Friendly Leverage: Points S2

Points farming has had its fair share of roller-coaster-emotion moments. From EL points 10Xing on whales to depegs to massive airdrops in a short period. Over the last 2 months, points have made us euphoric and depressed within a span of days.

While we can't control what happens with the sentiment of those protocols externally, Gearbox can try to improve your UX with leveraged points as much as possible. And well, that's exactly what we plan on doing in 3 easy steps.

What are they? We'll be explaining that below. And with users earning $25M in less than 75 days during Season 1, we'll also talk about what you can do with the friendlier leverage in season 2, the cost of points and some stats. Happy reading!

PS: Gearbox is able to improve rapidly due to our modular architecture which allows for more flexible design choices. You can read more about it in the article below. Incoming within the next months.

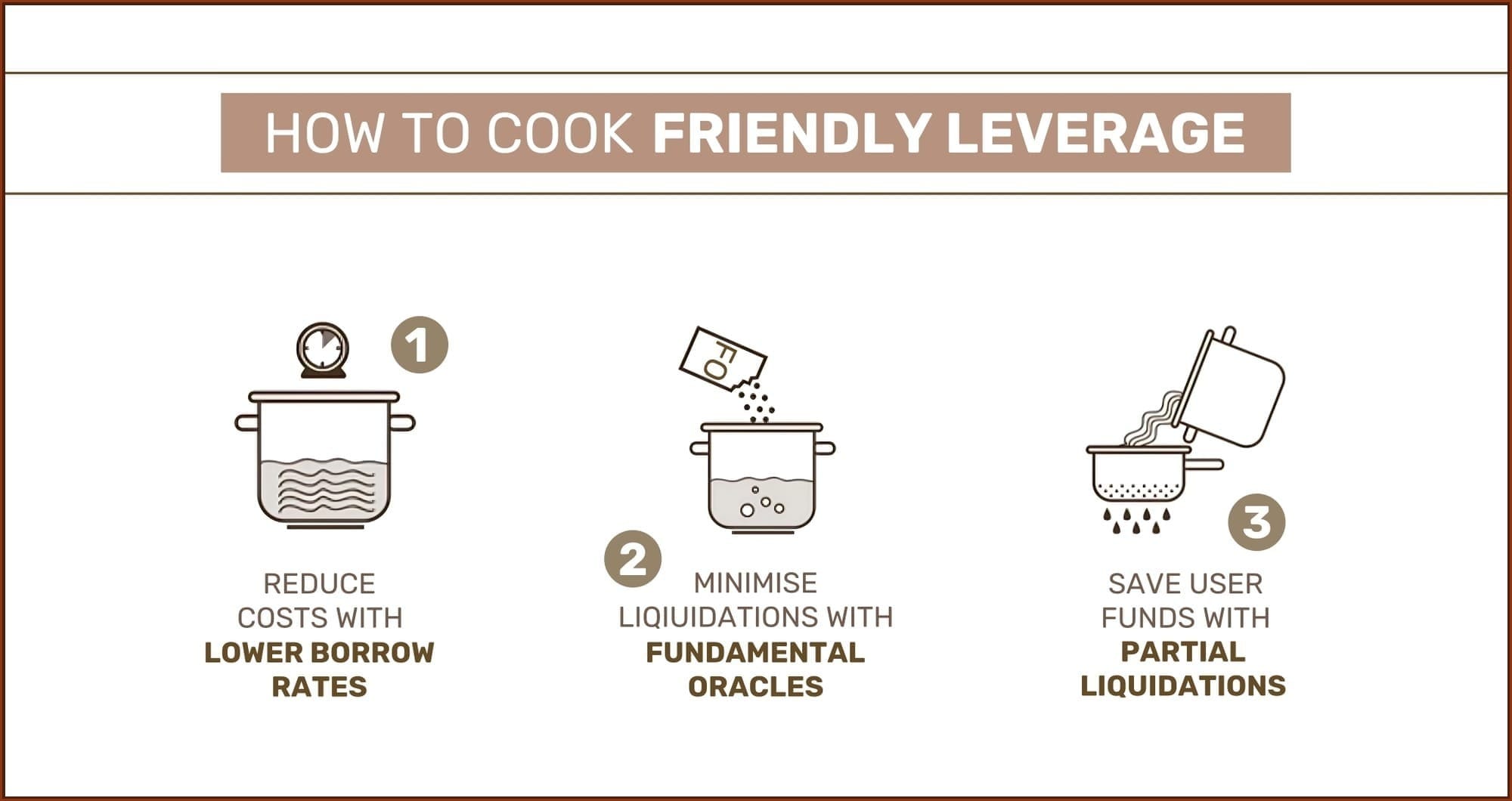

Friendly Leverage

There are 3 key features that make friendly leverage possible. The idea behind achieving this is simple and user-centric

Reduce costs -> Reduce the likelihood of liquidations -> Reduce losses during liquidations.

Let's dive into quick explanations!

I. Lower Borrow (Quota) Rates

Borrow rates are the primary factor (usually the only factor) that dictates the cost of your points. With season 2 kicking off for most LRTs, the TVL for these points is close to the ATH. This means season 2 across point farming opportunities is likely to have more total points earned by users compared to Season 1. Since the user anticipation is that a similar token allocation to season 1 will be given to season 2 points, the higher number of points leads to the value of an individual point potentially decreasing. ..

Considering this, the borrow rates on Gearbox have already been reduced. From 30% 2 weeks ago to 15% Borrow Rate now. That currently includes both the utilization borrow rate and the quota rate. You can read more here.

II. Fundamental Oracles

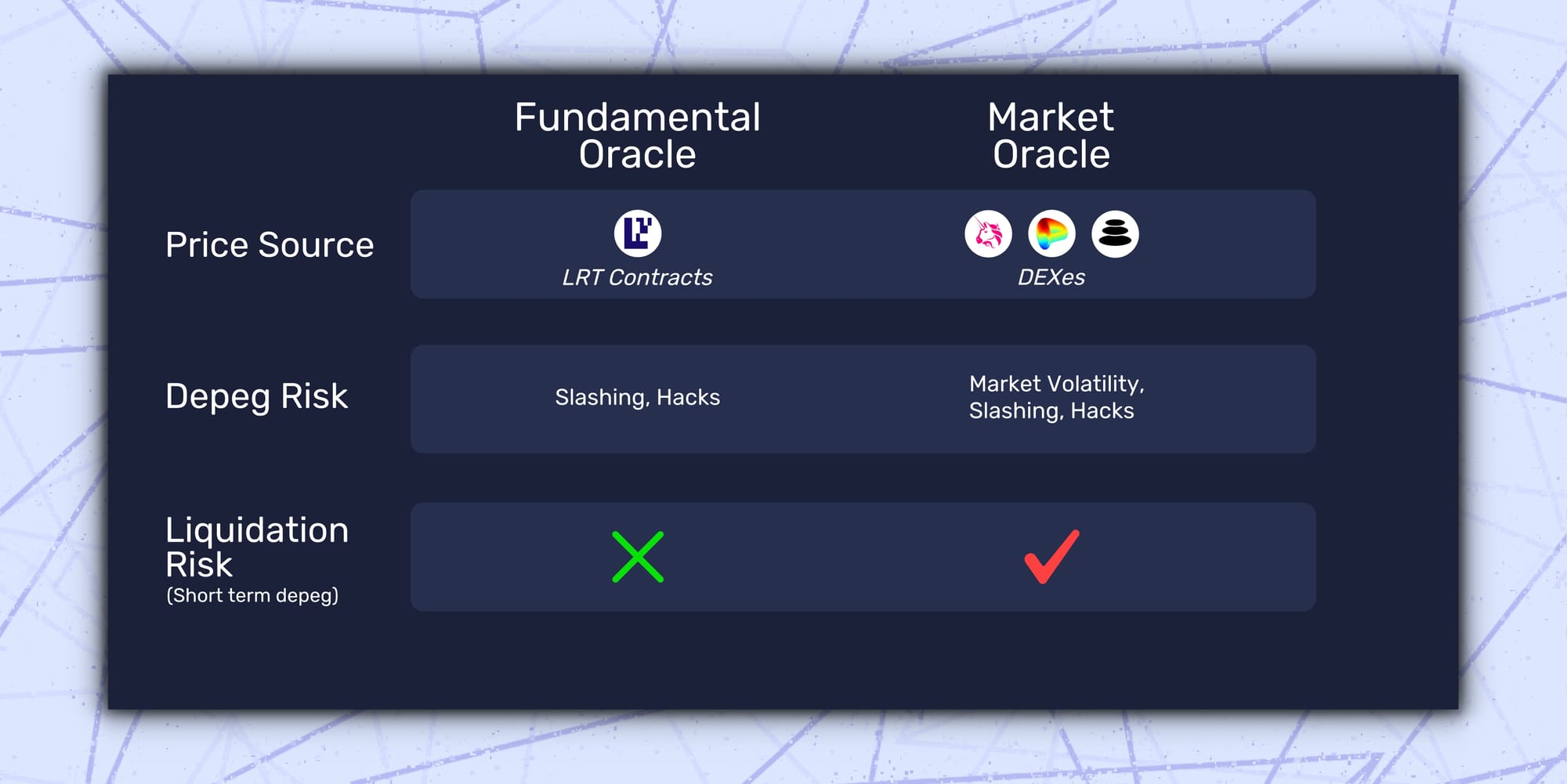

The other user feedback, apart from rates, was reducing the risk of liquidations. While liquidations are necessary during a depeg, where a depeg occurs can also matter. LRTs essentially have 2 sources of pegs against ETH:

- DEXes: The open market source where users can buy and purchase LRTs instead of directly liquid restaking and minting an LRT. These sources have liquidity risks and are prone to market volatility as we saw with the ezETH depeg recently. Market Oracles are based on aggregated DEX price reporting for assets. It's not about flashloan attacks or anything, it's just that depth on DEXes will always be lower than the direct withdrawals of real assets. So:

- Locked in restaking: This source looks at the total assets locked in EigenLayer (and LRTs) vs the total number of LRT tokens. While the DEX based peg is affected by a change in liquidity of the pools during volatility, the EigenLayer level peg is based solely on the backing of an LRT. These pegs are reported through Fundamental Oracles.

In season 2, Gearbox will gradually move to Fundamental Oracles.

To simplify, if in case of volatility the market dumps an LRT, leading it's DEX liquidity to reduce and in turn peg to wick down for a short term, Gearbox users are now unlikely to be affected. This will hold true as long as the assets locked in EigenLayer by the LRT maintain a peg. Since LRTs have verifiable redemptions, even if a short-term depeg occurs, fundamentally arbitrageurs will be able to back the peg in the worst case in 7 days. Thus, enabling a better levered borrow experience without risking bad debt.

Though, a hack or slashing at the LRT level is the scenario where Leveraged borrowers will now face depegging risks. Removing short-term market volatility risks. This movement significantly reduces risk for leveraged borrowers. However, slashing won't be live for a few months... Safu?

Taking the recent ezETH depeg as an example, while the depeg occured at a DEX level as multiple users offloaded, the peg at the locked funds in EigenLayer level was stable. A fundamental oracle in such a scenario wouldn't have liquidated users and instead waited for arbitrageurs to restore the peg, and that is what happened.

NOTE: While a fundamental oracle for ezETH wasn't available at the time, the chads at RedStone are now creating fundamental oracles for majority of the LRTs which should be going live over the coming days.

The fundamental oracle for weETH is already live, making it safer to ape in. Go ahead and earn your points with a 2X boost on EtherFi points and cheaper borrow rates:

III. Partial Liquidations

Gearbox previously had only hard liquidations. In this case, the entire position of the user was liquidated in one go when the HF dropped below 1. To improve this UX, Gearbox has now moved to partial liquidations.

A modular architecture enables Gearbox to adapt to user feedback and needs quicker as we build composable leverage.

— Gearbox ⚙️🧰 (@GearboxProtocol) May 1, 2024

And to improve leverage UX, live now are 𝙥𝙖𝙧𝙩𝙞𝙖𝙡 𝙡𝙞𝙦𝙪𝙞𝙙𝙖𝙩𝙞𝙤𝙣𝙨 to reduce your potential losses. How would they work? 🧵👇 pic.twitter.com/pOYBA7psJg

Partial liquidations won't fully liquidate a user but instead, close their position just enough for them to be back above a health factor of 1. This will reduce the losses leverage takers incur in such scenarios and at the same time ensure bad debt doesn't seep in.

So while the HF dropping below 1 gets tougher as fundamental oracles safeguard users from short term market depegs, partial liquidations will further reduce the damage a liquidation could cause.

NOTE: Additionally, Gearbox positions are fully liquid, as the market changes its stance on an LRT you can choose to increase or decrease your size. Your collateral is not burned instantaneously, you choose when you enter, when you leave and how much you spend.

LRTs switching on withdrawals

While this isn't a move being made by Gearbox, LRTs are now switching on withdrawals which will enable arbitrageurs to quickly recover peg and maintain liquidity even at a DEX level. EtherFi and Kelp now already have withdrawals enabled making their pegs more robust, lever them up here:

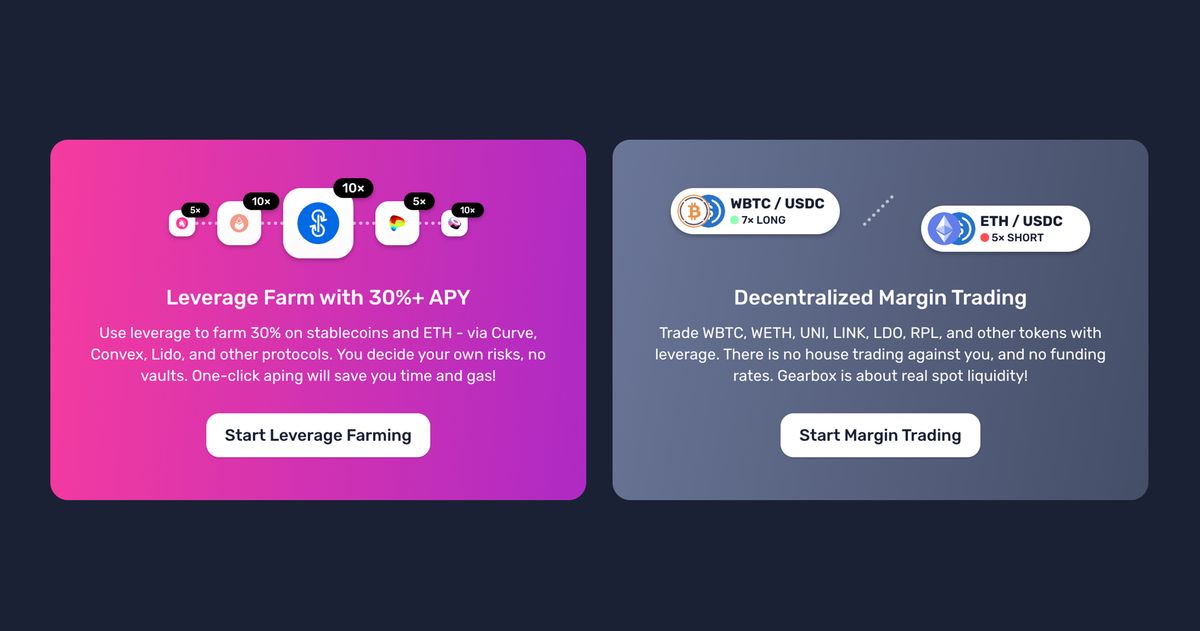

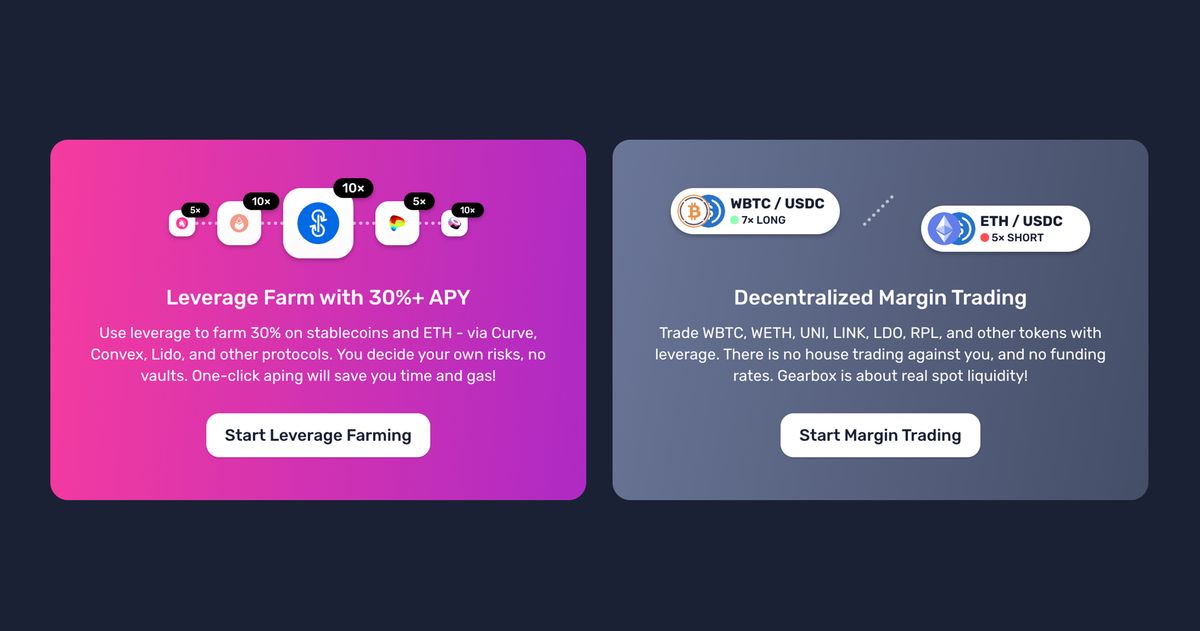

What can you do with Friendly Leverage?

So you have leverage that costs less, is less likely to liquidate you(soon for all) and in case you still get liquidated, will try to only partially liquidate you. But what can you do with it?

EigenLayer airdrop farming still remains one of the hottest propositions in crypto, even during this down trend. Season 1 farmers earned over $25M in airdrops within 75 days. While clarity on the value of season 2 points isn't entirely there yet, the cost per point has been significantly reduced with lowered borrow costs.

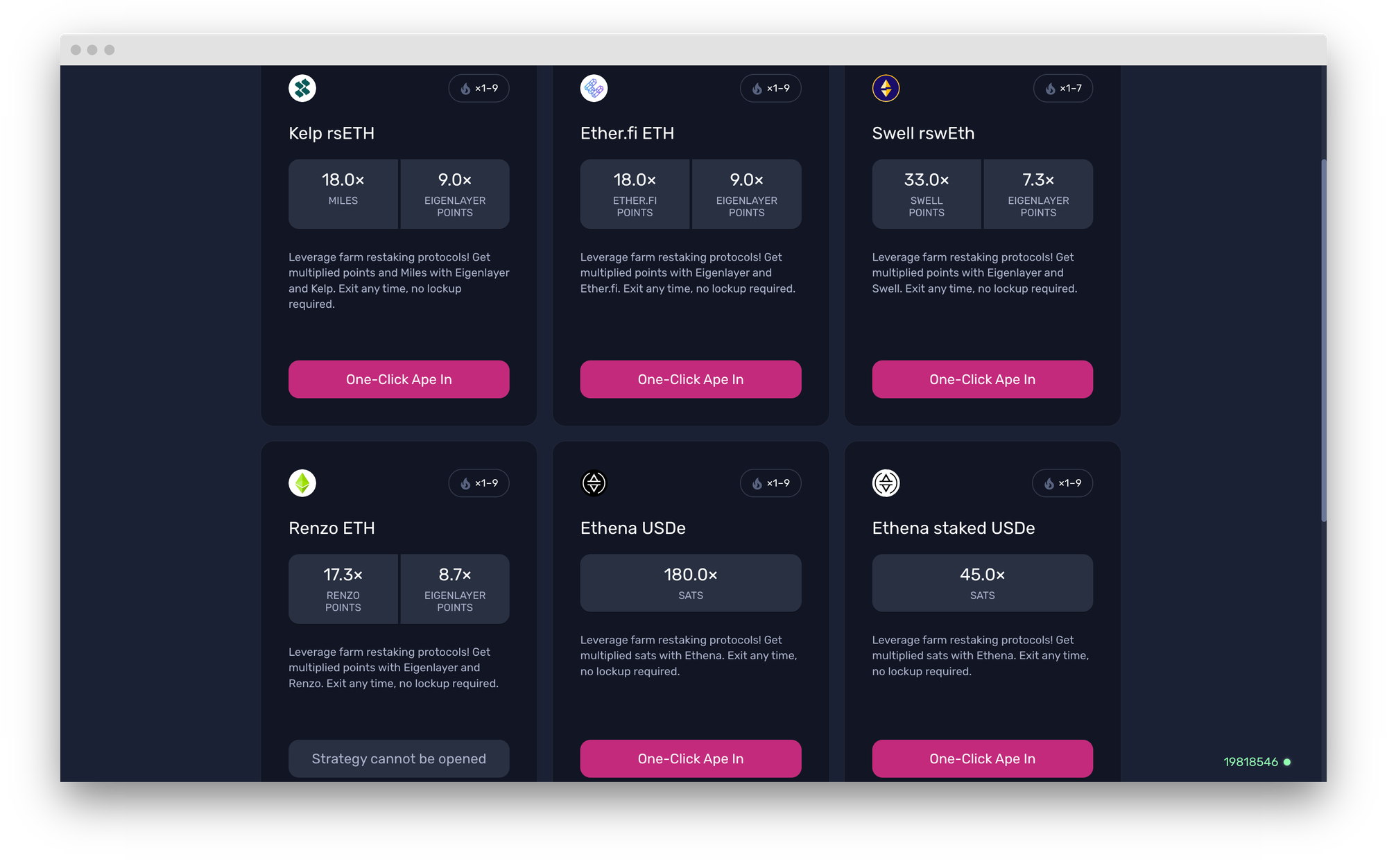

Here's a cheatsheet for you to quickly look at the available liquidity and the cost per EL point, please note this doesn't take into account the LRT points which you'll earn within the same cost as well. The boost for specific LRTs is mentioned as well.

To read about these in more details, read below. If you have your mind made up, go ape here:

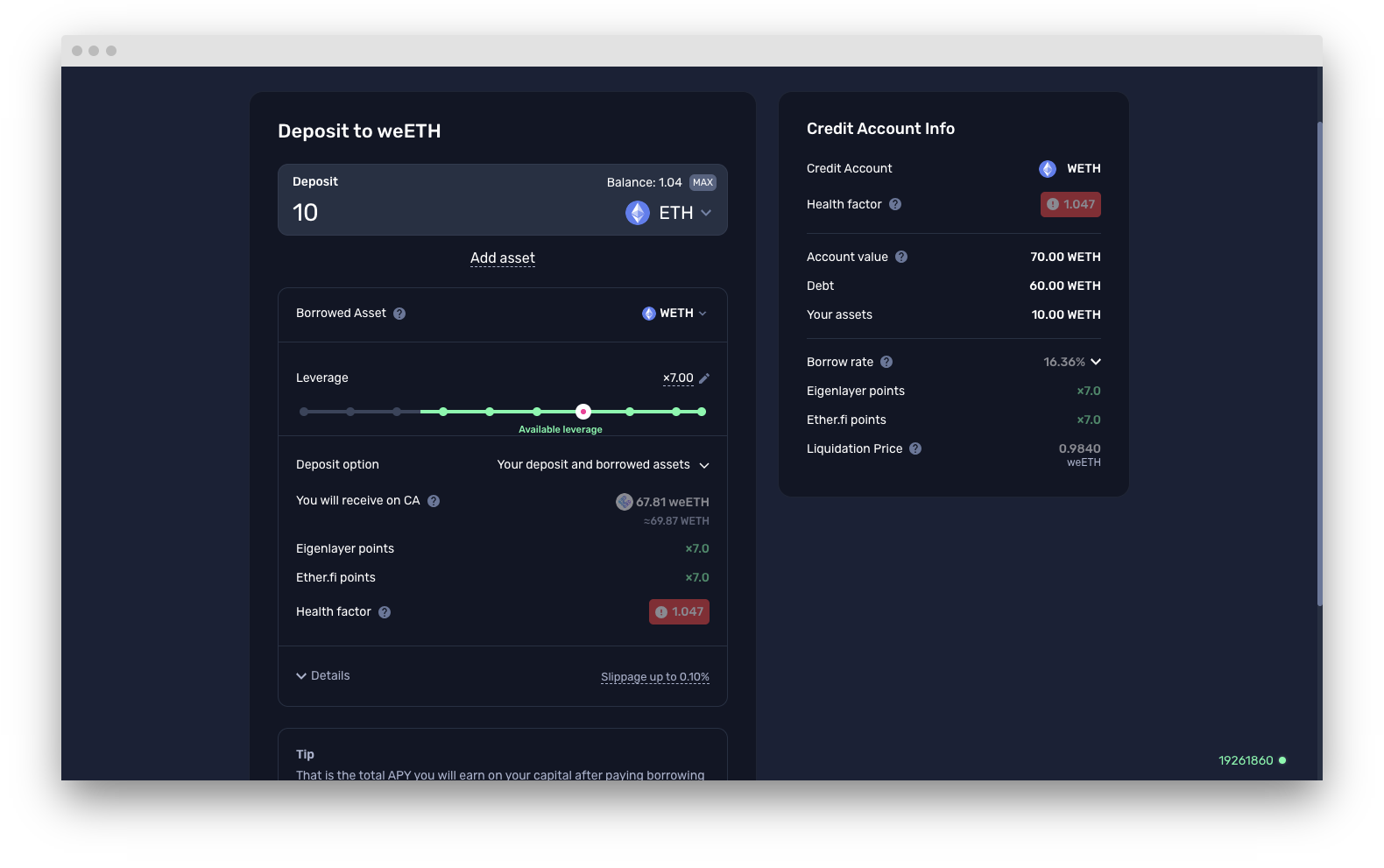

EtherFi weETH

By comparison, Gearbox is the least expensive weETH/ETH long in DeFi for a time period < 2 months, Pendle at $0.072 and Fluid's borrow APY being 4%+ higher. And with the Fundamental Oracle live and withdrawals enabled in Season 2 already, holds a more robust peg too.

weETH currently holds $35M+ or 11.8K ETH in TVL. Further, users can earn EtherFi's season 2 loyalty points with a 2X boost within the same cost. There's over 8.2K ETH worth of liquidity available at a current borrow rate of 15.89% APY.

EtherFi's season 1 of EtherFi loyalty points saw Gearbox users earn over 600M EtherFi points worth over $3.5M(as per whales market floor) in less than a month. This is beyond the 6.5M+ EL points weETH leverage takers earned during season 1 alone. Enter here:

Kelp's rsETH

Kelp's season 1 is still ongoing and Gearbox users have earned over 1.8B Kelp Miles worth $700K+. Kelp DAO has also extended a 2X boost to Kelp Miles on Gearbox. Which with leverage can deliver 18X Miles and 9X EL points.

The available liquidity for Kelp at the moment is 280 ETH, the limits are likely to go up as the fundamental oracle becomes available. You can enter rsETH here for a borrow rate of 18.9%:

Swell's rswETH

Swell's rswETH is Gearbox's latest LRT addition and it goes live with a 4.5X pearls boost thanks to the chad Swell team. Gearbox's cost per EL point through rswETH remains the lowest in DeFi as well, with Pendle's cost being $0.082 per point through rswETH.

The limit available for swell atm is 930 ETH and is likely to go up as a fundamental oracle becomes available. Meanwhile, you can earn 33X swell points and 7.5X EL points for a borrow rate as low as 16.48% APY here:

Renzo's ezETH

Renzo's season 1 saw Gearbox users earn over 70M ezPoints worth over $9.8M(as per whales market floor) in less than 2 months. This is beyond the 37M+ EL points ezETH leverage takers have earned already.

Renzo's Season 2 is now live though the strategy can not be opened on Gearbox. This is extremely likely to change over the coming days/weeks as RedStone releases a fundamental oracle for ezETH and withdrawals go live.

Renzilio.

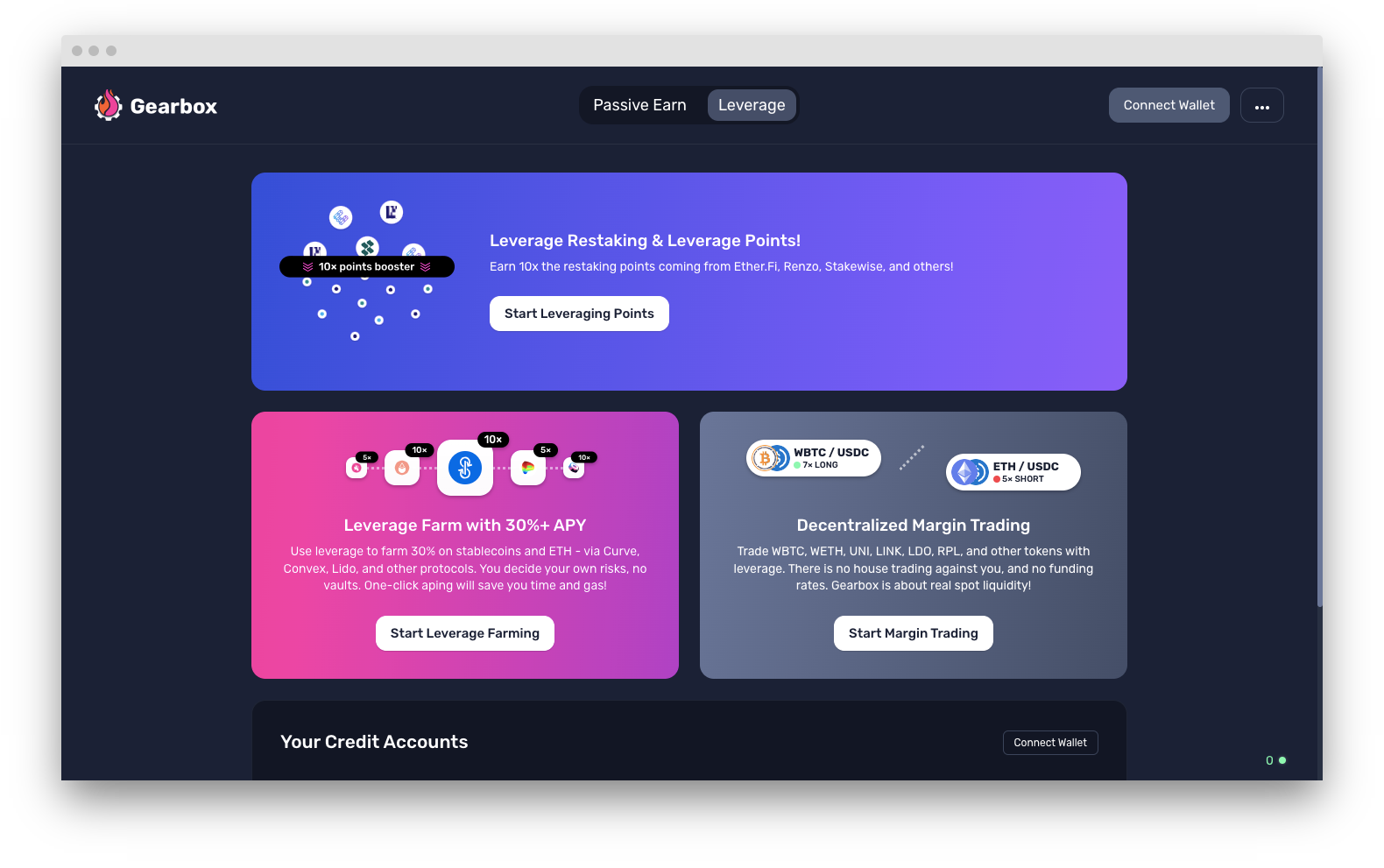

Opening a position: dApp UI walkthrough

To start it all, first, go to https://app.gearbox.fi/accounts

then:

A. Choose the Leveraged Restaking option: Which should bring you to this page. For now it’s Ether.Fi only, later more should be available.

B. Choose Your Leverage: Customise the position as per your risk tolerance. The page also displays the borrow rate, the liquidation price and more to help you take an informed decision. All these details are up to you, you decide all the parameters!

C. Scroll to the bottom of the page and click on "Open position".

And Voila! You are all set. Multicall will now execute all the required transactions in one go, using account abstraction.

As a parting note, these changes only become possible because of User feedback. Gearbox is a DAO that has no "team", what you say in the discord matters the most and is always considered. If you think there's something we suck at, come berate us. Join the DAO - just get involved on Discord. Discuss, research, lead and share. Call contributors out on their bullshit and collaborate on making things better. Here is how you can follow developments:

- Website: https://gearbox.fi/

- Farming dApp: https://app.gearbox.fi/

- PURE margin trading: https://pure.gearbox.fi/

- User Docs: https://docs.gearbox.finance/

- Developer Docs: https://dev.gearbox.fi/

- Github: https://github.com/Gearbox-protocol

- Telegram: https://t.me/GearboxProtocol

- Twitter: https://twitter.com/GearboxProtocol

- Snapshot page: https://snapshot.org/#/gearbox.eth

- And of course, Notion monthly reports: