The $GEAR Wars

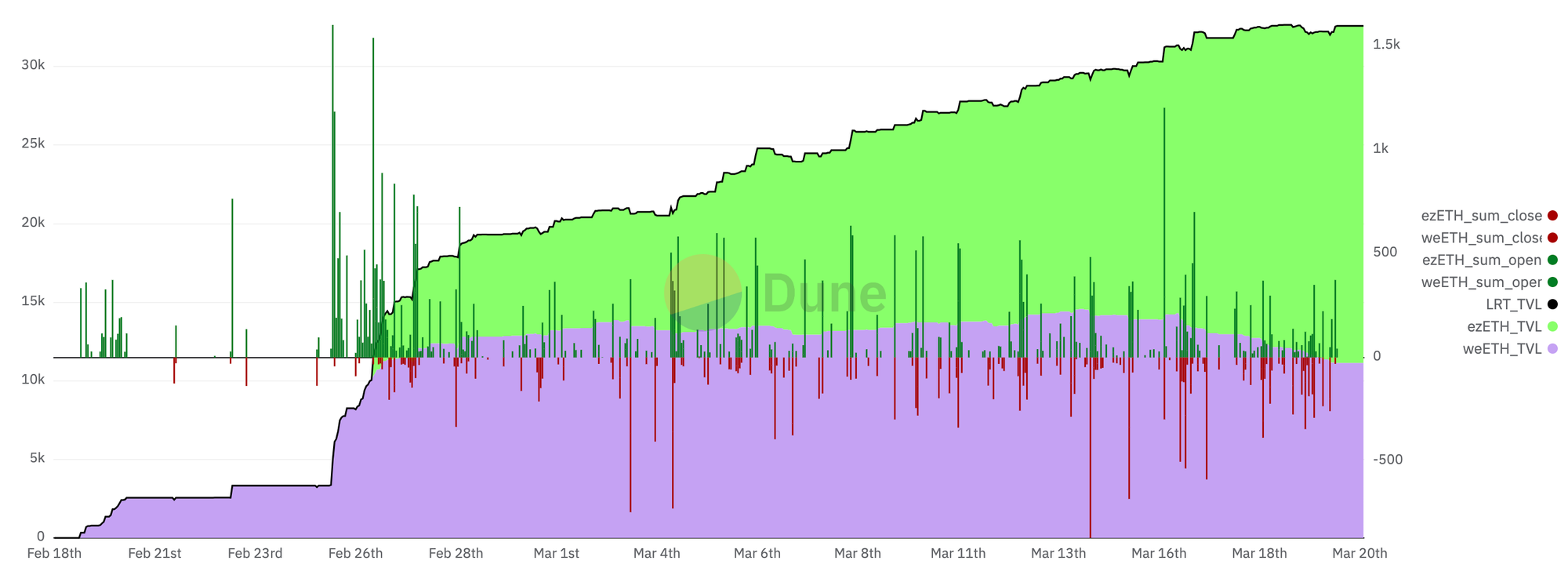

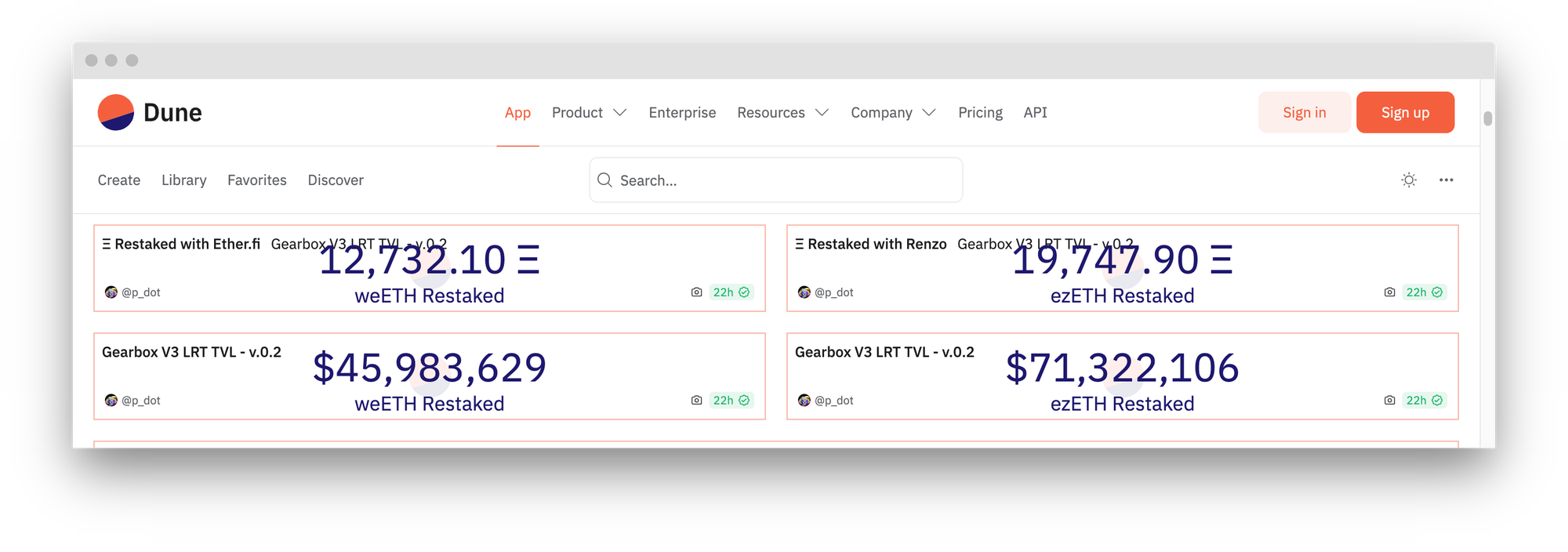

Leveraged restaking has now brought in over $105M in restaked ETH. It all kicked off with Gearbox DAO introducing EtherFi's weETH, which raced to a 10,000 ETH restaked mark, after which Renzo's ezETH was added as well. Interestingly, since ezETH's introduction, Renzo has added over 21.4K ETH, while weETH has only grown by about 1K ETH. This has enabled Renzo to become the leading LRT provider on Gearbox with 21K+ ETH restaked compared to EtherFi's 11.1K ETH restaked. How did this happen and how is $GEAR involved in all of this? Meet gauges and $GEAR wars...

Gearbox, V3 and Risk Limiting

Gearbox was developed with the aspiration to deliver boundless, composable leverage. In practice, this means users are able to borrow multiples of their funds to create a leveraged position. Since the leveraged position is made of real assets, you can utilize it throughout various approved DeFi protocols instead of being stuck holding it on the platform you created the position. And effectively turn anything leveraged. As an example, that means you could post USDC collateral to get 5x leverage on ETH, and then you could take that ETH and stake it for yield in stETH. This was made possible by Gearbox's Credit Accounts which function as smart contract wallets and kick started the creation of DeFi's leveraged layer.

It all started with Gearbox V1, which was a test in prod, a product that enabled devs to validate the idea. Gearbox V2 was built to explore composable leverage on scale but was limited to bluechips as mid and long tail products could have been risky. Gearbox V3 though was designed to expand. A more robust risk framework that enabled the protocol to have caps on the exposure to a particular asset and protocol enables Gearbox V3 to even add newer, not-yet bluechip assets. This was made possible by the introduction of limits, for ex: users combined can't borrow more than 20K ETH to swap to ezETH. This enables Gearbox to limit the risk to available DEX liquidity for any asset and thus add it safely. But how do these then get divided amongst users? And how did this enable Renzo to grow?

Quotas and Interest

The division of these limits is rather simple. Users can reserve a part of the limit to themselves, this reservation is called Quota and is first come, first serve in nature. The quota amount denotes the maximum overall position size and not just the debt. Quota doesn't just denote the maximum size you can hold of a position but also the maximum amount that can count towards your health factor. So when you reserve a quota, make sure you don't just account for the size you want to scale the position to but also the additional margin you want to be counted towards your health factor. This quota is then exclusively held for the user even if they choose to not utilise it entirely.

But since you are effectively consuming a part of these limits, which in turn reduces consumption for the remaining users, a fee has to be levied for these borrowings. This is called the quota interest but how do you decide who pays what? How do you make different strategies have different rates even if the borrowing is from the same pool?

Meet Gauges...

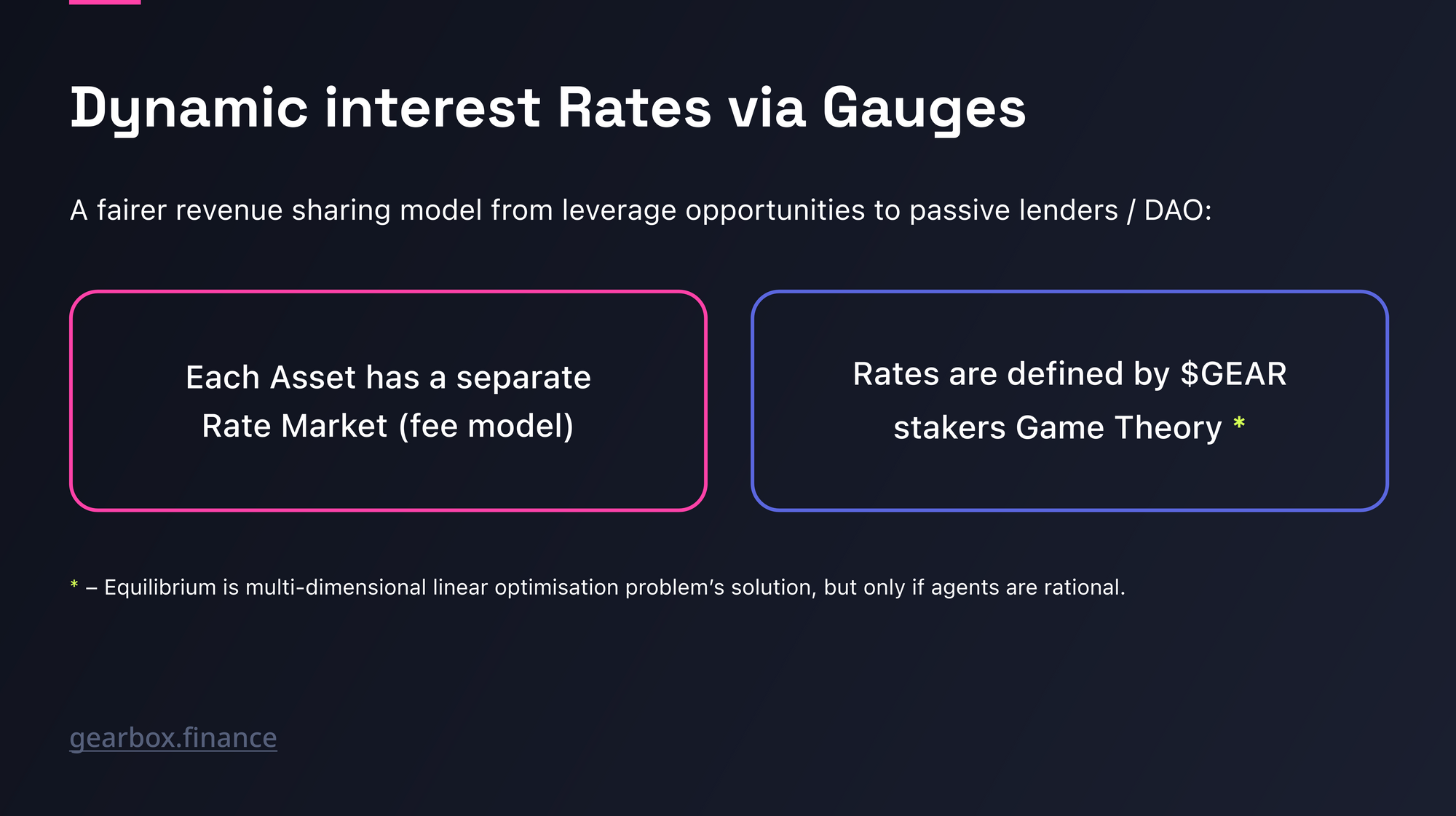

Quota interests are applied on top of the utilisation(base) borrow rates applied to borrowers. Your overall borrow rates = quota interest rates + base borrow rates, this enables users to decide on asset's specific rate.

Gauges: $GEAR staking and dynamic rates

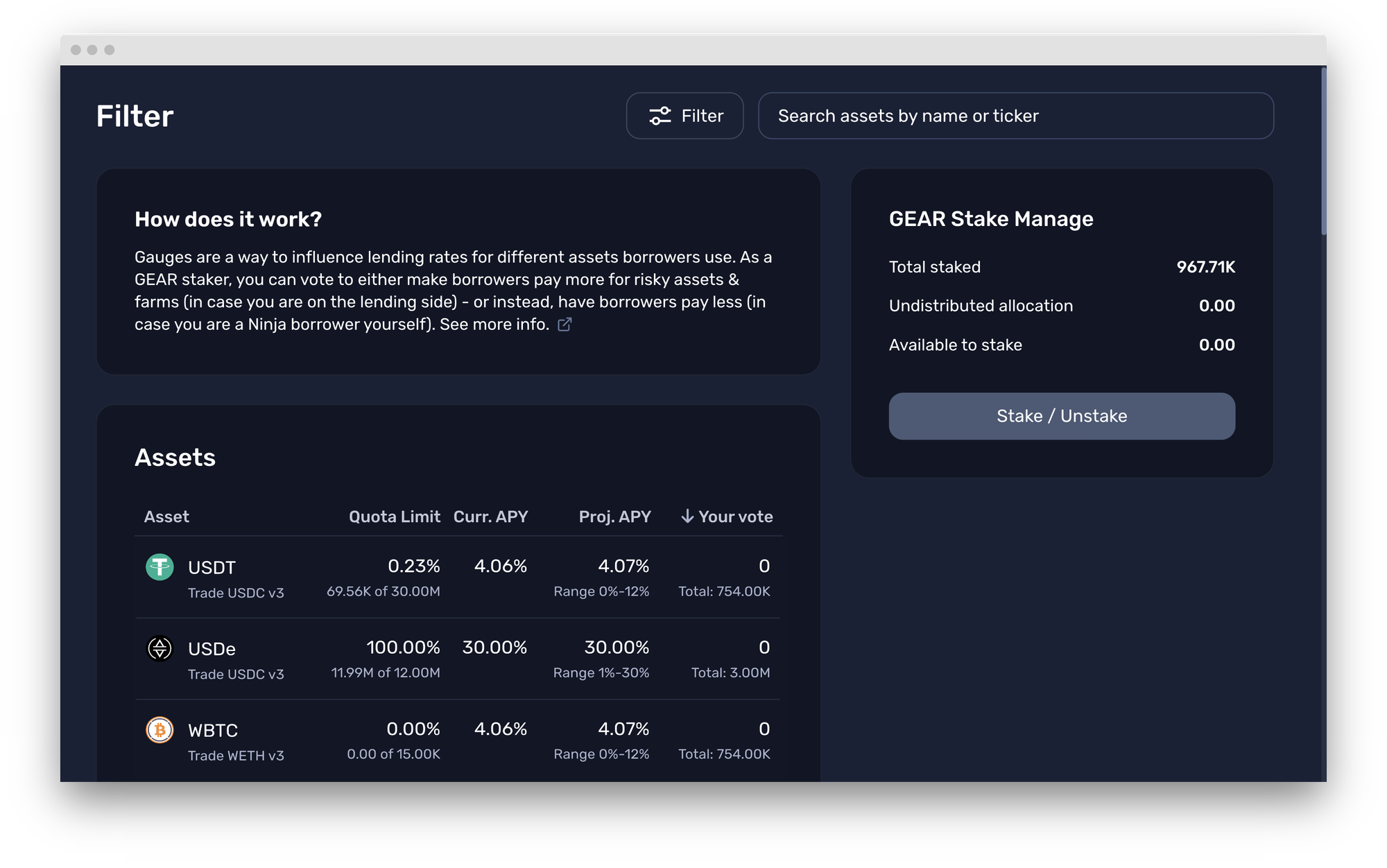

Gauges on Gearbox are different from what we are used to. They don't funnel incentives to users but instead encourage users to deposit $GEAR and help finalise the overall borrow rates. Users vote to increase or decrease the quota interest for an asset within an interest rate range as they deem fair. The result of this voting is implemented at the end of each epoch which is every Monday at 12:00PM UTC.

To do this users can stake their $GEAR on the gauges page. Each staked $GEAR gives them 1 vote to reduce or increase the upcoming epochs rates.

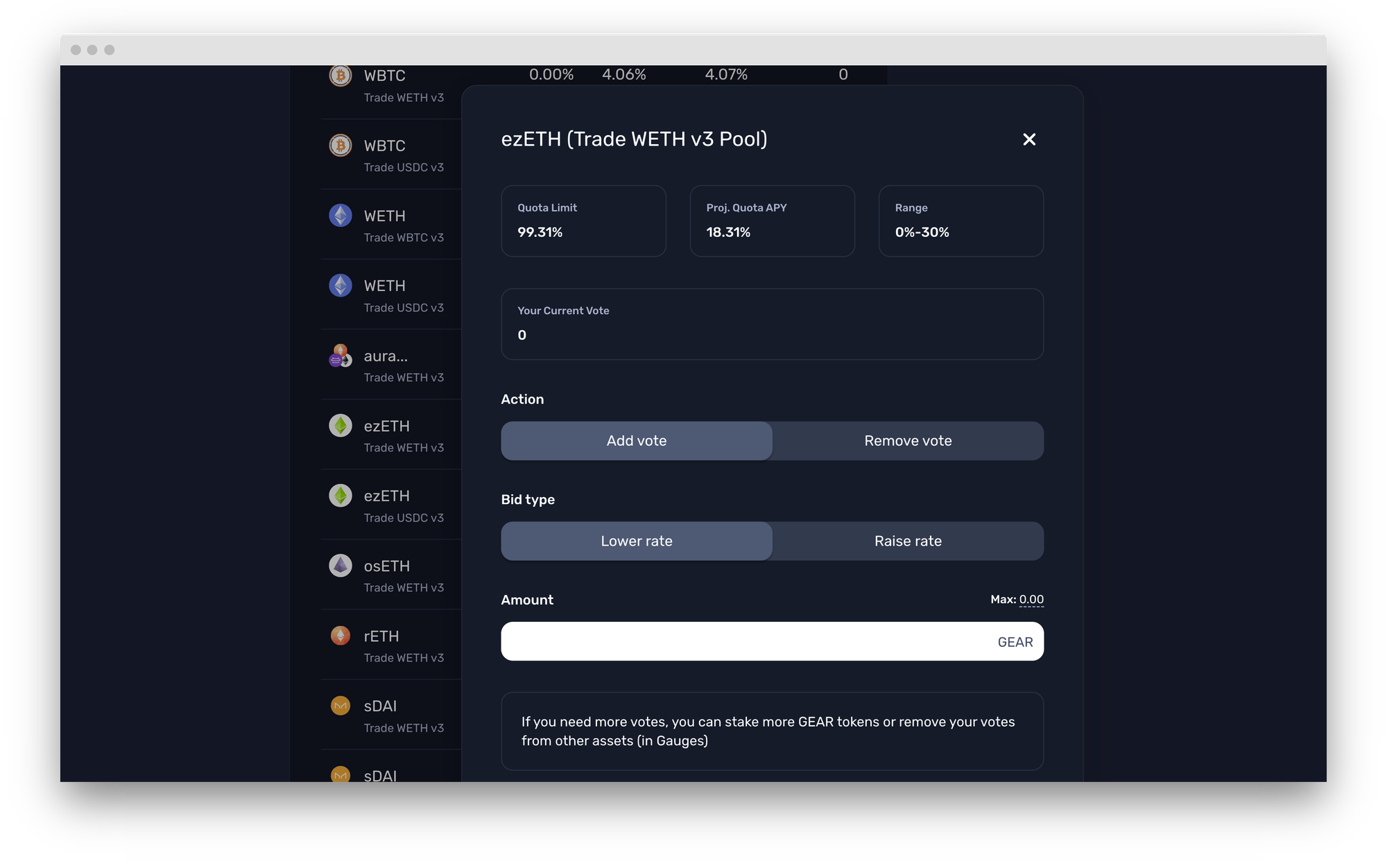

Once a user has the voting power, they can choose the asset they want to affect and choose the required action, as shown below.

The above mechanism effectively turns every leverage opportunity into a GEAR sink. As you increase the number of debt assets for the leveraged strategies, the number of GEAR sinks increases further. Till date, over 3% of the circulating GEAR has been staked to vote on quota interest rates. $GEAR once staked have a 4 week long unstaking period.

In general, these rates depend on a few factors for a particular asset:

- Debt Pool: The pool you take the debt from

- Associated Risks: Depending on if the borrowing is for a long tail, mid tail or bluechip

- Incentives: Either on supply or demand side that can affect rates

and the restaking strategies have seen the same being applied to them, with Renzo pulling levers to grow the fastest.

Renzo growing by influencing GEAR wars

If you have been actively monitoring restaking strategies on Gearbox, you'd have noticed Renzo having a slightly lower borrow rate compared to EtherFi. Last month when the borrow rates on ezETH were 21.17%, they were 25.8% on weETH. Currently, when ezETH is at 28.8% borrow rates, weETH has a borrow rate of 30.8%.

The primary purpose of leveraged restaking has been to earn leveraged EIGEN airdrops. The cheaper you get the points, the more returns you make and less ETH you burn. Since EIGEN points through ezETH were available for $0.085 compared to $0.1 through weETH even last week, Renzo became the preferred choice for borrowers.

How was this made possible?

The base borrow rates on both ezETH and weETH are the same, as they always have been. The overall borrow rates though were influenced through quota interests.

34% of the GEAR voters moved to reduce rates on weETH whereas 39% of the GEAR voters moved to reduce rates on ezETH. Leading to lower rates on Renzo.

How did Renzo get more favourable votes?

Renzo incentivised the lending side with ezPoints proportional to the share of ezETH's LRT holdings, this moved the lenders to push borrows for ezETH over weETH. In order to achieve this, ezETH saw more GEAR voters lowering rates. And thus, ezETH was able to achieve lower rates.

And amongst this, gauges saw an additional ~$300K of GEAR being staked to vote on restaking strategies.

Leveraged Restaking has been a fine example of how gauges aren't just organically enabling risk-adjusted fair rate dynamics, but also enable to GEAR to gain meaningful utility. It shows how projects can influence growth by pulling GEAR as a lever to deliver better UX.

This dynamic isn't just valid for restaking though, you can use it across strategies by staking GEAR. All depends on the kind of user you are.

Quota System for Borrowers

As a borrower you of course want to pay a lower fee, that's the best for your returns. But at the same time, as a borrower you want access to supplied funds by lenders. For which you need to pay rates that incentivise them to lend. The goal is to strike a balance and monitor projected rates. If you believe the quota rates are getting too expensive, you should stake GEAR to lower them to a risk adjusted rate.

Lowering the rates too far below risk adjusted rates can lead to lenders withdrawing and in turn the pool's utilisation increasing. Which is when you would see the base borrow rates shoot up and you will still end up paying higher APYs just with lower available liquidity.

Quota System for Lenders

Similarly for lenders, of course you want to maximise your returns too. But pushing rates towards the max point while the market is cheaper will just drive away borrowers. This will reduce utilisation and in turn significantly lower your lending yields.

Striking the correct balance of quota interest rates is important to ensure that rates for lenders and borrowers in Gearbox are high enough to attract more TVL and grow the protocol. As a GEAR staker, you have that power!

Quota System for GEAR Holders/Projects

As a GEAR holder your goal is to help grow the TVL to the maximum possible potential. Part of which is ensuring that the lending-borrowing dynamics are competitive and fair. So use your GEAR to make sure that neither the lenders nor the borrowers are able to skew the rates towards one side enough.

You are the balance keeper. It's a GEAR war and we are all participants.

As for projects, the key goal for you is to maximise the TVL inflow from Gearbox supply pools to your protocol/assets. So making decisions that boost the supply side and at the same time enable you to get those funds flowing to your TVL is the key. So designs that capture that essence pay off the best. Renzo is a great and first of many examples.

Closing notes

As more assets get added, it will be harder to ensure votes are allocated efficiently. In the future, perhaps additional filters or a dashboard could be created that help users find potential inefficiencies in the quota system and help users quickly determine where to allocate votes each epoch. (Good project idea for anyone looking to get involved!) Some useful data would include filtering out assets with 0% quota utilization, and sorting assets by the highest % of quota utilization.

NOTE: Your vote will remain indefinitely — ie, once you vote, you do not need to re-vote unless you want to change your voting allocation.

If you would like to join the DAO — just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion DAO monthly reports: