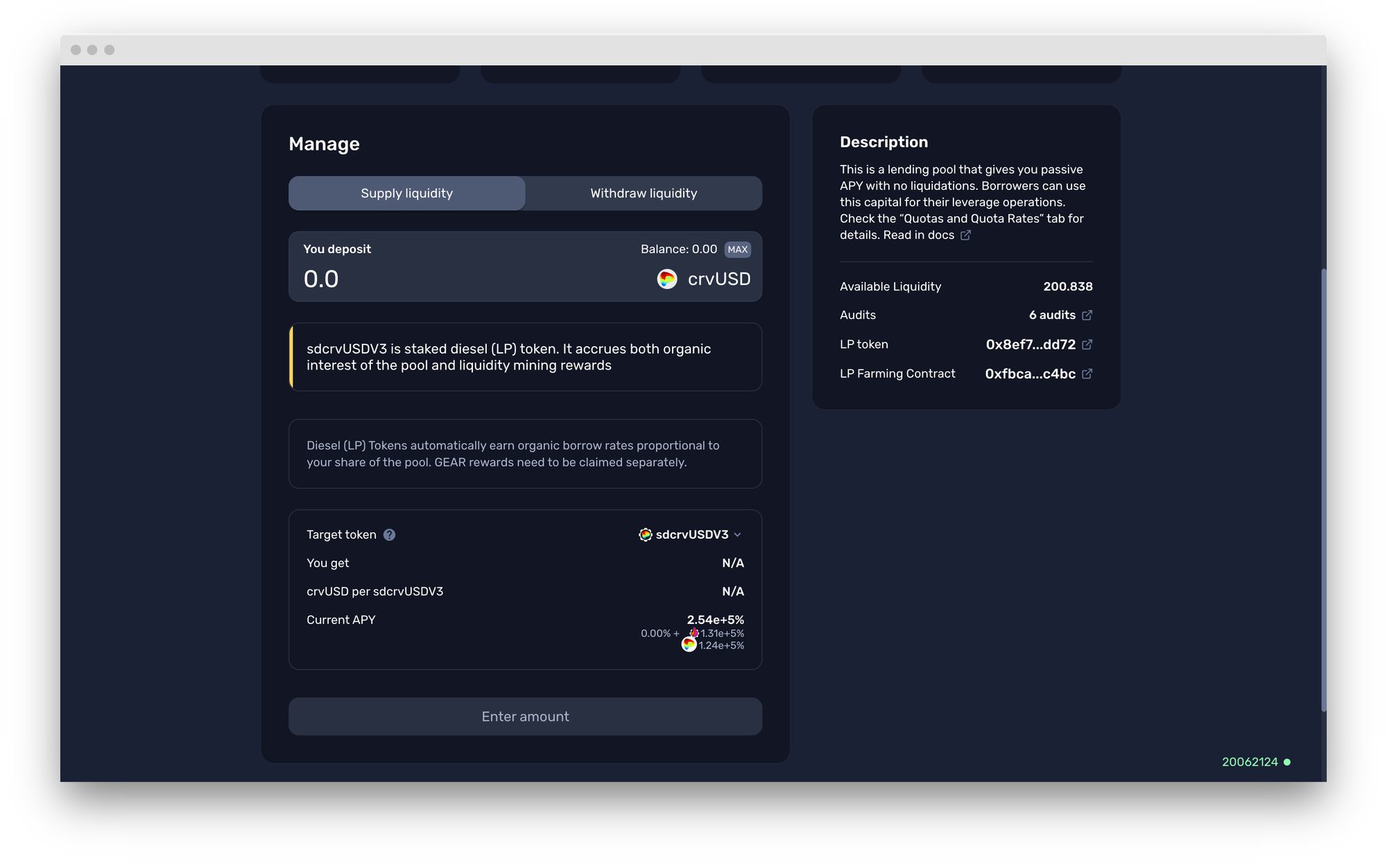

Simple...

- Choose the crvUSD v3 Pool

- Complete the transaction to deposit and start earning.

That's it your passive earning without worrying about position management, worrying about IL, locks or fee is now live. Go Ahead and supply!

Final note on Security

Security is our number 1 priority and our number 1 cost centre. There are multiple measures that we take in order to ensure bad debt doesn't seep in. This ranges from intelligence tools to audits, from complete security versions to automated risk management. You can read the complete details about it here.

security, security, security

— Gearbox ⚙️🧰 (@GearboxProtocol) March 12, 2024

At Gearbox, our top priority is to provide the safest possible protocol for your capital 🛡️ To make that possible, there are multiple measures we take to fortify security, so you can lend & borrow peacefully.

From monitoring tools to audits to... 👇 pic.twitter.com/jHupyc5NJf

If you would like to join the DAO — just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion DAO monthly reports: