Gauges: Democratising Borrow Rates

This week saw the rise of macroeconomic experts across CT. Will Powell cut rates by 25 BPS? Or by 50 BPS? CT waited with bated breath to know how the Fed would affect our internet coins. While the build-up to the event was fascinating, it also outlined the importance of interest rates. This stands true even for onchain lending markets, where the cost of capital is crucial to the demand for debt. But on Gearbox, you don't have to wait for a centralised party or a team to decide how the rates change. Instead, YOU choose how the rates move, thanks to Gauges. How? Read below.

What are Gauges?

Gauges democratise how borrow rates work. They enable users to stake GEAR and vote on whether the borrow rate for a particular asset needs to be reduced or increased. The ratio of these votes determines the borrow rate for the asset for the upcoming week. The result of this voting is implemented at the end of each epoch, which is every Monday at 12:00PM UTC.

Gauges make borrow rates predictable, stable and dynamic. By enabling users to vote, borrow rates on Gearbox also account for factors like:

- Associated Risks with Collateral Asset

- Debt Asset

- Overall Demand

- Rates on other markets

Making borrow rates fairer. But how? Details below.

Why Gauges are needed

Gearbox V3 was designed to expand modular leverage to more assets. This was made possible through the development of a more robust risk framework. The more robust framework enables the protocol to have limits for every allowed asset. These limits cap the overall risk exposure to a particular asset called Quotas. For ex: the maximum combined holding of any Mellow LRT can not be more than 7K ETH across all CAs. Quotas, thus, limit the risk exposure to below the available DEX liquidity for any asset, making additions safe.

Risk management and security are key priorities for the DAO. The risk parameters for the assets onboarded to the protocol are analysed and recommended by Chaos labs, a leading risk research lab. You can find there methodology below.

While quotas enable Gearbox to add new and mid-tail assets/protocols safely, how do you ensure that the borrow rates also reflect the risks, demand and other associated factors with the asset? This is where Gauges come in.

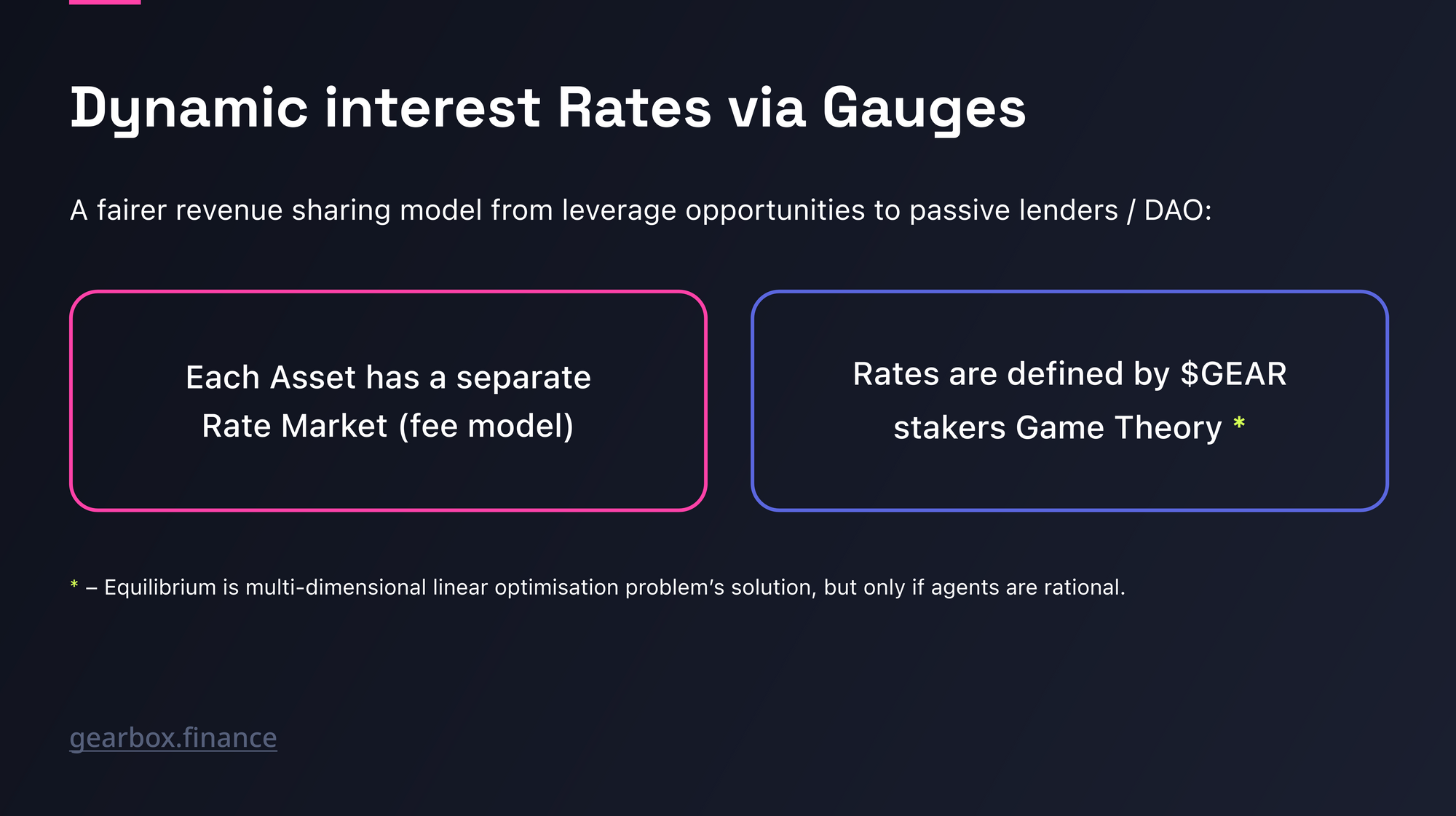

While traditional DeFi lending protocols determine the rates basis the asset you borrow, rates on Gearbox have 2 components.

- Base borrow rate: The base rate of borrowing an asset which is common to all positions. As we see in traditional protocols.

- Quota Rates: Quota rates are asset specific and enable lenders to earn risk adjusted and demand adjusted rates. Gauges help determine these Quota rates.

Below is how this works.

How Gauges help determine Quota Rates

Imagine a see-saw with a bucket on either end. One bucket denotes the lenders, while the other denotes the borrowers. Users receive 1 unit of water for every GEAR token and can choose to pour their allocation in either of the buckets.

Every time a user pours water in either of the bucket, the equilibrium state of the see-saw changes. Where the see-saw finally stops at the end of the epoch decides the quota rates, as per the range marked on the sides of the buckets.

Quota Rates from a Borrower's perspective

As a borrower, you, of course, want to pay a lower fee as that's the best for your returns. You, thus, pour your votes in the Ninja bucket. This causes the see saw to reach the lower end of the range and decrease Quota rates.

But at the same time, as a borrower you want access to supplied assets by lenders. For which you need to pay rates that incentivise them to lend. The goal is to strike a balance and monitor projected rates. If you believe the quota rates are getting too expensive, you should stake GEAR to lower them to a risk adjusted rate.

Lowering the rates too far below risk adjusted rates can lead to lenders withdrawing and in turn the pool's utilisation increasing. Which is when you would see the base borrow rates shoot up and you will still end up paying higher APYs just with lower available liquidity.

Quota Rates from a Lenders perspective

Similarly for lenders, users would want to pour their allocation in the lender bucket and try to maximise rates. But pushing rates towards the higher end will likely drive away borrowers if the risk and demand factors don't justify the rates. This will reduce utilisation and in turn significantly lower your lending yields.

Striking the correct balance of quota interest rates is crucial. You ideally want to be in a state where rates are high enough to be attractive for lenders. And, at the same time, affordable enough for borrowers to generate decent returns.

This is often made possible through open dialogue between users on Gearbox's Discord. Join us

Quota System for GEAR Holders

As a GEAR holder your goal is to help grow the TVL to the maximum possible potential. Part of which is ensuring that the lending-borrowing dynamics are competitive and fair. So use your GEAR to make sure that neither the lenders nor the borrowers are able to skew the rates towards one side enough.

You are the balance keeper.

Gauges, thus, give the power of determining rates back to the users.

NOTE: Your vote will remain indefinitely — ie, once you vote, you do not need to re-vote unless you want to change your voting allocation.

Stable and Predictable Borrow Rates

Since gauges have weekly epochs, the rates for majority of the assets during the week remain stable in a relatively small range. A significant spike in borrow rates is only possible if the debt pool's utilisation rises beyond 90%.

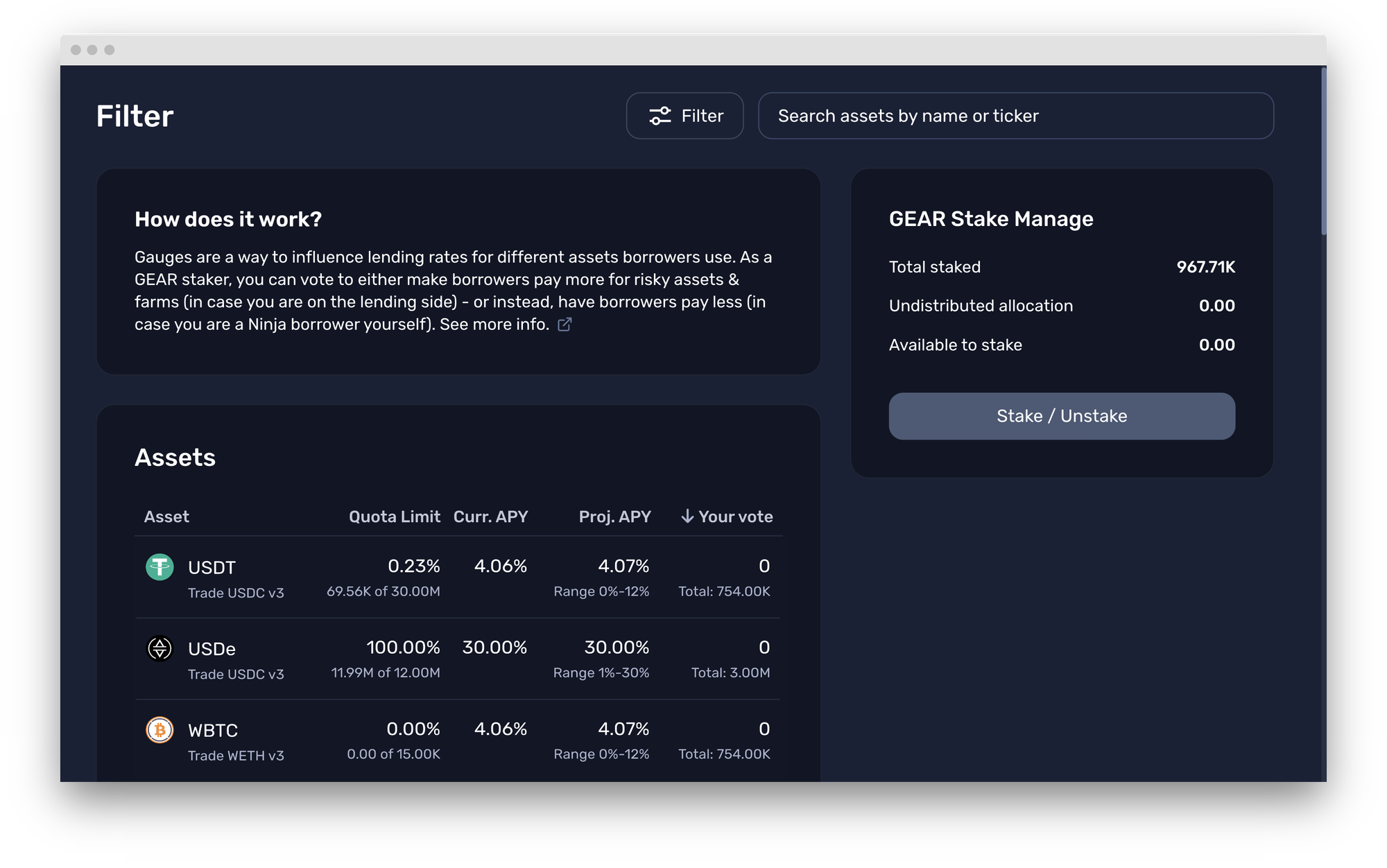

Meanwhile, Gauges enable users to check the upcoming change in rates on https://app.gearbox.fi/gauge. Changes in rates can be found under the "Projected APY" header. If you disagree with them, stake your GEAR and vote for what you believe is a fair price.

Gauges Walkthrough

How do you vote for these changes though? Let us walk you through.

- To do this users can stake their $GEAR on the gauges page.

- Click on "Stake/Unstake" to stake the GEAR you want to vote with.

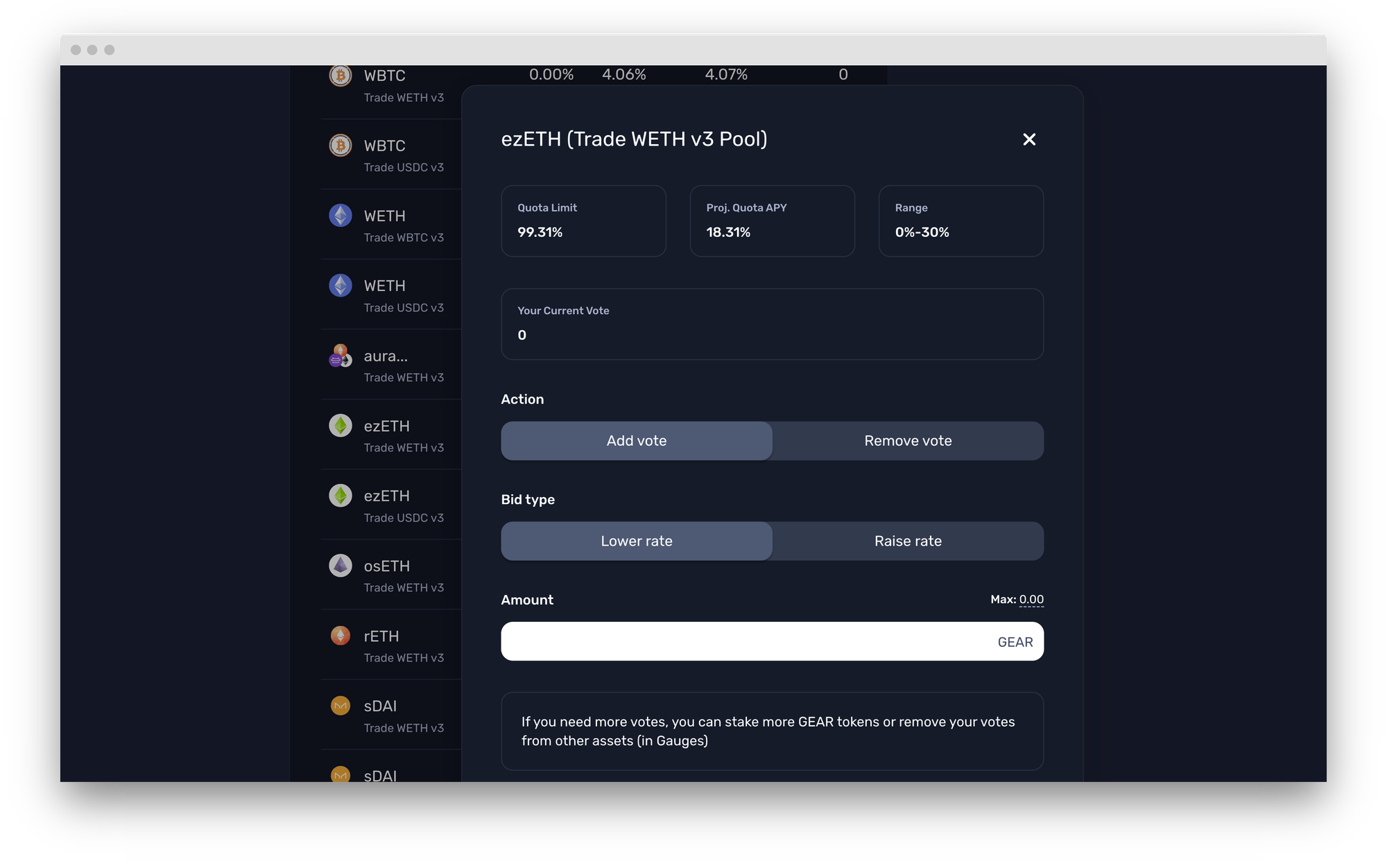

- With your GEAR staked, you'll now be able to vote on assets. Search for the asset whose rate you want to change and click on it. The below pop up would appear.

- Choose the action you want to take (Lower or Raise rates) and put in the amount of GEAR you want to vote with. The UI will update the projected APY when you input the amount of GEAR. This enables you to evaluate the impact of your vote on the next week's Quota rates.

- Sign the transaction and your vote is in!

The above mechanism effectively turns every leverage opportunity into a GEAR sink. Over 2.8% of the total GEAR supply is currently staked in gauges.

NOTE: Gauges have a 28 day un-staking period to avoid easy manipulation of rates.

Paladin and Incentivised Voting

Like everything Gearbox, Gauges too are composable and have projects building atop them. Want to influence rates beyond the GEAR you hold? Meet Paladin. Using Paladin you can set up rewards to incentivise the user action you want. Complete details in the tweet below!

Introducing Transmission, the @GearboxProtocol voting incentives marketplace.$GEAR stakers are now able to earn rewards by voting in the gauges—read the thread to find out how it works! 🧵👇 pic.twitter.com/VKpnXC6qd0

— Paladin 🗳️ (@Paladin_vote) September 19, 2024

Gearbox DAO has no "team", what you say in the discord matters the most and is always considered. If you think there's something we suck at, come berate us. Join the DAO - get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- dApp: https://app.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: